Stablecoins are a strong answer in digital finance. They combine blockchain’s benefits with fiat currencies’ stability. Their price stability makes them ideal for transactions. They’re better than volatile cryptocurrencies like Bitcoin. Stablecoins are changing global finance. They cut costs and enable fast cross-border payments, boosting efficiency, lowering fees, and improving financial inclusion.

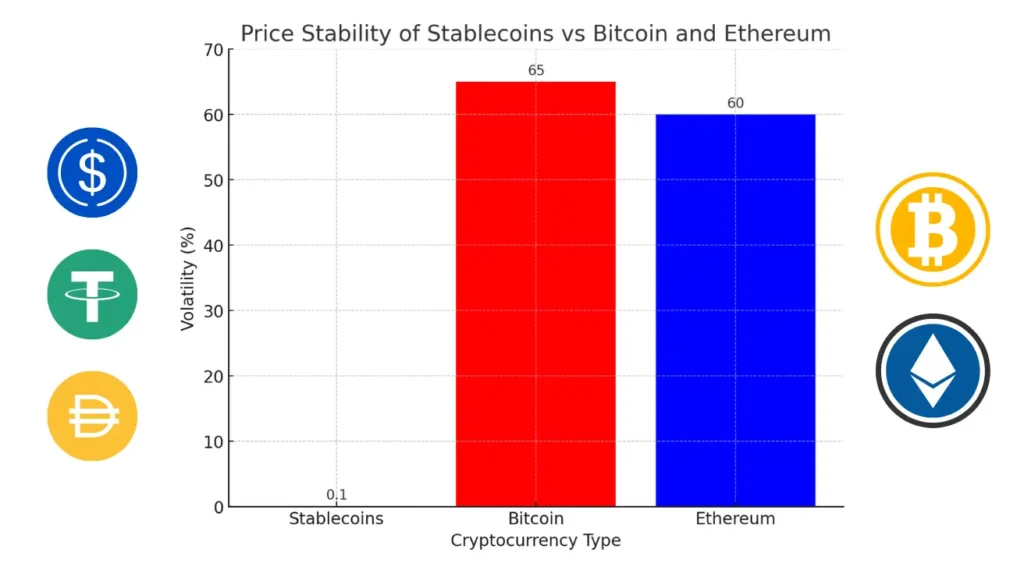

The Price Stability of Stablecoins

Stablecoins offer a unique advantage in the cryptocurrency world by providing price stability. Stablecoins are pegged to fiat currencies, like the U.S. dollar. Unlike Bitcoin and Ethereum, they are not volatile like those cryptocurrencies. This keeps their value constant. They are an attractive option for businesses and investors. They seek a stable medium of exchange for financial transactions.

Pegging Mechanism of Stablecoins

Stablecoins maintain their peg to fiat currencies through various mechanisms, ensuring low volatility. For example:

- Fiat-backed stablecoins, like Tether (USDT) and USD Coin (USDC), are backed by real-world assets, such as cash and government bonds. This ensures that each stablecoin can be redeemed for its fiat equivalent and provides confidence in its stable value.

- Crypto-collateralized stablecoins, like DAI, use smart contracts. They lock up cryptocurrencies, such as Ethereum, as collateral. Despite market changes, these reserves keep the stablecoin’s value near its pegged fiat currency.

- Algorithmic stablecoins rely on algorithms and smart contracts to regulate supply and demand. The algorithm automatically adjusts the supply to restore the balance if the stablecoin’s value drifts from its peg.

| Stablecoin Type | Example | Pegging Mechanism | Stability Mechanism |

|---|---|---|---|

| Fiat-backed | USDT, USDC | Backed 1:1 by reserves in fiat currencies | Reserve-based peg |

| Crypto-collateralized | DAI | Collateralized with cryptocurrencies | Over-collateralization via smart contracts |

| Algorithmic | TerraUSD (UST) | Managed by algorithms and smart contracts | Supply and demand adjustments |

Stability in Cross-Border Transactions

Stablecoins have low volatility and a stable value, making them useful in cross-border payments. Businesses and individuals can make international payments at a fixed cost, and they need not worry about changes in currency value. Also, blockchain technology processes payments quickly and securely. It often avoids the high fees and slow speeds of banks.

Note

Stablecoins can enable stablecoin-backed transactions. They are a trusted option for global trade, remittances, and business.

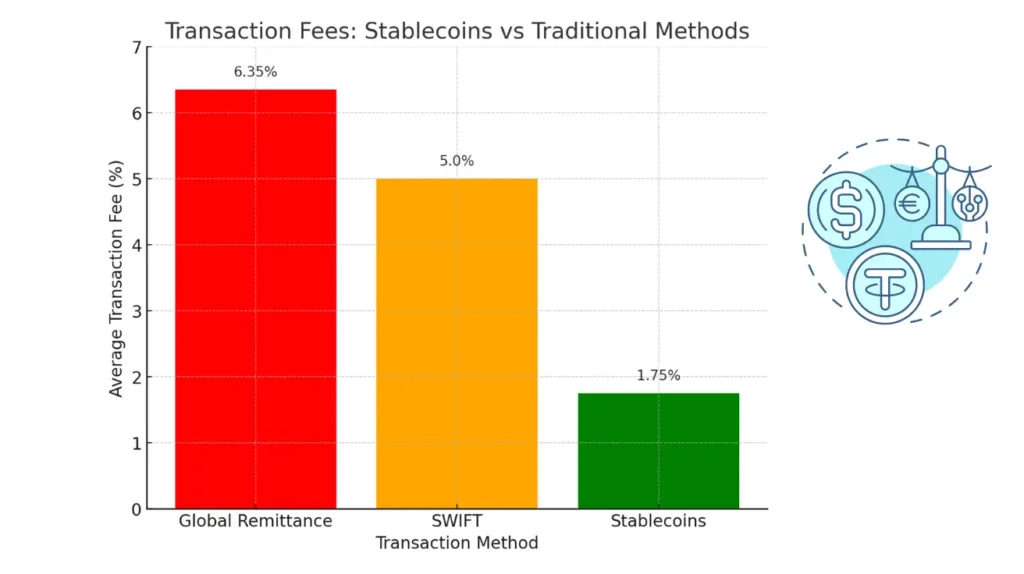

Reduced Transaction Costs and Faster Settlements

Stablecoins have changed digital payments. They have lower fees and faster settlement times than traditional systems. By using blockchain, they cut out intermediaries. This saves businesses and consumers, especially in cross-border payments, where banks charge high fees and cause delays.

Lower Fees for Merchants and Consumers

One key financial benefit of using stablecoins in transactions is the drastic fee reduction. Stablecoin transactions are usually cheap. Unlike credit card processors and banks, like SWIFT, they are cheaper. For instance, while global remittance services often charge up to 6.35% in transaction fees, stablecoins reduce this to an average range of 0.5% to 3%. This makes stablecoins appealing to high-volume merchants and consumers. They want to avoid the hidden costs of traditional finance.

Instant Settlement for Cross-Border Payments

Another key benefit of stablecoins is their instant settlement, which is crucial for international payments. Traditional cross-border payments can take days due to intermediary banks and currency conversion. Stablecoins allow near-instant settlements. They boost cash flow and give consumers faster access to funds. Stablecoin transactions cut out middlemen, lowering fraud and raising transparency using public blockchain records.

Checklist:

- Reduced payment processing time.

- Direct peer-to-peer transactions.

- Elimination of intermediary fees.

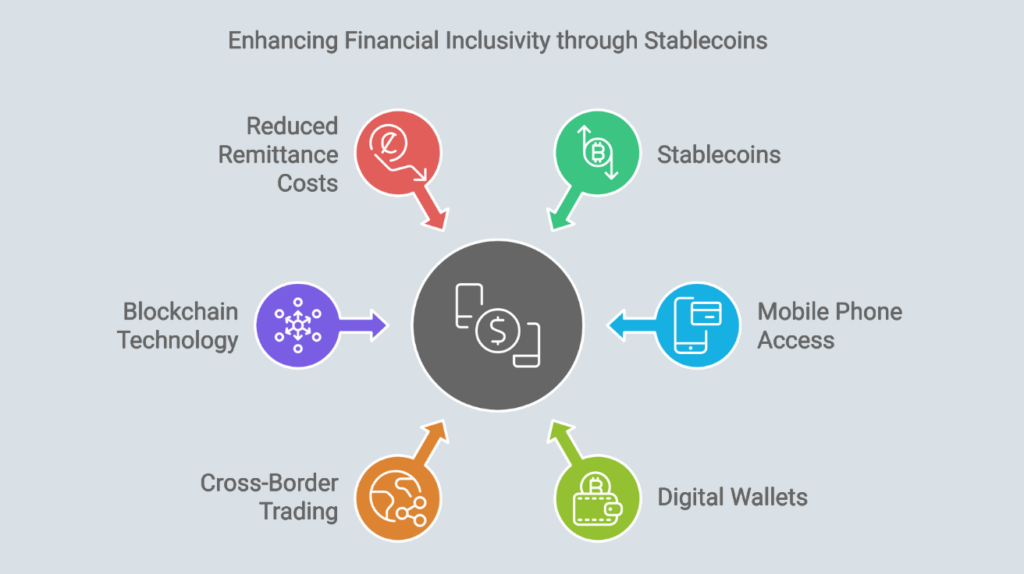

Financial Inclusivity and Global Accessibility

Stablecoins are transformative in global financial inclusion, particularly in underbanked regions. Stablecoins offer a way to access financial services via mobile phones. They let people and businesses trade globally without using traditional banks. This is especially important in developing nations with limited access to banking but high mobile phone usage.

Stablecoins Bridging the Gap for the Unbanked

Stablecoins allow people without access to banks to participate in finance. With smartphones, people can use digital wallets, make payments, and trade across borders. This helps those in underserved areas, reduces reliance on banks, and opens up opportunities for financial growth. Stablecoins, backed by blockchain, are more secure and transparent. They protect users’ funds from fraud and unauthorized access.

Remittances Using Stablecoins

Stablecoins are a game-changer for remittances. They offer faster, cheaper transfers than traditional services like Western Union. They let families and businesses receive funds instantly. Their fees are 0.5-3%, much lower than the 8.5% remittance costs in some regions. In the Philippines and Argentina, slow, costly remittance processes are gone. Stablecoins replaced them. Now, recipients keep more money.

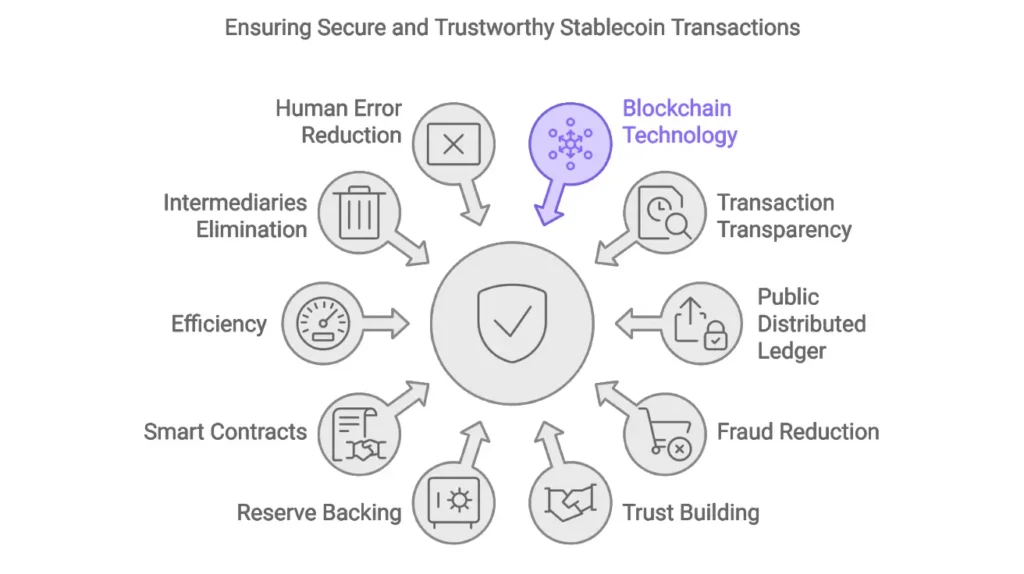

Security and Transparency of Stablecoin Transactions

Through blockchain technology, stablecoins offer enhanced security and transparency. Every transaction is recorded on a public ledger, ensuring visibility and preventing fraudulent activities. This feature makes stablecoins a secure option for transactions. Users can confidently track and verify the movement of funds.

Blockchain Technology and Transaction Transparency

Blockchain technology secures stablecoin transactions. It provides a transparent, unchangeable record of each one. Each stablecoin transfer is recorded on a public, distributed ledger, reducing the risk of fraud or manipulation. This transparency builds trust. Users can then confirm that stablecoins are backed by reserves. Also, smart contracts automate the terms of financial transactions. This increases efficiency, cuts out intermediaries, and reduces human error.

Regulatory Scrutiny and Compliance

Regulative frameworks further strengthen stablecoin. Security and transparency. As oversight evolves, stablecoin issuers must meet strict standards. They must publish regular audits of their reserves to ensure transparency, which will protect consumers. For example, in the EU and the US, new rules, like MiCA, require that stablecoins be backed by real assets. They must also comply with AML and KYC rules. These efforts add trust for users. They ensure stablecoins are secure and transparent to a global audience.

Learn More About:

- Setting Up a Crypto Wallet

- Introduction to Stablecoins

- Using Cryptocurrencies Securely

- The Role of Stablecoins in DeFi

- Beginner’s Guide to NFTs

Stablecoins offer many benefits. They have a stable value. They are also more secure, thanks to blockchain technology. They are reshaping global finance. Furthermore, they offer faster cross-border payments, lower costs, and better access for the unbanked. As regulations evolve, stablecoins will likely play a bigger role. They will boost trust and transparency in digital transactions.