The FATF crypto guidelines for 2024 highlight the importance of implementing Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) measures to maintain the integrity of the global crypto market. With the continuous rise in cryptocurrency usage, global crypto compliance is becoming essential to mitigate financial crime risks.

The FATF recommendations on crypto emphasize enhanced transparency, data-sharing mandates for Virtual Asset Service Providers (VASPs), and stricter monitoring measures to ensure that crypto transactions comply with international standards.

Overview of FATF’s AML and CTF Guidelines for Crypto Transactions

The FATF guidelines form the backbone of global efforts to combat money laundering and terrorist financing in the crypto sector. These guidelines are recommendations and international standards that member countries are encouraged to adopt. By focusing on robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) measures, FATF aims to ensure that cryptocurrency transactions are secure, transparent, and free from criminal exploitation. The application of these standards varies by jurisdiction but emphasizes stringent verification and monitoring protocols for Virtual Asset Service Providers (VASPs) across the board, ensuring a cohesive global approach to crypto regulation.

The FATF Travel Rule for VASPs

One of the most critical aspects of the FATF crypto guidelines is the Travel Rule, which is vital in increasing the transparency of crypto transactions. This rule mandates that VASPs (Virtual Asset Service Providers) must collect and share information about the originators and beneficiaries of transactions. Specifically, VASPs must exchange data, such as names, addresses, and account details, to ensure full crypto transaction transparency. This system enhances the traceability of funds, which is crucial in preventing their misuse for illicit activities like money laundering or terrorist financing.

Despite the Travel Rule’s clear objectives, there are notable implementation challenges, particularly around cross-border transactions. Many VASPs face difficulties aligning with differing national data privacy laws and technical requirements. Still, the FATF Travel Rule is seen as a critical component in ensuring the crypto ecosystem’s long-term compliance and security.

Note

- EU MiCA Crypto Regulation Framework

- Comprehensive Guide to FATF’s Crypto Travel Rule

- Top Crypto Compliance Tools

- Understanding AML Requirements for DeFi Platforms

- Crypto Risk Management Strategies

KYC and Transaction Monitoring Requirements

The Know Your Customer (KYC) protocol is another foundational aspect of the FATF’s AML guidelines. For crypto exchanges and VASPs, KYC means rigorously verifying customers’ identities before allowing them to transact. It’s designed to prevent anonymity in crypto trading, which can lead to misuse for illegal activities.

In addition to customer identification, the FATF crypto guidelines require continuous transaction monitoring to identify any suspicious activity or red flags. These red flags could include unusually large transactions, transfers to high-risk countries, or patterns that suggest criminal behavior. Crypto service providers can stay compliant with FATF’s strict AML standardsby employing real-time monitoring systems.

Checklist:

- Verify customer identity: Ensuring proper ID documentation and verifying against international databases.

- Monitor transactions for red flags: Keeping an eye on unusual transaction patterns.

- Report suspicious activities: Notify authorities of any potential risks or criminal behavior.

- Retain transaction records: Keep detailed logs for auditing purposes, as per regulatory requirements.

Note

holistic approach—combining KYC with transaction monitoring—creates a secure environment for crypto transactions, aligning with global compliance efforts

FATF’s Global Implementation of Crypto Standards

The FATF’s global standards for regulating virtual assets aim to bring consistent AML and CTF compliance across different countries. However, the pace of adoption varies significantly. While some countries proactively align their laws with FATF crypto guidelines, others lag, leaving gaps in global crypto oversight.

Japan, South Korea, and Singapore are at the forefront, having introduced comprehensive frameworks to govern virtual asset service providers (VASPs) by FATF’s recommendations. Meanwhile, nations with slower implementation risk falling under the FATF’s grey list, facing reputational damage and economic sanctions.

Leading Nations in FATF Crypto Compliance

Countries like Japan and South Korea have made significant strides in adopting FATF’s guidelines. Japan’s regulatory framework, for instance, goes beyond basic AML measures by integrating rules that ensure full crypto transparency and address potential loopholes in the virtual asset market. Japan’s Financial Services Agency (FSA) has implemented stringent requirements for crypto exchanges, including detailed reporting and customer verification, aligning closely with FATF recommendations.

Similarly, the EU has taken a proactive stance by introducing the Fifth Anti-Money Laundering Directive (AMLD5), which requires crypto exchanges and wallet providers to comply with robust Know Your Customer (KYC) and reporting standards. The directive mandates that crypto firms implement the same level of compliance as traditional financial institutions, thus tightening the reins on the potential misuse of cryptocurrencies for illegal purposes.

Note

South Korea, too, is a leader in crypto regulation, having implemented the Act on Reporting and Use of Specific Financial Transaction Information. This act mandates that all VASPs must comply with AML and CTF measures, reinforcing crypto transaction transparency.

FATF’s Grey List and Its Impact on Non-Compliant Countries

Countries that fail to meet FATF’s AML and CTF standards face serious consequences, one of which is being placed on the FATF grey list. Being on this list signals to the global financial community that a country poses a high risk of supporting financial crimes, making it harder for these nations to conduct international transactions. Nations such as Iran and North Korea have already been placed on the FATF’s grey list due to concerns about their insufficient AML/CTF measures, particularly in regard to cryptocurrencies.

Countries at risk of grey listing face several challenges:

- Reduced foreign investments due to reputational damage.

- Higher costs for international financial transactions, as banks may impose stricter due diligence requirements.

- Economic sanctions that can isolate them from the global financial system.

Comparative Table: FATF-Compliant vs. Grey-Listed Countries

| Country | Compliance Status | Compliance Strategies | Consequences of Non-Compliance |

|---|---|---|---|

| Japan | Fully Compliant | Implemented strong KYC, transaction monitoring, and reporting protocols. | N/A |

| South Korea | Fully Compliant | Enforced regulations requiring VASPs to adhere to FATF guidelines. | N/A |

| EU | Largely Compliant | Adopted AMLD5 directive, covering crypto service providers. | N/A |

| Iran | Grey-Listed | Lack of comprehensive AML/CTF measures in crypto space. | Economic sanctions and reputational damage. |

| North Korea | Grey-Listed | No substantive compliance with FATF’s crypto standards. | Isolation from the global financial system. |

Key Components of FATF’s AML and CTF Measures for Crypto

The FATF’s guidelines for Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) in the cryptocurrency sector emphasize a robust framework for identifying and mitigating risks associated with virtual asset transactions. These guidelines include several critical components, such as enhanced due diligence for high-risk transactions and real-time monitoring to detect suspicious activity.

Note

Together, they create a cohesive system that helps VASPs and financial institutions comply with global standards, while protecting the financial ecosystem from misuse by criminals or terrorist groups.

Enhanced Due Diligence for High-Risk Transactions

One of the core requirements of FATF’s guidelines is the application of enhanced due diligence (EDD) for high-risk crypto transactions. This is particularly relevant for large-value or cross-border transfers, which are often susceptible to exploitation by illicit actors. Under FATF’s recommendations, VASPs and financial institutions are expected to apply additional scrutiny to transactions that are deemed higher risk. This includes verifying the source of funds, closely monitoring the originators and beneficiaries, and requiring more detailed documentation than standard KYC procedures.

EDD is especially crucial for transactions originating from or destined for high-risk jurisdictions. Countries that are on the FATF’s grey list or those known for weak AML/CTF controls are subjected to a heightened level of scrutiny under these guidelines. VASPs are encouraged to maintain a risk-based approach, which allows for flexibility in determining which transactions require enhanced due diligence.

Real-Time Transaction Monitoring and Red Flags

To ensure compliance with FATF’s AML and CTF guidelines, VASPs must also implement real-time monitoring systems that flag suspicious activities as they occur. Real-time crypto transaction monitoring allows service providers to detect and react to potential risks immediately, preventing the flow of illicit funds. This process involves tracking the flow of funds, identifying inconsistencies between transaction details (such as discrepancies in originator or beneficiary information), and screening for entities that appear on sanctions lists.

Red flags in crypto transactions typically include:

- Unusually large or frequent transactions that don’t align with the customer’s profile.

- Transfers involving high-risk jurisdictions or regions with weak AML/CTF enforcement.

- Transactions that are split into smaller parts to avoid reporting thresholds, a technique known as smurfing.

- Discrepancies in information between the originator and beneficiary, such as incorrect or incomplete names and addresses.

Checklist:

- Monitor large or unusual transactions: Track significant deviations from normal transaction behavior.

- Track discrepancies in originator or beneficiary information: Ensure data accuracy for every transaction.

- Screen for sanctioned entities: Use automated tools to detect and block transactions involving blacklisted parties.

- Report and flag suspicious activities: Notify relevant authorities in real time.

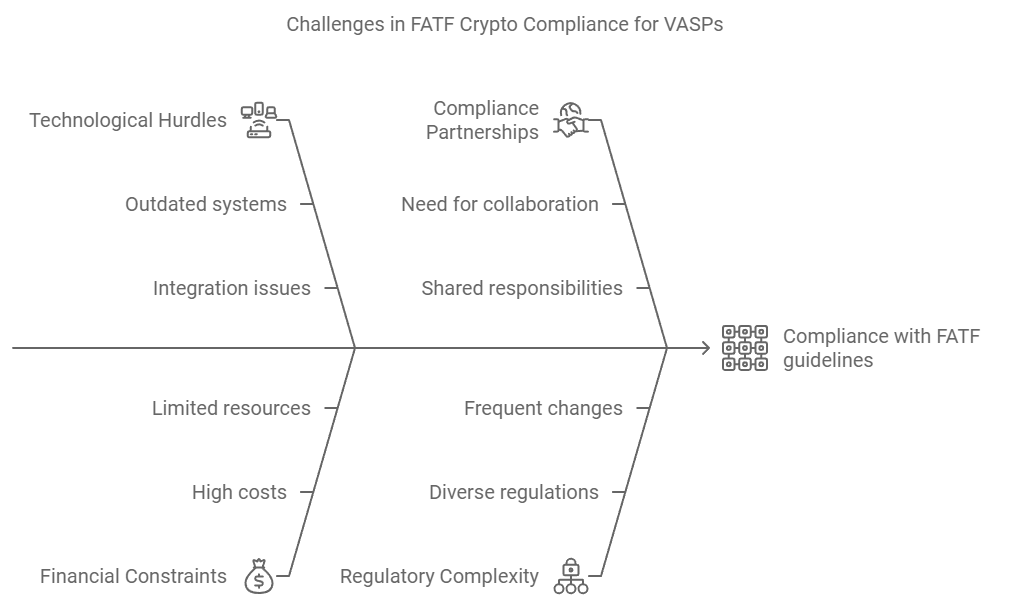

Challenges and Solutions for FATF Crypto Compliance

As the FATF’s crypto guidelines become more stringent, Virtual Asset Service Providers (VASPs) face significant challenges in maintaining compliance, particularly with the Travel Rule and associated AML/CTF requirements. These challenges can impact VASPs of all sizes, from technological hurdles to financial constraints. However, various solutions, including technological innovation and compliance partnerships, offer viable ways to mitigate these difficulties.

Technological Challenges in Implementing FATF’s Travel Rule

The FATF Travel Rule requires VASPs to collect, verify, and share detailed information on transaction originators and beneficiaries. This rule, designed to enhance transparency in the crypto ecosystem, presents several technological challenges, especially when applied to cross-border transactions.

One of the main obstacles is interoperability between compliance tools. Many VASPs operate across jurisdictions with differing regulatory requirements, making it difficult to streamline data-sharing processes. This is particularly evident in international transactions, where differing data privacy laws and encryption standards complicate the collection and transfer of information.

Note

lack of standardized protocols for implementing the Travel Rule has led to further fragmentation. While some countries have developed sophisticated compliance tools, many VASPs are still struggling to adopt or integrate them. To overcome this, the industry is moving toward adopting interVASP Messaging Standards (IVMS 101), a framework designed to improve interoperability across different platforms and jurisdictions.

Cost and Resource Constraints for Small VASPs

Meeting the stringent requirements of FATF’s guidelines can be particularly challenging for smaller VASPs due to limited resources. The costs associated with implementing advanced compliance technologies, maintaining legal teams, and ensuring continuous monitoring are substantial, putting these smaller players at a disadvantage.

One potential solution is forming compliance partnerships with established industry players. These partnerships allow smaller VASPs to leverage the existing infrastructure of larger firms to meet compliance requirements, reducing the burden on their resources. Another viable solution is using compliance software tailored for smaller exchanges. These solutions, often cloud-based, provide scalable compliance features at a fraction of the cost of building in-house systems.

Note

VASPs can also explore regulatory technology (RegTech) solutions that automate many compliance tasks, such as transaction monitoring and KYC processes, which reduces manual effort and lowers operational costs. By leveraging these tools, smaller VASPs can ensure compliance without significantly increasing their overhead.

In conclusion, the FATF’s crypto guidelines continue to be an essential framework for ensuring that the cryptocurrency ecosystem remains safe from misuse by criminal actors. As seen throughout this article, the AML and CTF measures set forth by the FATF are integral for global crypto exchanges, VASPs, and financial institutions. By implementing rigorous verification, monitoring, and compliance practices, these entities can meet international standards and protect the integrity of the crypto market.

While numerous challenges are associated with the FATF’s Travel Rule, especially regarding cross-border compliance and resource limitations for smaller VASPs, there are equally promising solutions. Compliance partnerships, adoption of interoperable technologies, and leveraging RegTech solutions can help mitigate these hurdles and ensure a future where crypto transactions are secure, transparent, and globally regulated. Crypto businesses and regulatory bodies must work together to close the remaining compliance gaps and improve global crypto compliance, ensuring that the digital asset space continues to thrive while preventing its exploitation for illegal activities.