The G20’s 2024 summit has paved the way for a comprehensive roadmap addressing global cryptocurrency regulation. As digital assets continue to influence international markets, the G20 aims to establish cohesive global standards to ensure financial stability and protect consumer rights. By focusing on international cooperation, the summit has outlined a strategy that addresses regulatory gaps while encouraging cross-border compliance. This Article explores the summit’s key outcomes and their implications for the future of the global crypto industry.

International Cooperation for Cryptocurrency Regulation

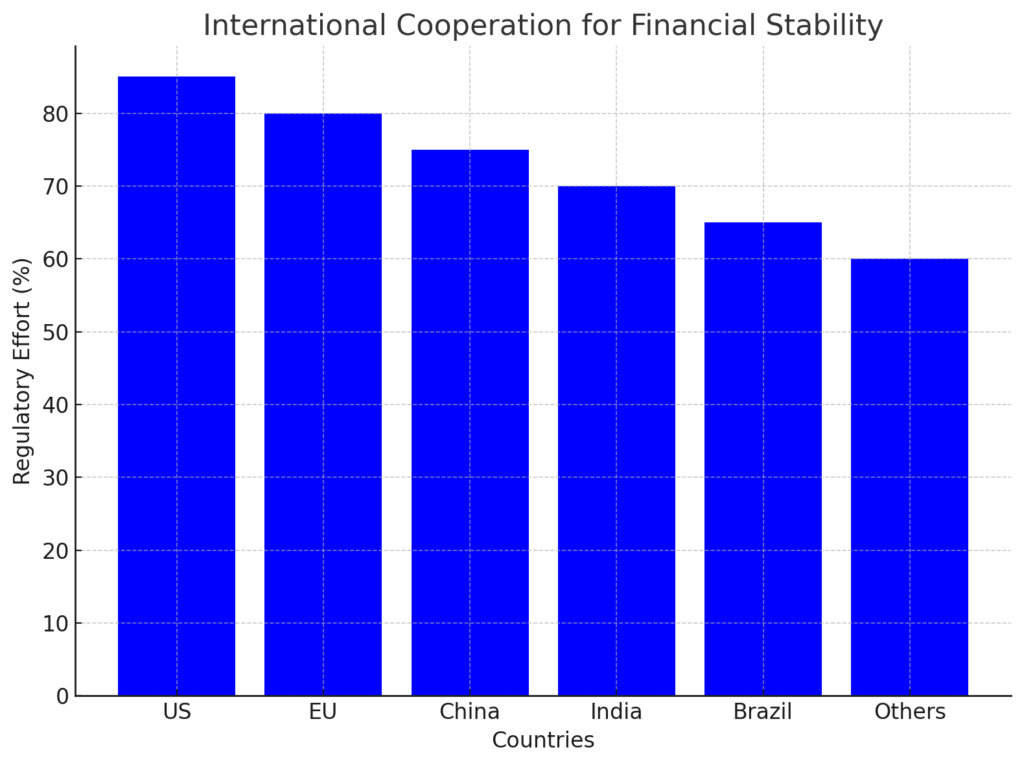

The G20 is driving a coordinated global effort to standardize cryptocurrency regulation to close regulatory gaps across borders. With the rapid rise of digital currencies and decentralized finance, fragmented national policies have created financial stability and enforcement risks. To address this, the G20 has focused on developing global standards, facilitating cooperation among nations, and ensuring transparent crypto policies. Initiative emphasizes the importance of cross-border compliance, encouraging international bodies to work together to reduce financial crime and foster global economic security.

G20’s Global Regulatory Framework for 2027

By 2027, the G20 aims to implement a unified global crypto regulatory framework, a monumental task that involves collaboration between nations and influential organizations like the Financial Stability Board (FSB). ThFSB’s recommendations are crucial in shaping this vision, particularly in creating risk-based regulatory models that both developed and emerging markets can adopt. Key components of this framework include:

- They harmonized taxation policies across borders.

- A robust AML (Anti-Money Laundering) and KYC (Know Your Customer) compliance framework.

- Standardized rules for the regulation of crypto exchanges and stablecoins.

The 2027 goal is not just about setting policies but ensuring global enforcement minimizing the risk of regulatory arbitrage, where companies may move operations to less regulated regions. The G2G20’s2G20’sapeflects its dedication to creating a stable and secure cryptocurrency environment for global markets, reducing volatility, and protecting investors from fraud.

Cross-Border Crypto Compliance Initiatives

A critical aspect of the 2G20’s is focus on cross-border compliance, which is essential in the fight against tax evasion, money laundering, and other financial crimes facilitated by a cryptocurrency’s realized. The IMF-FSB Synthesis Paper, presented at the G20 summit, lays out several key compliance initiatives:

| Initiative | Associated Risks | Participating International Bodies |

|---|---|---|

| Global AML/KYC Standards | Tax evasion, money laundering | FATF, FSB, IMF |

| Cross-border Crypto Reporting Standards | Lack of transparency, tax avoidance | G20, OECD, FATF |

| Stablecoin Regulation for Market Integrity | Market instability, consumer risks | IMF, FSB, G20 |

Note

By unifying its approach to crypto regulation, the G20 seeks to create a safer financial ecosystem, especially in areas prone to financial crimes through crypto assets.

Stablecoin and CBDC Oversight

The rapid expansion of stablecoins and Central Bank Digital Currencies (CBDCs) has brought these digital assets to the forefront of regulatory discussions. At the 2024 G20 summit, leaders emphasized the need for a secure and transparent regulatory framework for these assets to protect market stability and mitigate risks associated with their adoption. Given their potential to disrupt traditional financial systems, stablecoins and CBDCs are now seen as critical components of the future digital economy, and the G20 is working on comprehensive strategies to address their challenges.

Stablecoin Regulations for Market Stability

Stablecoins often pegged to fiat currencies, have gained popularity for their ability to reduce volatility in cryptocurrency transactions. However, without proper regulation, they can introduce market stability and consumer protection risks. To address these concerns, the G20 has established a regulatory framework to ensure stablecoins are backed by secure reserves and subject to regular audits. Key measures include:

- Ensuring stablecoins are fully backed by reliable assets to prevent liquidity issues.

- We are introducing strict rules to safeguard users and prevent the potential liability of stablecoin failure.

- Issuers must provide transparent, real-time reporting on reserve assets, ensuring market participants can trust the stablecoin.

Note

Regulations aim to create a safe environment for stablecoin usage, mitigating the risk of sudden market crashes due to unstable reserves or mismanagement.

Implementation of CBDCs Across G20 Nations

Central Bank Digital Currencies (CBDCs) are viewed as the next frontier in digital payments, offering a government-backed alternative to private cryptocurrencies. Many G20 nations are exploring the integration of CBDCs to modernize their financial systems and enhance payment efficiency. However, introducing CBDCs presents its own challenges, particularly around market volatility and privacy concerns. The G20 has outlined a straightforward approach to oversee the implementation of CBDCs, focusing on the following:

- Central Bank Responsibilities: Central banks must ensure that CBDCs function as a reliable form of digital currency without destabilizing traditional banking systems.

- Technical Requirements: The infrastructure supporting CBDCs must be secure, scalable, and resilient to cyber threats.

- Compliance Benchmarks: Countries must adhere to global compliance standards, ensuring that CBDCs can be used for cross-border payments without facilitating illegal activities like money laundering.

Related Article for you:

- MiCA’sMiCA’st on Self-Hosted Wallets

- US SEC’s SEC’siEnfoMiCA’stns Against Crypto

- FSB’s FSB’sCRoaSEC’sforl Crypto Regulation

- G20 CryFSBCryFSB’seportingwork Implementation

- FATF Guidelines on Crypto Transactions

Financial Stability and Market Integrity

As the adoption of cryptocurrencies continues to rise globally, the G20 has prioritized protecting financial stability and market integrity through its 2024 roadmap. Introducing stricter regulatory frameworks is critical to mitigating the risks associated with digital assets. With the surge in decentralized finance (DeFi) and increased crypto trading, global leaders are working together to implement policies ensuring investor protection and market transparency.

Risk Reduction in Crypto Markets

The G20 has strongly emphasized addressing the inherent risks in the cryptocurrency markets, particularly those related to fraud, hacking, and market manipulation. To reduce these risks, several strategies have been outlined:

- Enhanced Market Surveillance: The G20 pushes for more rigorous market monitoring systems to detect fraudulent activities, hacking incidents, and real-time real-time market manipulation. This includes monitoring large transactions and unusual trading patterns that could signal illegal activities.

- Stricter Regulations on Market Participants: Regulatory bodies ensure that crypto exchanges and service providers adhere to Anti-Money Laundering (AML) and Know-your-customer (KYC) standards, which help prevent criminal activities.

- Regulation of Market Speculation: Excessive speculation is one of the significant concerns in crypto markets, leading to volatility. The G20 advocates for regulatory measures limiting speculative trading practices to prevent sudden market crashes.

Note

Initiatives aim to create a more secure environment for investors while ensuring crypto markets operate with integrity.

G20’s G20’sap for Crypto Asset Reporting Standards

A critical part of the G20’s roadmap is introducing comprehensive reporting standards for crypto-assets. G20’stG20’stablishingparent reporting mechanisms, the G20 ensures that crypto activities are monitored effectively, reducing the likelihood of illicit activities such as money laundering and tax evasion. The roadmap includes:

| Type of Asset | Reporting Requirements | Penalties for Non-Compliance |

|---|---|---|

| Stablecoins | Real-time reporting of reserve assets and audits | Financial penalties and restrictions on operations |

| Crypto Exchanges | Regular transaction reporting and user data transparency | License suspension or revocation for non-compliance |

| DeFi Platforms | Transparency in liquidity and transaction volumes | Fines and operational limitations |

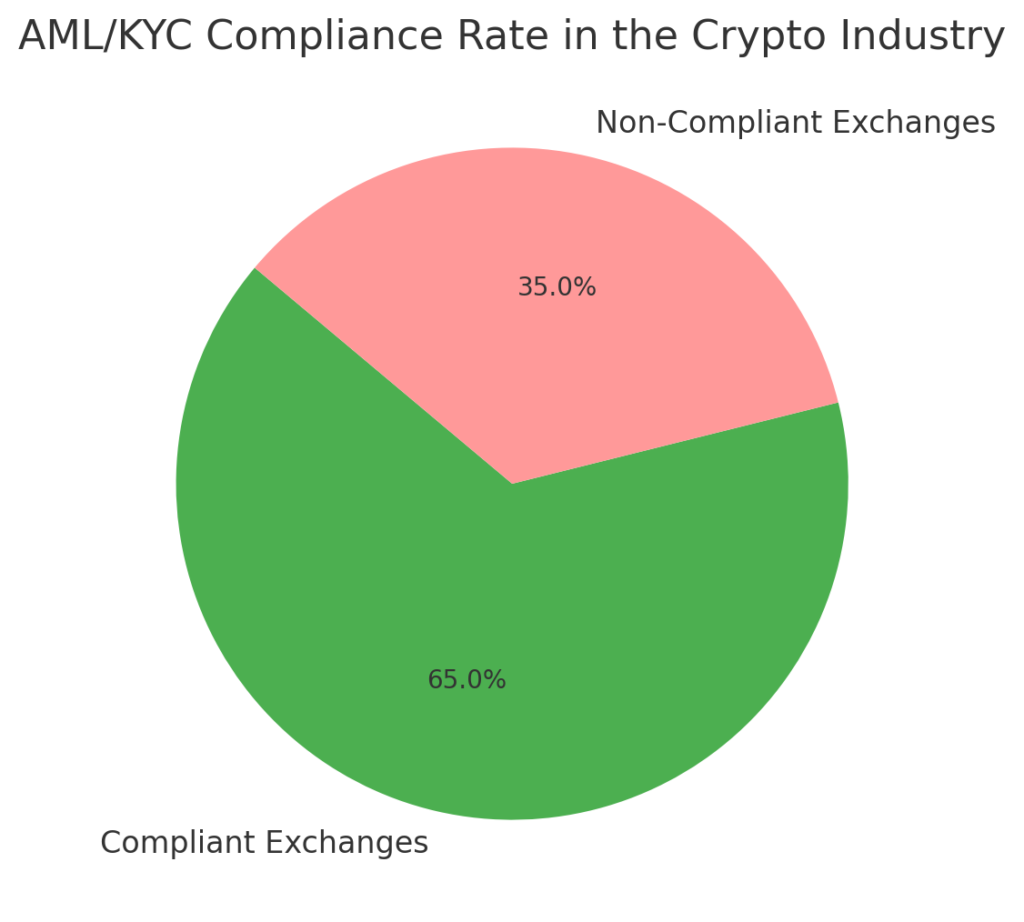

Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance

As the global adoption of cryptocurrencies accelerates, so does the need for robust measures to curb their misuse for illegal activities. At the 2024 G20 summit, leaders emphasized reinforcing AML and KYC compliance. These regulations are crucial for maintaining market integrity and ensuring that cryptocurrencies are not exploited for money laundering or terrorist financing. The G20 aims to enhance security in cross-border crypto transactions by tightening the framework around these processes, creating a safer environment for investors and financial institutions.

AML Guidelines for Global Crypto Markets

The G20 has laid out comprehensive anti-money laundering (AML) guidelines tailored to the unique risks posed by the cryptocurrency market. These guidelines align with the Financial Action Task Force (FATF) standards, requiring cryptocurrency exchanges and other digital asset service providers to implement stricter controls. Key recommendations include:

- Exchanges must employ advanced analytics to detect, report, and report suspicious activities to relevant authorities in real time.

- International bodies are encouraged to share information on illicit crypto activities, preventing criminals from exploiting regulatory loopholes across borders.

- Service providers must assess users’users’levels and apply heightened scrutiny to higher-risk transactions or accounts.

Note

G20 crypto recommendations on AML reflect the incidents of financial crimes by ensuring all jurisdictions comply with global standards.

KYC Protocols for Cross-Border Crypto Transactions

The Know Your Customer (KYC) protocols have become a focal point in the G20’s G20’satory roadmap, especially in light of the increase in cross-border cryptocurrency transactions. Strengthened KYC protocols are esG20’esG20’salsure that financial institutions and crypto exchanges can effectively verify user identities, minimizing the risk of illegal activities. The G20 has proposed several vital steps to reinforce KYC practices:

- Exchanges must implement stringent identity checks using government-issued identification to verify the true identity of all users.

- Personal information and transaction histories must be recorded and securely stored to track suspicious activity.

- Regular risk assessments are required to ensure that high-risk accounts are closely monitored for unusual behavior patterns.

The G20 seeks to create a unified framework that enforces these KYC protocols to ensure crypto exchange-compliant operation, even across borders.

Essential KYC Steps for Crypto Exchanges:

- Step 1: Collect verified personal infexcinfexchanges’romsers.

- Step 2: Store transaction histories securely.

- Step 3: Perform regular risk assessments for high-risk users.

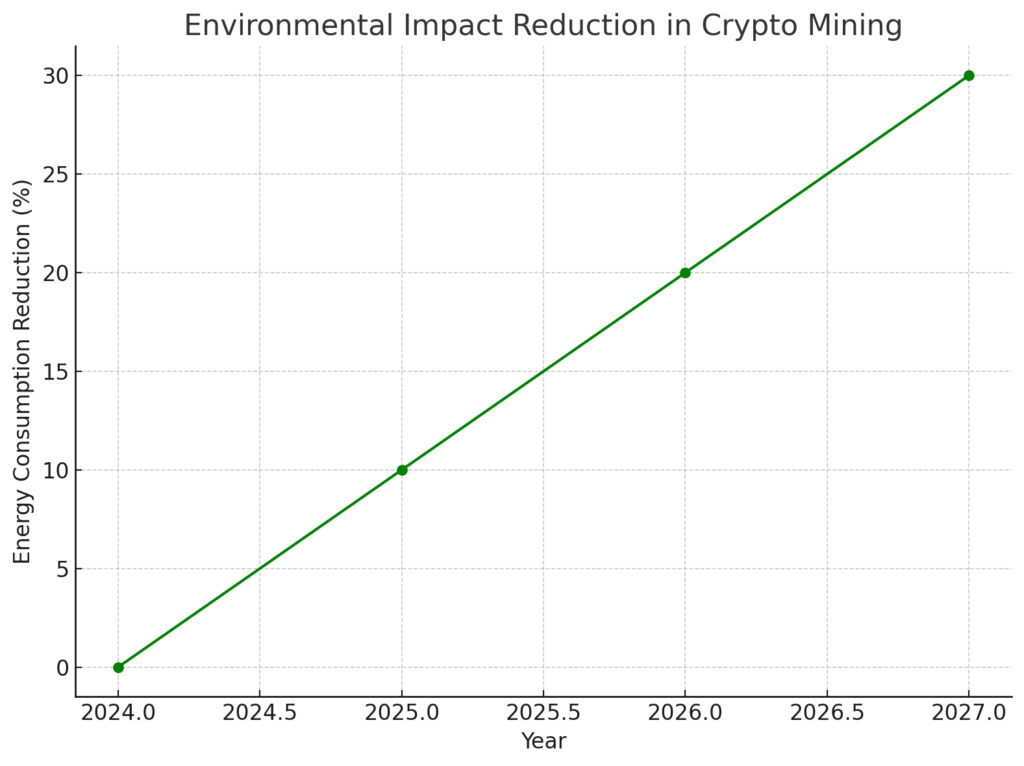

Environmental Impact and Sustainability in Cryptocurrency Mining

The G20 has increasingly focused on the environmental impact of cryptocurrency mining, especially as the energy demands of blockchain operations continue to grow. At the 2024 summit, G20 leaders stressed the importance of integrating sustainable practices into crypto mining to mitigate the strain on global energy resources. With the rise of large-scale mining farms and the energy-intensive nature of consensus mechanisms like Proof of Work (PoW), there is a pressing need to address both these operations’ footprint and energy consumption.

G20’s G20’sonmental Standards for Crypto Mining

The G20 has proposed a set of environmental standards to curb cryptocurrency mining operations consumconsumptiG20’sheseards are designed to:

- Reduce Carbon Footprints: Mining operations will be required to adopt more energy-efficient technologies, and governments are expected to incentivize using renewable energy sources such as solar and wind power.

- Energy Efficiency Audits: Mining farms must undergo regular energy efficiency audits to ensure compliance with the G20’s G20’sinability targets. Companies that do not meet these standards may face penalties or operational restrictions.

- Adoption of Proof-of-Stake (PoS) Protocols: The G20 is encouraging G20’sfG20’sftenergy-intensive consensus mechanisms like Proof of Work (PoW) to more environmentally friendly alternatives like Proof of Stake (PoS), which drastically reduces energy consumption while maintaining network security.

Sustainable Blockchain Practices for Future Regulations

Looking ahead, the G20 is committed to promoting sustainable blockchain practices through future regulations. Governments and companies in the blockchain space are expected to:

- Blockchain companies will be encouraged to invest in green technology that reduces the environmental impact of mining and transactional operations.

- Companies may form partnerships with renewable energy providers to ensure that their operations run on clean energy. This not only helps reduce the environmental impact but also maintains cost efficiency in the long term.

- The G20 aims to align international regulatory frameworks with environmental goals by ensuring that crypto exchanges adhere to strict sustainability criteria. This could include restrictions on high-energy consumption assets and promotion of eco-friendly tokens.

Regulatory efforts signal a shift towards a more sustainable blockchain ecosystem, focusing on balancing technological advancement with environmental preservation. Environmental standards reflect the global consensus on responsible mining practices aligning with broader climate change goals.

The G20’s roadmap for cryptocurrency regulation sets a critical foundation for ensuring global financial stability and market integrity in the fast-evolving world of digital assets. By prioritizing international G20’s operational environmental sustainability in mining and enhancing AML/KYC compliance, the G20’s paves the way for a more transparent, secure, and eco-conscious crypto ecosystem. These regulatory measures will likely shape the future of global cryptocurrency adoption, setting the stage for G20’s blah in the digital economy.