Luxembourg’s Blockchain Laws, updated by Blockchain Bill IV, will reshape its finances. It will further integrate distributed ledger technology (DLT). These amendments aim to boost blockchain use in finance. Make Luxembourg a key hub for financial innovation in Europe. The changes expand the DLT legal framework to include equity securities. Also, introduce a control agent. These support the issuance and management of tokenized securities. To promote greater transparency and security in financial markets.

Developments in Luxembourg’s 2024 Blockchain Law Amendments

Luxembourg’s 2024 Blockchain Bill IV aims to boost legal certainty for DLT in finance. It has significant advancements. These changes expand previous blockchain laws. They address trends in digital securities. They also strengthen Luxembourg’s position as a top European hub for financial innovation. The amendments improve the regulatory framework. They align Luxembourg’s financial market with the latest tech, including blockchain-based securities management.

Features of Blockchain Bill IV

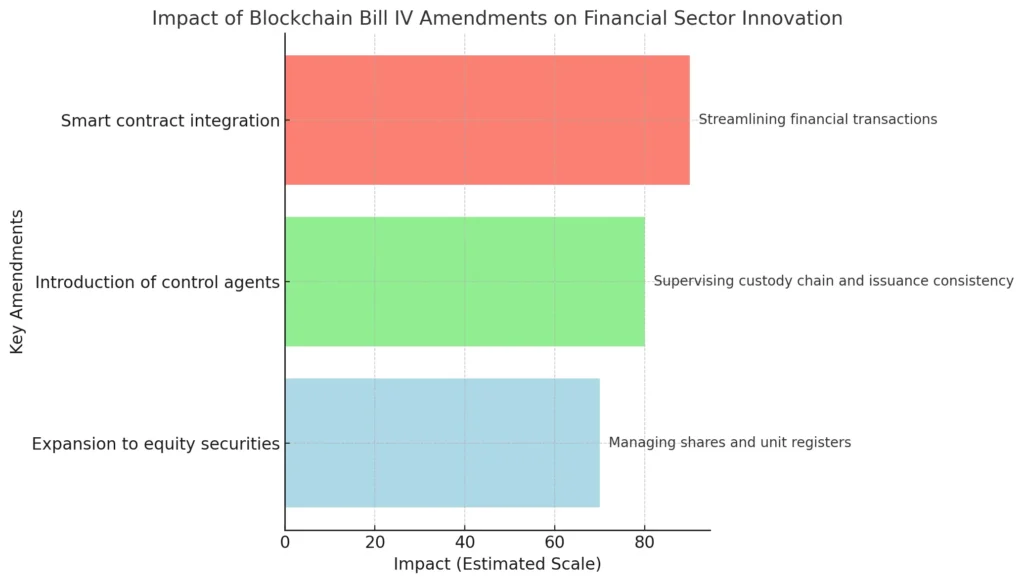

Blockchain Bill IV changes Luxembourg’s DLT laws. It is critical. A key amendment is to include equity securities besides debt securities. It lets financial firms use DLT to manage shares and unit registers. This streamlines processes for fund management and transfer agents. The law also introduces a control agent. It is an EU investment firm or credit institution. It will oversee the issuance of dematerialized securities using DLT. The control agent ensures consistent securities registration on the DLT network. It supervises the custody chain, enhancing transparency and reducing reliance on traditional intermediaries.

Effect on Financial Sector Innovation

The regulators designed the updated blockchain regulations to foster financial innovation. The law simplifies payments and reconciliations. It does this by allowing tokenized securities and smart contracts. Using smart contracts in the DLT framework automates key financial transactions. This cuts costs, boosts efficiency, and improves market transparency. For Luxembourg, this shift boosts its financial sector competitiveness. It also positions the country as a global leader in blockchain adoption.

| Amendment | Benefit | Blockchain Application |

|---|---|---|

| Expansion to equity securities | Increased flexibility for financial institutions | Managing shares and unit registers using DLT |

| Introduction of control agents | Enhanced legal certainty for securities issuance | Supervising custody chain and issuance consistency on DLT |

| Smart contract integration | Automation and reduced costs | Streamlining financial transactions |

Note

Update of Luxembourg’s regulations will boost blockchain use in its financial markets. It provides the needed legal basis.

Role of Control Agents in Securities Issuance

The introduction of control agents is a critical feature of Blockchain Bill IV. The issuer can select these entities. They manage the issuance of dematerialized securities using DLT. They must maintain securities accounts and verify the consistency between issued and registered securities. Also, supervise the custody chain for investors and account holders. Control agents offer a better way to issue securities. They use DLT for securities management. This removes the need for traditional intermediaries. It makes the process more efficient and transparent.

Regulatory Enhancements for DLT and Tokenization

Luxembourg’s new rules have increased the use of DLT in its financial markets. They focus on tokenization. The Blockchain Bill IV expands DLT’s role. It aims to boost blockchain use and market transparency. These rules have made Luxembourg a leader in financial innovation. They provide a flexible, secure framework for digital assets. This helps the financial sector stay competitive in a fast-evolving global market.

Expanded Scope for Tokenized Securities

A major change in Blockchain Bill IV is this: it expands the DLT framework to include equity and debt securities. This change helps the fund industry and financial institutions in Luxembourg. It lets them issue, hold, and manage tokenized securities on a blockchain. It allows for more efficient, flexible management of shares and units, and reduces the need for intermediaries.

Note

Tokenization boosts liquidity for illiquid assets like real estate and private equities, making them more accessible to a broader range of investors.

Legal Framework for Financial Collateral

Luxembourg’s rules boost DLT use for financial collateral. They ensure legal certainty for digital securities transactions. The 2024 updates allow using DLT securities as collateral under the financial laws. It makes pledging digital assets easier. It also clarifies the law for firms and investors using blockchain to collateralize assets. These updates clarify the law and make Luxembourg better for blockchain finance.

Integration of Smart Contracts

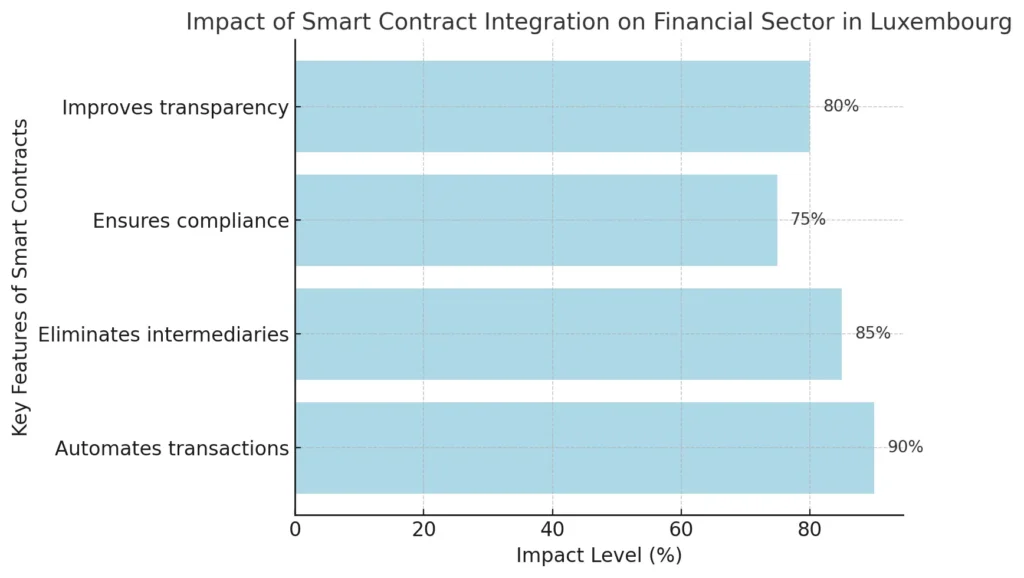

Another critical development is the integration of smart contracts in Luxembourg’s DLT framework. Smart contracts automate financial transactions. They embed rules in the blockchain and cut out middlemen. They also speed up payments and boost security and transparency. Luxembourg’s updated rules on smart contracts boost efficiency in the financial sector. They automate payments, interest, and dividends, making managing them more manageable.

Potential Checklist for Smart Contract Integration:

- Automates financial transactions (reducing manual processes).

- Eliminates intermediaries, lowering costs.

- Ensures compliance by embedding regulatory requirements directly into contract execution.

- Improves transparency with real-time, immutable transaction records.

Impact on Market Security and Transparency

Luxembourg’s new rules aim to improve security and transparency in its blockchain finance market. DLT will boost the security of financial operations. This is vital for investor confidence. The new regulations make Luxembourg a leader in digital finance. They set a clear legal framework for using DLT in securities and asset management.

Enhancing Market Transparency with DLT

DLT enables real-time tracking and verification of financial transactions. This greatly boosts transparency in Luxembourg’s financial markets. DLT provides a shared, viewable ledger. It allows tracing of each transaction. This makes records tamper-proof and auditable. This lowers the risk of fraud. It also improves financial data for issuers and investors. DLT’s transparency is vital for complex financial products and tokenized assets. They often need more oversight.

Safeguarding Investor Interests

The updated laws also protect investors. They ensure legal certainty for blockchain transactions. The Control Agent, from Blockchain Bill IV, oversees securities issuance. It must ensure proper management of digital assets on the DLT network. Ensures all records are consistent and reliable. It’s key to safeguarding investor interests, especially with tokenized securities.

Note

Luxembourg’s Rules create a more transparent market. Investors can then trust the integrity and security of their digital assets.

Impact on Market Security and Transparency

Luxembourg’s new rules aim to improve security and transparency in its blockchain finance market. DLT will boost the security of financial operations. This is vital for investor confidence. The new regulations make Luxembourg a leader in digital finance. They set a clear legal framework for using DLT in securities and asset management.

Enhancing Market Transparency with DLT

DLT enables real-time tracking and verification of financial transactions. This greatly boosts transparency in Luxembourg’s financial markets. DLT provides a shared, viewable ledger. It allows tracing of each transaction. This makes records tamper-proof and auditable. This lowers the risk of fraud. It also improves financial data for issuers and investors. DLT’s transparency is vital for complex financial products and tokenized assets. They often need more oversight.

Safeguarding Investor Interests

The updated laws also protect investors. They ensure legal certainty for blockchain transactions. The Control Agent, from Blockchain Bill IV, oversees securities issuance. It must ensure proper management of digital assets on the DLT network. Ensures all records are consistent and reliable. It’s key to safeguarding investor interests, especially with tokenized securities. These rules also create a more transparent market. Investors can then trust the integrity and security of their digital assets.

Implications for Crypto Businesses and Blockchain Adoption

Luxembourg’s new blockchain laws favor crypto startups and blockchain firms. Blockchain Bill IV and MiCA (Markets in Crypto-Assets) help crypto. They provide more legal certainty, better security, and a flexible legal framework. This makes Luxembourg a more attractive hub for blockchain and crypto firms.

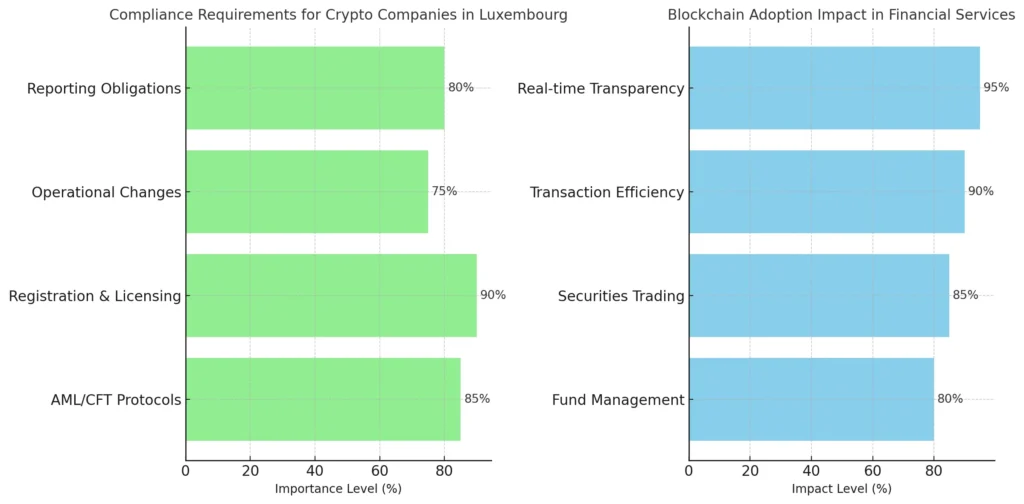

Compliance Requirements for Crypto Companies

For crypto businesses operating in Luxembourg, compliance with updated regulations is critical. The CSSF requires crypto-asset service providers to get licenses to operate legally. Key compliance areas include AML/CFT (Anti-Money Laundering and Counter-Terrorism Financing) protocols. They need strict reporting and operational standards. MiCA requires crypto firms to register and follow EU rules. These rules protect consumers, ensure market integrity, and maintain financial stability.

Potential Checklist:

- Key Compliance Areas: AML/CFT protocols, registration, and licensing.

- Operational Changes: New reporting and operational standards under MiCA.

- Reporting Obligations: Regular communication and compliance checks with CSSF.

Blockchain Adoption in Financial Services

Luxembourg’s new laws also promote using blockchain in finance. Distributed Ledger Technology (DLT) is being used more in finance. It can streamline transactions, like those with tokenized securities and intelligent contracts. These innovations reduce costs, increase efficiency, and provide real-time transparency. Blockchain is revolutionizing financial services, including fund management and securities trading.

Check the below Links for Further Reading

- Taiwan’s Digital Asset Regulations Update

- Impact of US Inflation Data on Crypto

- DeFi Protocols Adapting to Regulation

- SEC’s New Crypto Reporting Requirements

- New DeFi Protocol Launches and Market Impact

Luxembourg’s new blockchain laws boost the crypto and finance sectors. They create a more robust and adaptable environment for both. These changes will boost blockchain use and secure the market. They will also set key standards for crypto firms. Luxembourg is a global financial hub that fosters innovation while maintaining regulatory oversight.