Airdrops have become a significant catalyst for immediate token price fluctuations in the cryptocurrency market. In September 2024, several notable airdrops, including those from projects like Arbitrum and Celestia, profoundly affected token prices and market dynamics. These events often lead to sudden price surges, increased trading volumes, and market volatility. We will delve into the immediate market impact of these airdrops, examining how they influenced token prices, liquidity, and investor behaviour. By exploring these recent occurrences, we can better understand the short-term effects of airdrops on the crypto market.

Significant Airdrops and Their Immediate Market Impact

Analyzing recent airdrops such as Arbitrum, Celestia, and Blur reveals their substantial impact on token prices and market dynamics. These events often lead to swift changes in market behavior, with tokens experiencing notable fluctuations in price and trading volume. This section examines these airdrops in 2024, highlighting how they influenced market activities, including liquidity shifts, price surges, and trading volume spikes.

Arbitrum Airdrop and Its Impact on Token Price

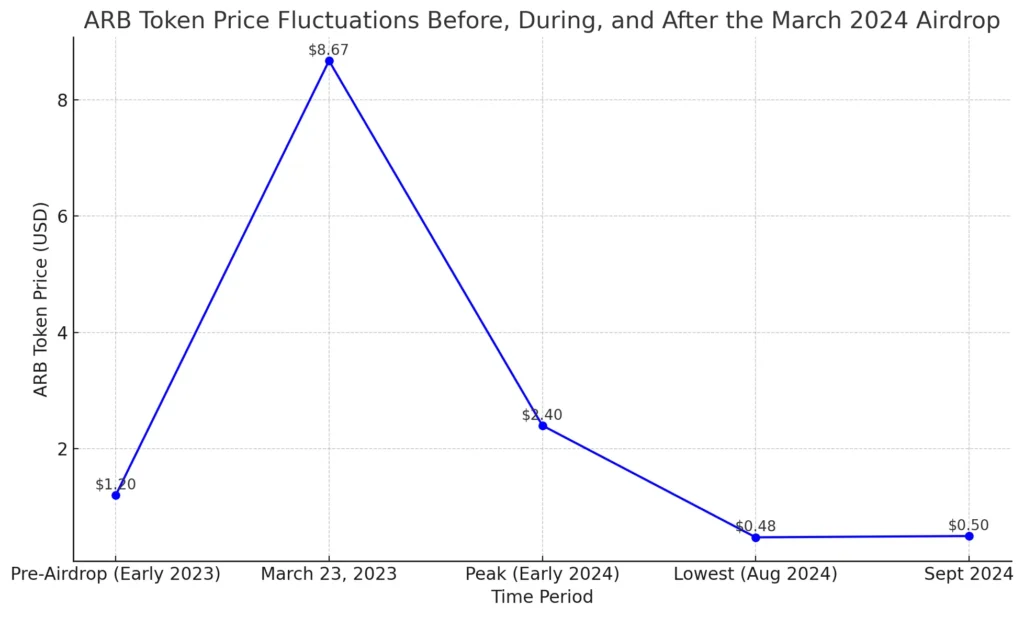

In March 2024, Arbitrum conducted a highly anticipated airdrop that distributed ARB tokens to early users and supporters of the Arbitrum network. This event had an immediate and significant impact on the ARB token’s price. Pre-airdrop, the ARB token was trading at modest levels, with speculative buying pushing prices higher in anticipation. Immediately following the airdrop, ARB token prices surged due to the sudden influx of new holders and market excitement.

Price spike was followed by rapid fluctuations. As many users received free tokens, a wave of sell-offs ensued, causing a sharp decline in the ARB price shortly after the initial surge. Despite this volatility, the airdrop brought considerable attention to the Arbitrum network, contributing to increased trading activity and heightened market interest.

| Time Period | ARB Token Price |

|---|---|

| Pre-Airdrop | Around $1.20 (early 2023) |

| Post-Airdrop | Opened around $8.67 on March 23, 2023 |

| Peak Price | $2.40 (early 2024) |

| Lowest Price (2024) | $0.4778 (August 2024) |

| Price as of September 2024 | Around $0.50 |

Celestia Airdrop and Market Response

The Celestia airdrop in October 2024 marked another significant event in the crypto market. The distribution of TIA tokens to early adopters and participants in the Celestia ecosystem led to an immediate market response. Initially, the TIA token witnessed a rapid price increase as a result of heightened demand and trading activity. Early recipients of the airdrop often rushed to sell their tokens, leading to significant trading volume spikes.

The market’s response was not uniformly positive. Following the initial surge, the TIA token experienced a period of heightened volatility. Traders responded to the sudden increase in token supply by adjusting their strategies, resulting in fluctuating prices. Despite these short-term market oscillations, the Celestia airdrop succeeded in generating widespread awareness and engagement with the Celestia network, attracting new users and liquidity into its ecosystem.

Blur’s Second Airdrop and Trading Volume Surge

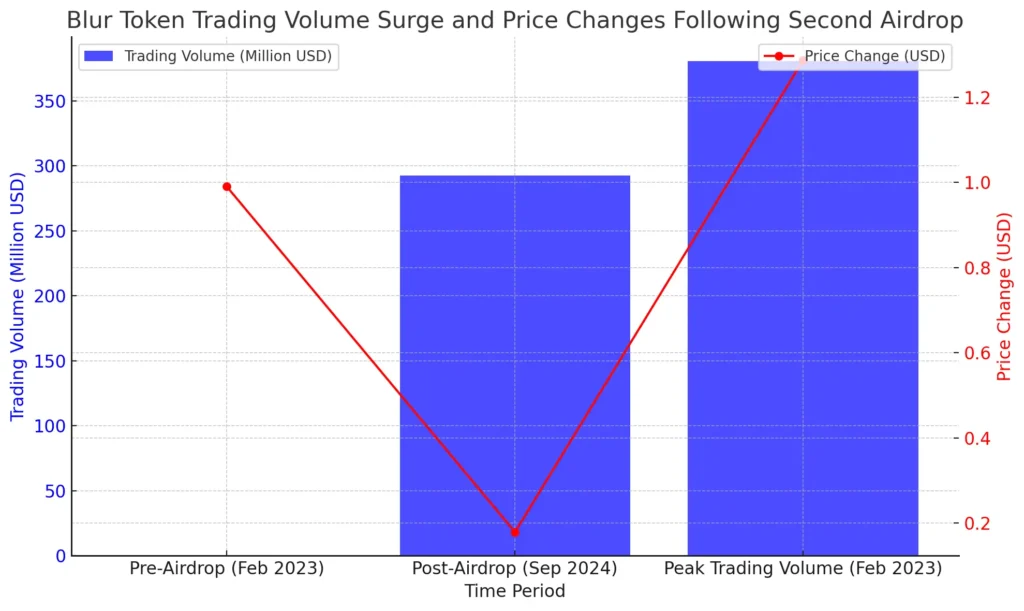

Blur’s second airdrop in 2024 had a pronounced impact on token prices and trading volumes, particularly within the decentralized finance (DeFi) sector. This airdrop involved the distribution of additional tokens to early users and liquidity providers on the Blur platform. In the immediate aftermath, the trading volume on Blur experienced a notable surge as recipients of the airdrop rushed to capitalize on their newfound assets.

Influx of activity led to increased liquidity and trading opportunities within the Blur ecosystem. The airdrop’s effect on token prices was evident, with a sharp increase in the value of Blur tokens as demand soared. However, similar to other airdrops, the initial price surge was followed by a period of price correction as some investors took profits, leading to market stabilization.

| Time Period | Trading Volume | Price Change |

|---|---|---|

| Pre-Airdrop | Not specified | Around $0.99 (Feb 2023) |

| Post-Airdrop | $292.6 million+ | $0.178835 (Sep 2024) |

| Peak Trading Volume | Not specified | Up 30% post-airdrop (Feb 2023) |

Token Price Fluctuations Post-Airdrop

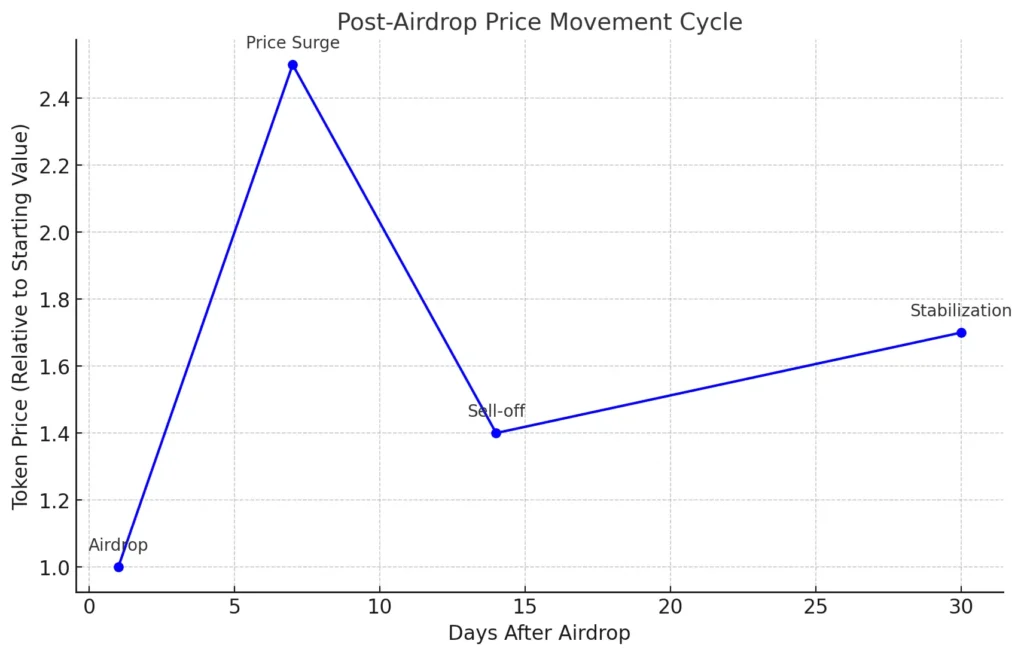

Tokens often experience sharp price movements in the days following an airdrop, influenced by market sentiment, trading volume, and investor behavior.

Sudden Price Peaks Within 14 Days

A recurring trend observed in many airdrops is a sudden price peak within the first two weeks post-event. Tokens often reach their all-time highs (ATH) in this period due to a combination of factors, including market hype, increased trading volume, and speculative buying. In 2024, several tokens displayed this pattern. For instance, the Arbitrum (ARB) token saw a significant price surge immediately after its airdrop in March 2024. The influx of new token holders and speculative traders drove the ARB price to a peak within the first week.

Similarly, Celestia’s (TIA) airdrop in October 2024 led to a rapid price increase. Within days of the airdrop, the TIA token experienced a sharp rise as traders and early adopters sought to capitalize on the market’s enthusiasm. However, these sudden peaks are often short-lived, as the initial buying frenzy subsides and market participants reassess the token’s value.

Key Factors Influencing Price Peaks:

- Hype and Market Sentiment: Anticipation of potential gains fuels a buying frenzy.

- Limited Supply and Demand Dynamics: Early airdrops often have limited token supply, leading to high demand.

- Speculative Trading: Traders engage in short-term buying, contributing to price surges.

Market Volatility and Sell-offs After Airdrops

After the initial surge, airdropped tokens often face significant market volatility, largely driven by large-scale sell-offs. Many recipients of airdropped tokens tend to sell immediately to secure profits, leading to a sudden increase in selling pressure. This influx of tokens into the market can cause sharp price declines, contributing to market instability.

A prime example is the Arbitrum airdrop in March 2024. Post-airdrop, the ARB token experienced heightened market volatility as a large number of tokens were offloaded by recipients. The result was a pronounced price decline, as the market struggled to absorb the increased token supply. This volatility is often accompanied by a spike in trading volumes, reflecting the heightened activity as traders respond to the shifting market conditions.

Sell-off Consequences:

- Price Decline: Immediate selling pressure drives token prices down.

- Trading Volume Spike: Market activity surges as tokens are sold off.

- Market Stabilization: Prices eventually stabilize as market dynamics adjust to the new supply.

Airdrop-Driven Market Changes and Trading Behavior

Airdrops can lead to rapid shifts in market behavior, as they often result in changes in liquidity, trading volumes, and investor strategies. The influx of new tokens into the market typically causes a ripple effect, altering trading dynamics both on centralized and decentralized exchanges. In 2024, several notable airdrops have demonstrated how these events can reshape the market landscape almost instantaneously.

Liquidity Increases Post-Airdrop

One of the immediate effects of an airdrop is the increase in market liquidity. When new tokens are distributed to many users, the available supply of that token in the market expands rapidly. For instance, the Celestia airdrop in October 2024 resulted in a significant boost in the liquidity of the TIA token. As thousands of recipients received the airdropped tokens, many moved to exchanges to trade, increasing the token’s availability and fostering a more dynamic trading environment.

The sudden influx of tokens into the market leads to heightened trading activity. Increased liquidity can attract more traders, as it reduces the impact of large trades on the market price. This increased token availability often leads to tighter bid-ask spreads, making it easier for traders to enter and exit positions. However, while liquidity increases can benefit market participants, they can also introduce short-term volatility as the market finds a new equilibrium.

Short-Term Trading Volume Spikes

Airdrops frequently cause a surge in trading volumes as both recipients and speculative traders seek to capitalize on the event. The distribution of tokens typically generates a burst of activity on both centralized and decentralized exchanges. Following Blur’s second airdrop in 2024, trading volumes on platforms like Uniswap and Binance surged as participants rushed to trade the newly distributed tokens. This spike in activity is driven by selling pressure from those looking to cash in on their airdropped assets and buying pressure from traders seeking to benefit from the anticipated price movements.

Trading volume spikes can significantly impact market behavior. On decentralized exchanges (DEXs), this increased volume can lead to higher liquidity pool utilization and increased trading fees for liquidity providers. Conversely, on centralized exchanges (CEXs), the influx of trading activity can sometimes cause short-term congestion, leading to temporary trading halts or increased spreads. Despite these challenges, the overall effect is an immediate burst of market dynamism, characterized by rapid price discovery and increased trading opportunities.

Price Corrections and Market Stabilization After Airdrops

After the initial surge and excitement of an airdrop, the crypto market often enters a phase of correction and stabilization. During this period, the token’s price adjusts from its post-airdrop volatility, settling into a more sustainable market value. In 2024, several airdrops have demonstrated this pattern, highlighting the processes that drive market stabilization and impact investor behavior.

Typical Price Correction Patterns

Following a major airdrop, tokens commonly undergo sharp price corrections. Initially, the surge in price is driven by speculative buying and trading activities. However, a correction typically follows as the market starts to absorb the new supply of tokens. In 2024, tokens like ARB (Arbitrum) and TIA (Celestia) exhibited this trend, where the prices peaked shortly after the airdrop and then corrected significantly within days or weeks.

A typical pattern observed is a “sell-off” phase, where many recipients of the airdropped tokens choose to sell, realizing their profits. This selling pressure often leads to a sharp decline in the token’s price. This initial correction phase is usually marked by high volatility as the market attempts to find a new equilibrium. Following this phase, the market often moves into a stabilization period where the token price gradually settles, influenced by factors such as long-term investor interest, project fundamentals, and overall market sentiment.

Note

The impact of these corrections on investor sentiment can vary. While some investors view this as a buying opportunity, others may see it as a sign of inherent market risk. For instance, after the Arbitrum airdrop in March 2024, the ARB token’s price underwent a significant correction, initially creating a sense of market uncertainty. However, as the market stabilized, investor confidence gradually returned, guided by the project’s long-term potential and community engagement.

Long-Term Market Impacts

While the immediate effects of an airdrop are characterized by volatility and rapid price changes, the long-term impacts can be more nuanced. Airdrops can contribute to the token’s distribution and decentralization, potentially fostering a more engaged community of users and holders. This can enhance the token’s utility and use cases over time, contributing to its value proposition in the market.

For example, Celestia’s airdrop in October 2024 resulted in short-term market fluctuations and attracted a broader user base to its network. Over the long term, this can lead to increased adoption and integration of the token into various decentralized applications and ecosystems. However, the long-term market outlook for a token post-airdrop heavily depends on the project’s development, utility, and overall market conditions.

Airdrops can also influence market dynamics by affecting token liquidity. As tokens are distributed more widely, they become more accessible, potentially leading to more consistent trading volumes and liquidity in the market. Nevertheless, the token’s long-term success will largely depend on how well the project delivers on its roadmap and value proposition beyond the initial airdrop hype.

Airdrop Effects on Market Sentiment and Investor Behavior

Airdrops can significantly impact market sentiment and investor behavior, leading to diverse reactions ranging from optimism to caution. The sudden influx of new tokens into the market can alter trading dynamics, influence investor psychology, and prompt strategic decision-making.

Investor Reactions to High-Value Airdrops

High-value airdrops, such as the Arbitrum airdrop in March 2024, often generate considerable buzz in the market, directly affecting investor sentiment. When investors receive a significant amount of free tokens, it typically leads to an initial wave of optimism. For early participants in the Arbitrum ecosystem, the airdrop was seen as a reward for their early adoption, fostering a sense of confidence in the project’s prospects. This positive sentiment can increase buying pressure and higher trading volumes as new investors rush in to participate in the anticipated growth.

However, high-value airdrops can also evoke caution among more experienced investors. While some view airdrops as an opportunity to accumulate assets at a lower cost, others remain wary of potential sell-offs and market volatility that often follow these events. For instance, the subsequent market correction post-Arbitrum’s airdrop led some investors to reassess their strategies, especially as prices adjusted to the new supply. The psychological impact of airdrops can vary, with risk-averse investors opting for a more cautious approach to avoid potential losses during periods of heightened volatility.

Short-Term Trading Strategies Post-Airdrop

Airdrops can create a fertile ground for various short-term trading strategies, as investors seek to capitalize on the immediate market movements. One common strategy observed post-airdrop is the “sell-the-news” approach, where investors quickly sell their airdropped tokens to realize immediate profits. This strategy is often employed when airdrops generate excessive hype, leading to an initial price surge. For example, after the Blur airdrop in 2024, many traders sold their tokens shortly after receiving them, contributing to a brief spike in trading volume followed by a price correction.

Another strategy involves “dip buying,” where investors look for buying opportunities during the post-airdrop correction phase. When prices drop due to initial sell-offs, some traders view this as an opportunity to acquire tokens at a discounted rate, betting on the token’s potential for long-term growth. This behavior can contribute to market stabilization, as it introduces new demand and can lead to price recovery over time.

More aggressive traders might engage in arbitrage opportunities, especially if the airdropped tokens are listed on multiple exchanges. By taking advantage of price discrepancies across different platforms, traders can potentially secure quick profits. However, these strategies carry risks, as airdrop-induced volatility can lead to unexpected market swings. Therefore, while airdrops present various short-term trading opportunities, they also require a careful assessment of market conditions and risk tolerance.

Related Article for you:

- Cryptocurrency Market Cap Changes

- Daily Crypto Market Overview

- Impact of Network Congestion on Crypto Prices

- Market Reactions to Interest Rate Changes

- Market Effects of DeFi TVL Decline

Airdrops have immediate and profound effects on the cryptocurrency market, influencing token prices, liquidity, and investor behavior. While they can lead to short-term volatility and price corrections, they also introduce opportunities for market engagement and growth. Understanding these dynamics provides valuable insights into market behavior and the evolving strategies of crypto investors.