Brazil’s Central Bank is pushing for strict crypto rules in 2024. It’s a key step in making digital assets part of the formal financial system. These rules aim to protect investors and boost transparency. They seek to create a safer crypto market. Brazil’s crypto rules also seek to boost innovation and ensure stability. They will be rolled out in phases.

Brazil’s Phased Approach to Crypto Regulation

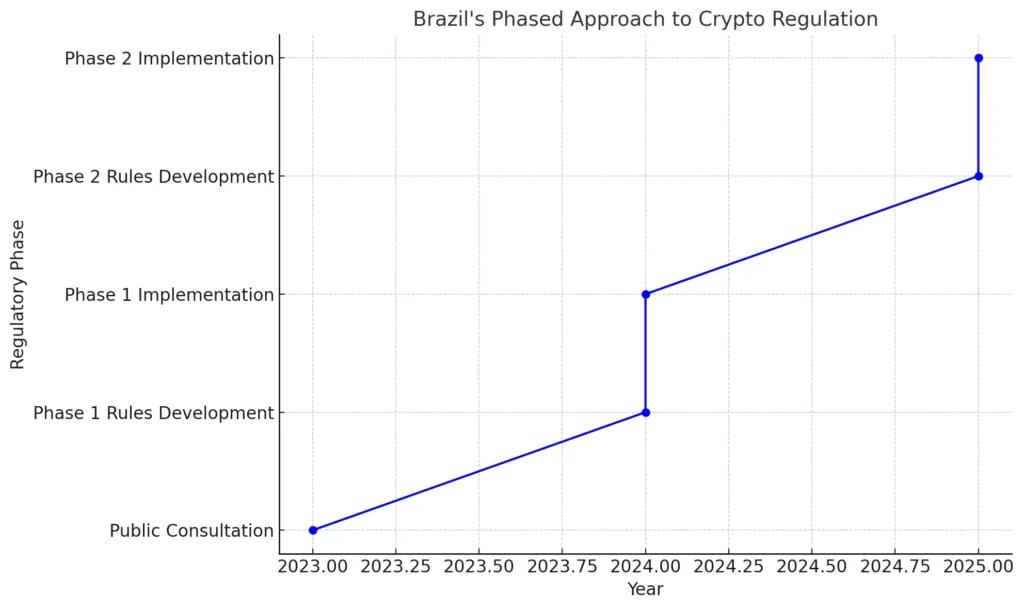

Brazil has a phased plan to regulate its fast-growing crypto sector. The Central Bank of Brazil (BCB) is leading this effort. Given the complexity and diversity of virtual asset activities, this strategic approach is essential. The phased plan aims to engage the public. It also seeks to create strong, practical rules for virtual asset service providers (VASPs). These rules will guide their operations.

Public Consultations and Regulatory Drafting

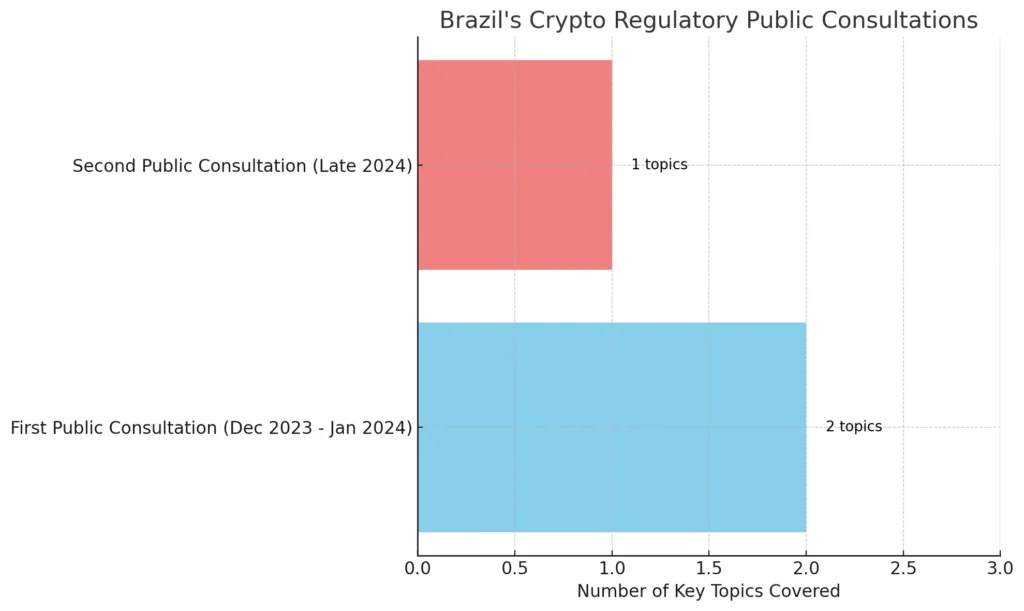

Public consultations have been integral to shaping Brazil’s crypto regulatory framework. The first consultation was in December 2023 and January 2024. It gathered input on key issues like asset segregation and risk management for VASPs. These talks helped find gaps in the 2022 law. They provided a clearer base for Brazil’s crypto rules. The second consultation phase is scheduled for the latter half of 2024, and it will focus on drafting detailed regulatory texts based on public and market feedback.

- First public consultation (2023-2024): Covered topics like asset segregation and risk management for VASPs.

- Second consultation (late 2024): Aimed at finalizing regulatory texts with public input.

- Public input on VASP asset segregation: Addressed during the consultations.

Final Regulatory Proposals for 2024

The Central Bank plans to finalize the crypto regulatory proposals by the end of 2024. These new rules will establish clear guidelines for VASPs, focusing on transparency, consumer protection, and preventing financial crimes like fraud and money laundering. The new framework should make crypto transactions safer, grow the market, and boost innovation.

Consumer Protection and Market Transparency

Brazil’s new cryptocurrency regulations emphasize enhancing consumer protection and ensuring market transparency. These regulations aim to secure crypto transactions. They require virtual asset service providers (VASPs) to meet strict standards. This will prevent fraud, reduce risks, and ensure financial stability.

Investor Protection Measures

Brazil’s regulatory framework emphasizes safeguarding investors in the crypto market. VASPs must get licenses and follow the rules. They are to protect investors from fraud and market manipulation. These guidelines mandate transparency in operations, including the explicit disclosure of risks to investors. Brazil’s Central Bank is also involved in monitoring and regulating VASPs. It ensures they comply with the regulations.

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Requirements

Brazil has strict AML and KYC rules to prevent crimes like money laundering and terrorism. VASPs must comply with these regulations, which involve thorough customer due diligence (CDD) processes and reporting suspicious transactions to the Council for Financial Activities Control (COAF). Not complying with these rules can lead to severe penalties, including fines and suspension.

- AML protocols for crypto: Entities must follow strict AML rules. They must report any suspicious activities.

- KYC compliance for VASPs: Mandatory customer identity checks to prevent illicit transactions.

- Consumer data protection guidelines: Ensuring data privacy and security during crypto transactions.

Integration of Digital Assets into Brazil’s Financial System

Brazil’s crypto rules aim for more than oversight. They seek to integrate digital assets into the national financial system. This effort aims to boost financial inclusion. It will enable domestic and cross-border transactions. This will increase the use of digital currencies in Brazil’s economy.

Central Bank’s Oversight on Crypto Services

The Central Bank of Brazil (BCB) plays a crucial role in regulating and overseeing crypto services in the country. It ensures that virtual asset service providers (VASPs) comply with established guidelines prioritizing security and transparency. The BCB sets the operational standards for VASPs. It ensures they have secure environments for crypto transactions. This oversight is vital to preventing fraud and protecting investors. It will help develop a safe, regulated crypto market in Brazil.

Stablecoin and Cross-Border Transactions

Stablecoins are essential to Brazil’s crypto strategy, especially in facilitating cross-border payments. The BCB is creating rules for stablecoins used in payments and forex. These rules aim to integrate stablecoins into the financial system. They should be reliable for cross-border transactions and comply with strict standards, like anti-money laundering (AML) laws.

Taxation and Compliance for Digital Assets

Brazil’s 2024 crypto rules clarify the tax on digital asset trades. They will now match the regulations for other financial assets. These measures seek to ensure fairness and compliance in the crypto market as it grows. Crypto investors in Brazil must now follow capital gains tax rules. They must also report to avoid legal issues.

Tax Reporting for Crypto Transactions

Under Brazil’s updated tax guidelines, profits generated from cryptocurrency transactions are subject to capital gains tax. Any monthly disposals exceeding R$35,000 trigger this tax, with rates ranging from 15% to 22.5%, depending on the amount of profit. This tax applies to various taxable events. These include selling crypto for fiat, swapping one crypto for another, or using crypto to pay for goods and services.

Investors must report all relevant transactions annually via their personal income tax return. For transactions exceeding R$30,000 in foreign exchanges, taxpayers must also submit a monthly statement. Accurate record-keeping is critical for compliance.

Compliance Obligations for Crypto Exchanges

Crypto exchanges in Brazil must follow strict compliance rules. They must provide detailed reports to the tax authority, Receita Federal. These reports cover all buying, selling, and transfer activities involving cryptocurrencies. Additionally, exchanges must obtain operational licenses and comply with anti-money laundering (AML) and know-your-customer (KYC) requirements.

Note

Failure to adhere to these reporting and licensing standards can result in significant penalties, including fines or suspension of operations. Both domestic and foreign exchanges are under scrutiny. This is to ensure they operate within Brazil’s laws.

Future of Crypto Regulations in Brazil

Set for 2024, Brazil’s crypto regulations will change its finances. These regulations aim to foster investor confidence, improve market transparency, and position Brazil as a leader in the global cryptocurrency economy. The Central Bank of Brazil (BCB) is leading this effort. It aims to create a regulatory framework. It will use public consultations and international collaboration.

Impact on Market Liquidity and Growth

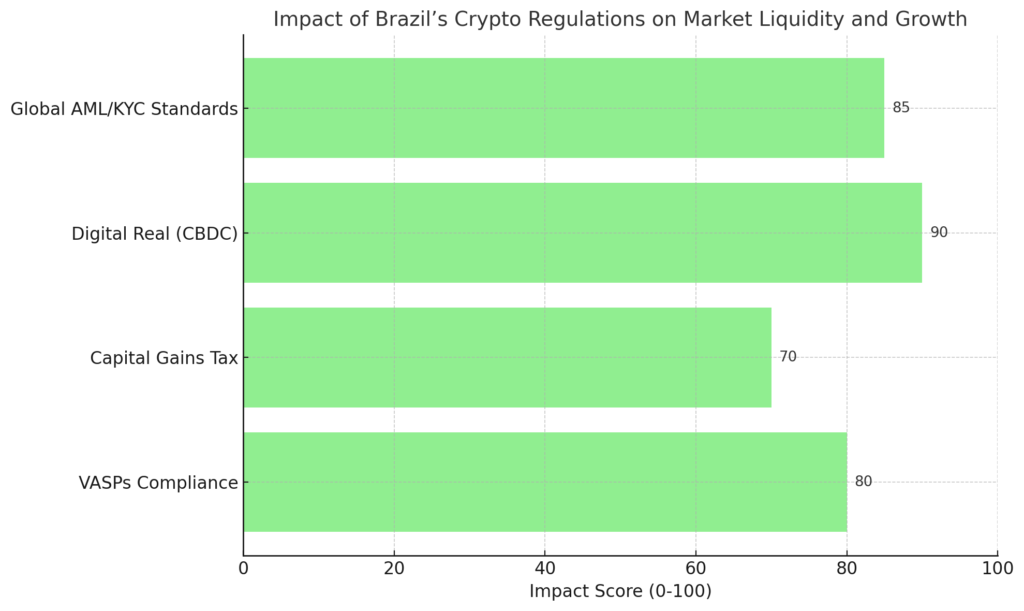

Brazil’s crypto regulations are expected to positively impact market liquidity and growth. Clear guidelines for virtual asset service providers (VASPs) will reduce risk and uncertainty, encouraging more institutional and retail investors to join the market. Brazil’s regulatory framework will create a stable environment, ensure transparency, and protect investors from fraud. This should boost liquidity and promote long-term growth in the crypto sector.

In 2024, Brazil will implement new cryptocurrency rules. They will affect the market’s liquidity and growth. These regulations aim to build trust among investors, ensure compliance, and create a safer and more stable market environment. The following table provides an overview of the most important regulations and their expected effects on the market:

| Regulation | Description | Market Impact |

|---|---|---|

| VASPs Compliance | Rules for Virtual Asset Providers (VASPs) | Increases investor trust and transparency |

| Capital Gains Tax | Tax on crypto profits (15%–22.5%) | Promotes tax compliance and market stability |

| Digital Real (CBDC) | Central Bank’s digital currency | Boosts liquidity through faster transactions |

| Global AML/KYC Standards | Anti-money laundering and KYC compliance | Attracts foreign investment, safer markets |

Note

Also, a “digital real” CBDC will boost the economy. It will improve liquidity with seamless digital transactions and cross-border payments.

International Collaboration and Regulatory Consistency

Brazil’s regulatory strategy is focused on domestic markets and aligns with global standards. The country is joining talks on cryptocurrency regulation. It is involved in initiatives like the G20 Techsprint program. Brazil must collaborate to align with other top crypto markets. This will ensure its rules are compatible with global finance and best practices.

Brazil’s alignment with global anti-money laundering (AML) and know-your-customer (KYC) standards shows its commitment to a secure, transparent crypto space. This will attract foreign investments and boost cross-border transactions.

Related Article for you:

Brazil’s crypto regulations for 2024 mark a pivotal moment for the nation’s digital asset market. The phased approach is vital to market growth and stability. It includes investor protection and global cooperation. By integrating digital assets into the financial system, Brazil is positioning itself as a key player in the crypto space. It aims to align with global standards. As these regulations evolve, they will continue shaping the future of crypto both domestically and internationally.