Bitcoin’s mining hashrate has been on an upward trajectory throughout September 2024, reaching new all-time highs. The Daily Bitcoin mining hashrate peaked at a record-breaking 746 EH/s, which signals the increasing robustness of the Bitcoin network. This trend reflects enhanced network security and growing competition among miners. As mining profitability becomes more challenging due to rising operational costs and hashrate increases, the industry is adapting to the evolving landscape.

Bitcoin Hashrate Growth and Network Security

The Bitcoin network reached an unprecedented hashrate of 746 EH/s in early September 2024. This surge in computational power plays a critical role in fortifying the network, significantly improving its security by making it more resilient against attacks such as the 51% attack. At the same time, this increase underscores the intense competition among miners, each striving to process transactions faster and secure block rewards despite rising operational costs.

Impact of Rising Hashrate on Network Security

The rising Bitcoin mining hashrate enhances the network’s ability to prevent malicious activities, such as the 51% attack, where a single entity could take control of the network. With such a high hashrate, the computational power required to carry out such an attack becomes prohibitively expensive, making Bitcoin’s blockchain one of the most secure public ledgers globally. This enhanced network security not only protects user transactions but also helps build confidence in Bitcoin’s long-term viability.

Long-Term Security Implications of Hashrate Trends

Over time, the consistently high hashrate trend suggests that Bitcoin’s security will continue to strengthen. Historically, higher hashrates have coincided with lower vulnerability to network attacks. Additionally, high hashrates are typically a precursor to bullish market movements, as they often indicate strong miner confidence in the network. Below is a comparison table showing historical hashrate levels and associated security events:

| Year | Hashrate (EH/s) | Major Security Incidents | Network Security Trend |

|---|---|---|---|

| 2020 | 150 | None | Strong |

| 2022 | 250 | None | Strengthened |

| September 2024 | 746 | None | Very Strong |

Mining Profitability Amid Rising Hashrate

The significant growth in Bitcoin’s hashrate throughout September 2024 has intensified concerns surrounding mining profitability. With operational costs increasing and Bitcoin’s price not keeping pace, miners are facing challenging financial conditions.

Hashrate Growth and Profitability Challenges for Miners

As Bitcoin’s hashrate continues to rise, miners are experiencing a notable squeeze in profit margins. This is primarily because the network’s difficulty has also surged, nearing an all-time high of 92 trillion. The increased difficulty means that miners must expend more energy and computational power to earn the same rewards as before. Coupled with a substantial gap between the cost of mining (around $74,000 per Bitcoin) and the market price (hovering around $57,000), many miners are struggling to maintain profitability.

Note

several mining companies have resorted to selling off their Bitcoin reserves to cover escalating operational costs. Additionally, some have turned to alternative fundraising methods, such as issuing equity or exploring renewable energy solutions to reduce expenses.

Adjusting to Higher Difficulty Levels

As network difficulty rises, both small-scale and large-scale miners need to adjust their operations to remain profitable. Below is a checklist for miners looking to optimize operations amid growing challenges:

- Upgrade Equipment: Invest in more energy-efficient mining hardware like the latest ASICs.

- Optimize Energy Use: Negotiate better energy deals or switch to renewable energy sources to reduce electricity costs.

- Monitor Profitability Tools: Use profitability tracking tools to stay updated on real-time metrics like hashprice, difficulty adjustments, and energy consumption.

- Diversify Operations: Consider branching into other computational fields, such as AI or high-performance computing, to offset reduced mining revenues.

Note

- Bitcoin Price Responses to Political

- How Network Security Impacts Cryptocurrency Prices

- Analysis of Bitcoin ETF Outflows

- Investment Opportunities in Bitcoin Mining Infrastructure

Daily Hashrate Fluctuations in September 2024

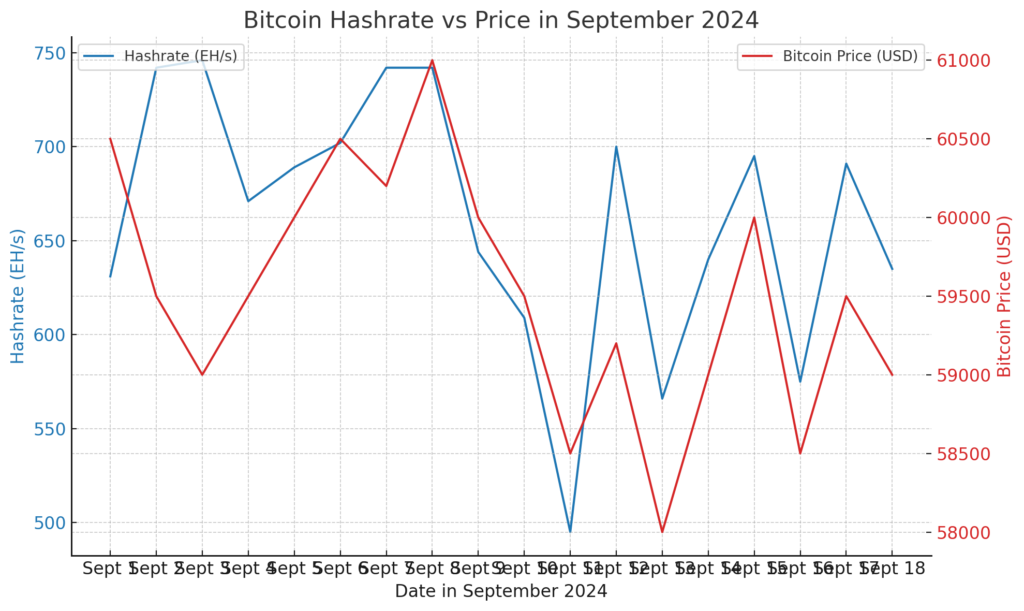

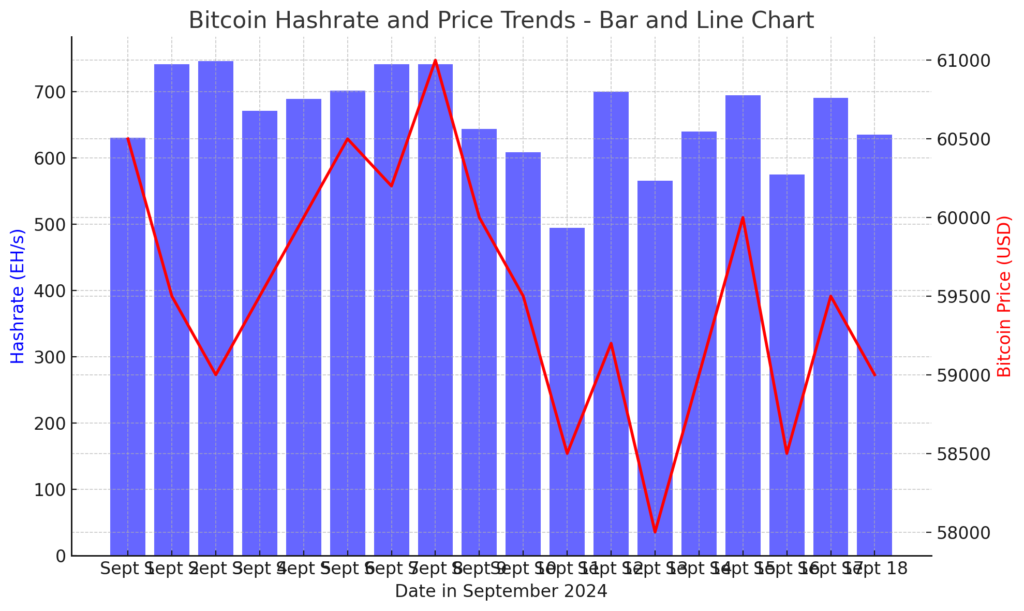

In September 2024, Bitcoin’s daily hashrate displayed noticeable fluctuations, influenced by both technical advancements and economic conditions. These fluctuations were critical as they reflected the network’s computational health and miners’ operational challenges. The overall trend for the month shows the Bitcoin hashrate reaching new peaks, but with intermittent drops due to network adjustments and external factors like energy issues and equipment upgrades.

Key Days of Hashrate Surges and Drops

Several key days in September saw significant hashrate changes. On September 3, the network hit a new all-time high of 746 EH/s, reflecting increased miner activity and new high-performance rigs coming online. However, on September 11, the hashrate dropped sharply due to a difficulty adjustment of +3.58%, raising the network’s difficulty to 92.67 trillion. Another spike occurred around September 16 when the hashrate touched 700 EH/s again, followed by a slow dip as miners adjusted to the rising operational costs and difficulty.

Implications of Daily Hashrate Fluctuations for Miners

These daily fluctuations directly impacted mining profitability. As the hashrate surged, smaller miners faced challenges maintaining profitability, especially with the operational costs climbing due to higher energy consumption and network difficulty. The drop in hashrate after the September 11 adjustment offered temporary relief, but the continual increase in difficulty forced miners to either upgrade their equipment or adjust operations to remain competitive.

Record Hashrate and Its Market Implications

In September 2024, Bitcoin’s hashrate reached unprecedented levels, setting a new all-time high of 746 EH/s on September 3. This surge highlights the growing power of the network but also raises important questions about its impact on the broader cryptocurrency market, particularly on Bitcoin prices and mining investments.

Impact of Daily Bitcoin Mining Hashrate Prices

While the Bitcoin hashrate continues to rise, there seems to be a notable disconnect between network strength and market price. Despite the hashrate reaching record highs, Bitcoin’s price dropped below $60,000. The increased hashrate has resulted in more competition among miners, driving up operational costs, but this has not directly led to an increase in Bitcoin’s price. Instead, the additional computational power has underscored the network’s security, while the market remains influenced by broader economic conditions.

Note

Historically, high Daily Bitcoin Mining Hashrate have sometimes preceded bullish market movements, but this correlation is not immediate or guaranteed. While a strong hashrate reflects confidence in the network’s long-term viability, it doesn’t necessarily translate to short-term price gains.

Investment Trends in Bitcoin Mining

The record-breaking hashrate has spurred significant investment in mining infrastructure. Major mining companies like Whatsminer and MicroBT are leading the charge by introducing new high-performance rigs and even exploring solar-powered solutions to mitigate rising energy costs. The surge in hashrate also prompted miners to seek renewable energy sources, such as converting methane gas to electricity, to remain profitable in a more competitive environment.

In response to the growing energy demands and higher operational costs, some companies are also expanding their AI integration to diversify revenue streams. The increase in hashrate has attracted both traditional mining companies and new entrants, further fueling investments in the sector despite the rising difficulty.

In September 2024, Bitcoin’s record-breaking hashrate reflects the growing resilience of its network and highlights key challenges for miners. As hashrate continues to surge, its market impacts, especially on miner profitability and infrastructure investments, will play a critical role in shaping the future of Bitcoin mining. Despite price fluctuations, the long-term outlook for network security remains strong.