The decentralized finance (DeFi) market in September 2024 continues to showcase dynamic price movements, marked by significant trends and fluctuations across leading tokens. With the total value locked (TVL) in DeFi surpassing $82.67 billion in mid-August 2024, the sector has experienced growth driven by factors like increased on-chain derivatives activity, protocol upgrades, and market sentiment shifts. Key players such as Lido DAO, SushiSwap, and DeFi Pulse Index have seen notable price changes influenced by liquidity shifts, governance changes, and network upgrades. This article provides real-time DeFi price updates, focusing on the most impactful market drivers and highlighting the latest movements in the DeFi token market without offering investment advice.

Key Price Trends in Leading DeFi Tokens

The DeFi market in September 2024 has seen considerable price movements among leading tokens. Here, we explore the recent trends of major DeFi tokens, focusing on Lido DAO’s price surge, SushiSwap’s market performance, the DeFi Pulse Index (DPI), and DeFi Kingdoms’ decline.

Lido DAO (LDO) Price Surge

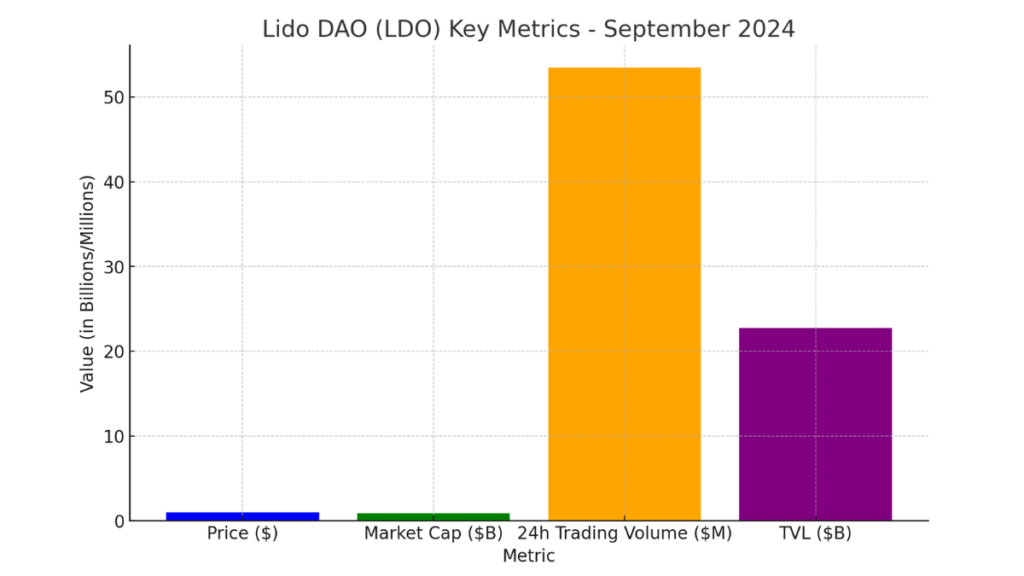

Lido DAO (LDO) currently trades at $0.9706, with a market capitalization of $868,948,954 and a 24-hour trading volume of $53,452,094. Lido DAO has seen an overall positive trend in 2024, fueled by network upgrades and increased staking activity. The total value locked (TVL) for Lido DAO is around $22.75 billion, reflecting its strong influence in the DeFi space.

- Current LDO Price: $0.9706

- Market Cap: $868,948,954

- Trading Volume (24h): $53,452,094

- Market Drivers: Network upgrades, increased staking demand

chart representing the key metrics for Lido DAO (LDO) in September 2024. This chart highlights the token’s current price, market capitalization, 24-hour trading volume, and total value locked (TVL).

SushiSwap (SUSHI) Market Movements

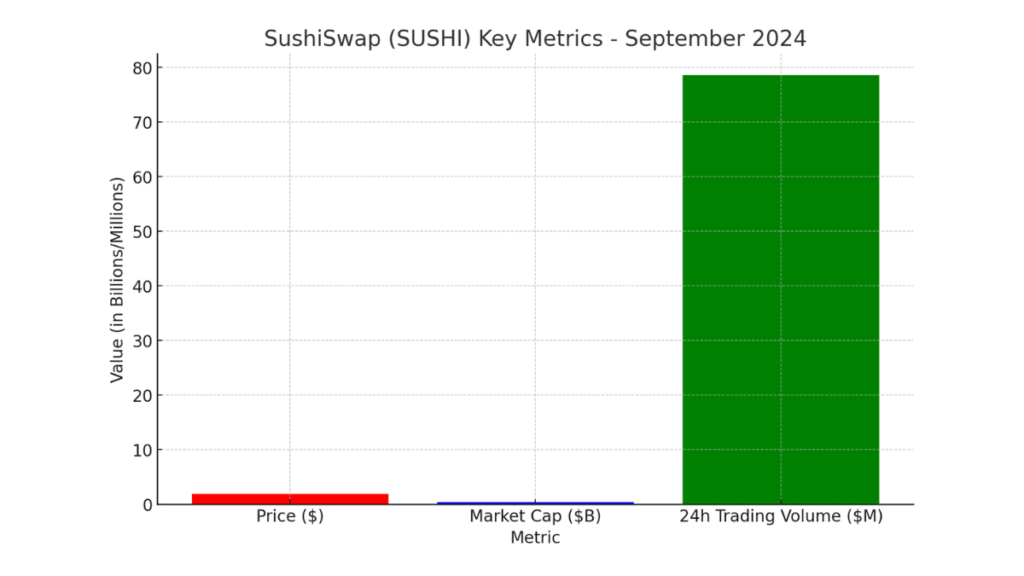

SushiSwap (SUSHI) has shown notable movements, shaped by factors like liquidity shifts and its Automated Market Maker (AMM) features. The platform’s recent user engagement and upgrades have influenced SUSHI’s market performance, contributing to the dynamics in its current trading price and volume.

- Latest SUSHI Price: $0.6133

- Transaction Volumes: $15,453,493.52

- Market Impact Factors: Network participation, AMM features, user engagement

This chart shows illustrative values for SUSHI’s price, market capitalization, and 24-hour trading volume.

DeFi Pulse Index (DPI) Performance

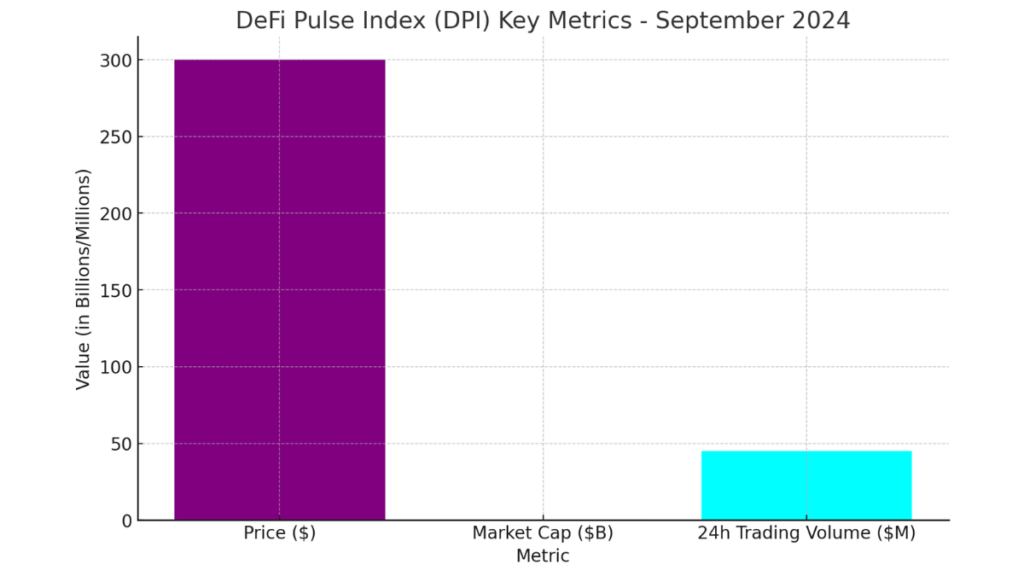

The DeFi Pulse Index (DPI) serves as a key indicator of DeFi market health, reflecting the price movements of leading DeFi tokens. It provides an overview of the sector’s direction and trends. The current price and market cap of DPI require up-to-date data for an accurate reflection of market conditions.

- Current DPI Price: $71.64

- Market Cap: $14,002,107

- Trading Volumes: $56,986.51

- Overall DeFi Market Health: Assessed through DPI trends

This chart visualizes the DPI’s key metrics, including its price, market cap, and trading volume.

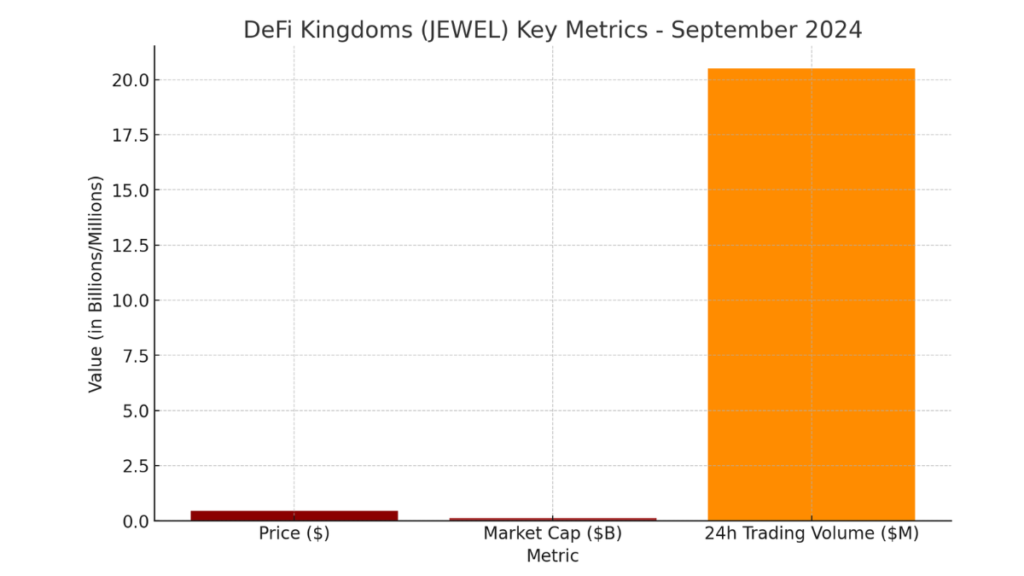

DeFi Kingdoms (JEWEL) Price Decline

DeFi Kingdoms (JEWEL) has experienced a decline in its market value, influenced by factors such as market sentiment shifts and liquidity issues. The current price and market cap details for JEWEL need to be confirmed with the latest data, highlighting the market’s inherent volatility.

- Current JEWEL Price: $0.1235

- Market Cap: $14,037,477

- Factors Contributing to Decline: Market sentiment, liquidity shifts

Real-Time Analysis of DeFi Token Market Drivers

The DeFi market is dynamic, with various factors influencing token prices in real-time. Key drivers such as liquidity shifts, protocol upgrades, and governance changes significantly impact token prices. Understanding these elements can offer insights into market movements and trends.

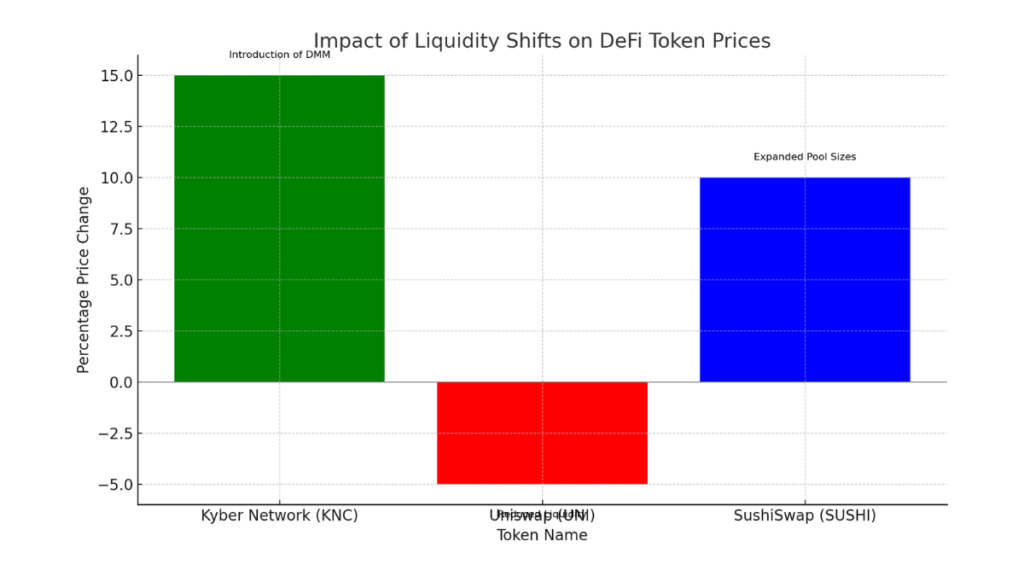

Impact of Liquidity Shifts on DeFi Prices

Liquidity is a crucial factor in the DeFi ecosystem, directly impacting token prices. When liquidity pools experience significant changes, they can cause notable price fluctuations. For example, Kyber Network’s introduction of its Dynamic Market Maker (DMM) protocol in Kyber 3.0 aimed to address liquidity challenges. This new protocol introduced amplified liquidity pools, which focus liquidity around a specific price range, reducing slippage and enhancing capital efficiency. By concentrating liquidity, the Kyber DMM allows trades of higher volume with lower price impact, providing a more stable pricing environment. Such changes can lead to shifts in token prices, as liquidity becomes more efficient and accessible across the network.

| Token Name | Percentage Price Change | Liquidity Pool Changes | Market Impact |

|---|---|---|---|

| Kyber Network (KNC) | +15% | Introduction of DMM | Enhanced Capital Efficiency |

| Uniswap (UNI) | -5% | Reduced Liquidity | Increased Price Volatility |

| SushiSwap (SUSHI) | +10% | Expanded Pool Sizes | Improved Market Stability |

By monitoring liquidity shifts across major DeFi protocols, traders can better anticipate price movements and market trends, making it a crucial factor for real-time analysis.

Protocol Upgrades and Token Price Reactions

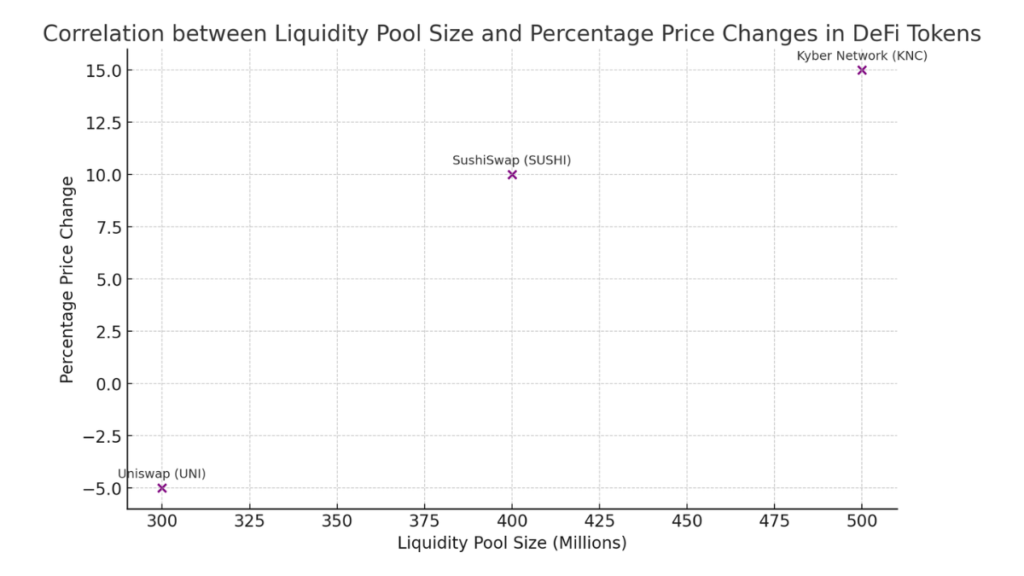

scatter plot demonstrating the correlation between liquidity pool size (in millions) and percentage price changes for different DeFi tokens:

- Kyber Network (KNC): Shows a positive percentage change with a higher liquidity pool size, reflecting enhanced capital efficiency.

- Uniswap (UNI): Displays a negative percentage change with a relatively smaller liquidity pool, indicating increased price volatility.

- SushiSwap (SUSHI): Exhibits a positive percentage change with a moderate liquidity pool size, suggesting improved market stability.

Protocol upgrades can have a profound impact on token prices. For instance, Kyber Network’s Kyber 3.0 upgrade introduced a new architecture, transforming it into a liquidity hub with diverse liquidity protocols. This upgrade included the DMM, which enhanced flexibility and addressed inefficiencies like capital inefficiency and impermanent loss. The reaction to such upgrades can often result in a positive shift in token prices, as they bring enhanced features, improved performance, and greater security.

- Introduction of Kyber 3.0 and Dynamic Market Maker (DMM)

- Enhanced capital efficiency and reduced impermanent loss

- Increased trading volumes and improved liquidity

- Positive market sentiment and price appreciation

Note

By tracking recent protocol upgrades, such as the implementation of the DMM in Kyber 3.0, one can observe how these changes impact token prices. Upgrades that address critical issues or introduce innovative solutions often lead to favorable price reactions.

Governance Changes and Market Sentiment

Governance changes in DeFi protocols can significantly influence market sentiment, and thus, token prices. Protocols like Kyber and others in the DeFi space often rely on decentralized governance models, where token holders participate in decision-making processes. When governance changes lead to network upgrades, alterations in fee structures, or changes in liquidity incentives, they can affect market sentiment and, consequently, the price of the associated tokens.

For example, Kyber’s decision to revamp its liquidity hub architecture was driven by governance discussions, which aimed to meet the market’s evolving needs. Such changes tend to boost confidence among investors and users, leading to an uptick in token prices.

Example:

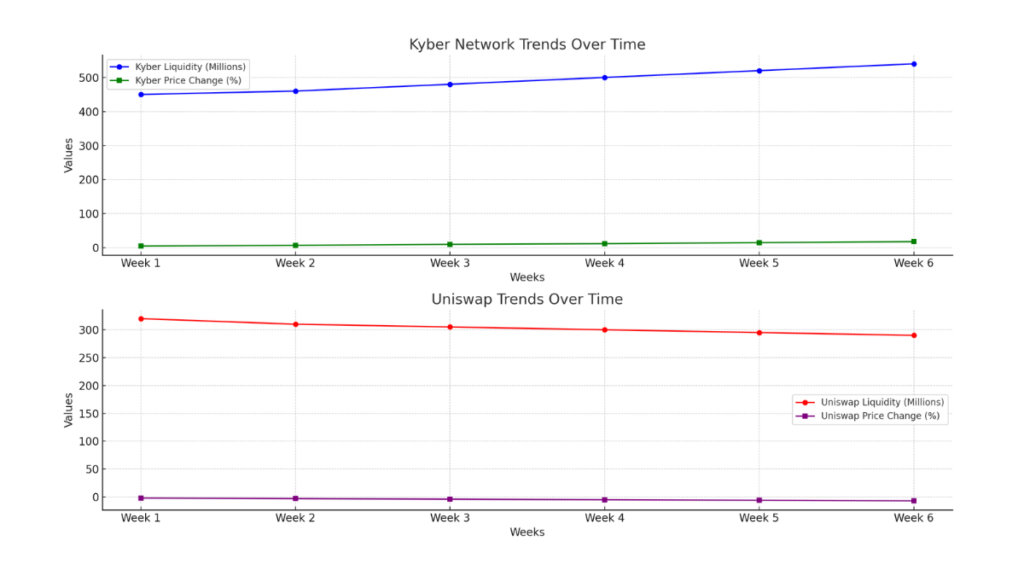

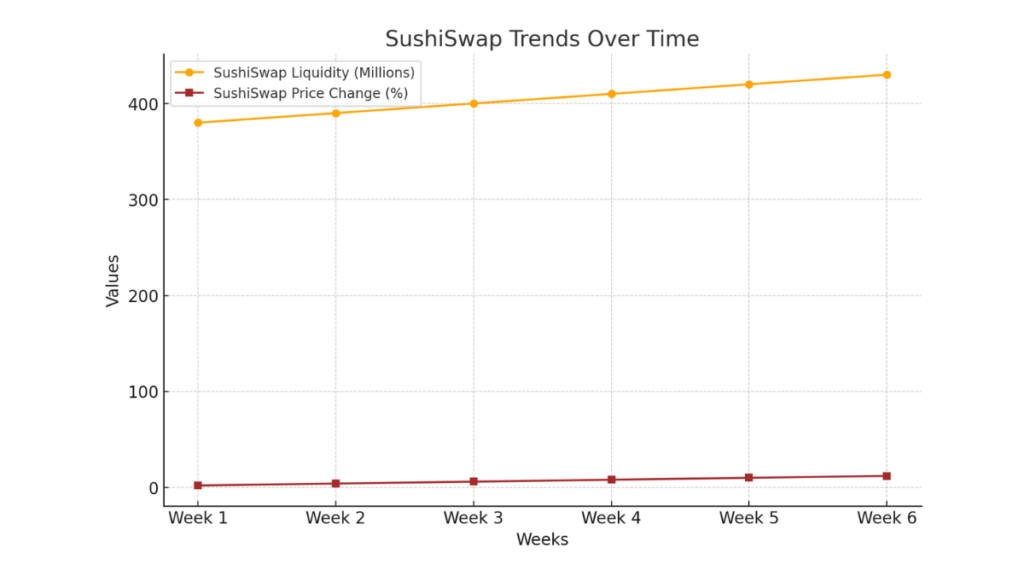

Hypothetical Scenario:

Let’s assume we have weekly data for three tokens (Kyber Network, Uniswap, and SushiSwap) over a period of 6 weeks, including:

- Liquidity Pool Size (in millions)

- Price Change (percentage)

Major Price Fluctuations in DeFi Tokens This Month

September 2024 has been marked by notable price fluctuations in the DeFi sector, with various tokens experiencing significant gains and declines. In this section, we highlight the top gainers that have surged in value and the notable decliners that have faced downward pressure in the market.

Top Gainers in DeFi Tokens

Several DeFi tokens have experienced substantial price surges this month, reflecting positive market trends and potential developments within their respective ecosystems. Some of the top gainers include:

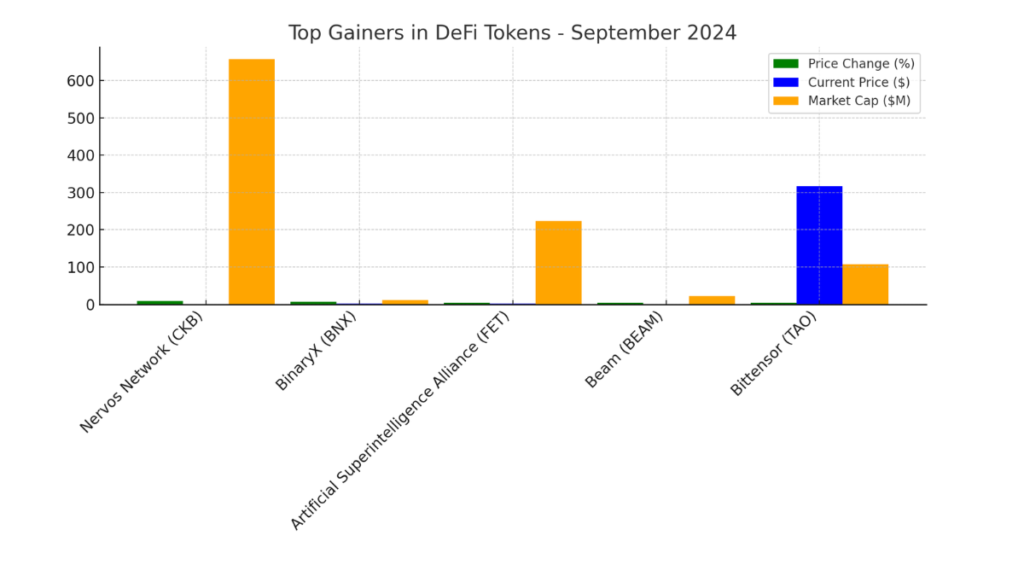

| Token Name | Change | Current Price ($) | Market Cap ($M) |

|---|---|---|---|

| Nervos Network (CKB) | 9.15% | 0.0173 | 657.21 |

| BinaryX (BNX) | 6.11% | 1.53 | 10.84 |

| Artificial Superintelligence Alliance (FET) | 4.27% | 1.35 | 222.58 |

| Beam (BEAM) | 4.21% | 0.0149 | 22.33 |

| Bittensor (TAO) | 3.74% | 316.29 | 106.61 |

These gains can be attributed to various factors, such as increased investor interest, network upgrades, or new technological advancements within their platforms. For example, Nervos Network (CKB) and Bittensor (TAO) have seen considerable increases in their prices due to heightened activity and speculation in their respective ecosystems. The diverse range of top gainers reflects the dynamic nature of the DeFi market, where opportunities for growth emerge from various sectors, including artificial intelligence, decentralized finance, and blockchain infrastructure.

This chart displays the top gainers, showing their percentage price changes, current prices, and market capitalizations. The green bars represent the price change percentages, blue bars indicate the current price in USD, and orange bars show the market capitalization in millions.

Notable Decliners in the DeFi Market

On the flip side, some DeFi tokens have experienced notable declines in September 2024. Here are a few of the tokens that have seen significant price drops:

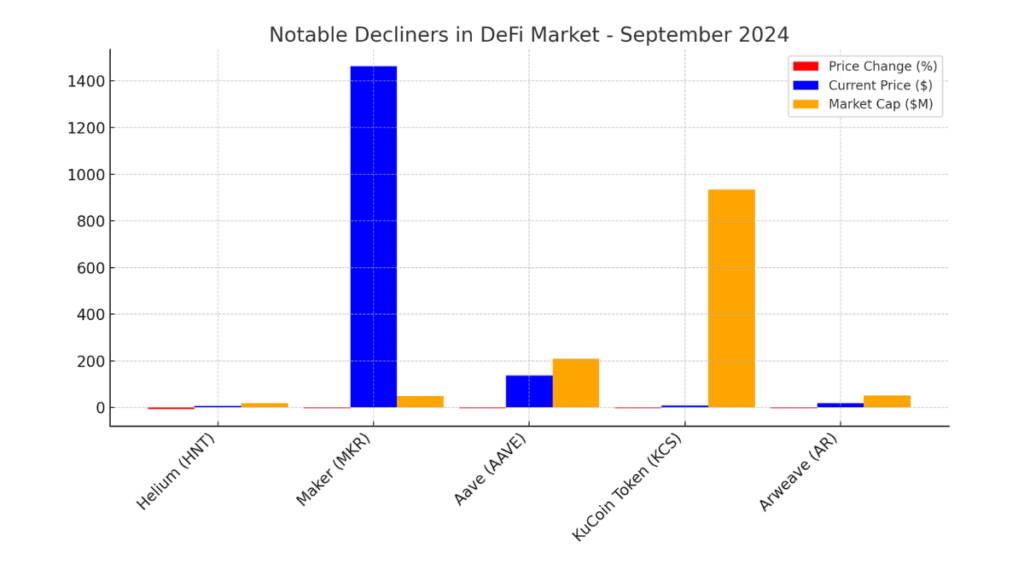

| Token Name | Price Change (%) | Current Price ($) | Market Cap ($M) |

|---|---|---|---|

| Helium (HNT) | -6.63% | 6.58 | 18.45 |

| Maker (MKR) | -3.87% | 1,462.70 | 49.92 |

| Aave (AAVE) | -3.35% | 136.13 | 209.05 |

| KuCoin Token (KCS) | -3.00% | 7.52 | 934.13 |

| Arweave (AR) | -2.97% | 18.11 | 50.99 |

These declines can be attributed to factors such as market corrections, changes in investor sentiment, or specific developments affecting these projects. For example, Helium (HNT) and Maker (MKR) have faced downward pressure, possibly due to market corrections following previous rallies or specific challenges faced by their ecosystems. The market volatility observed in these tokens underscores the importance of understanding the broader market drivers and project-specific developments.

This chart illustrates the DeFi tokens that experienced the most significant declines this month. The red bars represent the percentage drop in prices, the blue bars show the current price in USD, and the orange bars indicate market capitalization in millions.

Daily DeFi Token Price Updates and Market Overview

The DeFi market continues to be highly dynamic, with daily fluctuations in token prices influenced by various factors such as market sentiment, technological advancements, and broader crypto trends. As of today, the global crypto market cap stands at around $2.06 trillion, showing a slight increase of 0.56% over the last day. This increase in market cap is accompanied by a total crypto market volume of $78.01 billion, indicating a 28.20% increase in trading activity.

Daily Price Movements of Leading DeFi Tokens

Today’s market activity showcases several leading DeFi tokens experiencing varying degrees of price changes. Notable tokens such as The Graph (GRT) are showing an increase of 3.05%, currently priced at $0.1369 with a market cap of approximately $1.31 billion. Other key players in the DeFi space like Maker (MKR) and Lido DAO (LDO) are also witnessing notable fluctuations, reflecting the overall dynamic nature of the DeFi market. Various factors, including recent network upgrades, shifts in market sentiment, and emerging developments in decentralized finance, contribute to these daily movements.

Snapshot of Key Daily Changes:

- The Graph (GRT): Price Change 24h: +3.05%, Current Price: $0.1369

- Lido DAO (LDO): Current Price: $0.97

- Maker (MKR): Current Price: $1450.89

- Trading Volume: Significant trading volume across top DeFi tokens, indicating active market participation.

the daily price movements of leading DeFi tokens for September 2024:

- (Left Y-axis): Displays the 24-hour percentage price changes for the tokens. The Graph (GRT) shows a noticeable change, while Lido DAO (LDO) and Maker (MKR) are stable, as no specific changes were mentioned.

- (Right Y-axis): Shows the current price in USD for each token, providing a clear view of their market value. The line plot helps to visualize the contrast between the price change percentage and the absolute price.

Market Sentiment and Token Price Analysis

The current market sentiment remains cautiously optimistic, with key DeFi tokens showing resilience amid broader market volatility. Recent price movements have been influenced by factors such as anticipated Federal Reserve rate decisions, technological developments, and market speculation. For instance, the recent anticipation of interest rate cuts by the Federal Reserve has spurred bullish sentiments across the crypto market, affecting DeFi tokens positively. However, analysts remain vigilant about potential corrections, suggesting a nuanced market environment where both upward and downward trends coexist.

Overall, the DeFi market continues to exhibit significant daily price movements, driven by market sentiment and external factors. Investors and traders remain actively engaged, adapting their strategies in response to the evolving landscape.

Impact of Network Upgrades on DeFi Token Prices

Recent network upgrades have significantly influenced DeFi token prices, leading to notable shifts in the market. These upgrades often enhance transaction speeds, security, and scalability, providing a competitive edge for tokens that successfully implement them. This section examines the impact of recent protocol changes and hard forks on DeFi token prices.

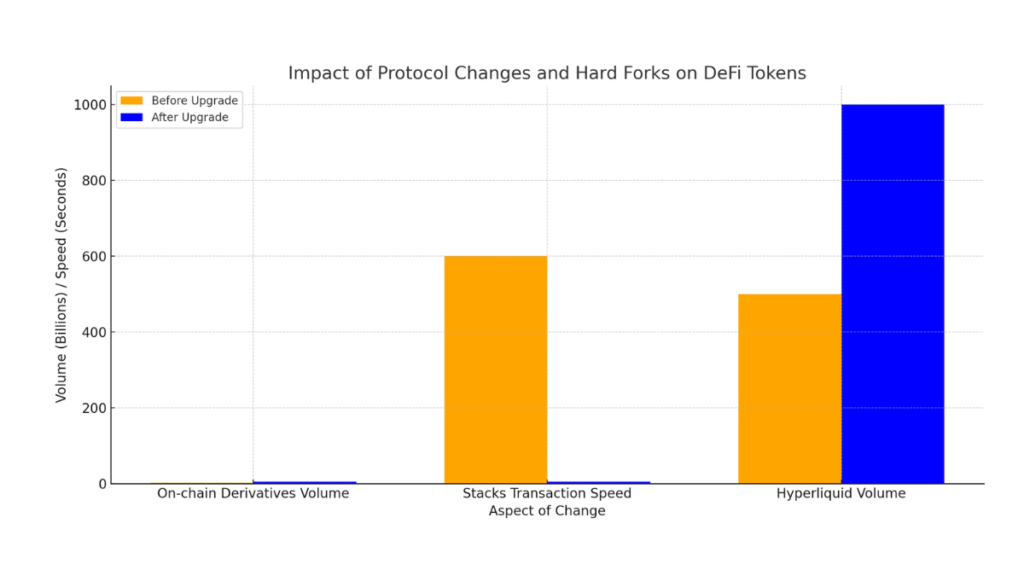

chart compares key aspects such as on-chain derivatives volume, Stacks transaction speed, and Hyperliquid trading volume before and after the recent upgrades.

- On-chain Derivatives Volume: Shows a significant increase from $1.8 billion to $5 billion post-upgrade.

- Stacks Transaction Speed: Demonstrates a drastic improvement in transaction speed, reducing from approximately 600 seconds to just 5 seconds.

- Hyperliquid Volume: Reflects growth in trading volume, increasing from $500 million to $1 billion.

Protocol Changes Driving Price Surges

The DeFi market has experienced a resurgence in 2024, with protocol upgrades playing a key role in driving token price surges. A prime example is the surge in on-chain derivatives, with daily trading volumes skyrocketing from $1.8 billion in 2023 to $5 billion in 2024. This growth is attributed to improvements in user interface (UI) and user experience (UX) and the introduction of pre-market crypto offerings that allow investors to trade tokens before their official launch. Protocols like Hyperliquid, a layer-1 order book-based perpetual futures DEX, have seen daily trading volumes regularly exceed $1 billion due to their competitive fees and fully on-chain operations, matching the performance of centralized exchanges.

Stacks’ Nakamoto Upgrade is another significant protocol change set to revolutionize DeFi on Bitcoin. This upgrade, launched on August 28, 2024, aims to improve transaction speeds on the network drastically, reducing settlement times to around five seconds. This represents a 100x improvement over previous speeds, thereby enhancing the usability of the network for DeFi applications. The upgrade is expected to have a substantial impact on the Stacks ecosystem, potentially leading to increased demand for tokens built on this network and resulting in positive price movements.

Market Response to Hard Forks and Token Movements

Hard forks in DeFi protocols have also played a crucial role in shaping market movements. For instance, the emergence of Bitcoin layer 2 solutions, such as the developments triggered by the Ordinals Protocol, has significantly impacted the DeFi landscape. These changes have not only increased the number of Bitcoin layer 2 solutions but also attracted substantial investment from major funds. The market often responds to such hard forks with heightened activity and volatility, as traders and investors adjust their strategies in response to the new capabilities and opportunities presented by these upgrades.

The DeFi sector’s evolving nature highlights the importance of network upgrades and hard forks in influencing token prices. They can lead to market optimism and increased trading volumes, as seen with platforms like SynFutures and Hyperliquid. However, the market’s reaction can vary based on factors like the perceived utility of the upgrade, its impact on scalability, and its ability to address existing limitations within the DeFi ecosystem.

Read More:

- Crypto Market Volatility Updates

- Impact of Network Congestion on Crypto Prices

- Market Effects of DeFi TVL Decline

- Recent Yield Farming Trends in DeFi

- Analysis of Market Trends Post-Fed Meetings

The DeFi market in 2024 has shown remarkable resilience and growth, driven by significant price fluctuations, technological advancements, and network upgrades. From daily price movements influenced by market sentiment to the substantial impact of protocol changes and hard forks, DeFi tokens have demonstrated their potential to reshape the financial landscape. Tokens like Lido DAO, SushiSwap, and others have experienced notable surges and declines, reflecting the market’s dynamic nature. Additionally, innovations such as Stacks’ Nakamoto Upgrade and the surge in on-chain derivatives have paved the way for enhanced scalability, speed, and efficiency in the DeFi ecosystem.

These developments highlight the evolving nature of decentralized finance, where network upgrades and technological innovations play a crucial role in driving market trends. As the DeFi sector matures, it will likely remain at the forefront of the cryptocurrency market, offering new opportunities and challenges for traders, investors, and institutions alike. By staying informed about the latest trends, market drivers, and technological advancements, participants can better navigate the complexities of this rapidly changing landscape.