The presidential debate between Kamala Harris and Donald Trump had a significant impact on cryptocurrency markets. Historically, political events like debates have influenced investor sentiment, causing price volatility in risk-sensitive assets such as Bitcoin and Ethereum. This debate was no different, with key moments causing notable fluctuations in cryptocurrency prices. Understanding these market reactions is crucial for traders, investors, and analysts monitoring the intersection of politics and finance. Both Bitcoin and other altcoins responded dynamically to the debate, reflecting broader market uncertainty.

Immediate Market Reactions Post-Debate

As political uncertainty increased, traders and investors reacted quickly, triggering price fluctuations across the board. The market response highlights the sensitivity of crypto assets to political events, especially in a closely contested election like this one.

Bitcoin Price Fluctuations

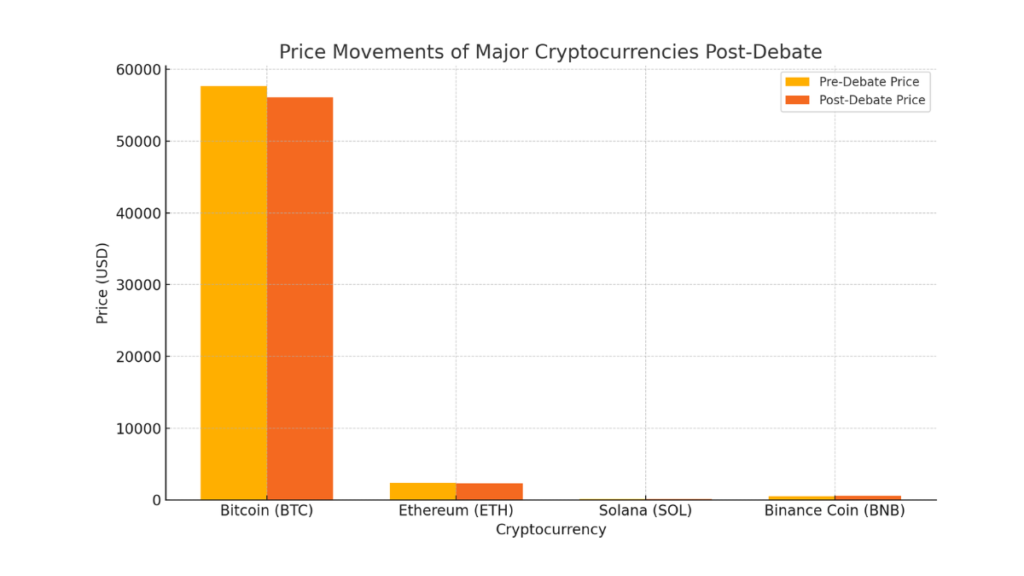

Following the debate, Bitcoin experienced a sharp dip. Initially trading around $57,650 before the event, the price dropped to $56,130 shortly after, marking a decline of approximately 2.5%. This downward movement was largely attributed to market uncertainties triggered by the debate, especially as traders weighed the impact of key moments on future economic policies. Although neither candidate directly addressed cryptocurrency, Bitcoin’s decline reflected the broader uncertainty surrounding regulatory approaches from both candidates.

- Pre-debate price: $57,650

- Post-debate price: $56,130 (2.5% decrease)

- Factors: General market uncertainty, potential policy shifts

- Sentiment: Traders reacted cautiously, with Bitcoin showing sensitivity to broader political tensions.

Altcoin Market Movements

The debate also impacted altcoins, although the reactions varied. Ethereum saw a decline of about 1.1%, trading at around $2,326 after the debate. Other altcoins like Solana and Cardano similarly experienced dips, with Solana dropping by 2.4%. In contrast, Binance Coin (BNB) rebounded slightly, recovering by 6.7%, as traders saw potential in altcoins amid the overall uncertainty. The comparative table below highlights the price movements of major altcoins in response to the debate.

| Cryptocurrency | Pre-Debate Price | Post-Debate Price | Percentage Change |

|---|---|---|---|

| Bitcoin (BTC) | $57,650 | $56,130 | -2.5% |

| Ethereum (ETH) | $2,350 | $2,326 | -1.1% |

| Solana (SOL) | $131 | $128 | -2.4% |

| Binance Coin (BNB) | $510 | $543 | +6.7% |

This table illustrates the varied reactions across the altcoin market, emphasizing how different coins respond to political tensions.

- Best for comparing the pre-debate and post-debate prices of individual cryptocurrencies side by side.

- Could also be used to show trends over time, but for this specific comparison, the bar chart is more effective.

Investor Sentiment and Trading Volume Shifts

The presidential debate had a notable effect on investor sentiment and cryptocurrency trading volumes. As the debate unfolded, political uncertainty caused fluctuations in speculative assets like meme coins. The overall market reacted cautiously, with traders making swift moves based on perceived candidate performance and election odds.

Shift in Investor Sentiment

During the debate, investor sentiment became increasingly cautious. Despite Donald Trump’s previously stated pro-crypto stance, his performance did not significantly boost market confidence. In fact, his debate performance seemed to create uncertainty, causing a dip in crypto prices, particularly in politically linked assets. On platforms like Polymarket, Trump’s odds of winning dropped by 3%, while Harris’s chances rose. This shift impacted crypto traders, with many investors pulling back from risky bets until more clarity emerged regarding future policies.

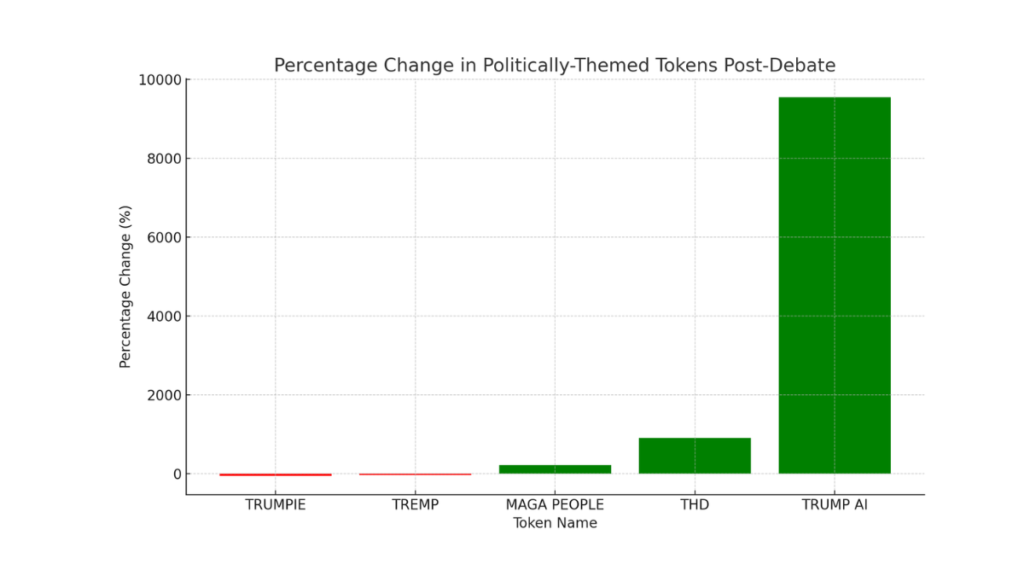

For instance, meme coins related to Trump, such as TRUMPIE and TREMP, saw sharp declines. TRUMPIE dropped by 47%, and similar assets lost between 25% and 50% of their value. This was largely attributed to shifts in the betting markets that mirrored changes in political sentiment.

Increase in Trading Volumes for Politically-Themed Tokens

Politically-themed tokens saw a surge in trading volume both during and after the debate. For example, the Trump Harris Debate (THD) token skyrocketed by 911% in just 24 hours. Other meme coins tied to political narratives, like TRUMP AI and MAGA PEOPLE, experienced significant, albeit short-lived, gains of over 900%. These spikes highlight how traders speculated on the debate’s outcome, treating these meme coins as short-term bets on political developments.

However, as with most speculative assets, these tokens quickly lost value once the initial debate-driven excitement faded. This volatility, especially in politically-themed tokens, underscores the risks associated with investing in assets tied to fleeting political events.

- Ideal for comparing percentage changes in multiple tokens.

- Another option if tracking changes over time rather than comparing different tokens.

Potential Long-Term Impacts on the Crypto Market

The 2024 presidential debate could influence cryptocurrency regulations, shaping the market’s future depending on policy outcomes.

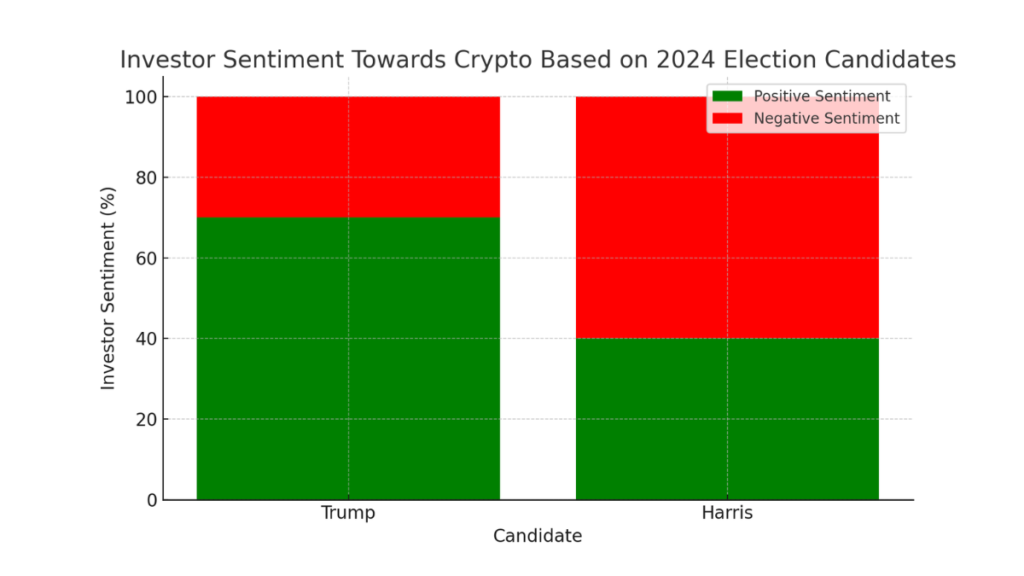

- Useful to compare positive and negative sentiment side by side for both candidates.

- Could also be used to show sentiment distribution for each candidate individually.

Regulatory Outlook Based on Debate Insights

Though cryptocurrency wasn’t a major discussion point in the debate, the candidates’ broader policies could have significant regulatory consequences. Donald Trump has pivoted to a pro-crypto stance, promising to support Bitcoin mining and eliminate regulations that hinder crypto growth. He has also vowed to dismiss SEC Chair Gary Gensler, who has taken a strict stance on crypto enforcement, signaling a possible relaxation of crypto regulations under a Trump presidency.

Kamala Harris, on the other hand, has been largely silent on crypto-specific policies. While her campaign has indicated a general support for emerging technologies, the lack of detail leaves uncertainty about how a Harris administration might approach crypto regulation. This uncertainty fuels concerns that her administration could continue or even strengthen the current regulatory stance established under the Biden administration.

Expected Market Trends Leading to Election Day

As the U.S. election approaches, crypto markets are expected to remain volatile. Investor sentiment tends to fluctuate with shifts in political odds, and many anticipate that clearer policy stances from both candidates could shape market trends. Trump’s pro-crypto stance might lead to market optimism, especially among Bitcoin investors, with potential rallies if he gains ground in the polls. Conversely, the lack of clarity from Harris leaves room for speculation, with some investors pulling back until more definitive policies are outlined.

Both candidates have the potential to drive significant movements in the crypto market, but the outcome of the election will be critical in determining whether the regulatory environment becomes more favorable or remains stringent.

Comparative Analysis with Previous Presidential Debates

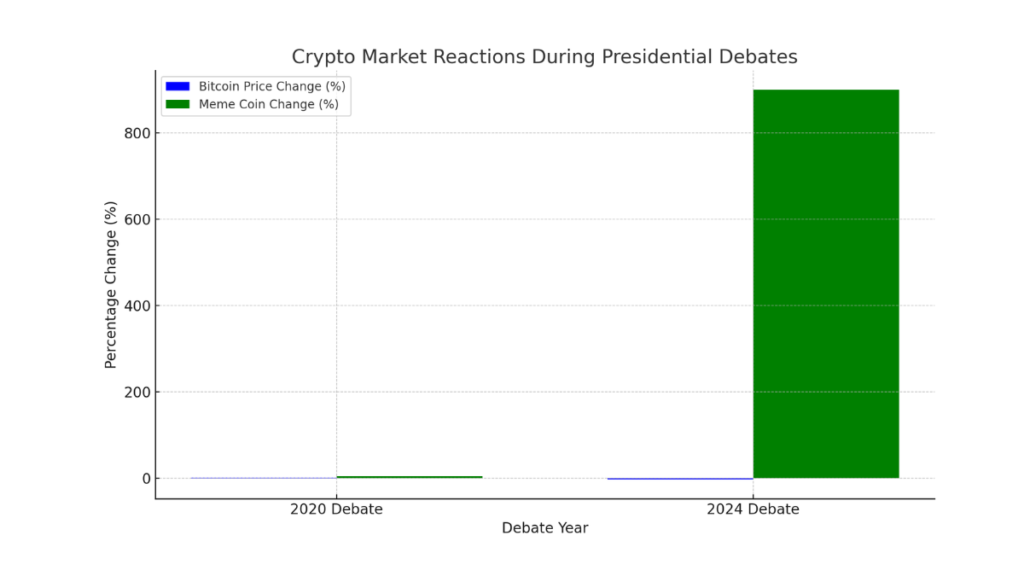

The response of cryptocurrency markets to presidential debates is not new, and comparing past debates with the 2024 election reveals interesting patterns. Both the 2020 and 2024 debates between candidates like Donald Trump and Joe Biden, or Kamala Harris, have shown that political uncertainty plays a significant role in shaping Bitcoin prices and investor sentiment.

Bitcoin’s Historical Price Movement During Political Events

Historically, Bitcoin has experienced price fluctuations during presidential debates. For example, during the 2020 Trump vs. Biden debate, Bitcoin’s price briefly jumped by around 1.1%, reaching $62,152, reflecting how quickly markets respond to political shifts. The price rise was linked to improved odds of a Trump victory on betting markets, signaling optimism among crypto investors regarding Trump’s crypto-friendly stance.

Fast forward to the 2024 debates, Bitcoin showed a different behavior. During the Trump-Harris debate in September 2024, Bitcoin initially dipped by 2.2%, as market participants were cautious about the regulatory uncertainty surrounding both candidates. While Trump has embraced a pro-crypto platform, promising favorable regulations and support for Bitcoin miners, Kamala Harris has remained largely silent on crypto, which has created concerns about increased regulatory scrutiny under her potential administration.

Political Debate Impact on Meme Coins and Altcoins

Meme coins and altcoins have also shown sensitivity to political debates. In 2020, Bitcoin wasn’t the only cryptocurrency influenced by political events. Meme coins and altcoins reacted to similar stimuli, particularly when debates had clear winners or when regulatory stances were mentioned.

In 2024, the trend continued but in a more exaggerated manner. Politically-themed meme coins like TRUMPIE and THD (Trump Harris Debate) experienced significant price volatility. For instance, the THD token surged by over 900% in 24 hours following the first debate, while other Trump-related meme coins saw drastic declines, sometimes falling by over 25%. These extreme fluctuations highlight the speculative nature of meme coins, driven by momentary political events and debate outcomes.

- This format clearly compares Bitcoin and meme coin price changes across two debates.

- Could be used for tracking changes over time during multiple debates.

Read More

- Political Uncertainty Impact on Bitcoin

- Investor Sentiment in Crypto Markets

- Bitcoin Market Dominance Trends

- Ethereum Market Performance

Broader Market Reactions: Stocks, Bonds, and Crypto Correlations

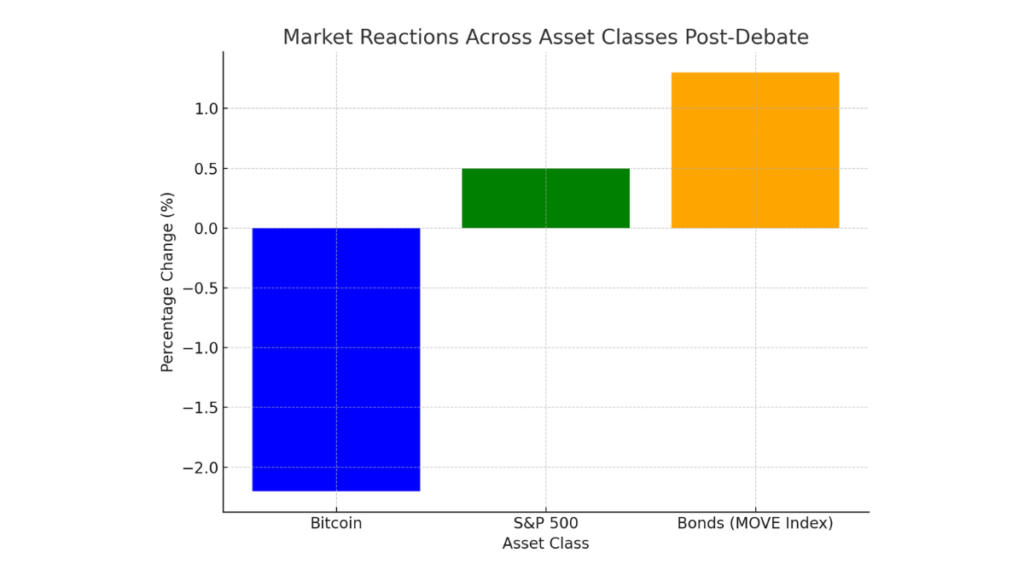

The September 2024 presidential debate between Donald Trump and Kamala Harris had notable effects on various asset classes, including stocks, bonds, and cryptocurrencies. As political uncertainty loomed, traders reacted by adjusting their positions across multiple markets, leading to increased volatility. This section explores how these different asset classes moved in response to the debate.

- Useful for comparing percentage changes across multiple asset classes.

- Could be used to show how these assets moved over time, especially during the debate.

Correlation Between Crypto and Equity Markets Post-Debate

Following the debate, there was a noticeable uptick in market volatility, especially in both the cryptocurrency and stock markets. Traditionally, crypto markets tend to move independently of equities, but during periods of political uncertainty, such as presidential debates, the correlation between these asset classes increases. In this case, both the S&P 500 and major cryptocurrencies like Bitcoin showed similar trends, with short-term drops reflecting heightened uncertainty. For example, Bitcoin saw a 2.2% dip following the debate, while major stock indices remained volatile, driven by traders reacting to potential shifts in political power.

Stocks and bonds exhibited mixed responses, with bond market volatility rising sharply as measured by the ICE BofAML MOVE Index. Meanwhile, equities initially saw selling pressure but remained relatively stable, indicating that investors might be waiting for more clarity on economic policy proposals before making large shifts.

Impact on Risk Sentiment Across Asset Classes

Risk sentiment across all asset classes was heavily influenced by the debate. Cryptocurrencies, known for their volatility, mirrored this with sharp reactions, particularly in meme coins and altcoins, which spiked due to speculative trading. On the other hand, stocks reacted more cautiously, with traditional investors seeking safer assets like bonds amid the political uncertainty. Treasury bonds, for example, saw increased volatility as traders sought to hedge against potential election-related risks.

Note

This broader market response underscores how debates and political events can affect investor sentiment across asset classes, prompting both speculative activity in riskier assets like crypto and a flight to safety in bonds.

As the political landscape continues to evolve, so too will the cryptocurrency market. The debate showcased the sensitivity of digital assets to political uncertainty, with immediate market responses reflecting broader concerns about regulatory clarity. The 2024 election may mark a turning point for crypto, depending on the eventual policies adopted by the next administration. Investors should stay informed and prepared for potential shifts in the regulatory environment.