Cryptocurrency transactions are popular. They reduce fees, speed up cross-border payments, and enhance security. But, crypto’s use in payment systems has challenges. These include volatility and regulatory uncertainty. This article will explore crypto payment systems. It will cover the benefits of digital currencies in commerce. It will also discuss the challenges of using them for payments.

Understanding How Crypto Payments Work

Cryptocurrency payments use blockchain tech. It makes transactions faster and safer than traditional methods. These payments cut intermediaries, making them more cost-effective for both merchants and consumers. Users must know wallets, payment gateways, and confirmations to use crypto in daily commerce. Let’s break down how these components work together.

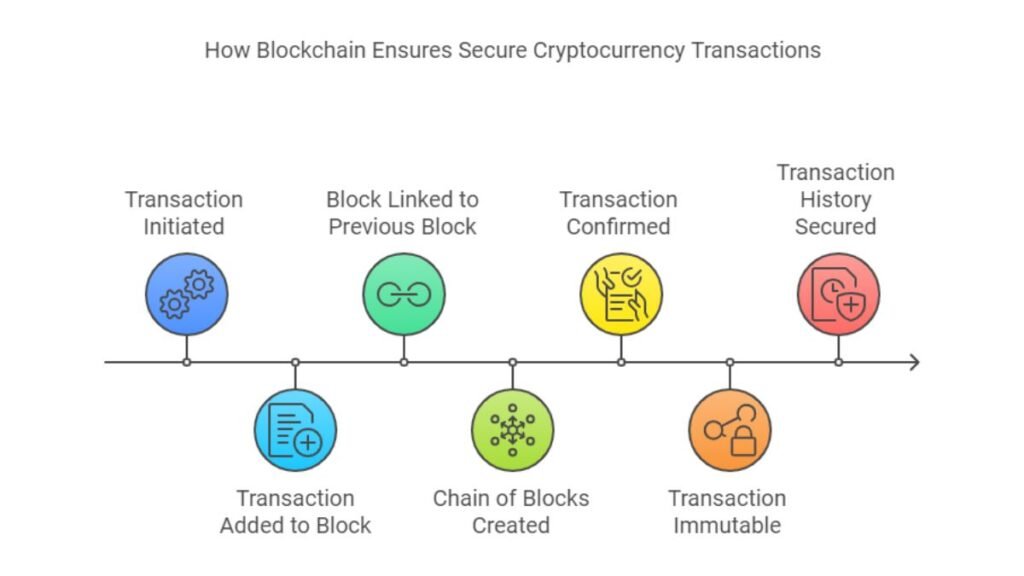

How Blockchain Powers Crypto Payments

Blockchain is the backbone of cryptocurrency payments. It is a secure, decentralized, and transparent ledger for recording transactions. Every transaction is added to a block. This block links to the previous one. It creates a chain that anyone can access and that cannot be changed. This means once a transaction is confirmed, it cannot be altered or reversed. Consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), ensure that all participants agree on the validity of each transaction. Nodes on the network verify transactions, enhancing security and preventing fraud.

A blockchain’s key components for crypto payments include the ledger. It records transactions for all participants. Miners or validators confirm the transactions. Public and private keys allow users to transfer funds securely.

Crypto Payment Processors

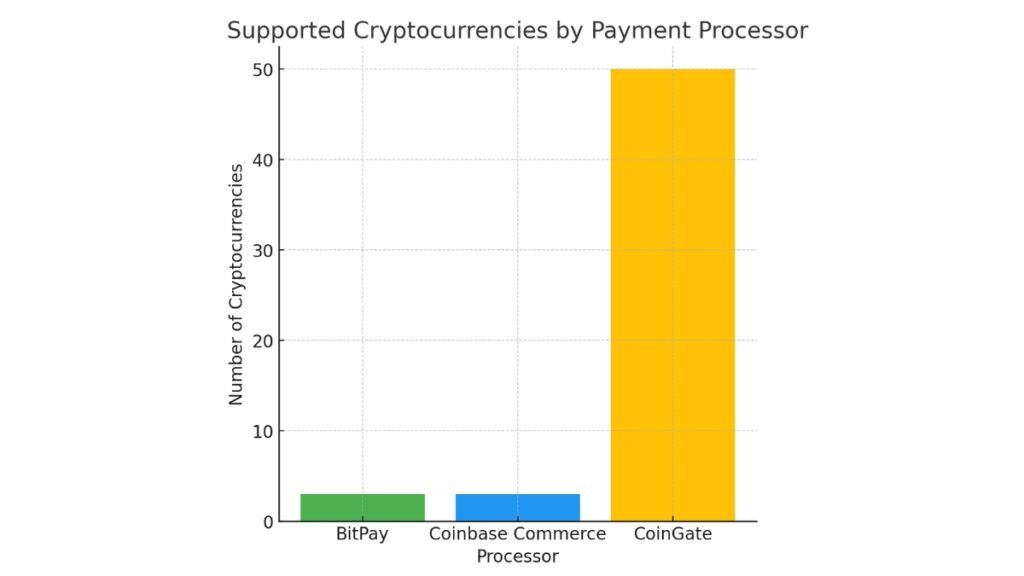

Crypto payment processors like BitPay, Coinbase Commerce, and CoinGate let businesses accept cryptocurrency. They do this without needing to handle crypto wallets. These processors convert cryptocurrency payments into fiat currencies (e.g., USD or EUR) if the merchant prefers. They offer various features, such as invoice generation and e-commerce integration. They also have auto-conversion to reduce risks from cryptocurrency’s volatility.

| Processor | Supported Cryptocurrencies | Transaction Fees | Key Features |

|---|---|---|---|

| BitPay | Bitcoin, Ethereum, Litecoin | ~1% | Instant conversion, invoicing, API |

| Coinbase Commerce | Bitcoin, Ethereum, USDC | 1% | Supports fiat conversion, e-commerce |

| CoinGate | Bitcoin, Ripple, Litecoin | ~1% | Supports over 50 cryptos, recurring billing |

Crypto payment processors simplify payments. They help businesses adopt crypto without deep technical knowledge.

It shows how many cryptocurrencies each payment processor supports. CoinGate tops the list.

Cryptocurrency Wallets and Payment Management

A cryptocurrency wallet stores the keys to send and receive payments. They are the private and public keys. There are two main types of wallets: software (hot) and hardware (cold).

- Hot wallets are internet-connected. They’re convenient for daily transactions. But they have higher security risks.

- Cold wallets are offline. They are more secure. So, they are best for long-term crypto storage.

Note

Businesses and individuals can choose wallets based on their needs. For example, a hot wallet is good for daily use. A cold wallet is better for long-term storage of large amounts of crypto.

Benefits of Using Crypto for Payments

Cryptocurrencies offer many advantages for both businesses and consumers. These benefits make them a good alternative to traditional payment methods.

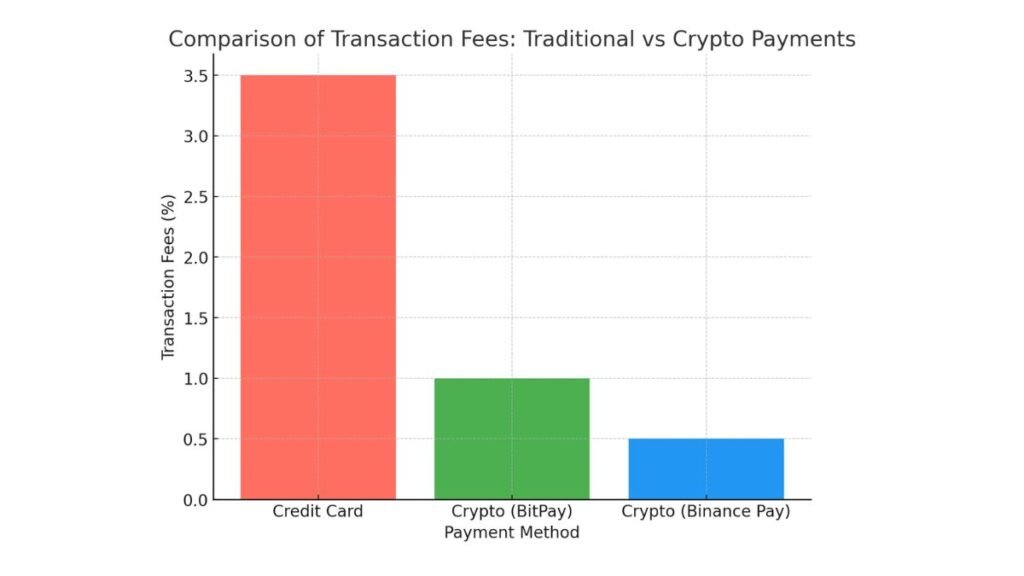

Here’s a bar chart. It compares the transaction fees of credit cards and crypto payment processors, like BitPay and Binance Pay. The chart shows that crypto payments have much lower fees. They are a cheaper option for businesses.

Lower Transaction Fees

Cryptocurrencies have a major benefit. Their transaction fees are lower than those of traditional payment methods. Credit card transactions often have fees of 2% to 4%. Crypto payments can often reduce fees to less than 1%. For instance, BitPay and Binance Pay bypass traditional intermediaries. This lowers fees and lets merchants keep more profit per transaction. Also, high-volume businesses can cut costs by eliminating many layers of banking fees.

Faster, Cross-Border Payments

Cryptocurrency payments also excel in speeding up cross-border transactions. Traditional methods, like bank transfers, can take days to process. There may be more delays from intermediaries and currency conversion fees. Cryptocurrencies cut out middlemen. They allow transfers to settle in minutes, no matter where you are. This is vital for those in global e-commerce, supply chains, or remittances. There, fast, low-cost transactions are crucial.

Key Benefits of Cross-Border Crypto Payments:

- No currency exchange fees.

- Near-instant settlement times.

- Transparent transaction tracking on blockchain ledgers.

- Enhanced accessibility in underserved markets.

Enhanced Security and Fraud Prevention

Blockchain technology provides robust security for crypto transactions. It is not possible to remove the adverb. Also, blockchain’s decentralized nature reduces the risk of data breaches. It makes it harder for hackers to access sensitive financial information. This offers an extra layer of security that traditional payment systems lack.

Challenges and Risks of Crypto Payments

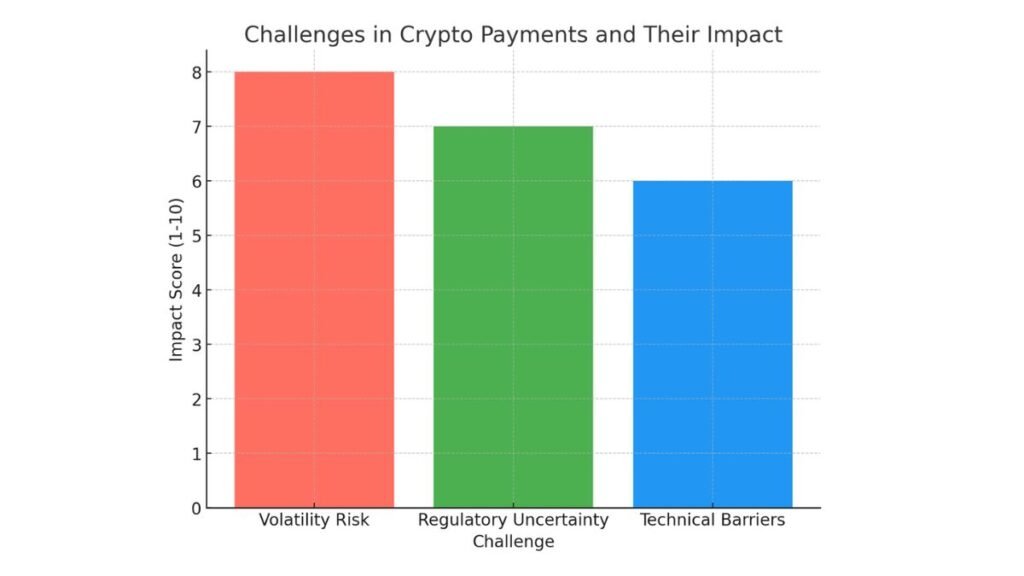

While cryptocurrencies present new opportunities for businesses, they also come with significant challenges. Businesses must navigate issues when integrating crypto payments. These include volatility, regulatory uncertainty, and technical complexities.

A bar chart shows the key challenges in crypto payments. It includes impact scores based on their severity.

- Volatility Risk: Scored the highest due to the unpredictable nature of cryptocurrency prices.

- Regulatory Uncertainty: Ranked closely behind as evolving laws across regions add complexity.

- Technical Barriers: Rated moderately, reflecting the challenges businesses face in integrating crypto payments.

Cryptocurrency Volatility

One of the biggest challenges with crypto payments is volatility. Cryptocurrencies, like Bitcoin and Ethereum, can experience dramatic price fluctuations over short periods. This volatility can challenge businesses. It makes it hard to price goods consistently. It also increases the risk of loss when converting crypto to fiat. For instance, a transaction might be valued higher at the time of payment but lose value by the time it is settled.

To reduce this risk, many businesses use stablecoins. These are cryptocurrencies pegged to stable assets like the US dollar. Stablecoins, like USDC or DAI, secure blockchain transactions. They also reduce price fluctuation risks.

Navigating Regulatory Challenges

Regulatory uncertainty remains a significant hurdle for businesses adopting cryptocurrency payments. Cryptocurrency laws vary by region. Governments are still defining how to regulate their use. Businesses must follow KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. They aim to prevent illegal activities. The lack of global regulations adds complexity. It makes it difficult for businesses operating in many jurisdictions.

- Implement KYC and AML procedures to verify customer identities.

- Regularly update security protocols to align with evolving regulations.

- Monitor regulatory changes in each operational region.

- Maintain detailed transaction records for tax and audit purposes.

Technical and Operational Barriers

Integrating crypto payments into existing systems requires overcoming several technical challenges. Businesses must ensure their infrastructure can support crypto transactions. This means setting up wallets, integrating payment processors, and securing customer funds. Employees must undergo training to handle the complexities of crypto payments with skill. Choosing the right payment processor, like BitPay or Coinbase Commerce, can simplify this. But, it still requires an upfront investment of time and resources.

Best Practices for Adopting Crypto Payments

Integrating cryptocurrency payments into your business requires careful planning. Choose the right payment processor and educate your customers. This will ensure a smooth shift to accepting crypto.

Choosing the Right Payment Processor

Selecting the right cryptocurrency payment processor is a crucial first step. Here’s a step-by-step guide to help you choose the best option for your business:

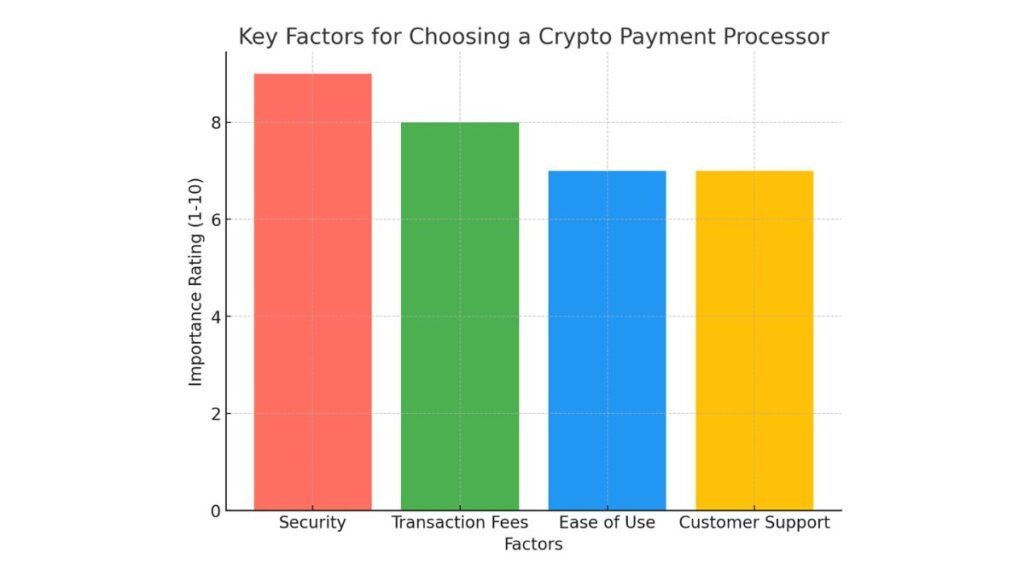

- Security: Look for a processor that prioritizes the security of transactions. It includes encryption and fraud prevention measures. They protect your business and customers from risks like hacking and data breaches.

- Transaction Fees: Crypto payment processors typically have lower fees compared to traditional methods. However, fees can still vary between providers. Compare transaction fees across different platforms to ensure you’re getting the best value for your business.

- Ease of Use: Choose a processor that is easy to integrate with your existing e-commerce or point-of-sale system. Look for platforms that offer simple APIs or plug-ins, making it easier for your team to manage the integration.

- Customer Support: As crypto is a new payment method, ensure your processor offers reliable support. A responsive team can help troubleshoot issues and provide guidance as needed.

Users trust popular options like BitPay, Coinbase Commerce, and CoinGate. They are reliable and easy to use.

A bar chart showing the importance of factors in choosing a crypto payment processor.

- Security: Rated highest due to the need to protect transactions.

- Transaction Fees: Close behind, as fees directly affect profit margins.

- Ease of Use: Important for smooth integration and usability.

- Customer Support: Equally important, as good support helps resolve issues quickly.

Educating Customers on Crypto Payments

Educating your customers about cryptocurrency is crucial for building trust and encouraging adoption. Here are a few tips to help you guide your customers through the process:

- Clear Instructions: Provide step-by-step instructions on how to make payments using cryptocurrencies. This can include details on how to set up a digital wallet, select a cryptocurrency, and complete the transaction.

- Highlight Benefits: Teach customers the benefits of crypto. They are lower fees, better security, and faster transactions. This can help alleviate concerns about volatility or unfamiliarity with the process.

- Build Trust: Transparency is key. Inform customers about how you protect their financial data. Also, share your security measures for safeguarding transactions.

The Future of Crypto Payments

As cryptocurrency adoption grows, payments will change a lot. This section highlights key trends that will shape the future of crypto payments. It focuses on the rise of stablecoins and the integration of AI with blockchain technology.

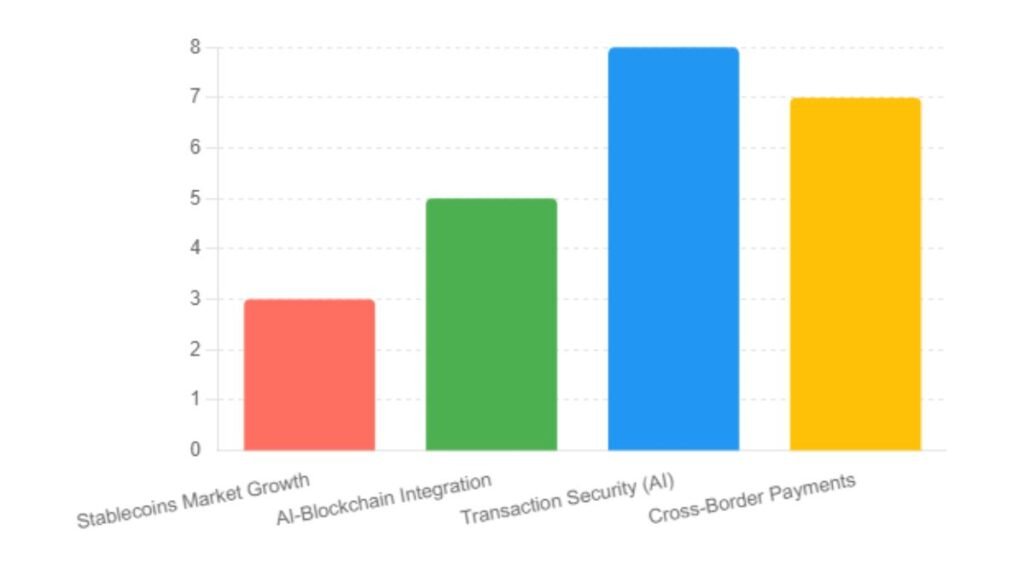

a bar chart visualizing key future trends in crypto payments:

- Stablecoins Market Growth: Projected to significantly expand in the coming years.

- AI-Blockchain Integration: Expected to drive efficiency and enhance security.

- Transaction Security with AI: AI is set to play a major role in securing transactions.

- Cross-Border Payments: Stablecoins could revolutionize international payments. They would cut costs and speed up transactions.

Growth of Stablecoins and Their Role in Payments

Stablecoins are vital to the crypto ecosystem. They hold a stable value, unlike volatile cryptocurrencies like Bitcoin. Stablecoins are pegged to fiat currencies, like the US dollar. They are reliable and ideal for everyday transactions.

Major players like PayPal have launched stablecoins (e.g., PYUSD). This enables faster, cheaper cross-border payments. Stablecoins are popular in remittance services. They cut fees and offer near-instant settlement. With rising adoption, stablecoin usage may exceed $3 trillion by 2028.

| Advantage | Benefit |

|---|---|

| Reduced Volatility | Pegged to fiat, stablecoins avoid the price swings of other cryptocurrencies. |

| Lower Transaction Costs | Fees are significantly lower compared to traditional bank transfers. |

| Faster Settlement | Near-instant transactions, 24/7 availability. |

| Cross-Border Efficiency | Avoids currency exchange fees, ideal for international remittances. |

Integrating AI and Blockchain for Enhanced Payment Security

AI and blockchain will improve the security and efficiency of crypto payments. AI can check blockchain transactions in real time. It can detect fraud patterns and optimize liquidity management. It also plays a vital role in automating smart contracts, making them faster and more secure.

AI bots are now common in DeFi. They prevent attacks, optimize trades, and manage liquidity. These advancements should create safer, more efficient crypto payment systems. They will come from a synergy between AI and blockchain.

| Feature | Benefit |

|---|---|

| Real-Time Fraud Detection | AI analyzes transaction patterns to detect and prevent fraud. |

| Automated Smart Contracts | AI optimizes contract execution, making settlements faster and more reliable. |

| Enhanced DeFi Security | AI bots monitor and manage liquidity, reducing risks of exploits. |

These innovations will make crypto payments more secure and efficient. They will boost adoption in consumer and commercial sectors.

For More Information:

- Singapore’s Guidelines for Digital Payment Tokens

- Web3 payment systems and adoption

- How to Avoid Cryptocurrency Hacks

- Common Crypto Terms

- Using Cryptocurrencies Securely

There are challenges to using cryptocurrency for payments, but the benefits are clear. With stablecoins, AI, and secure blockchains, crypto payments will transform commerce. As businesses adopt new technologies, they must focus on security, compliance, and customer education. AI and blockchain will drive the next wave of innovation. They will create a more efficient, global payment system.