Seychelles introduced new VASP regulations in 2024. They aim to boost compliance and transparency. The Seychelles Financial Services Authority (FSA) oversees these rules. They aim to curb financial crimes like money laundering and terrorist financing. These rules align with international standards, such as the FATF’s. They signal Seychelles’ commitment to a secure, transparent virtual asset market.

Licensing Requirements and Compliance Obligations for VASPs

Seychelles’ VASP rules take effect in September 2024. They require all VASPs to get an FSA license. This process ensures that service providers meet standards. They must align with Seychelles’ commitment to transparency and integrity. These rules aim to stop financial crimes, like money laundering and terrorist financing.

The Licensing Process

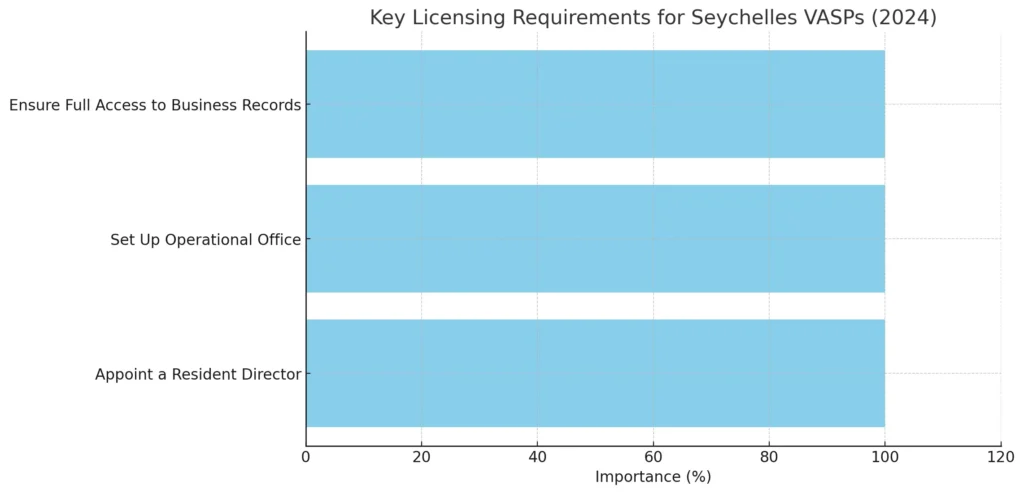

To operate legally in Seychelles, VASPs must meet several requirements. These include a substantial presence, a resident director, and fully staffed local offices. They must ensure FSA audits can access all records. This includes operational and financial records. These measures foster accountability and market transparency.

- Appoint a resident director.

- Set up an operational office in Seychelles.

- Ensure full access to business records for FSA audits.

Capital and Solvency Standards

The VASP regulations require companies to have enough capital. They must pay their costs and debts. Licensees must regularly report their financial status to the FSA. This protects the market’s integrity and ensures licensed entities’ long-term stability.

- Meet minimum capital adequacy thresholds.

- Ensure solvency based on the size of operations.

- Submit regular financial reports to the FSA.

Anti-Money Laundering (AML) and Financial Crime Prevention

Seychelles has introduced strong Anti-Money Laundering (AML) and counter-terrorism financing measures. These are part of its regulations for Virtual Asset Service Providers (VASP). These measures follow the Financial Action Task Force (FATF) guidelines. They want to stop using virtual assets for money laundering and terrorism financing.

Note

This framework reduces financial crime risks. It makes the virtual asset market safer and more transparent.

AML Compliance Requirements

VASPs in Seychelles must follow strict AML rules. These rules include thorough customer due diligence (CDD). It involves identifying and verifying clients’ identities and monitoring their transactions. VASPs must also report any suspicious activities to the FSA. These steps aim to detect and stop financial crimes before they take root.

- Customer identification and verification.

- Ongoing monitoring of transactions.

- Suspicious activity reporting to the FSA.

Reporting and record-keeping

To ensure transparency, VASPs are required to maintain comprehensive records of their operations, which must be submitted to the FSA for compliance reporting. These rules make businesses accountable in Seychelles’ virtual asset market. They must operate with complete transparency.

Cybersecurity and Data Protection Standards

Cybersecurity is critical to Seychelles’ Virtual Asset Service Provider (VASP) regulations. To protect the virtual asset market, VASPs must secure digital assets and user data. They must also use strong security protocols. The FSA enforces these rules to reduce cyber threats and build trust in digital finance.

Cybersecurity Protocols for VASPs

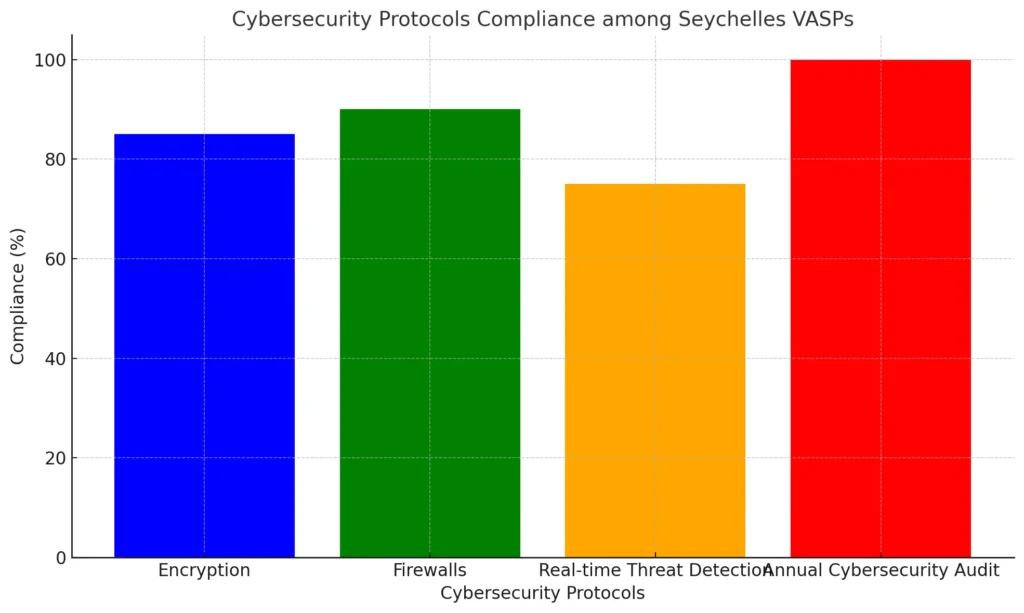

Seychelles VASPs must follow strict cybersecurity rules, use encryption, firewalls, and real-time threat detection, and submit an annual cybersecurity audit to the FSA. The audit checks for best practice compliance finds vulnerabilities, and tests their protocols against advanced cyberattacks.

- Implement encryption to secure digital assets and sensitive data.

- Install firewalls and deploy real-time threat detection systems.

- Submit an annual cybersecurity audit report to the FSA.

Safeguarding Client Assets

VASPs must secure their systems and protect client assets from fraud and unauthorized access. Cybersecurity protocols aim to stop cyberattacks that could compromise user funds or data. The Seychelles government enforces strict asset management rules and requires VASPs to have top security. This builds user trust and protects the market.

The table below shows the 2024 rules for VASPs in Seychelles. They are concerned with cybersecurity and data protection and include key reporting requirements.

| Requirement | Description | Frequency |

|---|---|---|

| Encryption | Use strong encryption to protect assets and client data. | Ongoing |

| Firewalls & Detection | Install firewalls and real-time threat detection. | Ongoing |

| Annual Cybersecurity Audit | Submit an independent audit report to the FSA. | Annually |

| Client Asset Protection | Secure systems to prevent unauthorized access to client assets. | Ongoing |

| Incident Reporting | Report any significant security breaches to the FSA. | Within 48 hours |

Regulatory Oversight and Market Integrity

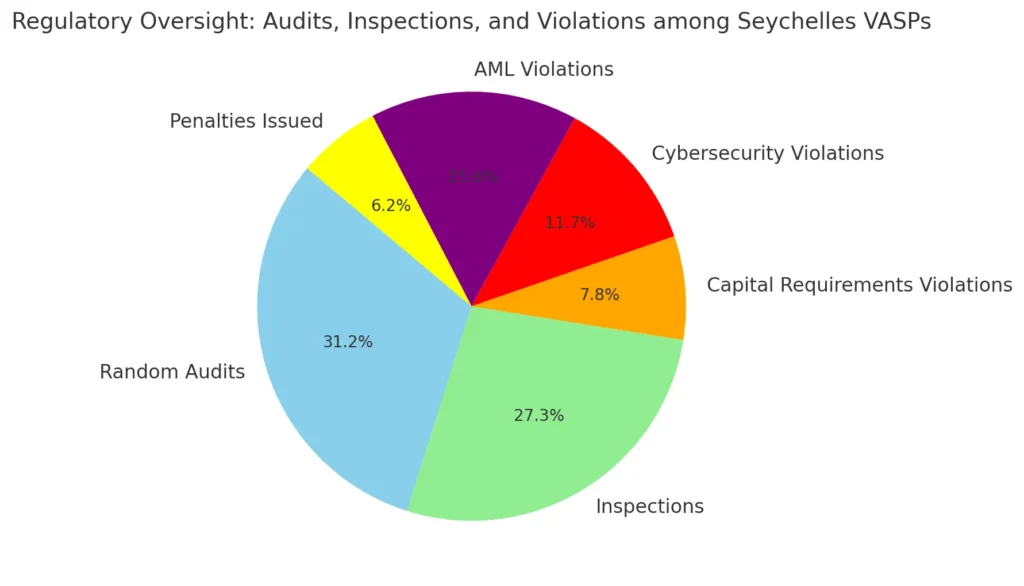

Seychelles’ Financial Services Authority (FSA) ensures VASPs follow strict regulations. The FSA’s main tasks are to inspect, audit, and enforce penalties for non-compliance. This oversight is vital. It ensures integrity and transparency in the virtual asset market.

Compliance Audits and Inspections

The FSA conducts random audits and inspections of VASPs to ensure they follow all regulations. These audits help find potential non-compliance issues, such as failures to meet capital, cybersecurity, or anti-money laundering (AML) obligations. If violations are found, the FSA can impose penalties, such as fines or revoking licenses.

Enforcement of Market Integrity Standards

To safeguard market integrity, VASPs in Seychelles must act fairly, transparently, and legally. The FSA enforces these standards. It ensures that VASPs operate responsibly and avoid fraud and risk. Enforcement mechanisms include penalties, suspensions, or license revocations for serious violations.

Related Topics for Further Reading

- Nigeria’s Comprehensive Crypto Legal Framework

- US IRS Simplifies Crypto Tax Reporting Guidelines

- Japan’s Stricter Crypto Exchange Regulations

- Regulatory Impact on DeFi Protocols

- Impact of Regulatory News on Crypto Trading

Seychelles’ 2024 VASP regulations aim to boost compliance, security, and market integrity. They provide a complete framework for this. The Financial Services Authority (FSA) enforces these rules via audits, inspections, and actions. This ensures transparency and the responsible operation of VASPs within Seychelles. As the virtual asset market evolves, these regulations are key. They protect investors while fostering innovation.