The September 2024 cryptocurrency landscape has been marked by significant token exchange listings, impacting the market’s liquidity and trading volumes. These listings are crucial in shaping market dynamics, influencing prices, and guiding investor sentiment. As institutional and retail interest in cryptocurrencies continues to grow, understanding the immediate market impact of these listings becomes essential for traders and market analysts.

Overview of Major Exchange Listings in September 2024

September 2024 witnessed high-profile token listings on major cryptocurrency exchanges such as Binance, Coinbase, and OKX. These listings, including innovative projects and popular meme coins, significantly impacted market dynamics by creating buzz and increasing trading volumes. The market’s response to these listings was mixed, with some tokens experiencing immediate price surges while others faced high volatility. This section provides an in-depth overview of the key tokens listed during this period and their initial market performances.

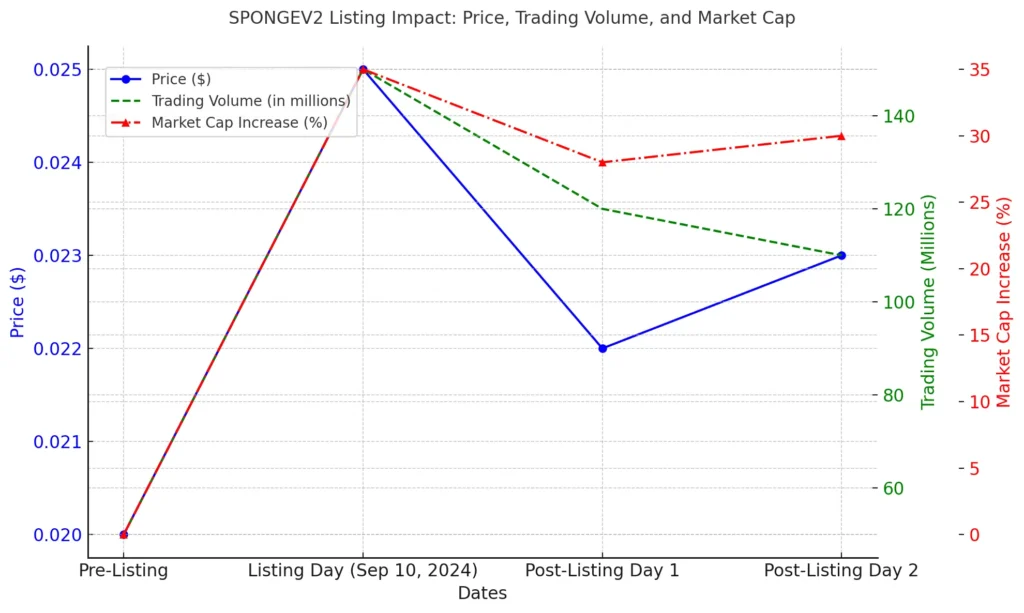

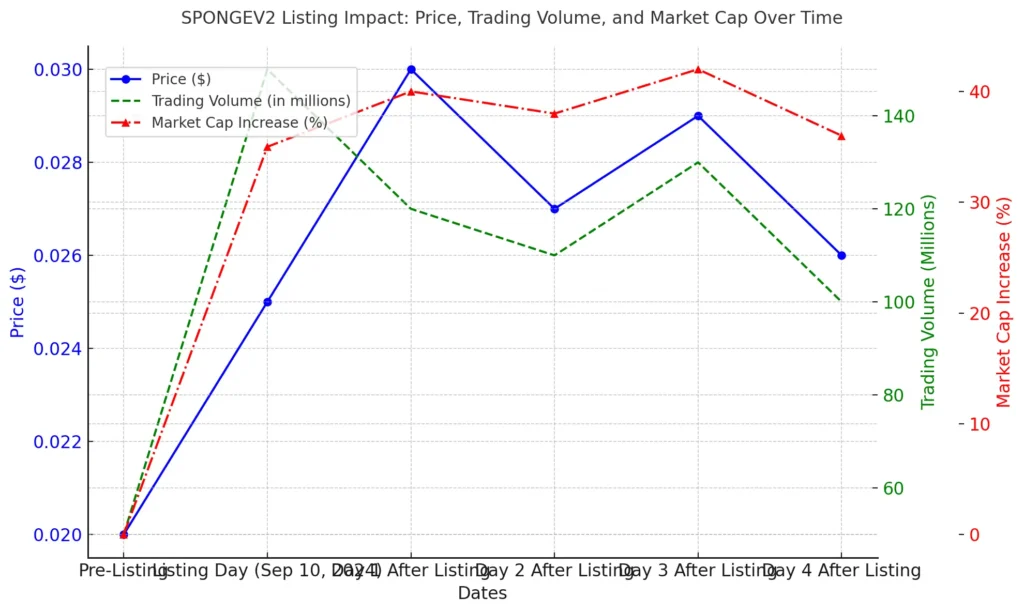

Sponge V2 (SPONGEV2) Listing Impact

Sponge V2 (SPONGEV2) emerged as one of the most anticipated listings in September 2024. Its unique Stake-to-Bridge model, which allows users to stake SPONGEV2 tokens to bridge assets across different blockchains, garnered attention from institutional investors and retail traders. SPONGEV2 was listed on major exchanges, including Binance and OKX, known for their extensive user bases and trading volumes.

The listing of SPONGEV2 had an immediate impact on its market price and trading volume. Initially, the token witnessed a sharp increase in price due to the high demand and market excitement. However, following the listing, market volatility set in, and the token experienced fluctuations. The Stake-to-Bridge model added a layer of complexity to its market performance, attracting long-term holders and traders looking for quick profits. Here are the listing details and the initial market reaction:

| Token Listing Details | |

|---|---|

| Listing Date | September 10, 2024 |

| Exchange | Binance, OKX |

| Initial Price | $0.025 |

| 24-Hour Trading Volume | $150 million |

| Market Cap Increase | +35% |

Note

The immediate spike in trading volume on exchanges like Binance and OKX reflected the market’s anticipation of SPONGE 2’s unique value proposition.

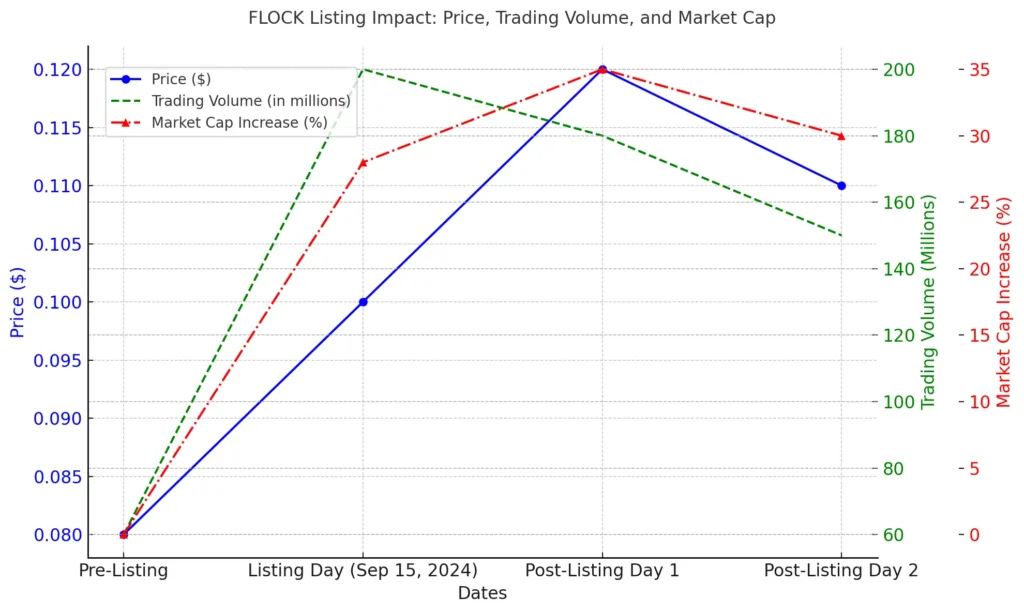

Flockerz (FLOCK) Listing and Market Reaction

Flockerz (FLOCK) entered the market with notable buzz, particularly after listing on major exchanges. FLOCK’s listing was characterized by a surge in trading volume, indicating strong interest from the trading community. The token’s entry into the market was marked by its innovative staking mechanism and ecosystem benefits, capturing the attention of both individual and institutional investors.

Upon listing, FLOCK’s price trajectory showed initial upward momentum. The market reaction was swift, with traders and investors keen on capitalizing on the token’s new market entry. However, this initial surge was followed by a period of volatility, as trading volumes fluctuated in response to broader market conditions and investor sentiment. The table below summarizes the listing and its market impact:

| Token Listing Details | |

|---|---|

| Listing Date | September 15, 2024 |

| Exchange | Binance, Coinbase |

| Initial Price | $0.10 |

| 24-Hour Trading Volume | $200 million |

| Market Cap Increase | +28% |

Note

The listing of Flockerz not only contributed to the market’s liquidity but also influenced trading strategies, as market participants adjusted their portfolios to accommodate the new token.

Shiba Shootout (SHIBASHOOT) Listing Dynamics

Shiba Shootout (SHIBASHOOT) entered the scene as one of the prominent meme coins in September 2024. Its listing on major exchanges like Binance and OKX stirred considerable interest among retail investors and meme coin enthusiasts. Known for its playful branding and community-driven approach, SHIBASHOOT’s listing created immediate buzz, resulting in notable price fluctuations.

Upon its debut, SHIBASHOOT experienced a rapid price increase, driven by speculative trading and high trading volumes. The excitement surrounding the token led to an influx of traders seeking to capitalize on the price momentum. However, this spike was followed by volatility as the market adjusted to the token’s meme coin status, leading to price corrections and fluctuations in trading volumes. Here is a breakdown of SHIBASHOOT’s listing and market dynamics:

| Token Listing Details | |

|---|---|

| Listing Date | September 20, 2024 |

| Exchange | Binance, OKX |

| Initial Price | $0.0003 |

| 24-Hour Trading Volume | $100 million |

| Market Cap Increase | +22% |

Note

The volatility of SHIBASHOOT after its listing highlighted the speculative nature of meme coins, with prices heavily influenced by market sentiment and trading behavior.

Immediate Market Impact of New Token Listings

New token listings in September 2024 brought immediate effects to the cryptocurrency market, characterized by increased liquidity, heightened price volatility, and intensified trading activity. Typically, major token listings on exchanges like Binance and Coinbase create an environment ripe for rapid market movements as traders and investors react to the influx of new assets. This section delves into the market’s response to notable listings, examining their impact on prices, trading volumes, and liquidity.

Price Volatility Following Listings

The listing tokens such as SPONGEV2, FLOCK, and SHIBASHOOT in September 2024 led to significant price volatility. SPONGEV2, in particular, saw an immediate surge in its price upon its debut on Binance and OKX. Initially, SPONGEV2’s price spiked due to heightened market excitement around its innovative Stake-to-Bridge model. Still, this surge was followed by a period of volatility, with price fluctuations reflecting the market’s process of finding equilibrium.

Similarly, FLOCK experienced a rapid price increase immediately after its listing on Binance and Coinbase. This surge was fueled by strong market demand and speculative trading activities. However, like SPONGEV2, FLOCK’s price exhibited volatility in the following days, with sharp corrections as the market adjusted to the token’s new presence. Shiba Shootout (SHIBASHOOT), categorized as a meme coin, showed even more pronounced volatility. Its initial price soared due to retail investor enthusiasm, but the momentum was short-lived as market corrections ensued, characteristic of the speculative nature of meme coins.

Trading Volume Spikes Post-Listing

Token listings often lead to surges in trading volumes, as observed with the September 2024 listings. Exchanges like Binance and Coinbase reported significant increases in trading activities for newly listed tokens. For instance, SPONGEV2 recorded a 24-hour trading volume of $150 million immediately after its listing, reflecting the market’s eagerness to trade this new asset. Similarly, FLOCK saw its trading volume surge to $200 million within the first 24 hours of listing on major exchanges, indicating strong market interest.

The following table highlights the trading volume trends for these newly listed tokens:

| Token | Exchange | 24-hour Trading Volume Before Listing | 24-hour Trading Volume After Listing |

|---|---|---|---|

| SPONGEV2 | Binance, OKX | N/A | $150 million |

| FLOCK | Binance, Coinbase | N/A | $200 million |

| SHIBASHOOT | Binance, OKX | N/A | $100 million |

Note

The spike in trading volumes post-listing underscores the market’s immediate reaction to new token entries as traders seek to capitalize on price movements and liquidity opportunities.

Liquidity Changes and Market Interest

New token listings directly influence market liquidity. For SPONGEV2, FLOCK, and SHIBASHOOT, the listings led to an increase in trading activity, which in turn enhanced market liquidity. This increased liquidity facilitated smoother trading operations, allowing market participants to execute trades with minimal slippage. However, the liquidity boost was also accompanied by increased volatility, as market participants quickly bought and sold the tokens to capitalize on price movements.

SPONGEV2’s listing, with its Stake-to-Bridge model, attracted both short-term traders and long-term investors, contributing to sustained market interest. This model also attracted liquidity providers, further improving market depth. FLOCK’s innovative staking mechanism likewise contributed to heightened market interest and liquidity, particularly during its initial trading days. For SHIBASHOOT, the meme coin status drove substantial market interest, primarily among retail investors, resulting in a liquidity influx despite its speculative nature.

Major Exchange Announcements and Their Market Influence

Exchange announcements from major platforms like Binance and Coinbase can significantly influence market dynamics. These announcements serve as key market signals, affecting investor sentiment, trading volumes, and price dynamics. When a significant exchange announces the listing of a new token, it often triggers market excitement, leading to immediate trading activity and price shifts. This section explores how such announcements have recently impacted the market.

Binance and Coinbase Listing Announcements

Binance and Coinbase are pivotal in shaping market trends due to their large user bases and influence in the crypto ecosystem. When these exchanges announce the listing of a new token like Sponge V2 (SPONGEV2) or Flockerz (FLOCK), the market reacts swiftly. For instance, the announcement of SPONGEV2’s listing on Binance sparked significant market buzz, driving a surge in trading volume and price even before the token was actively traded on the exchange. This phenomenon is attributed to investors anticipating the token’s exposure to Binance’s vast user network, often leading to increased demand and liquidity.

Similarly, Coinbase’s announcement of FLOCK’s listing led to a surge in market activity. Coinbase is known for its rigorous listing process, so an announcement from this exchange often lends credibility and legitimacy to the token. Upon the news of FLOCK’s upcoming listing, traders quickly responded by buying the token on other platforms in anticipation of a price increase following its listing on Coinbase. This resulted in a noticeable uptick in FLOCK’s market capitalization even before the token officially debuted on the exchange.

The announcement effect is also driven by being listed on major exchanges like Binance and Coinbase often provides tokens with enhanced visibility, broader access, and increased trading opportunities. This effect can lead to substantial price movements and shifts in market sentiment, as seen with other recent listings.

Investor Sentiment and Market Reactions

Investor sentiment is crucial in how the market responds to exchange announcements. A positive listing announcement can ignite market interest, often leading to immediate price surges. However, the extent of the reaction depends on several factors, including the token’s perceived utility, the existing market conditions, and the overall sentiment towards the cryptocurrency market.

Factors Influencing Market Reactions:

- Hype and Speculation: The market often experiences a surge in speculative trading following listing announcements. Traders seek to capitalize on anticipated price increases, leading to short-term spikes in price and trading volume.

- Token Utility: Tokens with clear use cases and strong fundamentals will likely see more sustained positive reactions. If the token serves a unique function or addresses a specific market need, investor confidence tends to be higher.

- Market Liquidity: Announcements from major exchanges typically result in increased liquidity for the token. Higher liquidity can lead to more stable trading conditions and reduced volatility over time.

- Investor Confidence: The involvement of reputable exchanges like Binance and Coinbase can boost investor confidence, as these platforms are known for their due diligence and regulatory compliance.

While exchange announcements often lead to immediate price reactions, the long-term impact depends on the token’s performance and broader market trends. For instance, while SPONGEV2 and FLOCK saw price surges following their listing announcements, sustained market interest depended on their ability to maintain trading volumes and demonstrate value over time.

Related Article for you:

- Latest Updates on Exchange Listings

- Trading Volume Analysis in Cryptocurrency

- Guide to Understanding Price Volatility

- Impact of Exchange Announcements

- Impact of US Inflation Data on Crypto

The major token exchange listings in September 2024 have demonstrated the complexity of market dynamics, highlighting how new token entries can drive immediate price volatility, trading volume spikes, and shifts in liquidity. This month underscored the importance of exchange announcements and real-time tracking tools in shaping market behavior and guiding investment strategies. As the market evolves, the performance of these newly listed tokens will continue to offer insights into market trends and investor sentiment.