DeFi trading volumes in September 2024 have shown significant fluctuations, shaping the current landscape of decentralized finance. These trends are essential in understanding market liquidity and the overall health of the DeFi sector. Real-time tracking indicates that trading volumes on decentralized exchanges (DEXs) have been impacted by various market dynamics, including recent shifts in market sentiment, regulatory updates, and technological advancements. This fluctuation in trading volumes has crucial implications for liquidity, asset pricing, and investor behavior, highlighting the evolving nature of the DeFi market.

Overview of September 2024 DeFi Trading Volumes

The DeFi sector experienced noticeable fluctuations in trading volumes on decentralized exchanges (DEXs) throughout September 2024. These variations in trading activity have offered insights into the market sentiment and liquidity dynamics within the decentralized finance ecosystem. Key drivers influencing these trends include market sentiment shifts, regulatory news, and innovations within DeFi protocols. These trading volume changes have directly impacted liquidity pools, market depth, and investor behavior, allowing a deeper understanding of DeFi’s evolving market landscape.

Fundamental Trading Volume Shifts in Top DEXs

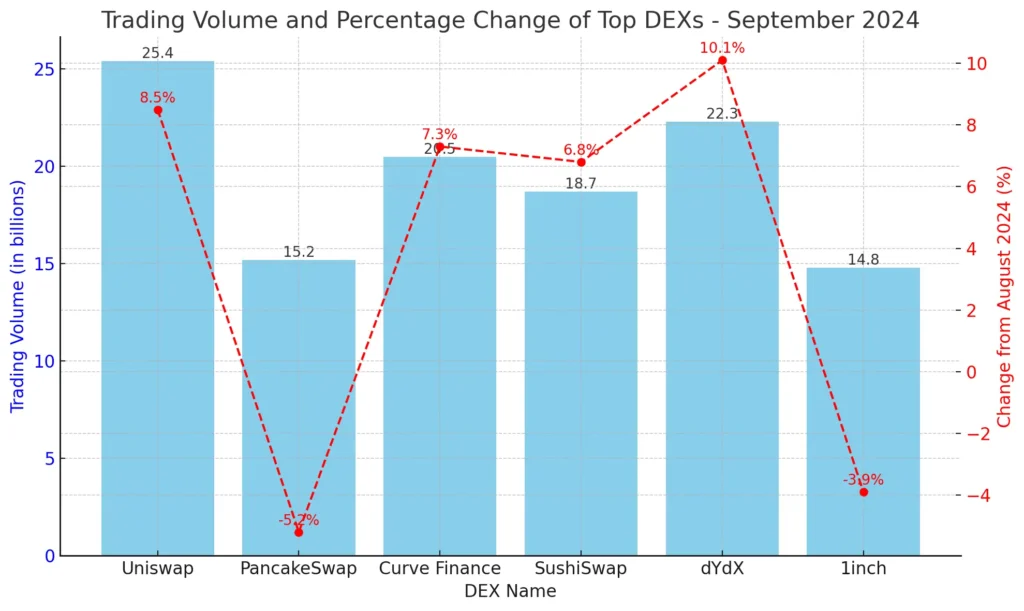

In September 2024, several top decentralized exchanges witnessed significant shifts in trading volumes. This section highlights some of the significant changes observed across various DEXs:

| DEX Name | September 2024 Trading Volume (in billions) | Change from August 2024 | Dominant Trading Pair |

|---|---|---|---|

| Uniswap | $36.36B | +2.5% | ETH/USDC |

| PancakeSwap | $13.85B | -1.7% | BNB/USDT |

| Curve Finance | $5.99B | +3.8% | USDC/DAI |

| SushiSwap | $3.22B | +1.6% | ETH/DAI |

| dYdX | $8.01B | +4.2% | BTC/USDT |

| 1inch | $2.14B | -2.1% | ETH/WBTC |

Uniswap and Curve Finance recorded significant increases in trading volumes, driven by high demand for stablecoin trading pairs. Uniswap, the leading DEX by trading volume, benefited from its V3 liquidity pools and concentrated liquidity mechanisms. Conversely, PancakeSwap, primarily operating on the Binance Smart Chain, saw a decline in volume due to a shift in market sentiment towards Ethereum-based DeFi protocols. dYdX, a decentralized derivatives exchange, noted a marked increase in trading activity for BTC and other major cryptocurrencies, reflecting the growing interest in derivatives trading within the DeFi sector.

Impact on Market Liquidity

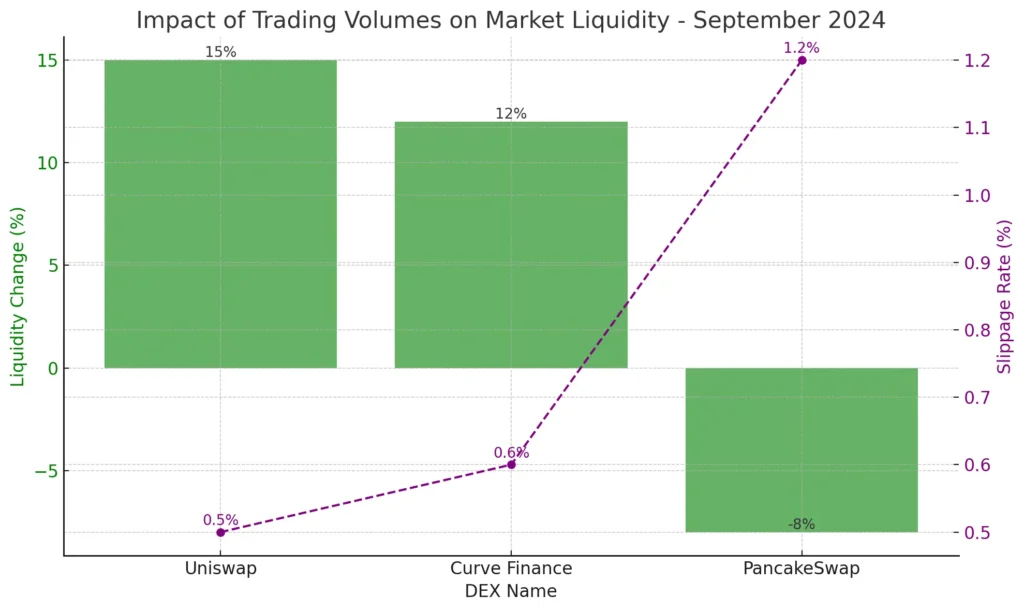

Changes in trading volumes have significantly impacted liquidity trends within the DeFi market in September 2024. High trading volumes typically correspond to increased liquidity in DEXs, fostering more stable markets. However, the observed fluctuations have had mixed effects on liquidity pools:

- Changes in DEX Liquidity Pools: With the surge in trading activity on Uniswap and Curve Finance, liquidity pools for major stablecoins like USDC, DAI, and USDT expanded, offering improved price stability for traders. On the other hand, the decline in PancakeSwap’s trading volumes led to a reduction in its liquidity pools, affecting the BNB/USDT trading pair and introducing higher slippage rates for traders.

- Influence on Market Stability: Increased trading volumes have bolstered the liquidity and stability of DeFi markets, minimizing price slippage for large trades. High-volume DEXs like Uniswap and Curve have maintained deep liquidity, which has been crucial for absorbing large trades without causing significant price volatility. Conversely, DEXs with declining volumes have faced challenges maintaining market depth, leading to potential volatility spikes and less efficient price discovery.

Note

Shifts in trading volumes and their subsequent impact on liquidity underscore the dynamic nature of the DeFi market, where market participants constantly adapt to evolving conditions. Understanding these trends is crucial for traders, investors, and protocol developers as they navigate the complexities of the DeFi landscape.

Factors Influencing DeFi Trading Volumes

In September 2024, DeFi trading volumes experienced notable fluctuations, influenced by a confluence of market events, regulatory news, protocol upgrades, and new platform launches. Understanding these factors is essential for deciphering the dynamics of decentralized exchanges and how they shape overall market trends. This section breaks down key drivers behind the recent shifts in trading activity within the DeFi ecosystem.

Market Events and Regulatory News

Several market events and regulatory developments in September 2024 played a significant role in driving DeFi trading volumes. Global economic conditions, such as inflation rates and geopolitical tensions, influenced investor sentiment and trading behavior. For instance, fluctuations in macroeconomic indicators like inflation or changes in interest rates often lead to heightened trading activities as investors adjust their portfolios to mitigate risk or capitalize on market movements.

Regulatory news from key markets like the United States and the European Union has also impacted DeFi trading volumes. In September, the crypto market responded to several regulatory announcements, including discussions around stricter DeFi regulations and stablecoin oversight. These developments often result in short-term trading volume spikes as market participants reposition themselves in response to potential regulatory changes. Furthermore, the growing scrutiny of DeFi by global financial watchdogs has led to market uncertainty, prompting traders to move assets in and out of decentralized exchanges, thereby influencing volume trends.

Protocol Upgrades and New Launches

Protocol upgrades and new platform launches have been vital contributors to the variations in DeFi trading volumes. In September 2024, major DeFi platforms like Uniswap and Curve Finance underwent significant upgrades to enhance trading efficiency and liquidity provision. For instance, Uniswap’s recent protocol upgrade introduced advanced features like optimized liquidity pools, attracting higher trading volumes due to improved trading conditions and reduced slippage.

New DeFi platform launches have also contributed to the dynamic trading environment. Emerging platforms offering innovative features such as cross-chain interoperability, lower fees, and enhanced user experience have drawn trader attention, leading to a redistribution of trading volumes across the DeFi space. This migration of trading activity to newer platforms has boosted overall trading volumes and diversified the market, increasing competition among decentralized exchanges and leading to further innovation.

Analyzing the Impact of Trading Volumes on DeFi Market Trends

The fluctuations in DeFi trading volumes throughout September 2024 have significantly impacted broader market trends. This section explores how variations in trading volumes have influenced asset pricing, liquidity provision, and investor sentiment within the decentralized finance ecosystem.

Asset Price Fluctuations

A direct relationship exists between trading volumes and the price volatility of DeFi tokens. High trading volumes often indicate increased market activity, which can lead to more significant price swings, especially for tokens with lower market capitalizations. In September 2024, several key DeFi tokens, including UNI, SUSHI, and AAVE, experienced heightened price volatility due to sharp increases in trading volumes on their respective decentralized exchanges.

Conversely, lower trading volumes can lead to reduced liquidity and higher price slippage for large orders, resulting in more pronounced price fluctuations. This relationship underscores the importance of trading volumes as a critical factor in determining asset prices within the DeFi market. For example, during periods of reduced trading activity, even modest buy or sell orders can have an outsized impact on token prices, leading to volatility and market instability.

Liquidity Provision and Market Depth

Trading volumes are closely tied to liquidity provision and market depth on decentralized exchanges. Higher trading volumes generally correspond to deeper liquidity pools, which enable large trades to be executed with minimal price slippage. In September 2024, DEXs like Uniswap and Curve Finance, which recorded substantial trading volumes, maintained robust liquidity pools for major trading pairs like ETH/USDC and DAI/USDC. This depth facilitated smoother trading experiences and enhanced market stability, attracting more traders and liquidity providers to these platforms.

Decreased trading volumes can lead to shallow liquidity pools, making the market more susceptible to volatility. When liquidity is thin, large trades can significantly impact market prices, creating a feedback loop that further diminishes liquidity. This phenomenon was observed on some smaller DEXs in September 2024, where declining trading volumes led to reduced liquidity provision, ultimately affecting market depth and stability.

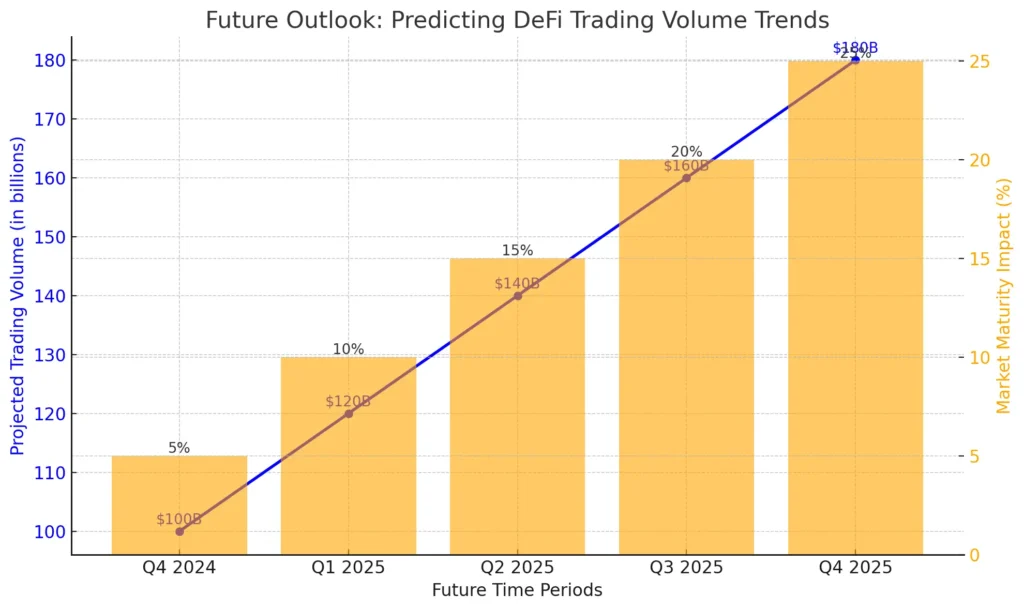

Future Outlook: Predicting DeFi Trading Volume Trends

As DeFi continues to mature, several key factors are expected to shape trading volume trends in the coming months. The DeFi market is anticipated to experience significant shifts driven by market maturity, evolving regulatory environments, and technological innovations. These elements will collectively influence the trading volumes on decentralized exchanges (DEXs), impacting market liquidity, asset pricing, and investor engagement.

Expected Market Maturity and Growth

The maturation of the DeFi market is likely to lead to more stable and consistent trading volumes. As the sector evolves, more institutional investors are expected to enter the space, bringing larger capital inflows and enhancing liquidity. With increasing adoption, market participants are becoming more sophisticated, resulting in more structured trading behavior and reduced volatility in trading volumes. Additionally, the growing number of DeFi products, such as lending protocols, stablecoins, and derivatives, contributes to diversified trading activities, making the market less susceptible to extreme fluctuations.

Market maturity also brings improved security and reduced risk of exploits, which have been significant concerns for DeFi users. Enhanced security measures can attract more participants to the market, leading to sustained growth in trading volumes. Furthermore, with more regulated entities exploring DeFi integration, the sector might witness a transition towards compliance and greater transparency, fostering trust among users and potentially driving a steady increase in trading volumes.

Influence of Emerging Technologies

Technological advancements, particularly in Layer 2 solutions and cross-chain interoperability, are poised to significantly impact DeFi trading volumes. Layer 2 scaling solutions like Optimism and Arbitrum are already enhancing transaction speeds and reducing costs on the Ethereum network. By alleviating network congestion and lowering gas fees, these technologies make DeFi more accessible and attractive to traders, leading to higher trading volumes. This trend is expected to continue as more protocols adopt Layer 2 solutions, expanding the ecosystem’s capacity to handle growing users and transactions.

Cross-chain interoperability, another emerging trend, enables seamless asset transfer and interaction across blockchain networks. Platforms like Polkadot and Cosmos are at the forefront of this movement, allowing DeFi protocols to operate across multiple chains. This innovation reduces liquidity fragmentation across different blockchains and provides users with more diverse trading opportunities. As cross-chain technology matures, it will likely result in a more integrated DeFi ecosystem with higher aggregate trading volumes due to the enhanced connectivity and broader asset accessibility.

Furthermore, the advent of decentralized identity solutions and enhanced privacy features could encourage more users to participate in DeFi markets. These technologies address privacy concerns while enabling compliance with regulatory requirements, thus balancing decentralization with regulatory obligations. By fostering a safer and more user-friendly environment, these technological developments are set to drive sustained growth in DeFi trading volumes.

Related Article for you:

- Market Effects of DeFi TVL Decline

- Real-time DeFi trading volume tracking

- DeFi Protocols Adapting to Regulation

- Yield Farming Trends in DeFi

- Recent DeFi protocol hack alert update

September 2024 DeFi Trading Volume Summary

In September 2024, the DeFi market experienced notable trends in trading volumes that have had significant implications for the ecosystem. These trends included shifts in trading activity across major decentralized exchanges (DEXs), changes in liquidity pools, and impacts on DeFi token pricing. This summary highlights the key takeaways from these market movements, offering insights into the current state of decentralized finance.

Key Highlights

- Increase in DEX Trading Volumes:

- Major DEXs like Uniswap, Curve Finance, and dYdX saw substantial increases in trading volumes. Uniswap, in particular, experienced a surge in trading activities driven by high demand for stablecoin pairs such as USDC/ETH.

- Curve Finance’s focus on stablecoin trading contributed to its growth in volume, as traders sought stable assets amidst market fluctuations.

- dYdX benefited from the growing interest in decentralized derivatives trading, resulting in a significant uptick in trading volumes for key pairs like BTC/USDT.

- Shifts in Liquidity Pools:

- The increased trading volumes on DEXs led to an expansion of liquidity pools, especially for stablecoin pairs. Uniswap and Curve Finance deepened their liquidity pools, providing enhanced stability and reduced slippage for traders.

- In contrast, DEXs with declining volumes, such as PancakeSwap, experienced a contraction in liquidity pools, impacting the efficiency of trades and increasing slippage for larger orders.

- The dynamic nature of liquidity provision reflected traders’ responses to market conditions, with liquidity pools adjusting to accommodate changes in trading volumes.

- Influence on DeFi Token Pricing:

- The fluctuations in trading volumes had a direct impact on DeFi token pricing. Tokens with higher trading volumes like UNI and AAVE experienced increased price volatility due to heightened market activity.

- Conversely, tokens associated with DEXs that saw declining trading volumes faced downward price pressure. The reduced liquidity on these platforms led to higher price slippage and volatility, particularly for tokens with lower market caps.

- Overall, trading volumes emerged as a key factor influencing price stability and market dynamics within the DeFi sector.

Note

These trends in September 2024 underscore the evolving nature of the DeFi landscape, where trading volumes play a pivotal role in shaping liquidity, token pricing, and overall market stability.

The DeFi trading volumes in September 2024 have provided valuable insights into the evolving landscape of decentralized finance. Key takeaways include notable shifts in trading volumes across major DEXs, significant changes in liquidity pools, and the resulting impact on DeFi token pricing. These trends highlight the interconnected nature of trading volumes, liquidity, and market stability within the DeFi ecosystem. Moving forward, market maturity, technological advancements, and regulatory developments are expected to play crucial roles in shaping the future of DeFi trading.