To buy Bitcoin securely on a crypto exchange, you must know the key steps and precautions. They are vital for a smooth, safe transaction. With Bitcoin’s rise, it’s vital to choose the right platform. Then, link payment options, manage fees, and secure your assets after buying. This article will guide you. We’ll help you confidently buy Bitcoin. You’ll avoid common pitfalls.

Choosing a Secure Crypto Exchange

When buying Bitcoin, selecting a secure and reliable crypto exchange is crucial. With many options available, each offering different features, fees, and security protocols, your choice of platform will significantly impact the safety of your transactions.

Key Factors in Choosing a Crypto Exchange

Several factors should guide your decision when selecting a crypto exchange:

- Security Features: A trustworthy exchange prioritizes strong security. It should use two-factor authentication (2FA), cold storage, and proof-of-reserves. These features help prevent unauthorized access and ensure your funds are safe even if the platform is hacked.

- Transaction Fees: While security is paramount, understanding the fee structure is also important. Most exchanges charge transaction fees, and these can vary significantly. Some exchanges, like Binance, offer competitive fees, starting as low as 0.1% for trades, while others may charge higher rates for credit card purchases.

- Payment Options: The payment methods can greatly affect your experience. Look for exchanges that support various payment options. These include credit/debit cards, bank transfers, and digital wallets like PayPal and Apple Pay. Flexible payment methods ensure a smoother purchase. They meet your needs.

- Reputation and Trustworthiness: Choose an exchange that has a strong reputation within the crypto community. Look for user reviews, security certifications, and how the exchange handled past incidents. Platforms like Kraken and Coinbase are known for their reliability and strict security protocols.

Top Recommended Exchanges for Beginners

If you’re new to cryptocurrency, simplicity and security should be your top priorities. Some of the best beginner-friendly exchanges include:

- Coinbase: Known for its user-friendly interface, Coinbase is ideal for newcomers. It offers a smooth registration process and easy-to-navigate trading options, combined with high security. However, keep in mind its slightly higher fees compared to other platforms.

- Binance: Binance provides both beginner and advanced trading options. Its low fees and strong security make it popular. It’s a good choice for users who want to scale their trading as they gain experience.

- Kraken: Another highly secure option, Kraken is known for its extensive security protocols and cold storage of funds. It offers a balanced mix of features for beginners and more advanced users, especially those concerned about security.

Verifying Security Features of an Exchange

When choosing an exchange, always ensure it offers the following security features:

- Two-Factor Authentication (2FA): This adds an extra layer of protection by requiring both your password and a secondary form of identification (like a code sent to your phone) to access your account. Platforms like Kraken and Binance offer this as standard.

- Cold Storage: Look for exchanges that store the majority of user funds offline in cold wallets, minimizing the risk of hacks. Coinbase and Kraken excel in this area, ensuring your assets remain safe.

- Proof-of-Reserves: This is a system that allows exchanges to publicly verify they have enough reserves to cover all user deposits. It’s an additional step that enhances transparency and trust.

By considering these factors and security measures, you can confidently select a crypto exchange that ensures your Bitcoin transactions are secure.

Setting Up and Verifying Your Account

Once you’ve selected a crypto exchange, the next essential step is setting up your account. This process involves registering with the platform. Then, complete KYC and AML checks. This ensures your account is secure and complies with legal regulations. These steps are crucial for ensuring the safety of both the exchange and the users, preventing fraudulent activities and identity theft.

Step-by-Step Guide to Account Setup

Creating an account on a crypto exchange is straightforward. Here’s how you can get started:

- Register on the Platform: Begin by visiting the exchange’s website or app and signing up. You will need to provide basic details such as your name, email, and create a password. Most exchanges also require you to verify your email before proceeding.

- Add Two-Factor Authentication (2FA): After registering, it’s strongly recommended to set up Two-Factor Authentication (2FA). This adds an extra layer of security by requiring you to verify your identity using a second method (e.g., a code sent to your phone).

- Link a Payment Method: Once your account is verified, link a payment method, such as a bank account or credit card, to facilitate deposits. Depending on the platform, you might be able to use PayPal or other digital wallets.

- Start Depositing Funds: You can now deposit fiat currency or transfer crypto from an external wallet to your account to start trading.

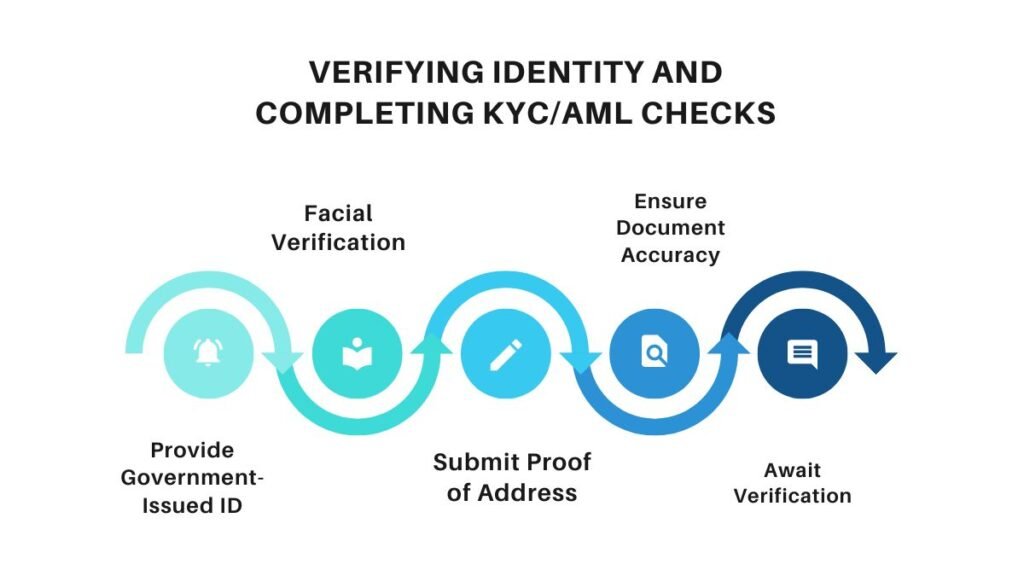

Verifying Identity and Completing KYC/AML Checks

Most exchanges require users to complete KYC and AML checks to prevent illegal activities like money laundering. Here’s what the process typically involves:

- Provide Government-Issued ID: Upload a clear copy of a government ID, like a passport or driver’s license.

- Facial Verification: Complete a selfie or facial verification to confirm that the ID belongs to you.

- Submit Proof of Address: Upload a recent utility bill, bank statement, or similar document issued within the last three months as proof of address.

- Ensure Document Accuracy: Verify that all documents are clear, valid, and current. This will avoid delays in the verification process.

- Await Verification: Once submitted, the platform will review the documents, with processing times ranging from a few minutes to several days depending on the exchange.

Passing these checks unlocks full platform access. It includes higher withdrawal limits and extra trading features.

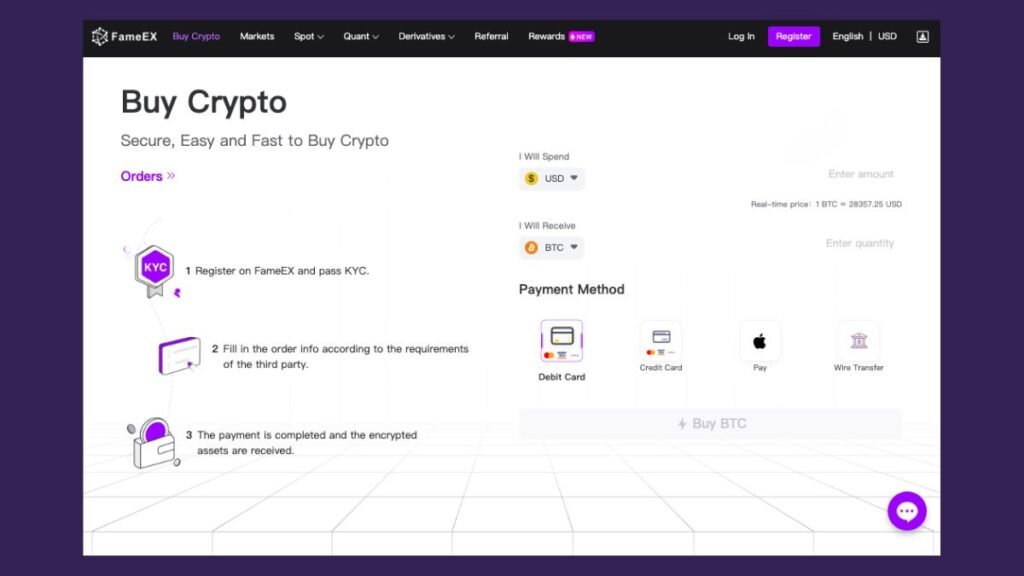

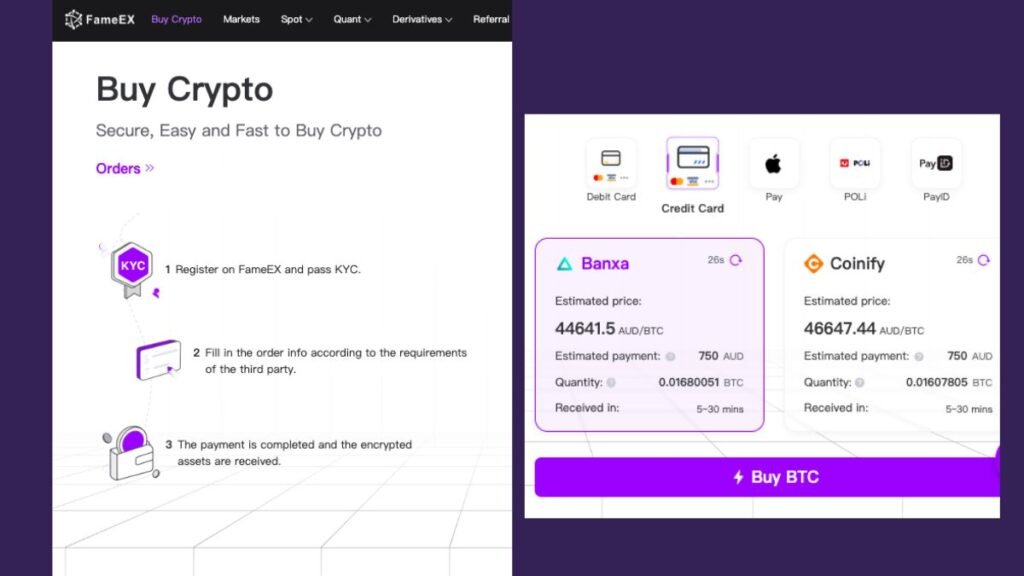

Steps for Getting Started with Cryptocurrency Trading on FameEX

Here are the steps to start trading crypto on FameEX. They are reformulated for clarity and brevity.

1. Choose a Cryptocurrency Exchange

Evaluate your trading goals to select an exchange that aligns with your needs. If you plan to trade often or use advanced strategies, like futures, margin, or options, look for platforms that offer them. FameEX offers many options. They include fiat-to-crypto and crypto-to-crypto trades, grid trading, and a strong referral program.

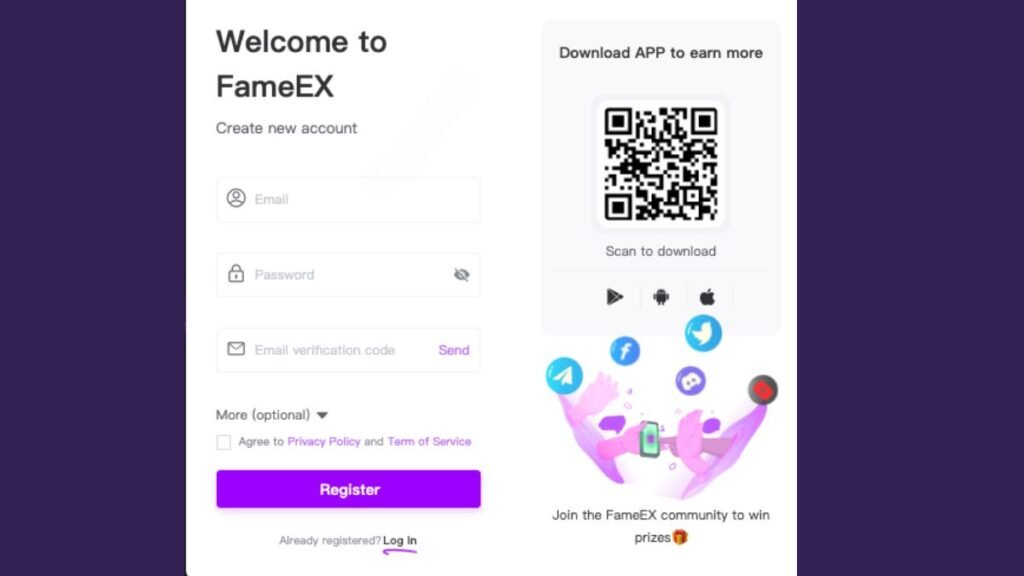

2. Create and Verify Your Account

After selecting an exchange, register by providing basic details like your email and a secure password. FameEX simplifies this by sending a verification code to your email, allowing you to activate your account quickly and begin trading.

3. Deposit Funds to Your Account

Fund your account using a variety of payment methods such as credit cards, bank transfers, or alternative solutions like Coinfy or BANXA. FameEX makes it easy for new users, offering flexible options to deposit funds without requiring a credit card.

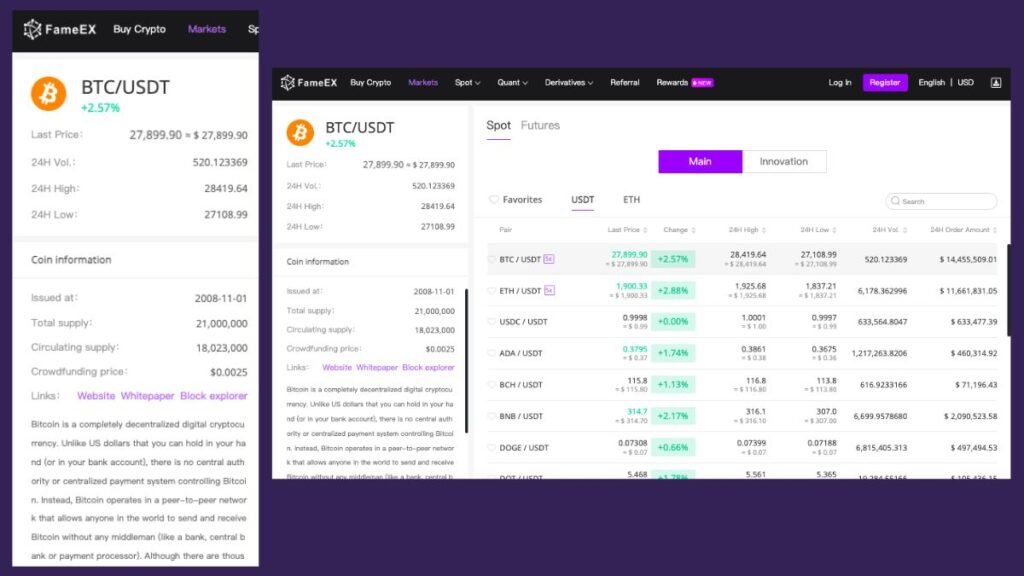

4. Place a Cryptocurrency Order

Fund your account with various methods. Use credit cards, bank transfers, or alternatives like Coinfy or BANXA. FameEX helps new users. It offers flexible, no-credit-card options to deposit funds.

5. Select a Storage Method

Store your cryptocurrencies in a wallet. Use a hot wallet (online) for convenience. Use a cold wallet (offline) for better security. FameEX has integrated wallets on its platform. But, use a non-custodial wallet if you want full control of your private keys.

Connecting Payment Options

To purchase Bitcoin securely, linking a payment method to your exchange account is essential. This section will help you navigate through the different payment methods available, weighing their pros and cons based on fees, speed, and ease of use.

Credit/Debit Card Payments for Bitcoin

Credit and debit cards are one of the most convenient and fastest ways to purchase Bitcoin. Most major exchanges, such as Binance, Coinbase, and Crypto.com, support card payments.

| Pros | Cons |

|---|---|

| Transactions with credit or debit cards are almost instant, allowing you to purchase Bitcoin quickly. | Credit card purchases often come with higher fees compared to other payment methods, typically ranging from 3-5%. |

| The process is straightforward, and most users find it user-friendly. | Some card issuers may treat crypto purchases as cash advances, leading to higher interest rates. |

Bank Transfers and Other Payment Methods

Bank transfers are a more traditional and cost-effective option for buying Bitcoin. Many exchanges, including Kraken and BitPay, accept both ACH and SEPA transfers.

| Advantages | Disadvantages |

|---|---|

| Bank transfers typically have lower fees compared to credit cards. SEPA transfers are often free or have minimal fees. | Bank transfers can take longer to process, typically taking 1 to 5 business days, depending on the exchange and method. |

| No concerns about accruing credit card debt. | Slower transaction speed compared to instant methods like credit cards. |

Other payment methods like PayPal and Apple Pay are also becoming popular. PayPal, for instance, allows direct purchases on some platforms. But users may face high fees—up to 1.8% per transaction, plus a spread fee. Apple Pay offers fast, easy payments on supported platforms. But, availability may vary by region and the exchange.

Understanding Fees and Limits

Each payment method comes with its own set of fees and limits. It’s essential to understand these before making a purchase:

| Payment Method | Transaction Fees | Processing Time | Limitations |

|---|---|---|---|

| Credit/Debit Card | 3-5% + interest (if applicable) | Instant | Potential cash advance fees |

| Bank Transfer (ACH) | Minimal to none | 1-5 business days | Delayed transaction times |

| PayPal | 1.8% + spread | Almost instant | High fees for large transactions |

| Apple Pay | Platform-dependent | Instant | Limited exchange availability |

To minimize costs, consider using bank transfers for larger purchases to avoid high card fees. For small, quick transactions, credit cards or digital wallets like PayPal are more convenient.

Securing Your Bitcoin After Purchase

Once you’ve purchased Bitcoin, securing it in a reliable wallet is crucial. The phrase “Not your keys, not your crypto” emphasizes the importance of controlling your private keys. Exchanges can be hacked. So, for long-term safety, move your Bitcoin to a personal wallet.

Hot Wallets vs. Cold Wallets

When it comes to Bitcoin storage, you have two primary options: hot wallets and cold wallets. Each has its own advantages and security considerations:

- Hot Wallets: These wallets connect to the internet. They are convenient for frequent transactions and active trading. Hot wallets are available as mobile apps or web-based platforms, offering quick access to your funds. However, because they are online, they are more vulnerable to hacks, malware, and phishing attacks.

- Pros: Fast transaction speeds and easy to use for everyday purchases.

- Cons: Higher risk of security breaches due to constant internet connectivity.

- Cold Wallets: Cold wallets, on the other hand, store your private keys offline, making them far more secure from cyber threats. They are ideal for long-term storage and large holdings of Bitcoin, where you don’t need daily access to the funds. Cold wallets can come in the form of hardware devices or paper wallets.

- Pros: Highly secure since they are offline and resistant to hacking.

- Cons: Less convenient for daily use and can be expensive, with devices ranging from $50 to $200.

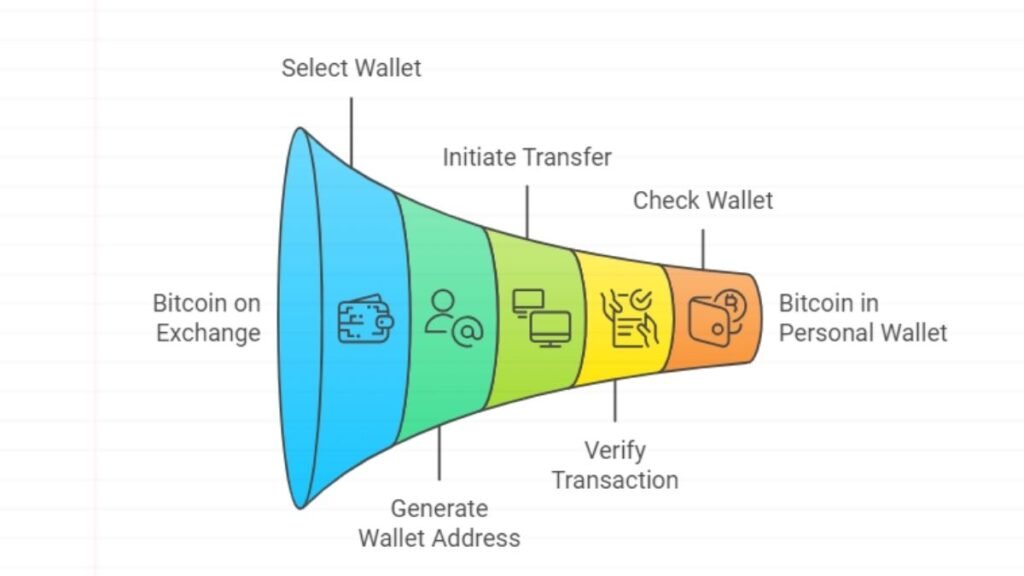

Transferring Bitcoin to a Personal Wallet

After buying Bitcoin on an exchange, you should transfer it to your personal wallet. Follow these steps to secure your crypto assets:

- Select a Wallet: Choose a hardware or software wallet depending on your storage needs. Hardware wallets like Ledger and Trezor are more secure. Hot wallets like Electrum and Mycelium are more convenient for small amounts.

- Generate a Wallet Address: Once you’ve set up your wallet, generate a new Bitcoin address. This address is necessary to receive funds.

- Initiate the Transfer: Log in to your exchange account and navigate to the withdrawal or transfer section. Enter your wallet address and the amount of Bitcoin to transfer. Double-check the address to avoid mistakes.

- Verify the Transaction: Confirm the transfer on the exchange and wait for the transaction to be processed. Depending on the blockchain’s activity, this could take several minutes to hours.

- Check Your Wallet: After the transaction is confirmed, check your wallet to ensure that the Bitcoin has been successfully transferred.

Note

By securing your Bitcoin in a personal wallet, you control your assets. This minimizes the risk of losing your funds to exchange hacks or failures.

Avoiding Common Mistakes and Scams

When purchasing Bitcoin, it’s important to avoid mistakes that could cost you money or compromise your security. This section will cover some common errors and how to steer clear of scams to protect your assets and minimize fees.

Avoiding High Transaction Fees

Transaction fees can hurt your Bitcoin purchases, especially during peak times when the network is busy. Here are some strategies to minimize fees:

- Use SegWit Wallets: Segregated Witness (SegWit) wallets help reduce the size of transactions, leading to lower fees. Wallets that support SegWit, such as those with addresses starting with “bc1,” are designed to optimize the transaction data, thus reducing costs.

- Batching Transactions: If you need to send multiple payments, combining them into one transaction can save you up to 75% in fees. This feature is particularly beneficial for businesses or users with frequent transactions.

- Leverage Layer-2 Solutions: The Lightning Network is ideal for small, frequent transactions. It operates off-chain and significantly reduces fees, making it a great option for users who don’t need to rely on the main Bitcoin blockchain.

- Timing Your Transactions: Fees often fluctuate with network demand. If possible, plan your purchases for off-peak hours when fewer people are using the Bitcoin network, which can lower the fees you need to pay.

How to Identify and Avoid Scams

The rise of Bitcoin has also led to an increase in various scams. Here are some of the most common scams and how to avoid them:

- Fake Exchanges: Scammers create fake cryptocurrency exchanges to steal funds. Always verify the legitimacy of a platform by checking the URL and using tools like Binance Verify to ensure you’re on the correct website.

- Phishing Attacks: These scams use fake emails or websites to steal your login info or private keys. To avoid phishing attacks, don’t click on suspicious links in emails or messages. Always go directly to the exchange’s official website.

- Fake Giveaways and Impersonation Scams: Scammers often impersonate celebrities or influencers. They promise free cryptocurrency if you send them a small amount first. Legitimate giveaways will never ask you to send crypto first, so avoid any offers that do.

Note

By staying vigilant and using secure methods, you can avoid common pitfalls and ensure a safer experience when buying Bitcoin.

Note

- How Global Regulations Impact Bitcoin Purchases

- Setting Up a Crypto Wallet

- Top 5 Secure Crypto Wallets for 2024

- How Bitcoin Plays a Role in DeFi Liquidity

- How Bitcoin’s Tokenomics Influence Its Long-term Value

To buy Bitcoin securely, choose a reliable exchange. Then, set up your account with KYC. Next, link a safe payment method. Finally, store your assets in a wallet. Whether you choose a hot or cold wallet depends on your transaction needs and risk tolerance. By understanding transaction fees and avoiding scams, you can protect your investments. As the crypto world changes, it’s key to know the latest ways to secure your Bitcoin.