The launch of Numerai V5 Atlas is a big step for Numerai’s data-driven investment strategies. Numerai aims to improve predictions in financial markets. It will use advanced machine learning and more financial data. As machine learning reshapes finance, V5 Atlas is a new era for financial market modeling and decentralized finance.

Overview of the Numerai V5 Atlas Launch

Numerai V5 Atlas is a major upgrade. It improves the platform’s use of machine learning for financial market modeling. The V5 Atlas update, launched on September 25, 2024, boosts data processing and adds better prediction models. This new version focuses on using larger data sets and better algorithms. It aims to make financial predictions more accurate and useful for data scientists and traders. Numerai aims to improve its model aggregation. It wants to create better investment strategies. This could benefit both institutional investors and data scientists on its platform.

Enhanced Machine Learning Algorithms

The advanced machine learning models in V5 Atlas are very different from earlier versions. These updated algorithms enable better data analysis and model aggregation. They result in more reliable predictions of financial markets. Notably, the V5 system improves the weighting and combination of models submitted by data scientists. This refinement ensures that the system can process a higher volume of data while maintaining accuracy. Also, using anonymized models in a unified system called Atlas helps improve market predictions. It makes the process more efficient and decentralized.

Expanded Financial Data Sets

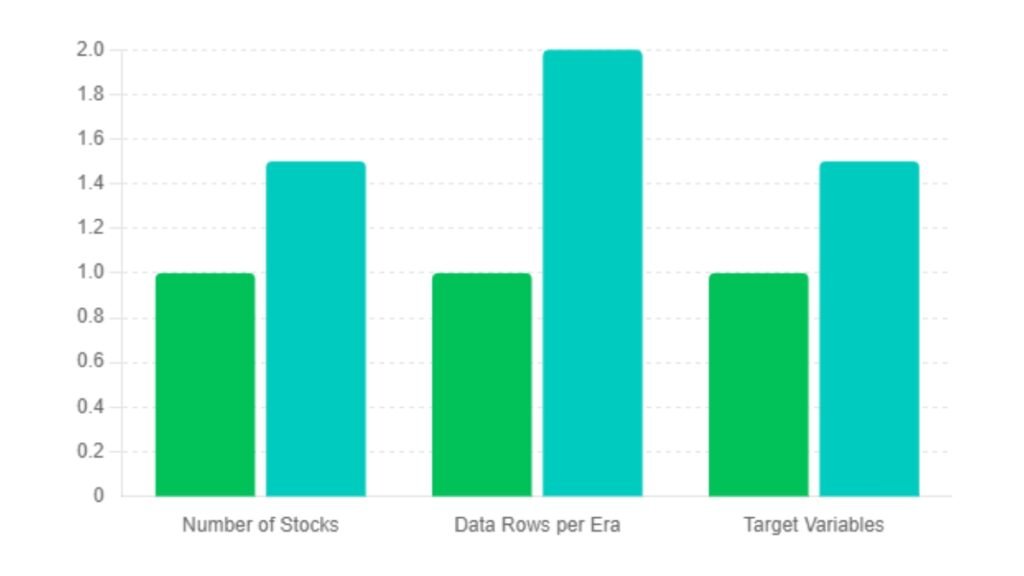

One of the key upgrades in V5 Atlas is the integration of more comprehensive and diverse financial data sets. These expanded data sets let Numerai add more financial instruments. This will enable better, more detailed models. For example, V5 adds new stocks and rows to its data sets. This gives data scientists more variables to work with. It improves prediction accuracy. The growth of data diversifies the modeling process. It improves insights and predictions in different sectors of the financial markets.

| Feature | V4.3 Dataset | V5 Atlas Dataset |

|---|---|---|

| Number of Stocks | Limited | Expanded with new stocks included |

| Data Rows per Era | Fewer rows | Increased by 1487 rows per era |

| Target Variables | Limited to older targets | Introduction of new targets like cyrusd and teager2b |

The bar chart compares the V4.3 Dataset with the V5 Atlas Dataset in Numerai, based on the improvements discussed. This chart shows the relative improvements in the number of stocks, data rows per era, and target variables.

Impact on Prediction Accuracy

V5 Atlas’s improved prediction accuracy is due to better machine learning algorithms and data sets. These updates lead to more accurate stock market predictions. They provide better tools for data scientists and financial analysts. Early reports say that larger datasets and better model aggregation have improved predictions in various markets. This gives quantitative traders a better edge. This accuracy helps traders and attracts institutional investors. They seek reliable, AI-driven financial predictions.

Implications for Data Scientists

For data scientists, V5 Atlas brings big changes. It affects how models are developed and rewarded on the Numerai platform. These changes promise better performance and precision. But, they also create new challenges. We must adapt to new data structures and a heavier workload. As financial data grows, we must adjust and retrain models to stay competitive and get the best results.

New Financial Data Targets and Features

V5 Atlas adds new financial data targets and improved features. They aim to boost model accuracy. Targets like cyrusd and teager2b give data scientists better tools. They can fine-tune their models for improved financial predictions. Data scientists must adjust their models. They must use new datasets, which have more rows per era and more stocks than before. These new data sets are vital. They provide a broader view of market movements. This will improve stock market models.

Staking and Token Rewards

In addition to model refinement, staking NMR tokens remains a critical part of Numerai’s ecosystem. Data scientists should stake their tokens on the models they believe in. Good predictions earn rewards. Poor ones cause token burns. This creates a competitive, rewarding environment. This staking system rewards accurate models. It also boosts the NMR token’s value, helping its price and demand. As more data scientists join, this reward system keeps them engaged and competitive.

Retraining Models for V5 Atlas

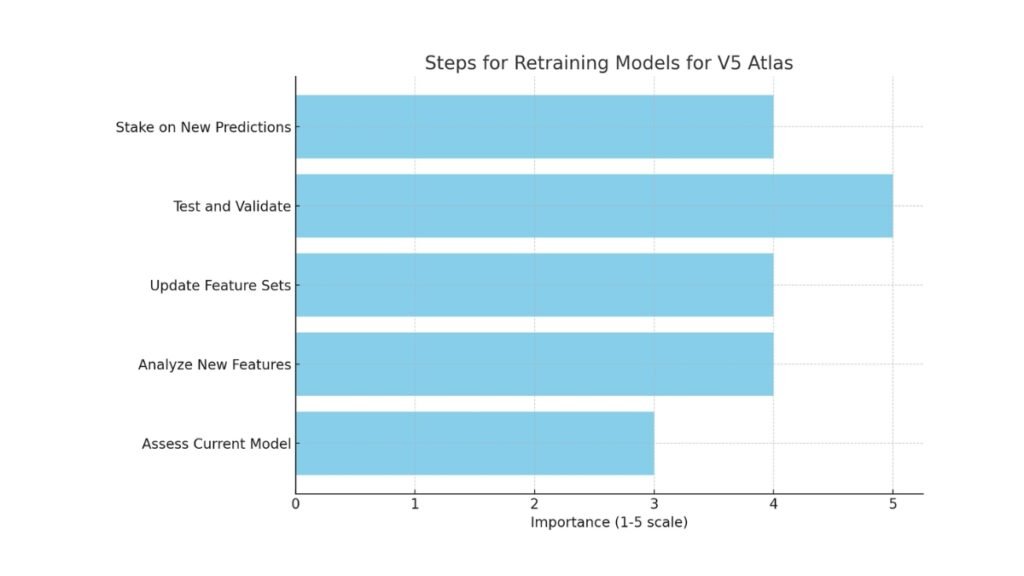

A horizontal bar chart showing the steps to retrain V5 Atlas models. It ranks their importance on a scale of 1 to 5. This visual helps prioritize tasks. It covers assessing the current model and staking on new predictions.

With V5 Atlas, retraining models is now essential. It will align them with the updated data structures. The larger datasets and new features require careful changes. They must maintain or improve model performance. A systematic approach can help data scientists transition smoothly:

- Assess Current Model: Evaluate how your current model performs on V5 data.

- Analyze New Features: Identify the new financial data targets and how they can enhance prediction accuracy.

- Update Feature Sets: Incorporate new features and targets into your model.

- Test and Validate: Run multiple iterations to ensure model stability.

- Stake on New Predictions: Submit your retrained model and stake NMR tokens with confidence.

The Role of V5 Atlas in Quantitative Trading

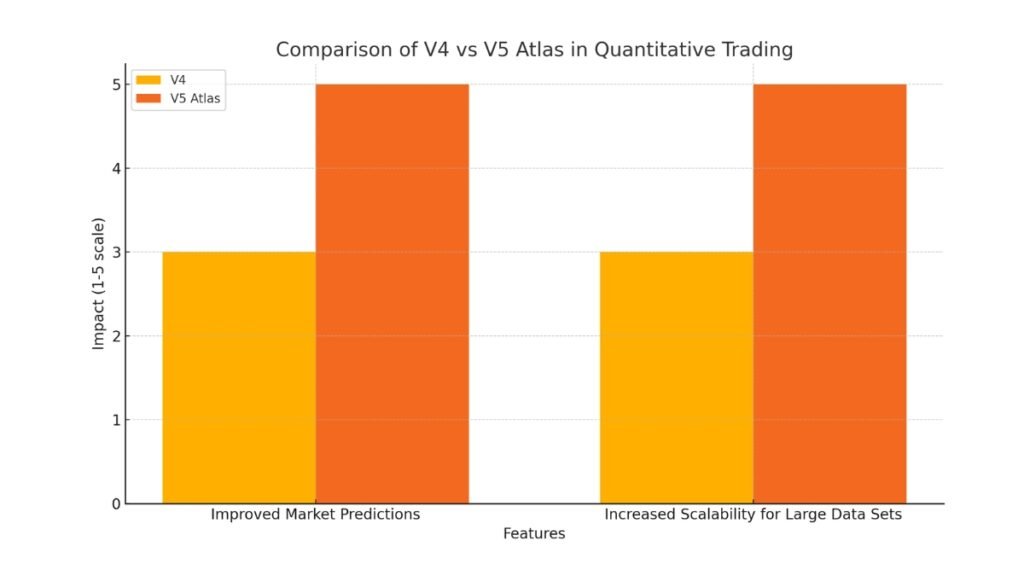

V5 Atlas is revolutionizing how quantitative traders approach financial markets. The platform uses advanced machine learning and bigger datasets. It gives traders better tools to make informed decisions. The system’s better accuracy, from improved data and model blending, gives a big edge to high-frequency and quantitative traders.

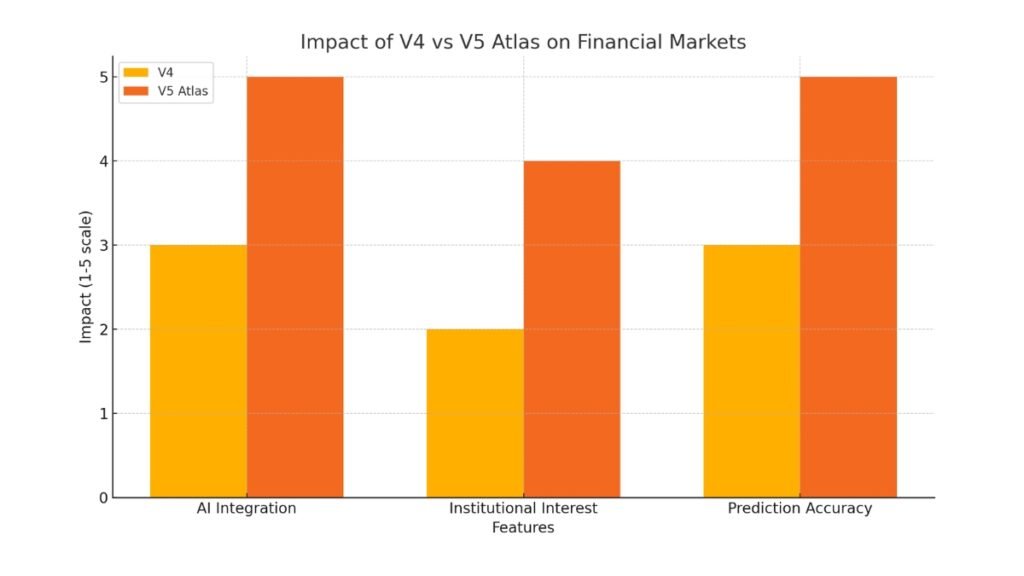

A bar chart comparing the impact of V4 and V5 Atlas in quantitative trading. It focuses on better market predictions and higher scalability for large data sets. It shows that V5 Atlas is much better than V4 in both areas. It gives traders better tools for decision-making.

Improved Market Predictions

The V5 Atlas platform aims to improve financial market predictions. This is crucial for quantitative traders who use data for quick decisions. V5 has improved stock market prediction accuracy. It used better data and algorithms. Traders now have better tools to anticipate market movements. These better predictions are vital in volatile markets. Small gains in accuracy can bring big financial benefits.

Increased Scalability for Large Data Sets

One of the standout features of V5 Atlas is its scalability. The platform can now handle much larger data volumes than before. This is a big advantage for quantitative traders using vast datasets. This scalability makes V5 particularly useful for traders utilizing high-frequency trading models, where the ability to process large amounts of financial data in a timely and efficient manner is critical. With improvements in data processing speed, traders can rely on V5 for smoother operations and more comprehensive data analysis.

Broader Implications for Financial Markets

V5 Atlas will reshape the integration of ML and data science in finance. V5 Atlas has advanced machine learning models and expanded datasets. It could drive the future of AI in finance. It may offer better predictions and improve financial modeling. This section explores how technology may affect both financial markets. It includes both institutional and retail markets.

Integration of AI in Financial Markets

Numerai’s V5 Atlas represents a major leap in the integration of AI in financial markets. By refining its machine learning algorithms and offering expanded data capabilities, V5 has set a new precedent for how financial predictions are made. This level of accuracy, driven by data science, is likely to inspire similar platforms, encouraging further adoption of AI-driven financial modeling across the industry. The use of AI in finance is not just improving the speed of data processing but also leading to more reliable and robust market predictions, which can be critical in high-stakes trading environments.

Institutional Interest in Numerai’s Model

The advancements seen in V5 Atlas are attracting significant interest from institutional investors. The platform can handle large datasets and make precise predictions. This appeals to hedge funds and analysts seeking reliable AI-powered tools. Institutions are drawn to V5 Atlas. It could provide more accurate, consistent returns. This makes it an attractive model for financial markets. As more analysts and firms see the value of AI models, Numerai may attract more institutional investments. This would further legitimize AI in financial analysis.

Future Developments and Expectations for Numerai V5 Atlas

V5 Atlas is evolving. Many exciting updates are coming. They will boost Numerai’s role in AI-driven financial modeling. These developments could give data scientists and analysts better tools for predicting stocks. They would improve their models’ robustness and efficiency.

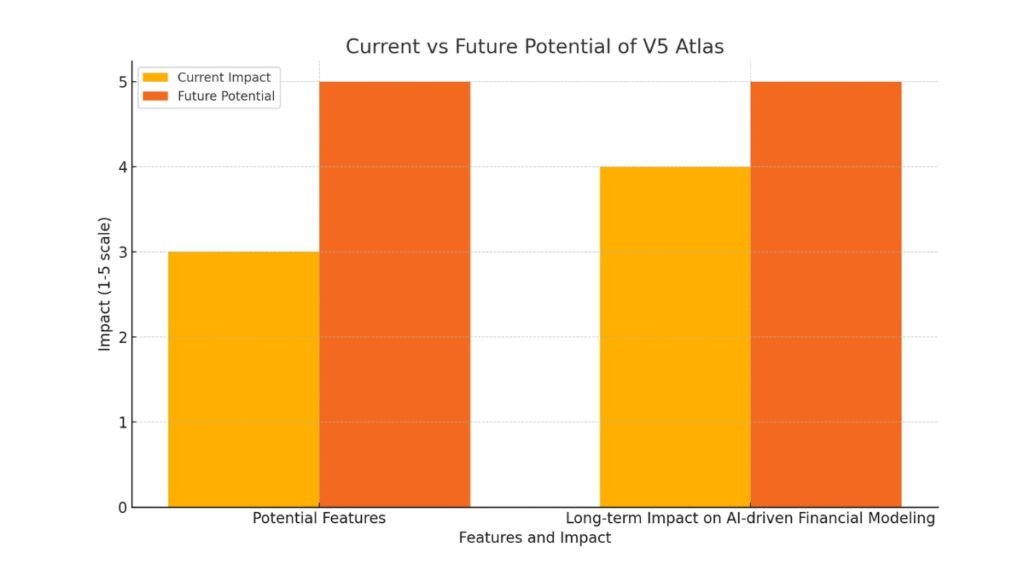

A bar chart comparing the current impact and future potential of V5 Atlas. It will focus on its new features and long-term effects on AI-driven financial modeling. It shows that future updates to V5 Atlas should greatly improve it.

Potential Features in Future Versions

Future updates to V5 Atlas will likely focus on data integration and new financial targets. Data scientists and the market want better algorithms and more datasets from Numerai. There are also talks about improving the validation and live scoring methods. Users want more transparency in predicting model performance. As the dataset grows, future versions may have advanced features. They will support deeper analysis and better scalability. This will cater to high-frequency traders and institutional investors.

Long-term Impact on Financial Modeling

V5 Atlas’s success could change how financial markets use machine learning. In the next decade, AI-driven financial strategies may become the norm. Platforms like Numerai will lead in providing accurate market predictions. Trust in AI for financial decisions is growing. This could lead hedge funds and institutional investors to adopt AI models. They may then better predict and navigate complex markets. Also, larger datasets and better data regularization should improve financial modeling. This will position Numerai as a key player in AI’s evolution in finance.

Note

- Basics of decentralized finance

- Crypto market reactions to inflation data

- Predictive analytics for crypto trading

- Binance BNB Chain Bohr Upgrade Improves

- Role of protocol fees in DeFi

The launch of Numerai V5 Atlas is a key moment in merging machine learning and finance. V5 Atlas is setting new standards for AI financial modeling. Its advanced algorithms, larger datasets, and better scalability make it so. Both data scientists and institutional investors expect innovations. These include better prediction models and new features in future updates. As V5 Atlas evolves, it will shape finance’s future. It will make AI-powered market predictions a key tool for navigating global markets. Numerai’s work will improve financial modeling. It will also advance machine learning in finance.