China’s updates to its anti-money laundering (AML) laws mark a major change in crypto oversight. The new amendments, effective in 2024, target virtual asset transactions. They close legal loopholes that allowed illicit activities to flourish. China’s crypto market has stricter penalties and more scrutiny. This affects investors, compliance pros, and lawyers. China’s legal reforms reflect a global trend. It favors stronger crypto-related AML measures.

Overview of China’s Revised Crypto AML Laws

The 2024 revisions have greatly expanded China’s AML laws. They now include virtual currencies. The new legal framework aims to close loopholes. It seeks to tighten control over cryptocurrency transactions. These changes aim to help the country combat illegal digital asset activities. They reflect China’s strict rules against financial crimes.

Key Amendments to AML Laws in 2024

In 2024, China updated its AML laws. It was the first major change since 2007. Virtual asset transactions may use for money laundering as a key change. This legal change ensures that cryptocurrencies can’t hide the source of illegal funds. Guilty offenders face fines of 10,000 to 200,000 RMB, or $1,400 to $28,000, for laundering money with virtual currencies.

Depending on the crime’s severity, they also face 5 to 10 years in prison. The new rules define “serious circumstances” for money laundering. They apply if amounts exceed 5 million RMB (about $700,000). They also apply if individuals fail to cooperate with investigators.

Expansion of AML Scope to Virtual Asset Service Providers (VASPs)

The revised laws extend AML rules to VASPs. They now have more regulatory duties. These non-financial entities must now follow stricter KYC rules. They must do thorough checks on user identities. Also, VASPs must report suspicious virtual asset transactions. They must audit regularly and submit compliance reports.

- Stricter KYC practices for all transactions.

- Mandatory reporting of suspicious crypto transactions.

- Regular audits and compliance documentation.

Impact on Crypto Exchanges Operating Overseas

While China bans local crypto exchanges, many citizens use overseas platforms through VPNs. The new AML laws aim to curb such activities. They state that citizens using foreign exchanges must follow China’s laws. This includes the risk of prosecution and severe penalties for any role in crypto money laundering. The laws add further complications for Chinese investors looking to circumvent national regulations.

Enforcement of Crypto AML Regulations in China

China has ramped up enforcement of AML laws. The judiciary plays a key role in prosecuting cryptocurrency-related money laundering cases. The 2024 updates to the AML laws aim to close gaps. They let virtual asset transactions avoid scrutiny. This crackdown is part of a broader effort to fight financial crimes in a more digital world.

Supreme Court’s Interpretation of AML for Crypto

In August 2024, China’s Supreme People’s Court ruled. It classified cryptocurrency transactions as money laundering under AML laws. This landmark decision is the first major update to the AML framework since 2007. The Supreme Court identified digital currencies as tools for money laundering. It has clarified the law for prosecuting crypto-related crimes. This ruling sets a precedent for future cases on crimes using virtual assets.

Penalties for Non-Compliance

The new AML rules impose harsh penalties for money laundering using cryptocurrencies. Fines range from 10,000 RMB to 200,000 RMB (approximately $1,400 to $28,000), depending on the severity of the offense. Serious violations can lead to 5 to 10 years in prison, especially for cases involving over 5 million RMB ($700,000). This approach demonstrates China’s commitment to curbing financial crime.

| Offense Type | Fine (RMB) | Imprisonment Duration |

|---|---|---|

| Minor Offenses | 10,000 – 50,000 | Up to 3 years |

| Major Offenses | 100,000 – 200,000 | 5-10 years |

Increased Prosecution Rates

Since the new laws took effect, crypto money laundering prosecutions have surged. In 2023, authorities prosecuted 2,971 individuals for such offenses, a significant increase over previous years. This shows China’s increased efforts to curb illegal use of digital assets.

Compliance Requirements for Crypto Firms in China

Crypto firms in China, or serving Chinese clients, must follow stricter AML rules. The 2024 updates aim to better monitor digital asset transactions. This is to prevent illegal activities, like money laundering and terrorist financing.

New KYC and Reporting Standards

To remain compliant, crypto firms must install enhanced Know Your Customer (KYC) procedures. It means doing thorough identity checks. Also, keep updated records of customers, especially UBOs. Regular monitoring of customer transactions is also mandatory to detect suspicious activity. Authorities require firms to submit Suspicious Transaction Reports (STRs) when necessary. These new standards align crypto firms with China’s strict rules, like the PBOC.

Transaction Monitoring and Thresholds

The updated regulations set thresholds for crypto transaction monitoring. Any transaction surpassing certain limits requires detailed reporting and review. Automated compliance tools, including AI, can help firms meet thresholds. They can monitor transactions and detect anomalies efficiently. These tools can also prevent money laundering.

Consequences for Non-Cooperation with AML Investigations

Firms that don’t cooperate with AML investigations may face severe penalties, including heavy fines and possible shutdowns. Directors, managers, and other staff could be liable for obstructing AML investigations. Fines would range from 20,000 to 200,000 RMB. Non-compliant businesses risk asset seizure and bans from the financial sector.

Related Article for you:

- Taiwan’s Digital Asset Regulations Update

- US SEC’s Enforcement Actions Against Crypto

- EU’s MiCA Regulation Overview

- India’s Pending Crypto Regulation Bill

- Japan’s Stricter Crypto Exchange Regulations

Implications for Global Markets and Crypto Adoption

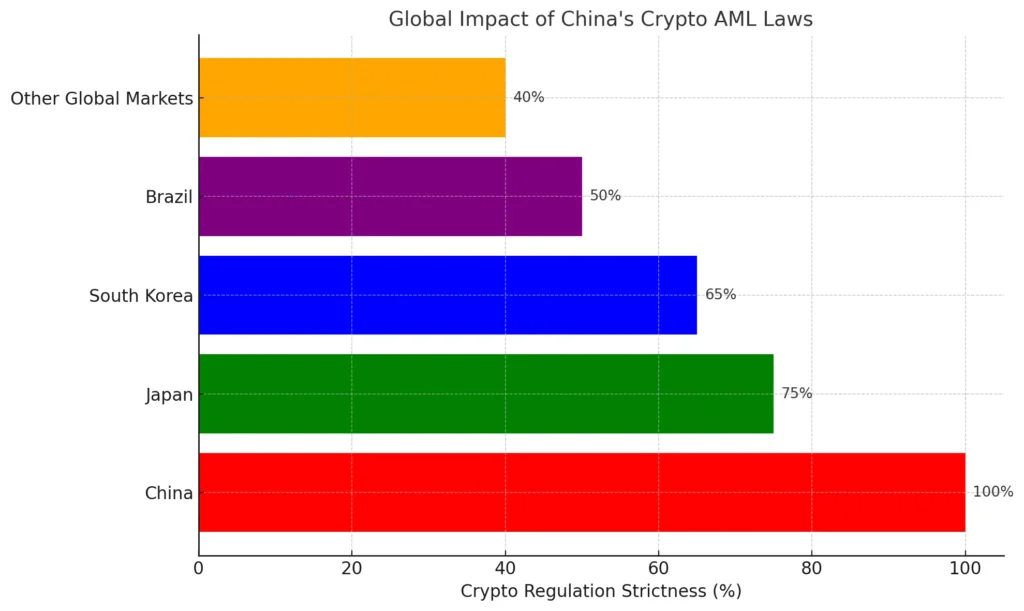

China’s updated Anti-Money Laundering (AML) laws on crypto are strict. They are impacting global markets, not the domestic ones. These laws are changing how the world views and manages cryptocurrencies. Other countries are now rethinking their regulations.

Global Impact of China’s AML Laws

China’s new AML laws target virtual asset transactions. They set a precedent for other countries to follow. Japan, South Korea, and Brazil have adopted crypto rules. But, China’s strict enforcement may push for tighter global oversight. Many may copy its approach as countries see China’s success in fighting crypto crimes. This is likely in areas with fast-growing crypto use. It could create a more restricted global crypto landscape. It would lessen some appeal of cryptocurrencies, like their anonymity and decentralization. It would also increase legal scrutiny on cross-border transactions.

The Role of China’s Digital Yuan and Crypto Regulation

Promoting its digital yuan (e-CNY), a CBDC, is a key factor in China’s regulations. This currency plays a pivotal role in China’s crackdown on decentralized cryptocurrencies. China aims to lead in financial sovereignty by tightly controlling the digital yuan. It wants to stabilize its economy. It also wants to reduce reliance on private cryptocurrencies like Bitcoin.

Note

The digital yuan is a government-controlled alternative. It may appeal to nations wanting tighter control over financial transactions. This could shift the balance in global digital currency adoption.

China’s 2024 crypto AML laws set a new global standard for crypto regulation. China aims to curb financial crimes with strict penalties. It will also expand the scope to include virtual assets. This framework will reshape domestic crypto markets. It may also boost global crypto adoption. It could encourage other nations to adopt similar measures. The rise of the digital yuan further underscores China’s drive to control finances.