The FSB’s roadmap for global crypto regulation sets an agenda. It aims to ensure financial stability amid the expanding cryptocurrency markets. This roadmap is a crucial blueprint for Global regulators. It seeks to align crypto rules and cut risks from unregulated markets. The plan outlines key strategies to address systemic risks and enhance the financial sector’s resilience. We will explore the FSB’s 2024 roadmap, its global impact, and the implications for market stability.

FSB’s Objectives for Global Crypto Regulation in 2024

The FSB aims to boost global crypto market stability by 2024. Its roadmap aims to create a global regulatory framework. It will ensure that cryptocurrencies and stablecoins meet strict compliance standards in all jurisdictions. The FSB aims to limit risks from cross-border crypto activities. It wants to prevent the fast-growing crypto market from threatening global financial stability.

Harmonizing Global Crypto Regulations

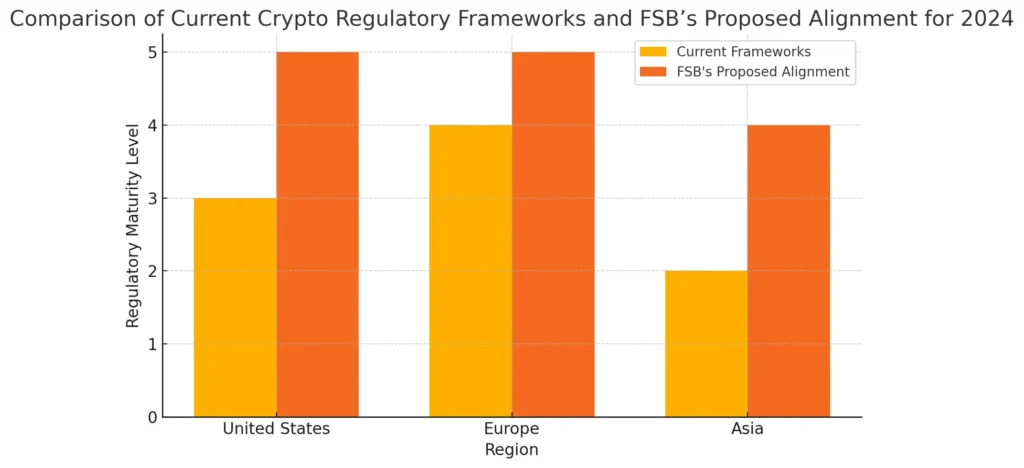

In 2024, a vital goal of the FSB is to align crypto regulations globally. This will ensure compliance in cross-border transactions. This is vital. Fragmented regulations across regions risk financial markets. The FSB’s roadmap urges greater alignment. It seeks regulatory consistency across the U.S., Europe, and Asia.

| Region | Current Framework | FSB’s Proposed Alignment |

|---|---|---|

| United States | SEC’s regulatory framework for crypto trading | Align with global standards for cross-border compliance |

| Europe | MiCA regulations for digital assets | Streamline MiCA with global FSB recommendations |

| Asia | Varied approaches across countries | Encourage uniform regulations based on FSB guidelines |

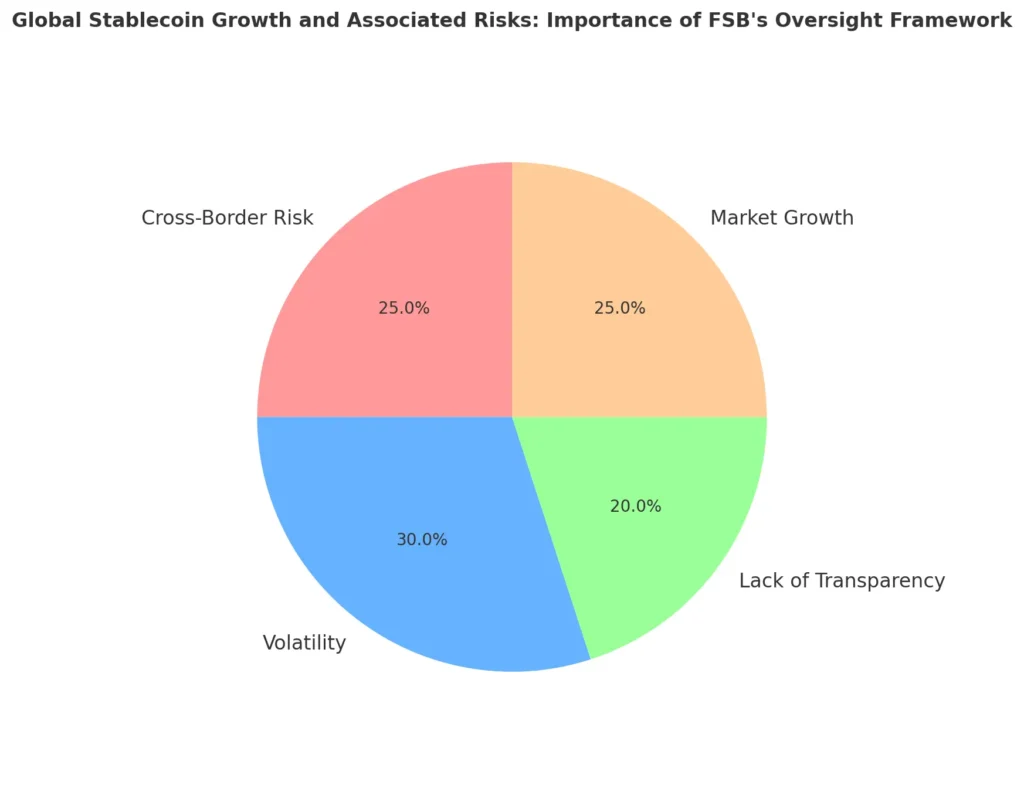

FSB’s Framework for Stablecoin Oversight

The FSB stresses the need to regulate stablecoins. They pose risks to financial stability, especially in cross-border use. To ensure stablecoins don’t destabilize the market, the FSB wants risk strategies and more transparency. The FSB aims to protect financial markets from unstable stablecoins, so it will enforce stricter compliance standards to reduce volatility.

Risk-Based Approach to Crypto Regulation

A vital goal of the FSB’s 2024 roadmap is to regulate crypto assets. It aims to use a risk-based approach to cut systemic risks. The FSB will boost oversight of cryptocurrency platforms, which will improve market transparency and cut risks. The FSB should focus on risk, not a one-size-fits-all solution. This will let it adapt regulations to the specific dangers of different crypto activities.

Impact of FSB’s Crypto Regulations on Global Markets

The FSB’s 2024 roadmap aims to impact global crypto markets. It seeks to boost compliance, cut risks, and improve transparency. These regulations are essential. They promote market integrity and reduce risks from unregulated crypto activities.

Financial Stability through Crypto Oversight

The FSB’s new rules stress market transparency to prevent disruptions. By separating customer assets from company funds, the framework reduces conflicts of interest and better protects user assets. The FSB also aims to address vulnerabilities exposed by recent market failures by boosting cross-border cooperation. This approach ensures the crypto ecosystem is transparent and resilient to financial shocks.

Cross-Border Payments and Compliance

A crucial aspect of the FSB’s roadmap is regulating cross-border crypto payments. The introduction of consistent standards across jurisdictions is expected to enhance global compliance and support international cooperation, particularly in streamlining payment processes.

Note

The efforts aim to stop regulatory arbitrage. They seek to make crypto platforms follow the same rules worldwide. This would create a more stable global crypto market.

Market Reactions to FSB’s Roadmap

The response from market participants to the FSB’s proposed regulations has been mixed. Some crypto exchanges and financial firms support calls for transparency, while others fear it may limit innovation. Despite this, many stakeholders agree that the FSB’s roadmap is needed. It is vital for the long-term security and sustainability of global financial markets.

Key Challenges and Opportunities in FSB’s 2024 Roadmap

The FSB’s 2024 roadmap could improve global crypto regulation. But, its implementation will face challenges due to the diverse rules in different countries. At the same time, there are clear opportunities to improve the global crypto ecosystem. It could be more resilient and transparent.

Overcoming Jurisdictional Challenges

One of the primary hurdles in executing the FSB’s roadmap is achieving a global consensus on crypto regulations. Countries are at different stages of crypto regulation and market maturity, complicating efforts to standardize crypto asset laws across borders. The EU is advancing its MiCA regulation on crypto-assets. In contrast, Asia is adopting unique approaches, creating a fragmented regulatory landscape.

Note

The discrepancies can hinder efforts to align regulations globally, challenging the FSB’s vision of unified global standards for stablecoin regulation and overall risk mitigation.

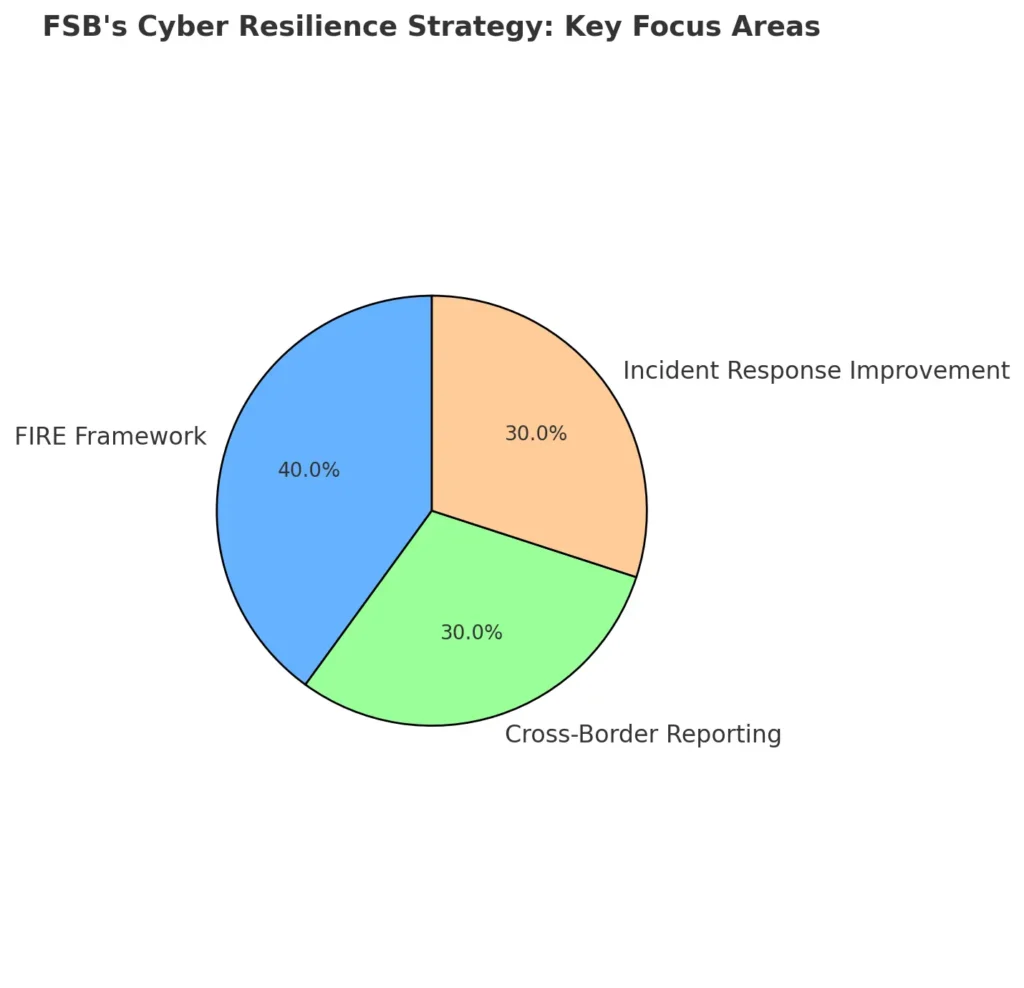

Enhancing Cyber Resilience in the Crypto Sector

The FSB’s 2024 roadmap significantly emphasizes strengthening cyber resilience in the cryptocurrency sector. As digital assets grow in use, cyberattacks pose a rising risk to global financial stability. Their frequency and sophistication are increasing. To address this, the FSB is using the FIRE framework. It aims to standardize cyber incident reporting across jurisdictions.

Here’s a breakdown of the FSB’s cyber resilience strategy:

- FIRE Framework: This format is designed to standardize how cyber incidents are reported. It will enable consistent reporting across banks and regulators. This will promote global cooperation.

- Cross-Border Reporting: The FSB wants to improve cross-border sharing of cyber incident data. This will speed up responses to global threats.

- Incident Response Improvement: The FIRE framework aims to improve the response to cyber threats. It will set common data requirements and use standard formats. This will make responses more transparent and efficient.

Future Implications of the FSB’s Roadmap

The Financial Stability Board’s (FSB) roadmap for 2024 is set to reshape global crypto regulation. Its long-term effects will impact the global financial system and the crypto market. The framework will address issues like market stability and risk management and cover cross-border compliance. As the framework matures, it will establish the foundation for global crypto regulations for years.

Preparing for Regulatory Implementation

Crypto exchanges, financial firms, and investors must prepare now to navigate the FSB’s rules. Crypto platforms must segregate client assets from company funds. They must avoid conflicts of interest. This is a key principle in the FSB’s guidelines. All parties should prepare for stricter transparency and oversight. It’s part of a global effort to harmonize regulations.

Practical steps include upgrading internal compliance protocols to meet new international standards and fostering cross-border cooperation. Investors must stay informed about new market transparency rules and prepare for a focus on compliance and reporting.

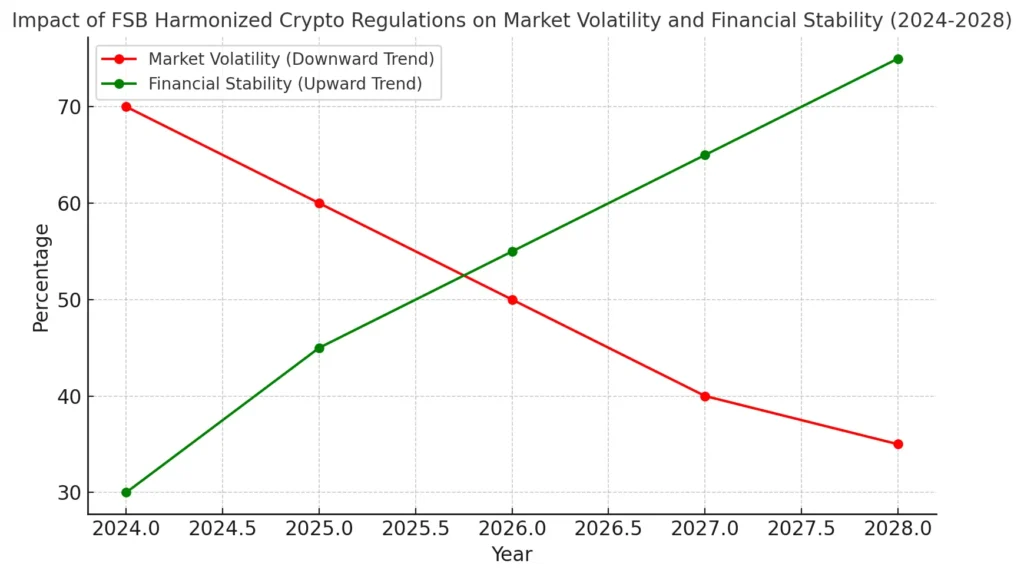

Long-Term Market Stability

The FSB’s framework aims to boost market stability. It will reduce systemic risks exposed by recent market events. Harmonizing crypto regulations across jurisdictions will play a significant role in preventing financial crises related to crypto assets. The FSB’s guidelines aim to reduce market volatility. They seek to create a more secure economic environment. They do this by ensuring a consistent approach to overseeing cryptocurrencies and stablecoins.

Note

The FSB’s 2024 roadmap aims to regulate global crypto. It seeks to ensure compliance across borders and financial stability. The FSB is setting a new standard for crypto markets, harmonizing regulations, boosting cyber resilience, and providing a consistent approach to stablecoin oversight. The roadmap’s implementation will likely lead to a more secure, transparent global financial system. It should boost trust in both traditional and decentralized markets.