Yield Guild Games (YGG) is redefining play-to-earn gaming. It raised $4 million in a Series A round, led by BITKRAFT Ventures. This investment, which included A.Capital Ventures and IDEO CoLab, will boost YGG’s NFT investments and expand its gaming guild. With this funding, YGG aims to expand its innovative model. It allows players to earn real income through blockchain games like Axie Infinity.

Understanding Yield Guild Games’ Expansion and its Strategic Funding

The funding is vital for YGG’s mission. It will enhance its play-to-earn ecosystem. This will allow more players to join blockchain games like Axie Infinity and The Sandbox. The extra capital lets YGG expand its NFT holdings and grow its gaming guild. This will give more players access to income-generating digital assets.

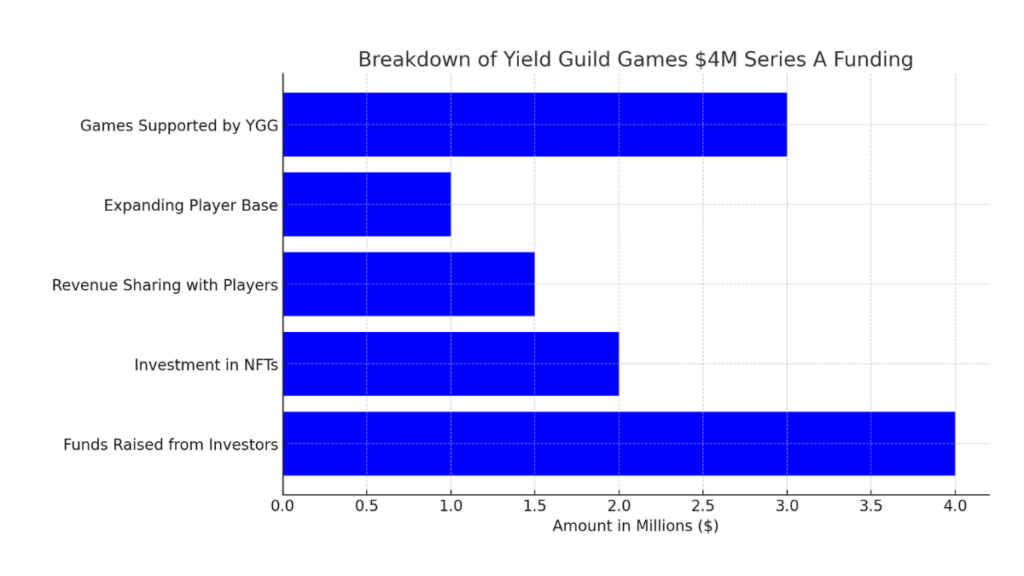

Breakdown of the $4M Series A Funding

YGG raised $4 million, backed by top VCs, including BITKRAFT Ventures, A.Capital Ventures, IDEO CoLab, and ParaFi Capital. Existing investors like Animoca Brands and SevenX Ventures also contributed to the round. These funds will primarily be used to purchase more NFT assets within blockchain games, fueling the growth of YGG’s play-to-earn model. YGG buys NFTs from popular games. Players can borrow and use them to earn in-game rewards. This creates a steady revenue stream.

Here’s a bar chart that shows the breakdown of Yield Guild Games’ $4M Series A funding, based on the data in the paragraph. The chart shows hypothetical allocations to various categories. These include funds raised, NFT investments, revenue sharing, and expanding the player base. It also includes the key games supported.

Key Blockchain Games Supported by YGG’s Expansion

YGG’s NFT investments span across major blockchain games, most notably Axie Infinity, The Sandbox, and Guild of Guardians. These games are key to the play-to-earn ecosystem. They let players earn cryptocurrencies by battling, managing land, or completing challenges. By investing in these games, YGG boosts its leadership in decentralized gaming. It helps to build a strong play-to-earn economy.

The Role of NFTs in YGG’s Business Model

At the core of YGG’s business model is the concept of NFT lending and yield farming. YGG buys NFTs. They are loaned to players. Players use them to earn in-game rewards, like Smooth Love Potions (SLP), in Axie Infinity. YGG takes a share of the earnings from these assets. Players keep the rest. This model has let YGG quickly grow its player base, especially in Southeast Asia. There, play-to-earn opportunities have transformed the economy.

How Yield Guild Games’ Play-to-Earn Model Works

Yield Guild Games (YGG) is a decentralized gaming guild. It acquires and distributes NFTs in blockchain games. YGG’s play-to-earn model lets players use NFT assets in games. They can earn rewards that convert to real-world income. This model benefits both YGG and its players. The guild takes a small share of the income from the assets. The players keep the rest.

Yield Farming with NFTs in Blockchain Games

In YGG’s play-to-earn model, yield farming is a unique strategy. Players earn by using NFT assets provided by the guild. In this system, YGG acquires NFTs from blockchain games such as Axie Infinity and The Sandbox and lends them to players. Players, in turn, use these NFTs to participate in the game’s ecosystem and generate income. Yield farming lets the guild and players share profits. It offers a new take on DeFi in gaming.

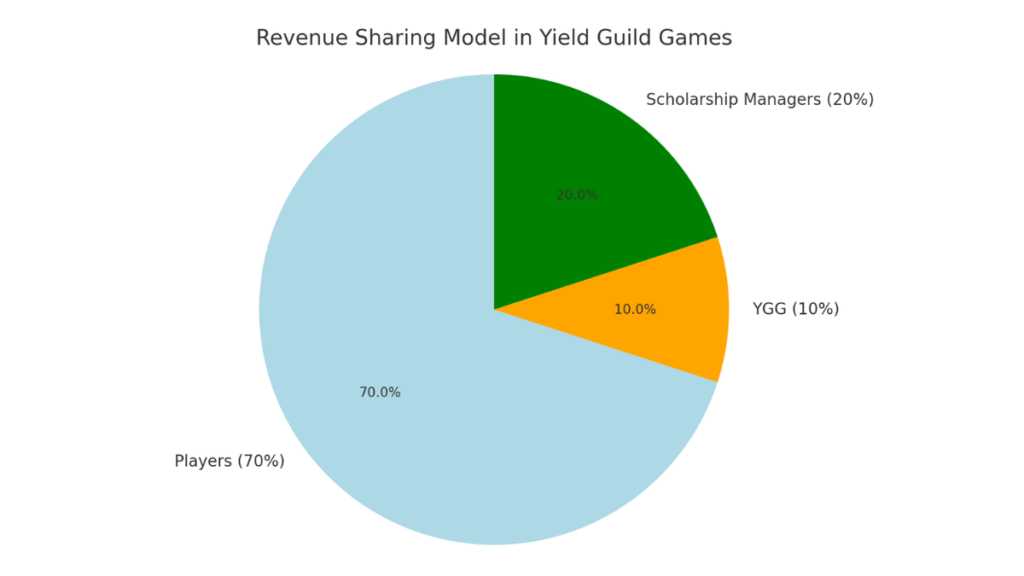

Revenue Sharing Between YGG and Players

YGG employs a structured revenue-sharing model that is central to its play-to-earn approach. When players earn from the guild’s NFTs, the earnings are split among stakeholders. Players usually keep 70% of the revenue. YGG takes 10%, and Scholarship Managers get 20%. Scholarship Managers play a crucial role by guiding new players, ensuring that they make the most of their NFT assets.

Revenue-Sharing:

- Players: Keep 70% of in-game earnings.

- YGG: Receives 10% of the generated revenue.

- Scholarship Managers: Earn 20% for mentoring and training players.

Here’s a pie chart representing the revenue-sharing model in Yield Guild Games. It visually displays how the earnings are distributed:

- 70% goes to players.

- 20% to Scholarship Managers.

- 10% to YGG.

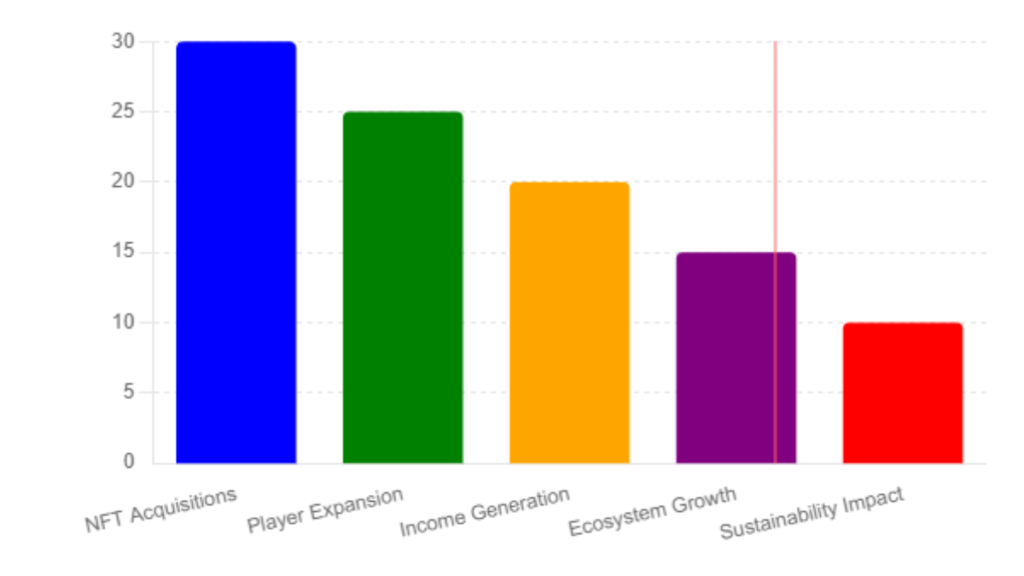

Strategic Importance of the $4M Funding for Play-to-Earn Growth

The $4 million Series A funding secured by Yield Guild Games (YGG) is key to expanding the play-to-earn gaming ecosystem. This investment boosts YGG’s ability to acquire NFTs. It will help YGG improve its offerings and scale its gaming guild. YGG’s focus on blockchain games can help a wider audience. It can give them a chance to earn real income through digital assets.

Here is a bar chart. It shows the impact of YGG’s $4M investment on the play-to-earn ecosystem. The chart breaks down key areas such as:

- NFT Acquisitions: Representing the portion of funding used to purchase NFTs.

- Player Expansion: A sign of more players joining the ecosystem.

- Income Generation: Demonstrating how the investment facilitates income-earning opportunities.

- Ecosystem Growth: Showing the overall growth of the play-to-earn gaming ecosystem.

- Sustainability Impact: Highlighting the long-term sustainability effects on the gaming model.

Scaling Blockchain Gaming Through NFT Investments

YGG’s NFT investments are a key factor in scaling the blockchain gaming ecosystem. The guild invests in NFTs in popular games like Axie Infinity and Guild of Guardians. It lends these assets to players who can earn by using them. This strategy makes blockchain gaming more accessible. It helps players in emerging markets who can’t buy NFTs upfront. YGG’s increased NFT holdings help more players join the play-to-earn model. This expands the blockchain gaming space.

Long-Term Impact on Play-to-Earn Ecosystem

YGG’s $4M investment will likely boost the play-to-earn ecosystem. Its long-term effects should be significant. This funding lets YGG strengthen its lead in decentralized gaming. It will support a sustainable economy in blockchain games. YGG’s income-generating NFTs let more players join virtual economies. This boosts engagement and helps sustain play-to-earn models. YGG’s decentralized approach spreads the benefits of gaming economies across its players.

Differentiating Yield Guild Games From Other Play-to-Earn Platforms

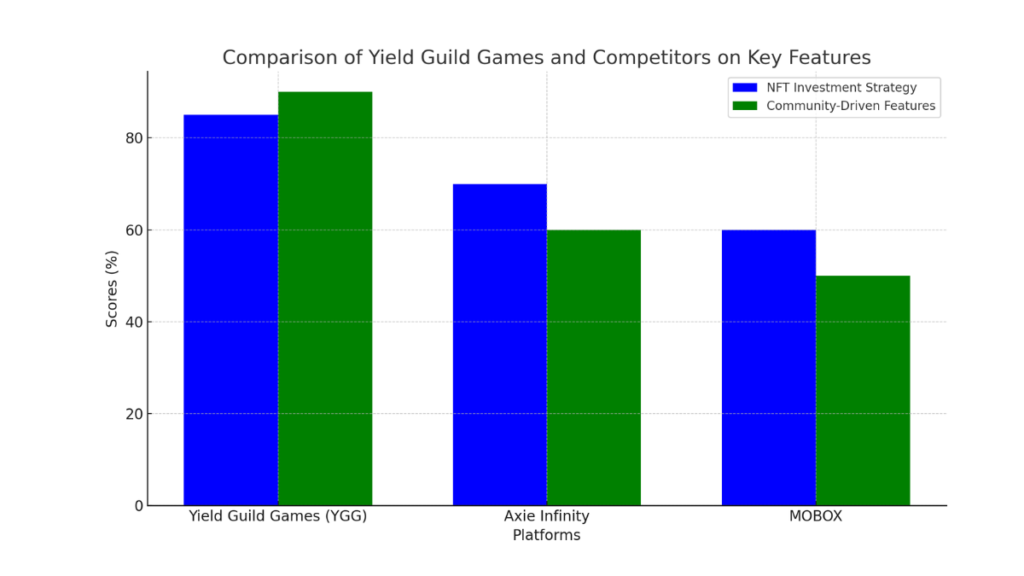

The P2E gaming space is competitive. Yield Guild Games (YGG) stands out. It uses a mix of strategic NFT investments, decentralized governance, and community growth. YGG has a broader strategy than many NFT or play-to-earn platforms. They focus on more than just trading and tokenomics. It aims to build a global community of gamers and investors. They will all benefit from the success of blockchain-based games.

Community-Driven Play-to-Earn Growth

At the heart of YGG’s success is its strong emphasis on community engagement. YGG’s play-to-earn model runs through a DAO. Members can use the YGG token to vote on decisions. This lets players shape the platform’s evolution. So, the guild is a real, community-driven initiative. Also, the YGG “Scholarship” program lets new players in emerging markets borrow NFTs. They can then earn without any upfront investment. This model has helped thousands of players in the Philippines and Venezuela. It has helped them to earn money.

Yield Guild Games vs. Competitors in NFT Investment

YGG’s strategy is to buy NFTs from popular blockchain games. These include Axie Infinity, The Sandbox, and Guild of Guardians. YGG’s approach to managing its assets sets it apart from other platforms. The NFTs are lent to members, who earn income from in-game activities. Other platforms may invest in NFTs. But, YGG’s revenue-sharing model and focus on early-stage investments give it an edge. YGG identifies games with strong tokenomics and guild-based gameplay. This, done early on, maximizes its yield potential.

Here’s a bar chart. It compares Yield Guild Games (YGG) with competitors, like Axie Infinity and MOBOX. It is based on their NFT investment strategy and community features. This visualization shows how YGG leads in both categories. Its strong investment and active community involvement drive this.

| Platform | Focus | NFT Investment Strategy | Community-Driven Features |

|---|---|---|---|

| Yield Guild Games (YGG) | Blockchain gaming, NFTs | Early investment in NFTs, revenue-sharing | Scholarship program, DAO governance |

| Axie Infinity | Play-to-earn gaming | Breeding and battling NFTs | Strong focus on in-game economy |

| MOBOX | GameFi and DeFi | NFT-based liquidity pools | Free-to-play model with yield farming |

The Future of Play-to-Earn Gaming With Yield Guild Games

Yield Guild Games (YGG) is leading the play-to-earn revolution. It aims for long-term growth in blockchain gaming. The recent $4 million funding round shows YGG’s commitment to expanding its NFT holdings. It aims to be a key player in decentralized gaming. The next sections will explore how YGG’s future deals will shape blockchain gaming.

Upcoming NFT Investments and Game Partnerships

YGG’s future growth will be heavily influenced by its continued investment in NFTs across multiple blockchain games. The guild has already invested in popular games like Axie Infinity, The Sandbox, and Guild of Guardians. YGG will use these investments to expand its yield-generating NFTs. It aims to create new opportunities for players. YGG also plans to partner with new blockchain games. This will let its members access a variety of in-game assets. It will help build a strong play-to-earn economy.

YGG is also working on expanding its marketplace by allowing NFT holders outside the guild to lend their assets to players. This marketplace will let NFT owners earn money. They can loan their assets to gamers, who will use them to earn in-game rewards. This initiative seeks to boost the NFT space and create new revenue streams for NFT holders and players.

Challenges and Opportunities in the Play-to-Earn Space

YGG is growing but faces challenges. These include NFT market volatility and the play-to-earn model’s sustainability. The broader blockchain gaming industry is still evolving, and it remains unclear how game economies will mature. Despite these uncertainties, YGG can adapt. It has a strong, community-driven approach and a commitment to decentralization.

On the opportunity side, interest in blockchain gaming and NFTs is rising. This creates huge potential for YGG to scale its operations. YGG can meet the rising demand for decentralized games. It should partner with game developers and expand its NFTs. Also, the guild’s community focus and scholarships will likely attract new players and investors. This should boost the play-to-earn ecosystem.

Read Also

- Bitcoin Mining Hashrate Decline

- Hamster Kombat Token Generation Event

- Centralized Exchanges Quarterly Trading Volume

- Alchemy Pay and AEON partnership

- Sonic Labs Testnet Launch

Yield Guild Games (YGG) is a pioneer in play-to-earn gaming. YGG is redefining blockchain gaming. Its focus on NFTs, revenue-sharing, and community creates real opportunities. YGG aims to expand its NFTs and partnerships. This will grow its decentralized gaming guild and attract new players and investors.