Token unlocks are pivotal events in the cryptocurrency market, often leading to significant impacts on market liquidity and token prices. They occur when a predetermined number of tokens allocated to early investors, project teams, or community incentives are released into circulation. These events can lead to market volatility, as was recently seen in instances like Aptos’ unlock in September 2024 and Arbitrum’s unlock earlier in the year. Understanding these token unlock schedules is crucial for token holders, traders, and blockchain enthusiasts, as they directly influence trading volumes, market sentiment, and liquidity dynamics. This article will delve into the schedules of upcoming token unlocks, their immediate market impacts, and how traders can track these events in real-time.

Overview of Upcoming Token Unlock Events

Token unlock events are pre-scheduled releases where a portion of a cryptocurrency’s supply, often allocated to early investors, team members, or for project development, becomes available in the market. These events can significantly impact market liquidity and prices, making it crucial for traders and investors to stay informed. September 2024 is poised to witness several major token unlocks, influencing market dynamics in various ways.

Major Token Unlocks in September 2024

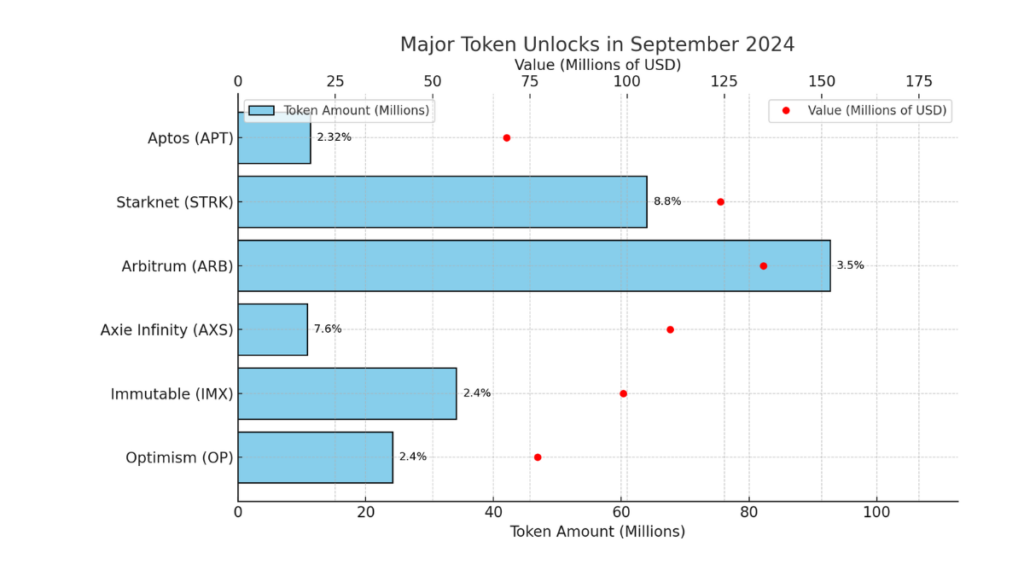

September 2024 features several key token unlocks that are anticipated to influence market conditions. The projects involved have scheduled these events as part of their tokenomics strategies, which include distributing tokens to investors, team members, and the community. Here are some of the significant token unlocks scheduled for September 2024:

| Project Name | Date | Token Amount | Value (Approx.) | Percentage of Total Supply |

|---|---|---|---|---|

| Aptos (APT) | Sep 11, 2024 | 11.31 million | $68.99 million | 2.32% |

| Starknet (STRK) | Sep 15, 2024 | 64 million | $124 million | 8.8% |

| Arbitrum (ARB) | Sep 16, 2024 | 92.69 million | $135 million | 3.5% |

| Axie Infinity (AXS) | Sep 17, 2024 | 10.87 million | $111 million | 7.6% |

| Immutable (IMX) | Sep 19, 2024 | 34.19 million | $99 million | 2.4% |

| Optimism (OP) | Sep 29, 2024 | 24.16 million | $77 million | 2.4% |

These token unlocks will introduce a substantial amount of tokens into circulation, potentially impacting market prices and liquidity. For example, Aptos recently unlocked 11.31 million tokens, valued at approximately $68.99 million, representing 2.32% of its total supply.

Understanding the scale and timing of these unlocks is vital for market participants to anticipate potential shifts in trading volumes and market sentiment.

Token Unlock Mechanisms and Processes

Token unlocks are typically governed by vesting schedules, which are designed to prevent a sudden influx of tokens into the market, thereby minimizing potential market disruptions. Vesting schedules specify the conditions and timeframes for releasing tokens, ensuring that team members, investors, and other stakeholders receive their allocations gradually. This mechanism helps prevent market manipulation by avoiding large-scale sell-offs that could lead to significant price volatility.

In many cases, projects employ lock-up periods during which tokens cannot be transferred or sold. Once this period ends, the tokens are released incrementally according to a predetermined schedule. Some projects utilize smart contracts to automate the unlocking process, ensuring transparency and compliance with the project’s tokenomics model. By employing these mechanisms, projects aim to maintain market stability and support long-term growth.

Historical Market Responses to Token Unlocks

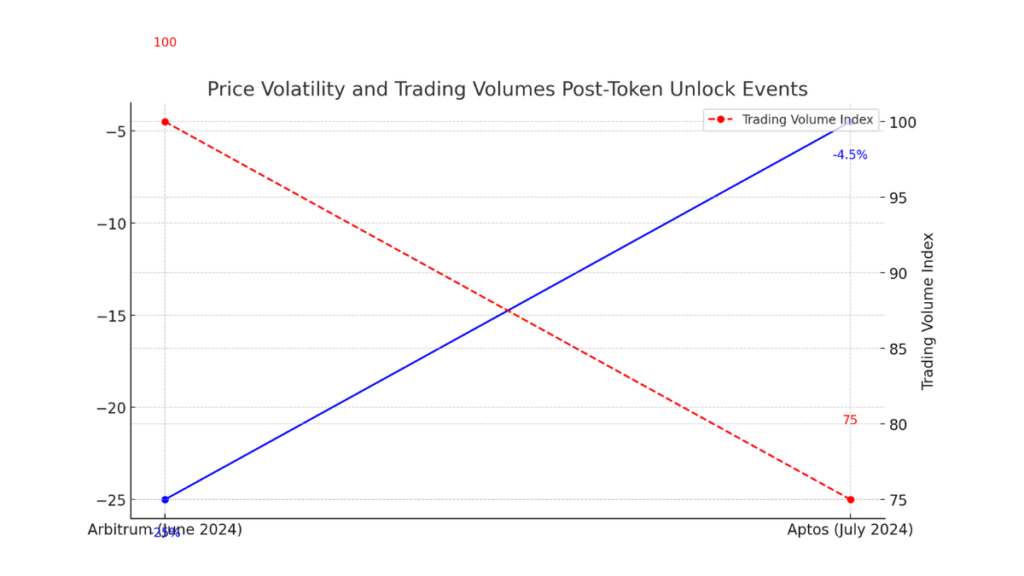

Historical market responses to token unlock events provide valuable insights into how the market may react to upcoming unlocks. In the past, token unlocks have often led to short-term price volatility. For instance, the Aptos token unlock in July 2024 saw a 4.5% price dip followed by a subsequent recovery, demonstrating how the market can initially react negatively to the increased supply but may stabilize as the event is absorbed by market participants.

Similarly, Arbitrum’s unlock in July 2024 resulted in a 25% drop in price before recovering most of its losses. These examples indicate that while token unlocks can lead to immediate market shifts, the long-term impact often depends on the broader market conditions, investor sentiment, and the project’s ongoing developments. Observing these patterns can help traders and investors better understand the potential market dynamics during future unlock events.

Immediate Market Impacts of Token Unlocks

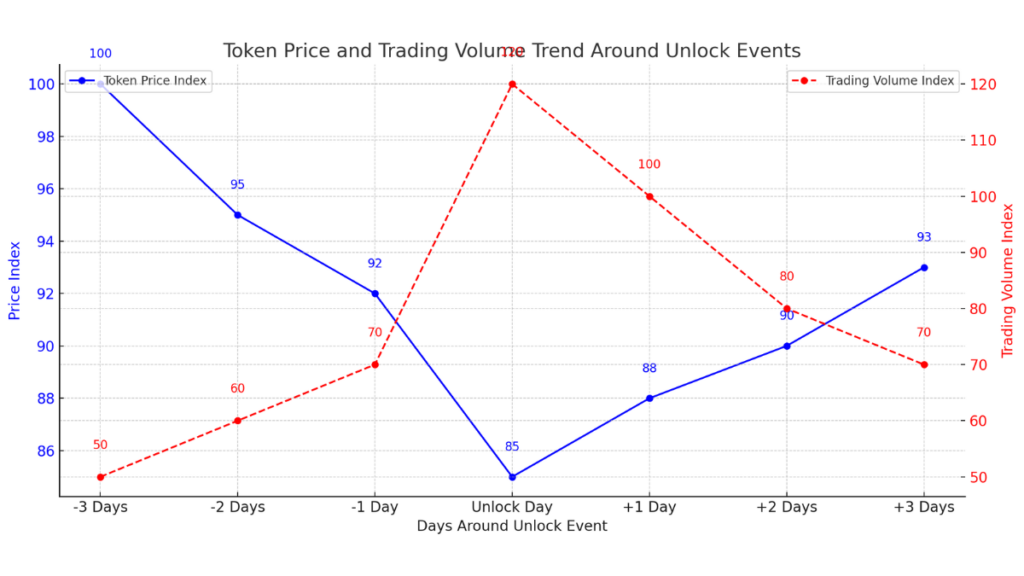

Token unlocks can significantly influence the cryptocurrency market, often leading to sudden changes in supply that affect token prices and trading volumes. These events can introduce volatility and alter market dynamics within a short period. This section analyzes the direct impacts observed during and immediately after token unlock events.

Price Volatility Post-Unlock Events

Token unlocks often lead to price volatility due to the sudden increase in the circulating supply. When a large number of tokens are released into the market, selling pressure can intensify, leading to short-term price dips. A notable example is the Arbitrum token unlock in June 2024, where the release of 24.2 million OP tokens, representing 3.75% of the circulating supply, led to a 25% decline in the token’s price before a gradual recovery. Similarly, Aptos experienced a 4.5% dip post-unlock in July 2024 when 4.54 million tokens were introduced into the market.

Such fluctuations occur because investors often anticipate these events, and some may sell their holdings in anticipation of a price drop, creating a self-fulfilling prophecy. Moreover, if a substantial number of tokens are unlocked and sold by early investors or team members, it can lead to increased downward pressure on prices. However, the market sometimes absorbs the unlocks with minimal disruption, especially if the event has been well-communicated and market participants are prepared.

Liquidity Fluctuations and Trading Volumes

Token unlocks can also result in notable changes in market liquidity and trading volumes. When a large volume of tokens is released into circulation, the market depth can be affected as the order books adjust to the influx of newly available tokens. This increased supply can lead to higher trading volumes as market participants adjust their positions. For instance, following the token unlock events of Arbitrum and Aptos, trading volumes surged as traders sought to capitalize on the price movements, either through speculative trading or by adjusting their portfolios to accommodate the increased supply.

Liquidity fluctuations during token unlocks can influence market depth and order book dynamics. In some cases, the added liquidity can improve market depth, making it easier for traders to execute large orders without significantly impacting the price. However, if a substantial amount of tokens is sold immediately post-unlock, it can create a temporary imbalance between buy and sell orders, leading to slippage and wider bid-ask spreads. This volatility in liquidity is crucial for traders and investors to monitor closely during and after token unlocks.

Market Sentiment and Token Unlocks

Market sentiment often plays a critical role in how token unlock events impact prices and trading volumes. Leading up to a significant unlock, investor sentiment can shift as the market anticipates the potential implications of the event. For instance, if the community perceives the unlock as a sign of project growth and development, the impact on prices may be muted. Conversely, if the event is seen as an opportunity for early investors or team members to exit, it can lead to negative sentiment and increased selling pressure.

To gauge market sentiment around token unlocks, it is essential to monitor various indicators, such as social media trends, trading volumes, and market sentiment indices. A spike in discussions on platforms like Twitter and Reddit, particularly concerning upcoming unlocks, can often signal a heightened state of alertness among traders. Changes in trading behavior, such as increased short selling or the use of derivatives to hedge against potential price drops, can also reflect shifts in market sentiment.

Checklist for Monitoring Market Sentiment:

- Monitor market sentiment indicators pre- and post-unlock.

- Analyze social media trends and discussions around major unlock events.

- Observe changes in trading behavior and volume spikes.

Note

Understanding how market sentiment reacts to token unlocks can provide insights into potential market dynamics. By closely monitoring these indicators, traders and investors can better prepare for the potential impacts on prices, liquidity, and overall market conditions.

Real-Time Tracking of Token Unlocks

Real-time tracking of token unlocks is essential for traders and investors to stay ahead of potential market movements. By monitoring these events, market participants can make informed decisions, manage risk, and identify trading opportunities. This section explores various tools and strategies to help you stay informed about upcoming token unlocks.

Using Token Unlock Trackers

Token unlock trackers are specialized tools designed to provide real-time updates and detailed information on upcoming token unlock events. They offer insights into token unlock schedules, the amount of tokens to be released, and the potential market impact. Here are some of the most popular token unlock tracking platforms:

| Tracker Name | Features | Real-Time Alerts | Coverage | Cost |

|---|---|---|---|---|

| TokenUnlocks.app | Detailed schedules, market impact analysis | Yes | Major projects and upcoming unlocks | Free |

| CoinGecko | Tokenomics data, token supply changes | No | Broad market coverage | Free |

| Dune Analytics | Customizable dashboards, on-chain data | No | User-created dashboards | Free/Paid |

| Messari | In-depth market analysis, research reports | Yes | Extensive coverage of crypto markets | Paid |

| Nansen | On-chain analytics, smart alerts | Yes | Major token unlocks, whale movements | Paid |

- TokenUnlocks.app: One of the most comprehensive platforms for tracking token unlocks. It offers detailed schedules of upcoming unlock events and provides insights into the potential market impact. The platform also allows users to set real-time alerts for specific token unlocks, enabling them to react promptly to market changes.

- CoinGecko: While primarily known as a price-tracking platform, CoinGecko also provides data on tokenomics, including circulating and total supply changes. It can be a valuable resource for monitoring the broader market and identifying upcoming unlock events.

- Dune Analytics: A customizable on-chain data analytics platform where users can create their dashboards to track specific token unlock events. While it does not provide real-time alerts, the platform’s flexibility allows users to build tailored solutions for tracking token distributions.

- Messari: Offers in-depth research reports and market analysis, including information on upcoming token unlocks. The platform provides real-time alerts for its subscribers, making it a valuable tool for professional traders and institutional investors.

- Nansen: An on-chain analytics platform that offers smart alerts and deep insights into token movements. Nansen can track whale activities and major token unlocks, providing real-time alerts to help traders and investors stay informed about market developments.

Integrating Unlock Data into Trading Strategies

Incorporating token unlock data into trading strategies can help traders anticipate market movements and manage risks effectively. Token unlocks can lead to increased market volatility, which presents both risks and opportunities for traders. Here are some ways to integrate unlock data into your trading strategies:

- Risk Management: By tracking upcoming token unlock events, traders can implement risk management strategies to protect their positions. For instance, they may choose to reduce exposure to a token that is set to undergo a significant unlock, thereby mitigating potential losses from increased selling pressure.

- Market Timing: Token unlock events can provide opportunities for market timing. Traders can monitor the market response to unlock events and identify potential entry and exit points. For example, if a token is expected to face short-term selling pressure post-unlock, traders might wait for the price to stabilize before entering a long position.

- Short-Term Trading Opportunities: Token unlocks often result in increased trading volumes and volatility, creating opportunities for short-term trades. Day traders and scalpers can take advantage of price fluctuations immediately following unlock events to capture quick profits. However, it is crucial to set strict stop-losses to manage risk in these high-volatility environments.

- Hedging Strategies: Advanced traders can use derivatives and options to hedge against potential price declines due to token unlocks. By opening short positions or purchasing put options, traders can protect their portfolios from adverse market movements.

- Long-Term Considerations: While short-term traders focus on immediate market impacts, long-term investors may use token unlock data to assess the project’s health and long-term viability. Understanding the distribution and unlock schedules can help investors gauge the token’s future supply dynamics and potential dilution.

Checklist for Integrating Unlock Data into Trading Strategies:

- Monitor real-time alerts from token unlock trackers.

- Adjust portfolio exposure based on upcoming unlock events.

- Identify potential entry and exit points by analyzing market responses.

- Implement stop-loss orders to manage risk in volatile markets.

- Consider hedging strategies using derivatives and options.

Key Observations:

By leveraging real-time token unlock trackers and integrating unlock data into their trading strategies, market participants can enhance their decision-making process and navigate the complex crypto market more effectively.

Market Reactions to Major Token Unlocks

Understanding market reactions to major token unlock events is crucial for anticipating potential outcomes of future unlocks. Historically, these events have led to various market dynamics, including price shifts, changes in trading volumes, and liquidity fluctuations. Analyzing past token unlocks can offer valuable insights into how the market might respond to similar events in the future.

Case Studies of Recent Token Unlocks

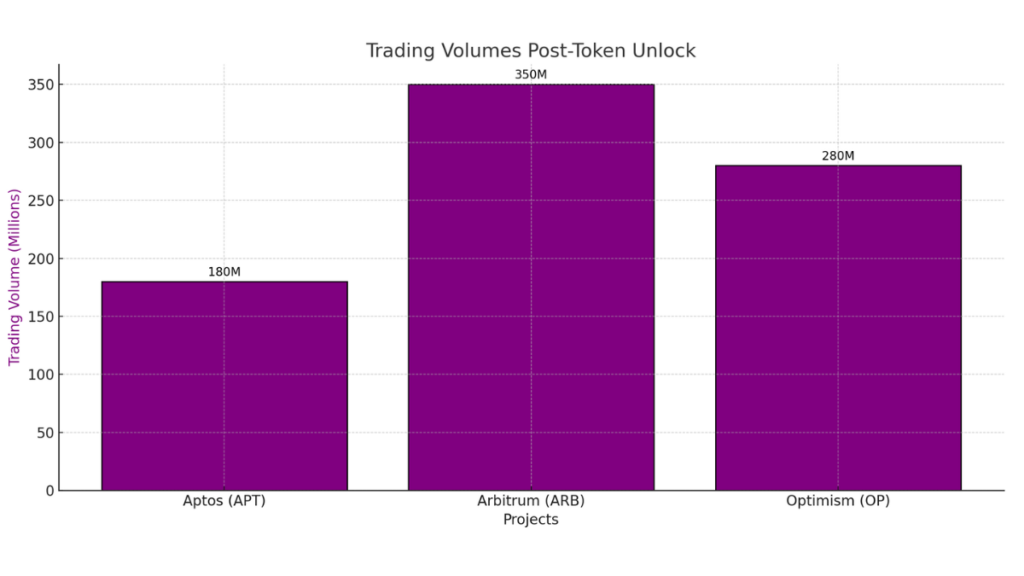

Token unlocks from projects like Aptos, Arbitrum, and Optimism have provided significant insights into market reactions. Each of these projects experienced different market dynamics following their unlocks, shaped by factors such as market conditions, investor sentiment, and the specific circumstances surrounding the unlock events.

- Aptos: On September 11, 2024, Aptos underwent a significant token unlock, releasing 11.31 million APT tokens, which represented 2.32% of the total supply and was valued at approximately $68.99 million. Despite concerns about potential selling pressure, the token price remained relatively stable, with a modest 1.77% decrease post-unlock. The market’s muted response indicated that the event had been well-anticipated and priced in, aided by transparent communication from the Aptos team about the unlock schedule. Furthermore, Aptos’ total market capitalization continued to hold strong, supported by its robust ecosystem growth and investor confidence.

- Arbitrum: In July 2024, Arbitrum released 24.2 million OP tokens, accounting for 3.75% of its circulating supply. This led to a 25% drop in the token’s price shortly after the unlock. The significant price volatility indicated a more immediate and intense market reaction to the influx of tokens. However, the token later recovered most of its losses, suggesting that while unlock events can trigger short-term volatility, the long-term impact often depends on how the market absorbs the increased supply.

- Optimism: Similarly, Optimism’s token unlock in July 2024 saw the release of a large number of tokens into the market, resulting in a notable price drop. The market responded with increased trading volumes as participants adjusted their positions. Despite the initial negative price impact, the market eventually stabilized, with the token recovering some of its lost value. These case studies highlight that while token unlocks can lead to immediate liquidity changes and price shifts, the overall market reaction is influenced by various factors, including the project’s fundamentals, market sentiment, and the unlock schedule’s transparency.

Analyzing Price and Liquidity Trends Post-Unlock

The immediate aftermath of token unlock events often features heightened price volatility and changes in liquidity. By analyzing data from key token unlocks, we can identify patterns in how these events impact the market. Below is a table summarizing price and liquidity trends post-unlock for recent significant unlocks:

| Project Name | Pre-Unlock Price | Post-Unlock Price | Price Change (%) | Liquidity Change | Trading Volume (24h) |

|---|---|---|---|---|---|

| Aptos (APT) | $6.22 | $6.10 | -1.77% | Stable | $180M |

| Arbitrum (ARB) | $2.10 | $1.58 | -25% | Decreased | $350M |

| Optimism (OP) | $1.35 | $1.00 | -26% | Decreased | $280M |

- Price Changes: As illustrated in the table, major token unlocks typically result in immediate price decreases due to increased token supply and selling pressure. For instance, Arbitrum’s price fell by 25% post-unlock, while Optimism experienced a 26% decline. However, the extent of the price change can vary based on the market’s preparedness and the project’s overall health.

- Liquidity Changes: Token unlocks can also cause shifts in liquidity. In some cases, such as Aptos, liquidity remained relatively stable, indicating that the market had adequately prepared for the unlock event. In contrast, projects like Arbitrum and Optimism saw decreased liquidity, reflecting increased sell-offs and market uncertainty.

- Trading Volumes: Trading volumes often surge immediately following a token unlock as market participants react to the newly available tokens. High trading volumes can lead to heightened volatility, as seen with Arbitrum’s $350 million trading volume within 24 hours post-unlock. This surge can be attributed to speculative trading, portfolio adjustments, and profit-taking strategies.

Understanding these trends can help traders and investors anticipate potential market dynamics during future token unlock events. While immediate market reactions may vary, long-term impacts are often moderated by broader market conditions, project fundamentals, and investor sentiment.

Suggested articles for you

- Current Bitcoin Price Trends

- Analysis of Market Trends Post-Fed Meetings

- arket Effects of DeFi TVL Decline

- Tokenomics of Ethereum Post-Merge

- Impact of CPI on Crypto Sentiment

Token unlocks play a critical role in shaping the dynamics of the cryptocurrency market. Their impact on price volatility, liquidity, and trading volumes can offer significant insights for traders, investors, and project stakeholders. As seen in recent events like those involving Aptos, Arbitrum, and Optimism, these events can lead to immediate market fluctuations, with their long-term effects varying based on factors like market preparedness, project fundamentals, and investor sentiment.

Staying informed about upcoming token unlocks and understanding how to track these events in real-time can provide a strategic advantage. It allows market participants to anticipate changes, manage risk effectively, and capitalize on trading opportunities. While token unlocks can present challenges, they also serve as opportunities for traders and investors who are well-prepared and informed.

By leveraging tools and strategies for tracking token unlock events, along with analyzing historical market reactions, participants can navigate the complexities of the crypto market with greater confidence.