The UAE crypto salary ruling is a key moment. It integrates digital currencies into the country’s legal framework. The Dubai Court of First Instance ruled that crypto payments in contracts are valid. This signals a growing acceptance of digital assets in the region. Labor Case 1739 of 2024 confirms that employers may offer partial compensation to employees through the use of cryptocurrency, specifically EcoWatt tokens. They must keep their value and not convert them to fiat currency.

The ruling shows a rise in crypto payments in the UAE, especially in tech and fintech. The Dubai court is enforcing cryptocurrency contracts. This encourages the use of digital currencies in employment agreements. It sets a precedent for future cases.

Legal Background of Crypto Salaries in the UAE

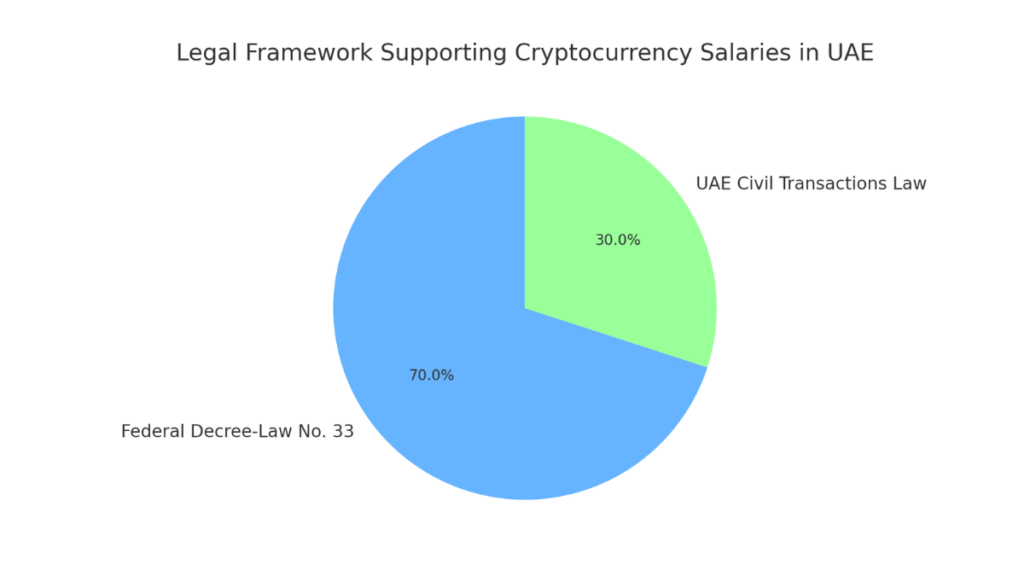

The UAE’s approach to cryptocurrency has evolved, especially in employment law. Federal Decree-Law No. underpins this shift. 33 of 2021, which regulates employment relationships in the private sector. This decree allows flexible payment systems. It includes digital assets, like cryptocurrency, if employment contracts define the terms.

Cryptocurrency payments are gaining acceptance in tech and fintech. This is due to the UAE’s progressive legal framework. These developments show the UAE’s intent to be a global hub for finance and tech innovation.

A pie chart illustrates how the Federal Decree-Law No. The UAE’s Law 33 of 2021 and its Civil Transactions Law support paying salaries in cryptocurrency. The chart shows that most support comes from the Federal Decree-Law No. 33. The UAE Civil Transactions Law is a secondary basis for enforcing such contracts.

Federal Decree-Law No. 33 of 2021 and Cryptocurrency

The Federal Decree-Law No. 33 of 2021 is a critical legal framework for UAE businesses. This decree outlines how to pay wages. Both parties can use alternative currencies. Wages were payable only in UAE Dirhams at the start. But now this law permits other forms of payment if the contract specifies them. The law is a landmark shift. It recognizes digital assets for salary payments. This is a big step toward using cryptocurrency more in business transactions.

Role of UAE Civil Transactions Law in Cryptocurrency Salaries

The UAE Civil Transactions Law is key to enforcing crypto-payment contracts. This law lets courts uphold contracts that pay salaries in digital tokens. The Dubai courts have cited this law in several rulings. This includes a landmark 2024 case that validated crypto payments in employment contracts. It makes contracts for digital assets legally binding. This is true if the terms are clear and meet regulations.

The Landmark 2024 Dubai Court Ruling on Crypto Salaries

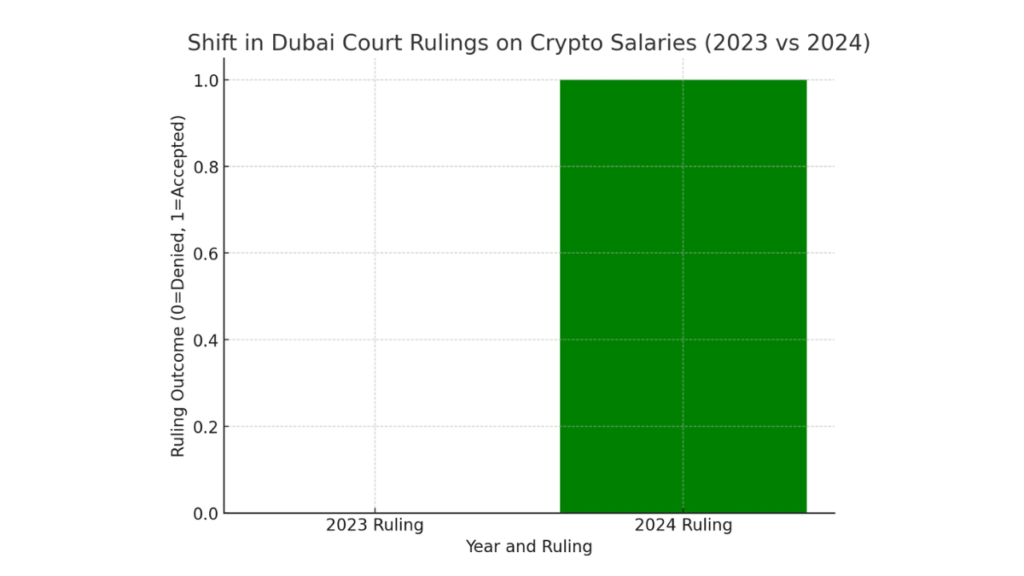

In Labour Case 1739 of 2024, the Dubai Court of First Instance made a landmark ruling. It validated paying salaries in cryptocurrency. The court ruled that the employer must pay the plaintiff in EcoWatt tokens, a digital currency. They must not convert it to fiat. This judgment shows a shift in the UAE’s legal stance on cryptocurrency. It reflects a growing acceptance of it in employment contracts. It also marks a shift from a 2023 case. There, the court rejected a similar claim. It was hard to value the cryptocurrency in traditional terms.

Case Study: EcoWatt Tokens and Employment Contracts

The case involved an employment contract. It set part of the employee’s monthly salary to be paid in 5,250 EcoWatt tokens. After six months of unpaid tokens, the employee sued for wrongful termination and unpaid wages. In 2023, the court ruled against the employee. It found that the contract included cryptocurrency but that its value was unclear. In 2024, the court ruled for the employee. It stressed the need to honor employment agreements, including cryptocurrency parts.

Shifting Judicial Perspectives on Cryptocurrency Payments

The ruling in 2024 marks a clear shift from the court’s earlier stance in 2023. Previously, the court required precise valuation of digital currencies in fiat terms. In contrast, the 2024 ruling recognized crypto payments as valid, even without converting them to fiat. This sets a strong precedent for future cases on crypto payments in employment contracts. The ruling highlights a trend in the UAE. It is towards recognizing digital assets in business, especially in tech and fintech.

The bar chart shows the change in Dubai court rulings on crypto salary payments between 2023 and 2024. In 2023, the court denied a claim for crypto salary payments due to unclear valuation methods, shown by a red bar. In contrast, the 2024 ruling, shown in green, accepted crypto payments as valid. It did not require conversion to fiat currency. It marked a significant legal evolution.

Implications for Employers and Employees in the UAE

The 2024 Dubai court ruling on crypto salaries opens new doors for tech, fintech, and blockchain employers and employees. This ruling supports token-based pay plans. But, it raises issues with valuing and the volatility of tokens. Employers must consider updating payroll systems to handle cryptocurrency transactions. They must also protect salaries from market fluctuations.

Structuring Crypto Salary Agreements

To legally structure cryptocurrency salary agreements, UAE employers should:

- Specify the Cryptocurrency: The contract must clearly define which cryptocurrency will be used.

- Valuation Method: State a way to convert the crypto to fiat for accounting or legal use.

- Volatility Protection: Define policies for conversion if the cryptocurrency experiences significant price changes.

Note

These steps protect both parties. They ensure clarity and compliance with UAE labor laws. This reduces the risk of disputes over salary payments.

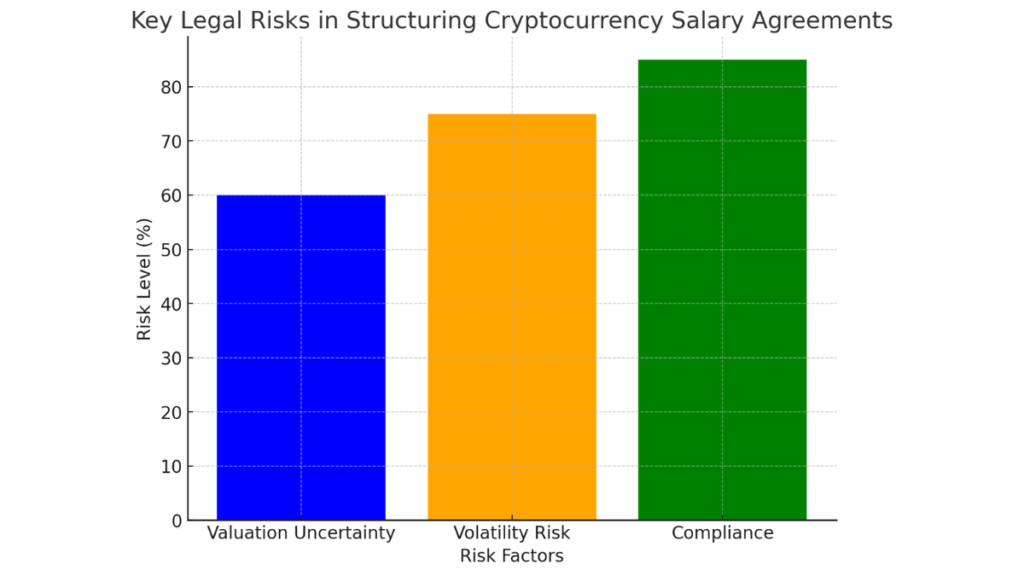

Legal Risks and Compliance for Employers

There are several legal risks associated with crypto salaries, including:

- Volatility: Cryptocurrencies have wild price swings. They can affect salaries over time. Contracts should include safeguards to mitigate this risk.

- Compliance: Companies must align their payroll systems with UAE regulations. This includes integrating with Wage Protection System (WPS) where needed.

The bar chart shows the main legal risks of crypto salary agreements. The chart highlights three major risks: Valuation Uncertainty, Volatility Risk, and Compliance. Compliance is the riskiest, followed by Volatility and Valuation concerns.

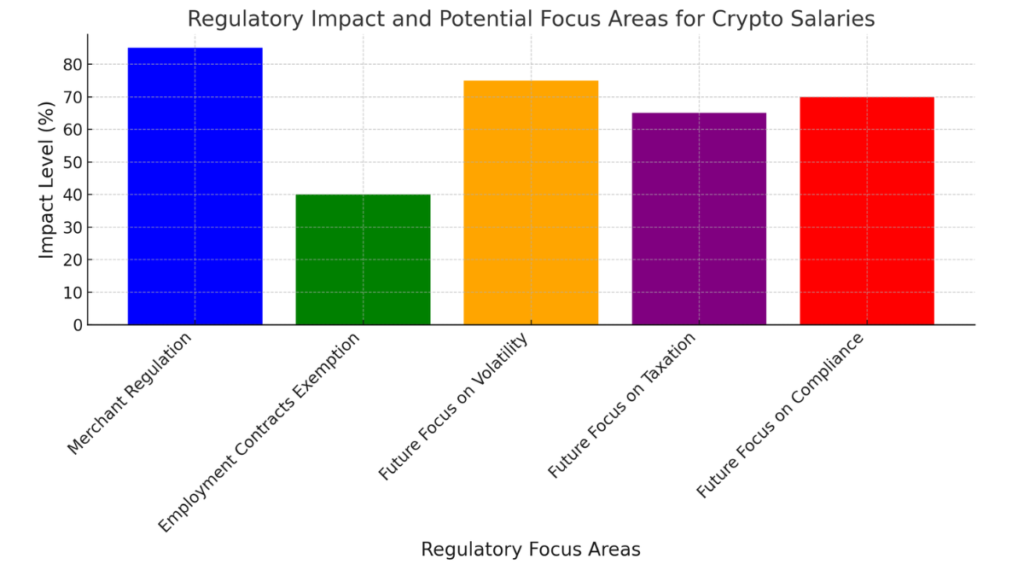

Regulatory Considerations for Crypto Salary Payments

The CBUAE’s PTSR regulate digital payment tokens in the UAE. They cover their issuance, conversion, and custody. It aims to ensure digital payment services meet strict licensing and compliance rules. However, the court ruling on crypto salary payments bypasses some regulations. It focuses on merchant payments, not employment contracts. The court’s decision allows using cryptocurrency in salaries. This is true if both parties agree on the terms. It is not fully subject to the PTSR.

The x-axis shows the regulatory focus areas. The y-axis shows the impact level in percent. This visualization better highlights potential future focus areas for crypto salary regulation. They are volatility, taxation, and compliance.

Payment Token Services Regulations vs. Employment Contracts

The Payment Token Services Regulations aim to regulate digital tokens, especially stablecoins, in the UAE’s financial system. These regulations are primarily aimed at businesses and merchants engaging in digital payments. While companies involved in issuing or converting payment tokens must obtain licenses, these rules do not directly restrict crypto salaries in employment contracts. This gap allowed the Dubai Court to rule in favor of crypto salary payments in Labor Case 1739 of 2024, without being constrained by the regulatory requirements for merchants.

Potential for Future Regulatory Updates

As cryptocurrency use grows in employee pay, the UAE may update its laws. Crypto employment contracts are not subject to the Payment Token Services Regulations for merchants. With digital currencies integrating into financial systems, the UAE Central Bank might set clearer rules for crypto salary payments. These updates could address volatility, taxation, and compliance. They should protect employers and employees within a strong legal framework.

Impact on UAE’s Fintech and Tech Sectors

A Dubai court’s 2024 ruling recognizes crypto as valid salary payment. It is expected to greatly impact the UAE’s fintech and tech sectors. This landmark decision makes Dubai a global fintech hub. It will attract more crypto businesses and talent. Allowing companies to pay employees in cryptocurrency boosts Dubai’s reputation as a leader in blockchain and digital innovation. Fintech firms can benefit from lower fees, faster payroll, and a global talent pool seeking modern payment methods.

Increased Adoption of Cryptocurrency Salaries in Tech

Cryptocurrency salary payments are gaining traction within the UAE’s tech and fintech sectors. For example, blockchain, DeFi, and fintech firms are adding crypto payments to their compensation packages. Dubai’s tech industry has begun using crypto for salaries, bonuses, and incentives. Benefits include: faster international payments, less reliance on banks, and appeal to tech-savvy employees. These payment structures attract expatriates and tech professionals. They see crypto as a way to bypass high banking fees.

Opportunities and Challenges for Employees in Tech

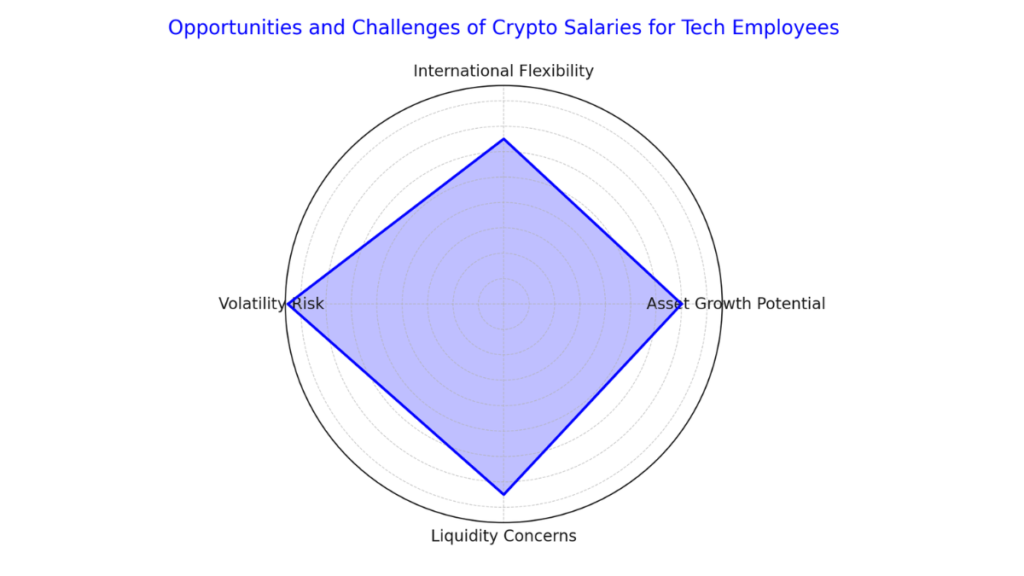

The radar chart above shows the main pros and cons of paying UAE tech workers with cryptocurrency. The chart shows that volatility risk is the most significant challenge, while asset growth potential and international flexibility provide strong opportunities. Liquidity concerns also pose a considerable challenge.

For employees, getting paid in cryptocurrency has benefits. If the crypto appreciates, it could grow their assets. Also, crypto payments can help remote or international employees. Digital currencies can be easily transferred and converted across borders. However, there are also challenges, primarily due to crypto volatility and liquidity concerns. Crypto salaries can fluctuate greatly. Employees must manage the risks of market instability. Furthermore, liquidating crypto assets into fiat can be complex without a well-established framework.

Read More

- EU’s MiCA Regulation Overview

- Impact of MiCA on EU-Based Crypto Exchanges

- FATF Guidelines on Crypto Transactions

- Crypto Market Reactions to Global CPI Data

- Institutional Investment in Cryptos

Dubai court ruling is a big step for the UAE. It recognized cryptocurrency as a valid way to pay salaries. This decision boosts Dubai’s status as a global hub for blockchain and digital asset innovation. It paves the way for crypto salaries, especially in fintech and tech. Both employers and employees have great opportunities. They include faster payments and financial flexibility. But there are challenges. These include volatility and regulatory uncertainties. This ruling sets a precedent for using digital currencies in job contracts.