In mid-2024, Bitcoin’s mining hashrate fell by 18.8%. It was the first major drop since 2022. This drop came from several key factors. The April 2024 Bitcoin halving, a rise in network congestion, and tougher competition in mining. The hashrate affects both network security and transaction speeds. So, this drop raises concerns for miners, investors, and the blockchain ecosystem.

Causes Behind the 18.8% Decline in Bitcoin’s Mining Hashrate

Bitcoin’s mining hashrate fell 18.8% in mid-2024. This was due to three factors: the April 2024 Bitcoin halving, more competition among miners, and network congestion. All these causes made mining less profitable. Many miners had to cut back on their operations. This section breaks down these primary causes in detail.

Impact of the Bitcoin Halving on Mining Rewards

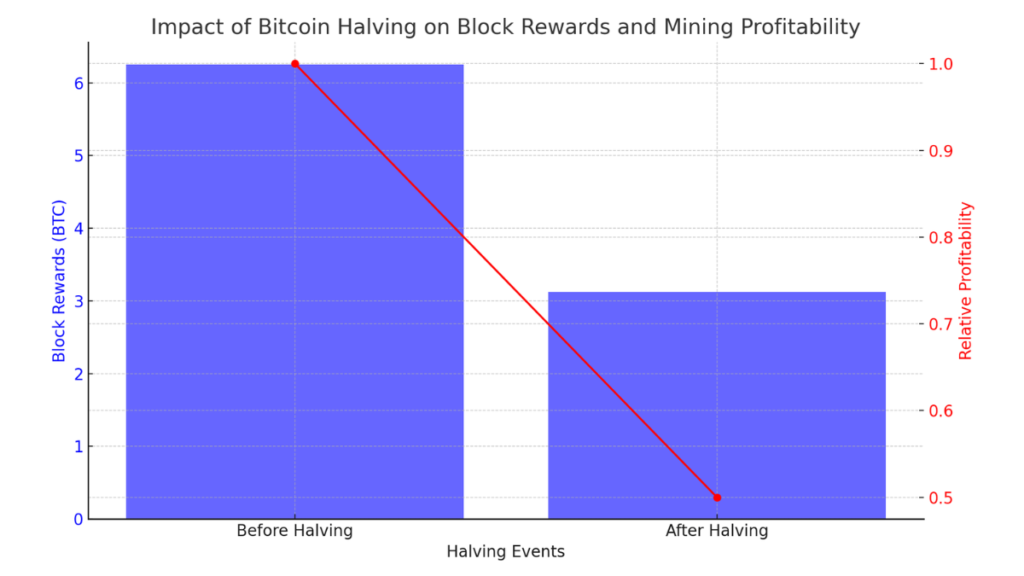

The Bitcoin halving event in April 2024 was a key driver behind the hashrate decline. The halving cut miners’ rewards for validating blocks by 50%. They dropped from 6.25 BTC to 3.125 BTC per block. This cut in rewards made mining much less profitable, especially for smaller operators. As a result, many miners had to cut back or stop operations. This caused a big drop in hashrate.

| Halving Event | Block Reward (BTC) | Impact on Miners |

|---|---|---|

| Before Halving | 6.25 BTC | Higher profitability due to larger rewards |

| After Halving | 3.125 BTC | Lower profitability, causing many miners to cut back |

The lower rewards, along with rising energy costs, hurt miners. This caused the hashrate to decline.

The graph shows how the Bitcoin halving affects block rewards and mining profits.

- The blue bars represent the block rewards (in BTC) before and after the halving.

- The red line shows mining’s profitability. It drops after the halving.

This dual-axis chart shows the link between lower rewards and reduced mining profits.

Increased Competition in the Mining Sector

The competitive landscape in the Bitcoin mining industry also intensified in 2024. Larger mining operations had an advantage. Their efficient equipment let them keep operating despite the halving. However, smaller mining operations struggled to stay profitable. The rewards were lower and energy costs were rising. Many miners exited the industry or scaled back their operations. This rise in competition forced out less efficient miners. It contributed to a decline in hashrate.

Role of Network Congestion in Mining Profitability

Another critical factor that affected mining profitability was network congestion. As more transactions flooded the Bitcoin network, miners faced higher fees and costs. Miners could collect fees from these transactions. But, the drop in block rewards after the halving meant that congestion did not offset the lower earnings. Also, the congestion slowed transaction processing. This cut mining profits.

Consequences of the Declining Hashrate on Bitcoin’s Network

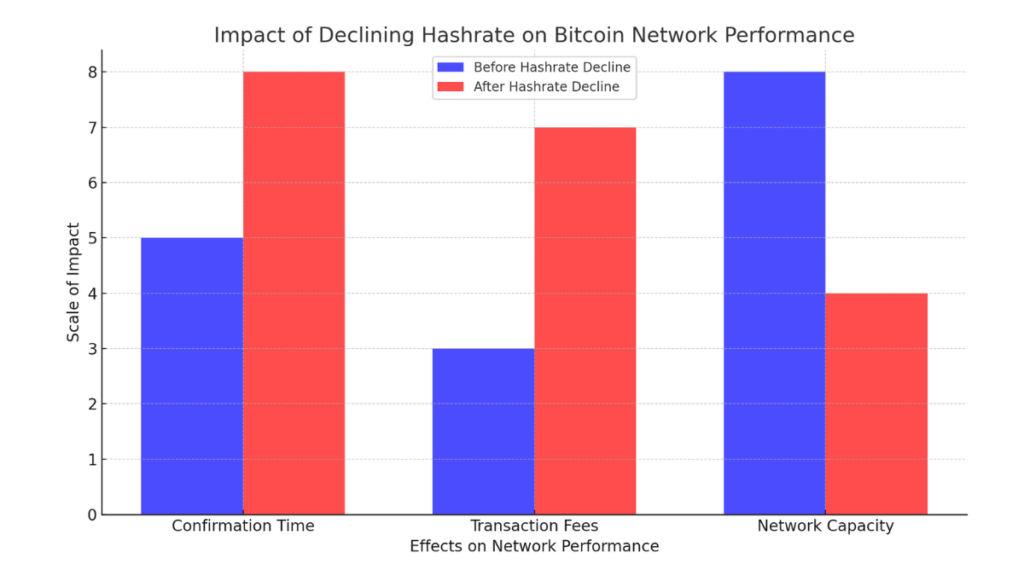

A big drop in Bitcoin’s hashrate can harm the network. It will hurt its security and slow transactions. Fewer miners are securing the network. This reduces its computing power. It affects key aspects of the blockchain’s functionality.

Here is a bar graph. It shows how a declining Bitcoin hashrate affects network performance.

- Confirmation Time: Increases as fewer miners validate blocks.

- Transaction Fees: Rise due to congestion in the mempool.

- Network Capacity: Declines, reducing the overall efficiency of the Bitcoin network.

The chart compares conditions before and after the hashrate decline. The red bars show the negative effects of a reduced hashrate.

Reduced Security Due to Lower Hashrate

A lower hashrate makes the Bitcoin network more vulnerable to attacks. Fewer miners means less computing power. This power is vital to protect the network from attacks, like the 51% attack. A malicious actor could take control of most of the network’s processing power. They could then alter transactions or block new ones from being confirmed. A higher hashrate is seen as a key indicator of Bitcoin’s security. It means more miners are competing to validate blocks.

Note

As the hashrate falls, the network is easier to disrupt. This worries miners and investors.

Slower Transaction Processing and Increased Fees

A lower hashrate also directly impacts transaction processing times. With fewer miners validating transactions, adding new blocks takes longer. This slows transaction confirmations. As block intervals lengthen, the mempool of pending transactions grows. This drives up transaction fees as users compete to get their transactions in the next block.

Effects on Transaction Efficiency:

- Slower confirmation times: Fewer miners are increasing block intervals. This causes longer waits for transaction confirmations.

- As the mempool fills up, users prioritize their transactions. So, fees rise.

- Reduced network capacity: The Bitcoin network’s processing speed slows. Its efficiency as a payment system declines.

Lower hashrates hurt Bitcoin’s security and efficiency for daily transactions. This impacts both miners and users.

Economic Impact on Miners Amid the Hashrate Decline

Bitcoin’s hashrate has fallen. This has hurt miners’ profits, especially after the April 2024 halving. As block mining rewards drop, many miners are losing profit. They are changing operations to cope with shrinking margins.

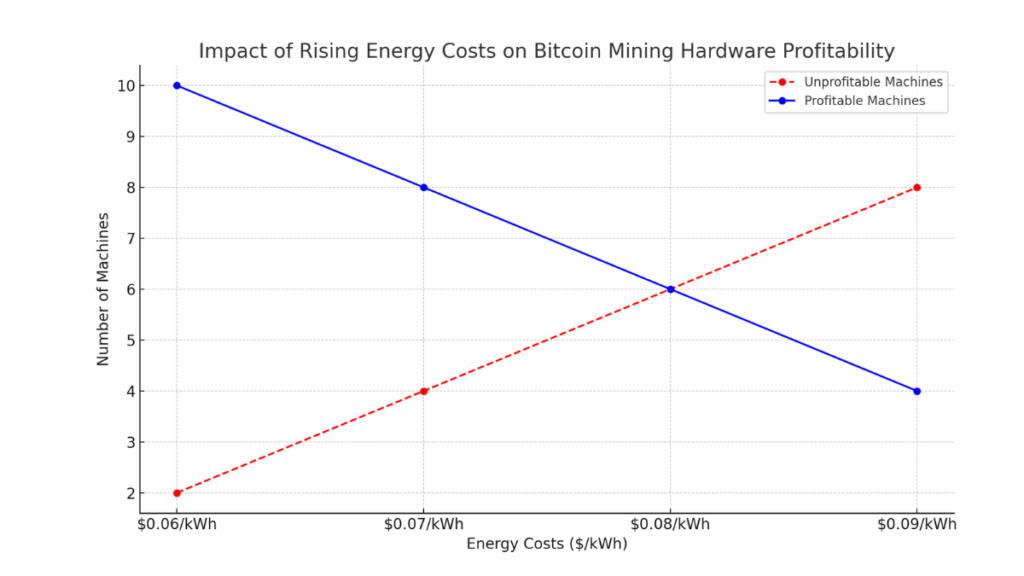

Rising Energy Costs and Their Impact on Profitability

One of the most pressing concerns for miners is the rising cost of energy. As Bitcoin mining becomes more energy-intensive, it is hurting many operators. Older, less efficient hardware is to blame. For instance, ASIC models like the S19 XP and M50S++ operate at a loss when electricity costs exceed $0.09 per kilowatt-hour, with many models becoming unprofitable above $0.08/kWh. The 2024 halving cut block rewards. This forced smaller mining operations to shut down unprofitable rigs.

For miners to remain competitive, they must seek energy cost optimizations. Larger mining operations can withstand higher costs. They have cheap energy and advanced hardware. But, smaller operators struggle to keep up.

This line graph shows how rising energy costs affect Bitcoin mining hardware profitability.

- Red Line: Shows the rise in unprofitable machines as energy costs increase.

- Blue Line: It shows how rising energy costs reduce profitable machines.

This chart shows how energy costs affect mining profits. It is especially true for older, less efficient ASIC models.

Strategies for Surviving in a Post-Halving Environment

To survive the post-halving economic pressures, miners are adopting various strategies. One approach is to invest in more efficient mining hardware, like newer ASIC models. They can cut energy use and boost profits. Companies like Marathon and Bitfarms have upgraded their fleets. They added more efficient machines to offset the drop in block rewards.

Miners are also trying to get good energy contracts. They are upgrading their infrastructure to optimize power use. Some are exploring aftermarket firmware and mergers to cut costs. The industry, post-halving, must adapt to a new economy. So, a shift to energy-efficient solutions should continue.

Potential Long-term Effects of the Hashrate Decline

The short-term effects of Bitcoin’s hashrate decline are clear. Its long-term impact, however, could reshape the mining sector and the Bitcoin network. The industry may see several outcomes as it adapts to new economic pressures.

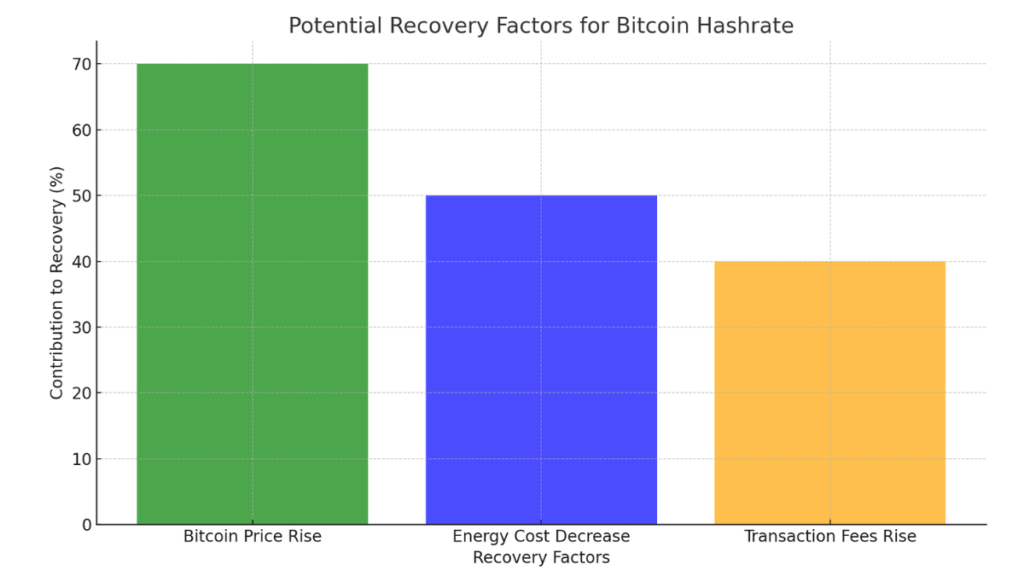

The bar chart shows the impact of various factors on Bitcoin’s hashrate recovery.

- Bitcoin Price Rise: The biggest factor that could boost the recovery.

- Energy Cost Decrease: Significant, but slightly less impactful than price increases.

- Transaction fees rise: can provide more support, though with a smaller contribution.

This graph illustrates the potential influence of these factors on hashrate recovery.

Future of Mining Operations and Infrastructure

The decline in hashrate is likely to influence future investments in mining infrastructure. As energy costs rise and halving cuts profits, inefficient mining rigs may shut down. This could lead to a consolidation in the industry. Centralized mining operations with cheap energy could dominate. They would squeeze out smaller competitors. This centralization raises concerns about the Bitcoin network’s security. A more concentrated mining power could make the network vulnerable to attacks.

This may boost investment in advanced, energy-efficient ASIC hardware. Miners will seek to cut costs. We may also see more miners moving to cheaper energy regions or to areas with stranded gas.

Potential Recovery and What It Will Take

For a recovery in Bitcoin’s hashrate, several factors would need to align. A big rise in Bitcoin prices would boost miners’ profits. This would encourage them to bring their rigs back online. If energy costs fall, mining might become more profitable despite lower block rewards.

Another potential source of recovery could come from Bitcoin transaction fees. Projects like Bitcoin Ordinals are boosting on-chain activity. Miners could offset lower block rewards with higher transaction fees. This would create an extra revenue stream.

However, this may not suffice to offset the halved rewards. Sustained innovations will be needed to maintain profitability.

Industry Response and Developments Post-Hashrate Decline

The recent hashrate decline has posed challenges. Yet, the Bitcoin mining industry is resilient. It is advancing technology and attracting new investments. New mining hardware and strong funding are key. They sustain operations and prepare for growth.

Innovations in Mining Technology

To combat post-halving pressures, many companies are investing in next-gen ASICs. They aim to improve mining efficiency. Newer models, like the Bitmain Antminer S19 XP Hyd and the WhatsMiner M66S, use much less power. Some reach as low as 18.5 J/TH. These improvements are vital for miners. They need to cut costs and stay profitable in a post-halving world where energy efficiency is key.

Note

By 2025, immersion-cooled systems and 5 J/TH ASICs will revolutionize the industry.

Investment and Expansion in the Mining Sector

Large-scale investments are continuing despite the hashrate challenges. Tether, for example, recently announced a $500M investment into Bitcoin mining. This funding will let the company expand and improve its infrastructure. It will ensure they can meet the network’s growing demands. Also, public mining firms like Bitfarms and Marathon are upgrading their fleets. They are adding new mining capacity to meet growth targets. By 2025, the total network hashrate is expected to recover. It may reach 725 to 775 EH/s due to these expansions.

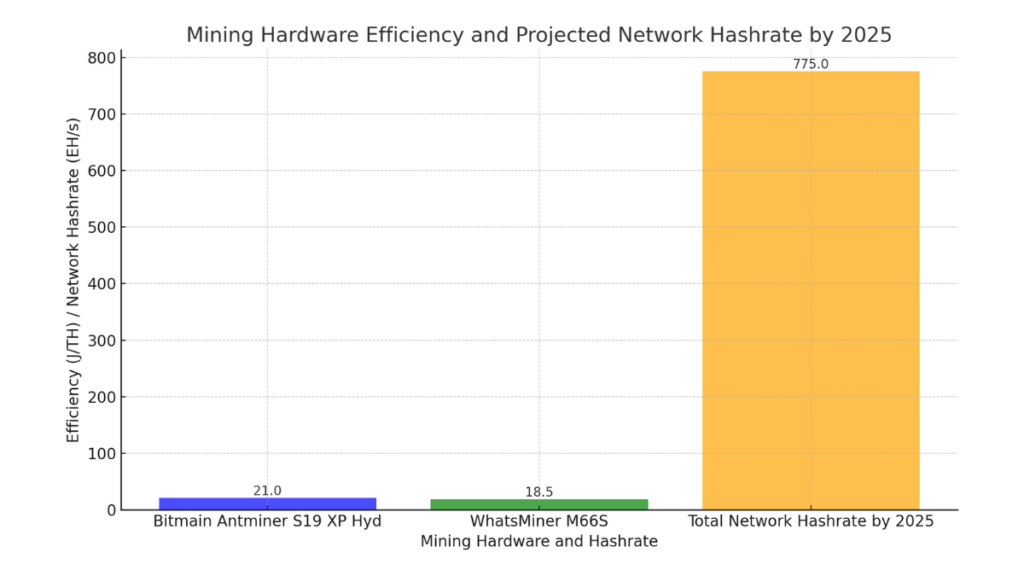

Here is a bar chart. It compares mining hardware efficiency and the projected network hashrate.

- Bitmain Antminer S19 XP Hyd: Efficiency at 21 J/TH.

- WhatsMiner M66S: Higher efficiency at 18.5 J/TH.

- Projected Total Network Hashrate by 2025: Expected to reach 775 EH/s.

This graph shows the gains in ASIC mining hardware efficiency. It also shows the potential recovery in the total network hashrate.

Read More

- Dubai Court Ruling Validates Crypto Salary Payments

- Crypto Market Reactions to Global CPI Data

- G20’s 2024 roadmap for global cryptocurrency regulation

- Centralized exchanges record $3.4 trillion in trading volume

- EOS Spring 1.0 upgrade introduces Savanna consensus

The decline in Bitcoin’s hashrate in mid-2024 tested the mining industry. It drove miners to innovate and adapt. Energy costs and efficiency are key to future profits. The sector’s commitment to new tech and investments offers a path forward. Future growth will depend on balancing these factors with changes in the market and better hardware.