In Q2 2024, centralized exchanges had a trading volume of $3.4 trillion. This was a 12.2% drop from the previous quarter. Despite the drop, top exchanges like Binance and Bybit still dominated the market. Binance led with a 44% market share. Bybit, the second-largest spot exchange, grew significantly.

Overview of Centralized Exchange Trading in Q2 2024

In Q2 2024, CEXs had a trading volume of $3.4 trillion. This was a 12.2% drop from the last quarter. It reflects changes in the cryptocurrency trading market. Despite this drop, major players like Binance and Bybit continued to lead the market. Binance, despite a drop in volumes, kept a big market share. It remains the top exchange. The drop in trading activity reveals broader trends. These include the rise of decentralized exchanges (DEXs) and growing regulatory pressures.

Decline in Overall Trading Volume

Centralized exchanges saw a 12.2% drop in trading volume in Q2 2024. Several factors caused this decline. One major contributor was the growing competition from decentralized exchanges. DEXs are popular for their decentralized nature. They offer more privacy and avoid some regulatory issues of centralized platforms. Regulatory pressures, like stricter KYC rules, made trading on centralized platforms harder. This pushed traders to DEXs, which saw a rise in activity.

Another key reason for the decline was market volatility. It caused a drop in speculative trading. Due to a tough economy, fewer institutional traders did high-volume trades. This hurt centralized exchanges’ performance. Despite the decline, centralized exchanges still led crypto trading. Binance was on top.

Binance’s Market Share Amid Declining Volumes

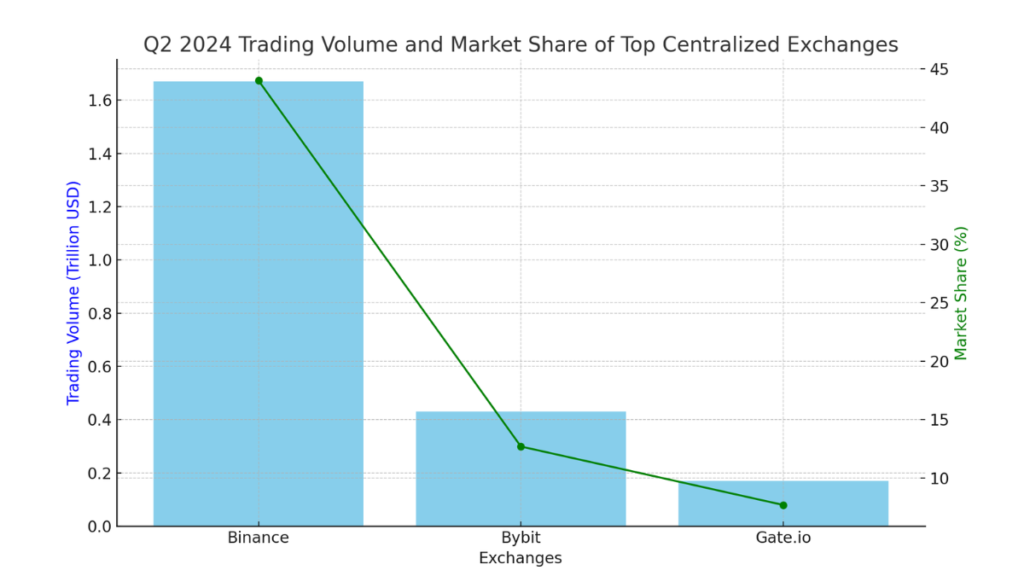

In Q2 2024, Binance led with a spot trading volume of $1.67 trillion. This was 44% of the total volume on centralized exchanges. This was a decrease from the previous quarter. But, Binance’s dominance remained unchallenged. The exchange offered many services, like futures and options trading. This kept it on top despite the market downturn.

Other top exchanges, like Bybit and Gate.io, gained market share from the shifting market. But, Binance’s extensive products kept it well ahead of its rivals. Bybit, for example, grew to 12.7% of the market. Its aggressive token listings and low fees drove this growth.

| Exchange | Q2 2024 Trading Volume (Trillion USD) | Market Share (%) |

|---|---|---|

| Binance | $1.67 | 44 |

| Bybit | $0.43 | 12.7 |

| Gate.io | $0.17 | 7.7 |

Here is a dual-axis chart. It shows the Q2 2024 trading volume and market share of the top centralized exchanges: Binance, Bybit, and Gate.io.

- The bar chart (blue) illustrates the trading volumes in trillion USD.

- The line plot (green) shows the corresponding market share percentages for each exchange.

This dual-axis format provides a clear comparison between trading volume and market share.

Bybit’s Growth in the Face of Market Decline

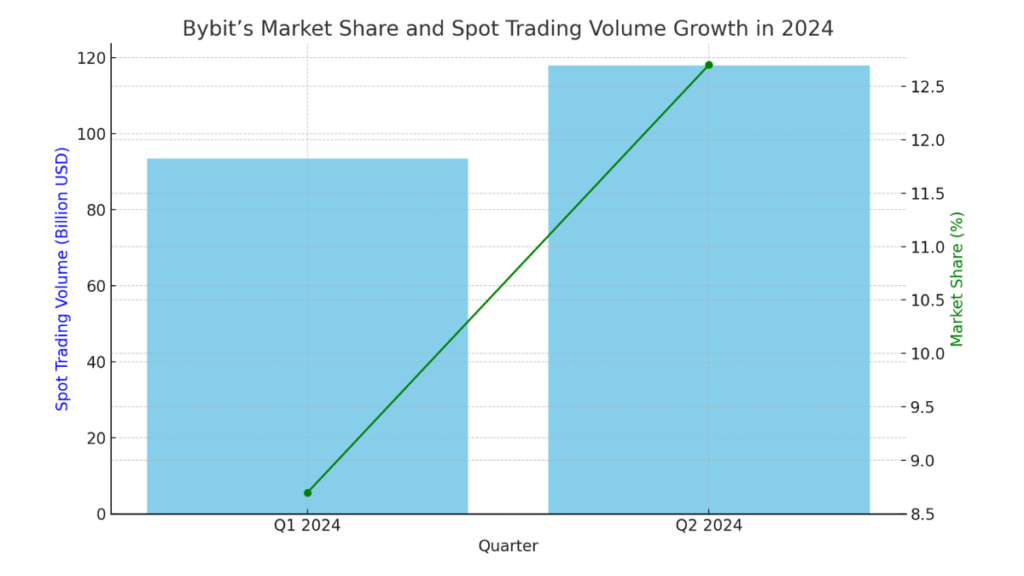

Bybit emerged as a standout performer in Q2 2024, despite the overall market decline. The exchange gained a 12.7% market share. It became the second-largest centralized exchange by spot trading volume. While other exchanges struggled, Bybit thrived. Its strategy of expanding token listings and keeping fees low worked. This aggressive expansion helped Bybit attract new users after the FTX collapse. It opened up growth opportunities.

Bybit’s Market Share Increase

Bybit’s market share rose from 8.7% in Q1 2024 to 12.7% by Q2. This shows it can capitalize on favorable market conditions. The exchange’s push to list new tokens drove a 4% market share growth. This effort appealed to both retail and institutional traders. Also, Bybit’s focus on customer retention has fueled its rise. It does this by offering lower fees and better trading features. The exchange recorded $117.9 billion in spot trading volume in June 2024 alone.

Here is a dual-axis chart. It shows Bybit’s Market Share and Spot Trading Volume growth from Q1 2024 to Q2 2024.

- The bar chart (blue) displays the increase in Bybit’s spot trading volume, rising from $93.5 billion in Q1 to $117.9 billion in Q2.

- The line plot (green) shows Bybit’s market share growth, climbing from 8.7% in Q1 to 12.7% in Q2.

This dual-axis format clearly shows Bybit’s big performance gains on both metrics.

Key Factors Driving Bybit’s Growth

Several factors played a crucial role in Bybit’s growth during Q2 2024:

- New Token Listings: Bybit’s rapid expansion of token offerings made it a popular platform. Traders sought to diversify their portfolios.

- Competitive Fees: Bybit had lower transaction fees than other major exchanges. This boosted its appeal.

- Post-FTX Market Opportunities: FTX’s collapse let Bybit gain market share as traders sought new, safe platforms.

- Strong Derivatives Market: Bybit’s strong derivatives trading and its growing spot market made it a top CEX.

HTX and Gate.io’s Market Movements in Q2 2024

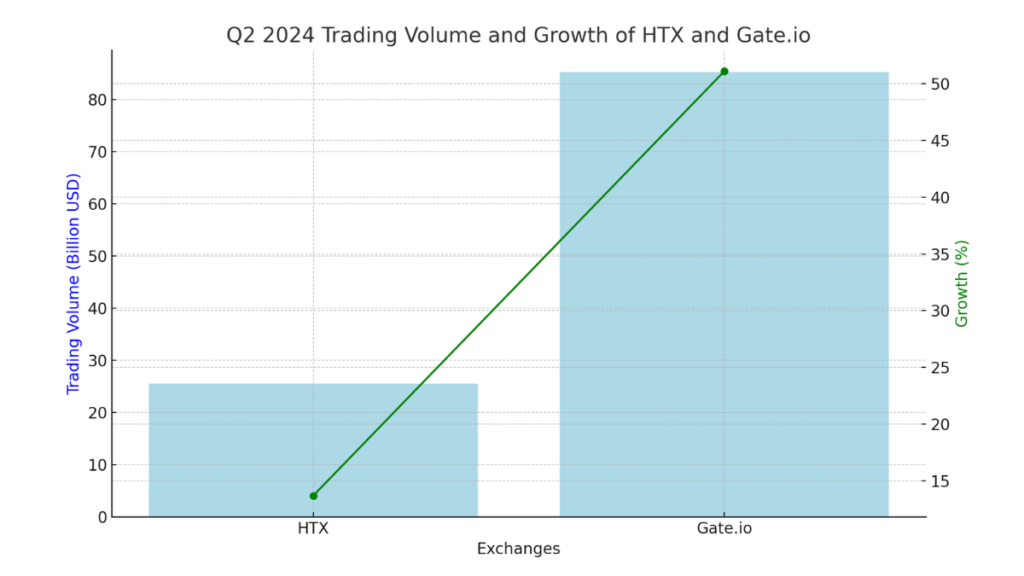

In Q2 2024, both HTX and Gate.io were centralized exchanges. They grew despite a market decline. While many top exchanges saw a drop in trading volumes, HTX and Gate.io grew impressively. Their strategic advancements paid off in a tough market.

Here is a dual-axis chart representing HTX and Gate.io‘s Q2 2024 Trading Volume and Growth:

- The bar chart (blue) shows the trading volumes, with HTX recording $25.5 billion and Gate.io achieving $85.2 billion.

- The line plot (green) highlights the growth percentages, with HTX growing by 13.7% and Gate.io seeing an impressive 51.1% increase.

HTX’s 13.7% Growth in Trading Volume

HTX achieved a notable 13.7% increase in spot trading volume during Q2 2024. This growth came from the exchange’s aggressive push to list new tokens. It helped attract more users. Also, HTX’s expanding services made it a strong competitor in the exchange market. By the end of the quarter, HTX’s trading volume hit $25.5 billion. This shows its upward trajectory.

Gate.io’s Record Growth

Gate.io was the biggest gainer in Q2 2024, experiencing a massive 51.1% increase in trading volume. This growth added an additional $85.2 billion to its trading volume, making it the highest-performing exchange among the top 10 centralized exchanges. Gate.io’s success can be attributed to its innovative fee structures and a strong focus on attracting new users with a range of trading tools and new listings. The exchange’s performance stood out as it significantly outpaced competitors during this period.

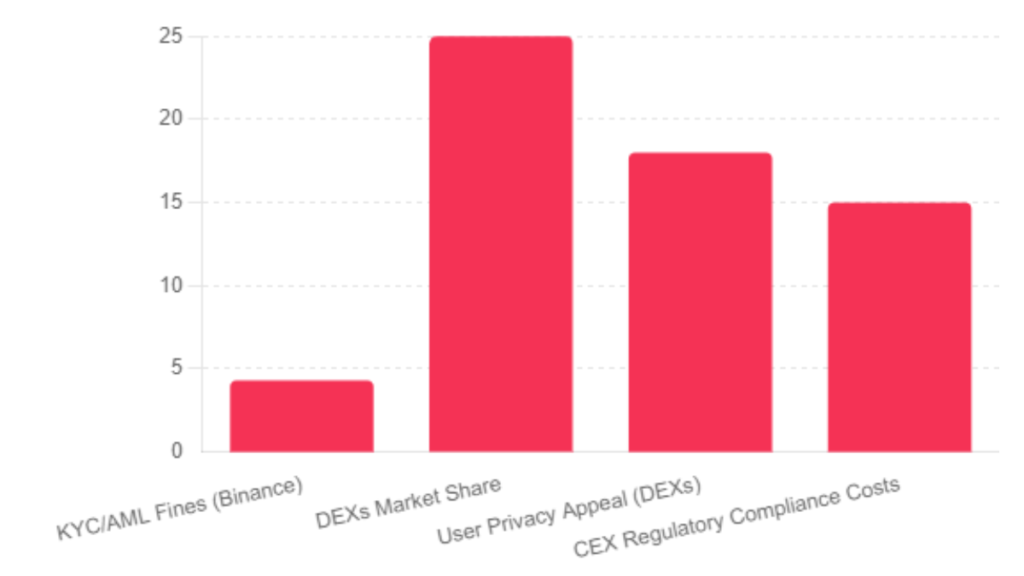

Challenges and Opportunities for Centralized Exchanges in 2024

In 2024, CEXs face challenges. They must adapt to stricter regulations and competition from DEXs. This new landscape has made many top exchanges, like Binance and Bybit, rethink their strategies. They face regulatory hurdles. Meanwhile, new players like Gate.io have grown by taking advantage of the situation.

Here is a bar chart representing key Challenges and Opportunities for centralized exchanges (CEXs) in 2024:

- KYC/AML Fines (e.g., Binance’s $4.3 billion fine).

- DEXs Market Share (estimated at 25%, showing increasing competition).

- User Privacy Appeal (DEXs attract users due to privacy benefits, valued at $18 billion in user migration appeal).

- CEX Regulatory Compliance Costs (CEXs face compliance costs estimated at $15 billion).

This bar chart visualizes the financial and operational impacts affecting CEXs and DEXs.

Regulatory Challenges for Centralized Exchanges

One of the most pressing issues for centralized exchanges in 2024 is the growing regulatory scrutiny. Governments across the globe are implementing stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. These regulations are not only designed to combat fraud and illicit activities but also to ensure transparency. Exchanges that fail to comply with these requirements face hefty fines. In 2023, Binance faced a $4.3 billion fine due to AML violations, and this trend is expected to continue into 2024.

Centralized exchanges are struggling to balance compliance with a good user experience. KYC processes are necessary but can frustrate users and slow onboarding. These hurdles, along with the high costs of compliance, challenge CEXs. They must compete in a toughening market.

Competition from Decentralized Exchanges

As centralized exchanges wrestle with regulatory pressures, decentralized exchanges (DEXs) are gaining ground. DEXs are an alternative trading platform. They avoid many issues of CEXs, like high fees and regulation. Users are drawn to DEXs for their low costs, privacy, and lack of government control. Smart contract-based systems like Uniswap and SushiSwap are on the rise. As a result, DEXs are gaining market share.

Decentralized exchanges offer benefits like privacy and low fees. But, they have challenges, especially with security and liquidity. Many DEXs struggle with scalability. Their weak KYC processes could invite regulatory issues. As they evolve, DEXs may threaten centralized platforms. This is especially true if they innovate in cross-chain and decentralized identity solutions.

Linking Suggestions

- VOOX AI-Driven Trading Platform Beta Launch

- Yield Guild Games Expands Play-to-Earn Access

- Crypto Market Reactions to Global CPI Data

- Institutional Investment in Cryptos

Centralized exchanges (CEXs) are facing a transformative period in 2024. Regulatory requirements and competition from DEXs have prompted major changes in the industry. Top platforms like Binance and Bybit are adapting. Newer players like Gate.io are capitalizing on the changes.

For competitiveness, centralized exchanges must balance innovation and compliance. Decentralized platforms are gaining traction. They offer more privacy and fewer regulations. Crypto trading will likely blend both models. Regulators want more oversight. Users want more control over their assets.