Uniswap V4 adds flexibility to decentralized exchanges. Uniswap V4 Decentralized Trading Features does this by introducing hooks, which allow advanced customization of liquidity pools. Uniswap V4 will transform decentralized trading. Its features, like flash accounting and the Singleton contract, will cut gas fees and boost efficiency. These innovations, plus TWAMM orders and dynamic oracles, will improve DeFi trading. They promise more flexible trading strategies.

Overview of Uniswap V4’s Key Features and Innovations

Uniswap V4 has groundbreaking features. They are hooks and a singleton contract. They improve customization, gas efficiency, and trading for DeFi users. These updates make Uniswap V4 a highly anticipated DEX upgrade. The platform aims to lead in DeFi by letting developers create adaptable trading strategies.

Hooks and Customizable Liquidity Pools

Uniswap V4 introduces hooks. They let developers attach external smart contracts to liquidity pools. This customizes the pool’s behavior. This means that each V4 liquidity pool can have unique logic. It offers unprecedented flexibility. Developers can modify actions like swaps and liquidity adjustments. They can also implement specialized market-making algorithms. For instance, hooks can enable TWAMM orders, dynamic fees, and on-chain limit orders. It helps liquidity providers and traders to optimize their strategies. It gives them more control over decentralized trading.

Note

- How Liquidity Pools Work in DeFi

- Yield Guild Games Expands Play-to-Earn

- Ethereum Gas Fees for September 2024

- Top DeFi Projects to Watch in 2024

- How Decentralized Exchanges Operate

Singleton Architecture for Gas Savings

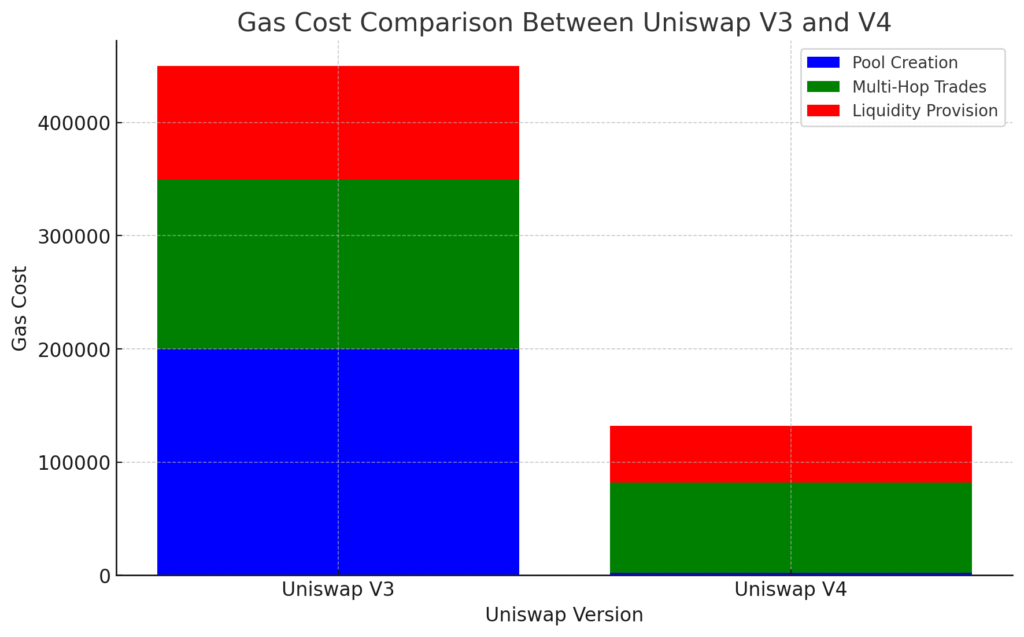

Uniswap V4’s singleton contract architecture improves gas efficiency. It does this by consolidating all liquidity pools into a single contract. Unlike Uniswap V3, where each pool had its own contract, V4 cuts costs by streamlining transactions under one system. This consolidation cuts the gas fees for trades, liquidity pools, and multi-hop trades.

Here’s a breakdown of gas savings between Uniswap V3 and V4:

| Action | Uniswap V3 (Average Gas Cost) | Uniswap V4 (Average Gas Cost) | Gas Savings |

|---|---|---|---|

| Pool Creation | 200,000 gas | 2,000 gas | 99% |

| Multi-Hop Trades | 150,000 gas | 80,000 gas | 47% |

| Liquidity Provision | 100,000 gas | 50,000 gas | 50% |

Flash Accounting System for Efficient Transactions

Uniswap V4’s flash accounting system improves efficiency. It transfers only net balances instead of executing each step individually. This system cuts gas fees for multi-action tasks. These include swapping tokens while adding liquidity. It lets users chain multiple actions in one transaction. This makes the process faster and cheaper.

Note

For example, in a multi-hop trade, the platform calculates the net result. It then transfers only the net balances, not moving tokens between each pool one by one. This upgrade boosts transaction speed and lowers users’ costs.

Native ETH Support and Dynamic Fee Tiers

One of the most awaited features in Uniswap V4 is native ETH support. It removes the need to wrap ETH (convert it to WETH) before using the platform. This simplifies the trading experience and saves gas fees. Also, dynamic fee tiers have been introduced. They let liquidity providers set fees based on market volatility and trading activity. This fee structure lets the platform adapt to market changes. It offers better prices for traders while boosting earnings for liquidity providers.

Note

Uniswap V4’s features and its hooks system make it a powerful DeFi tool. It offers flexibility and customization for users’ trading strategies.

How Uniswap V4 Hooks Transform Trading Strategies

Uniswap V4 introduces hooks. They let developers add new features, like on-chain limit orders and dynamic oracles. These changes give users more control over their trading strategies. They improve the flexibility and precision of decentralized trading on the platform.

Time-Weighted Average Market Maker (TWAMM)

Uniswap V4 hooks allow a new feature: the TWAMM. It is a Time-Weighted Average Market Maker. This function lets traders execute large orders. It breaks them into smaller, incremental trades over a set period. The TWAMM cuts price slippage and the risk of front-running. Front-running is when traders or bots exploit a large trade order before it’s fully executed. By splitting orders into smaller parts, TWAMM helps traders get better prices. It does this without dramatically affecting the market. So, it is ideal for trading large volumes of assets.

capability enables better trading. It caters to users who want to minimize their transactions’ impact on token prices.

On-Chain Limit Orders For Uniswap V4 Decentralized Trading Features

In centralized exchanges, limit orders let traders set a buy or sell price for an asset. Uniswap V4 introduces on-chain limit orders through the use of hooks, allowing users to perform these actions directly on the blockchain. This means traders can set orders to execute only at a predefined price. This adds precision not seen before in decentralized exchanges (DEXs).

Note

Feature lets traders stop watching prices. The platform will execute the trade when the conditions are met. It will do this while keeping a DEX’s transparency and trustless nature.

Custom Oracles for Price Adjustments

Uniswap V4’s hooks also enable the integration of custom oracles. Oracles are critical in providing real-time price data on decentralized exchanges, and in V4, they can be customized to improve trading accuracy. A key benefit of these custom oracles is the truncated oracle. It protects the pool from manipulation by reducing the price impact of large trades.

Traders and liquidity providers benefit from more accurate pricing, less manipulation, and greater overall reliability. Uniswap V4 uses custom oracles to ensure price accuracy. boosts liquidity pool reliability. It makes the platform more appealing for advanced DeFi strategies.

Benefits of Custom Oracles:

- Reduced price manipulation

- Improved trading accuracy

- Protection against large price impacts

Benefits of Hooks for Developers and Liquidity Providers

Uniswap V4’s hooks empower developers and liquidity providers with unparalleled flexibility. These hooks enable custom AMM functions and dynamic fees. They offer new ways to build advanced DeFi protocols and boost liquidity provider returns.

Developer Innovation with Hooks

Uniswap V4 has hooks. They let developers customize AMM functions by using external smart contracts in liquidity pools. This innovation lets developers create new DeFi protocols or enhance existing pools with advanced trading features. With hooks, developers can use unique strategies in liquidity pools. include custom price curves, on-chain limit orders, and yield farming.

For example, a developer could use hooks to create a pool. It would adjust its pricing algorithm based on market conditions. They could even integrate advanced oracles for real-time price updates. customizations create specialized pools for different market participants. They enable more complex DeFi protocols that can attract more liquidity.

Dynamic Fees for Liquidity Providers

One of the most exciting features for liquidity providers in Uniswap V4 is the introduction of dynamic fee structures. With hooks, liquidity providers can set flexible fee tiers. These can adjust based on market conditions, like volatility or trading volume. This allows providers to maximize their earnings by optimizing fees according to current demand and market trends.

For instance, during times of high volatility, liquidity providers can raise their fees to compensate for the increased risk. Conversely, they can lower fees during stable market conditions to attract more traders. This system lets liquidity providers adjust their fees. They are not locked into a static structure. This gives them more control over their earnings and aligns them better with market activity.

Uniswap V4’s Impact on the DeFi Ecosystem

Uniswap V4 is the largest DEX by trading volume. It has new features that set a high bar for DeFi innovation. This upgrade will boost the efficiency of decentralized trading. It will also drive more adoption of DeFi protocols across the ecosystem. With hooks and a more gas-efficient design, Uniswap V4 is a key advance. It will transform decentralized finance.

Competitive Advantage for Uniswap

Uniswap V4’s new features, like hooks and the Singleton contract, give it a big edge in the DEX market. Hooks let developers create custom liquidity pools. They can run advanced trading strategies, like dynamic fees and on-chain limit orders. innovations make the platform more appealing to traders and liquidity providers. They offer more control over trading behavior.

Uniswap’s new flash accounting system helps its edge. It boosts efficiency and cuts gas fees, especially for complex, multi-step trades. These features let Uniswap outpace other decentralized exchanges. It leads in decentralized trading innovations. Uniswap V4’s customizable smart contracts make it great for advanced DeFi apps.

Expanding the DeFi Ecosystem

Uniswap V4’s upgrades, especially hooks, will likely spur new DeFi protocols. Hooks support customized liquidity pools. They can interact with other dApps and protocols. This fosters a more connected DeFi landscape. For instance, the TWAMM feature allows large trades to be executed over time. reduces price impact and prevents front-running. It enables more advanced financial tools.

Also, Uniswap V4’s design will lower the barrier for new projects. It will cut gas costs and boost transaction efficiency. It will likely inspire better decentralized apps, liquidity tools, and yield farming. They will enrich the DeFi ecosystem.

Note

Uniswap V4 will boost DeFi platforms by expanding developers’ and liquidity providers’ abilities. It will create new opportunities for traders and liquidity providers.

Uniswap V4’s introduction of hooks and the Singleton contract architecture represents a pivotal moment in the evolution of decentralized exchanges (DEXs) and decentralized finance (DeFi). These innovations enable greater customization, efficiency, and flexibility, opening the door to advanced trading strategies and complex DeFi applications. By improving gas efficiency and empowering both developers and liquidity providers, Uniswap V4 is positioned to significantly expand the capabilities and adoption of decentralized finance.