In 2024, liquidity shifts in major cryptocurrencies have become a critical factor influencing market dynamics. Understanding these shifts is vital, as they affect price stability, trading volumes, and overall market health. Recent trends, such as the approval of Bitcoin exchange-traded funds (ETFs) and technological advancements, have dramatically altered the liquidity landscape, affecting crypto prices and investor behavior. These shifts have led to increased market volatility, emphasizing the interconnectedness of liquidity and market dynamics. The effects of these liquidity changes are particularly significant for major cryptocurrencies like Bitcoin and Ethereum, impacting both short-term price movements and long-term market trends. With the crypto market becoming more entwined with global financial systems, monitoring these liquidity shifts is more crucial than ever.

Overview of Liquidity Shifts in Major Cryptocurrencies in 2024

In 2024, liquidity trends in the cryptocurrency markets have undergone significant changes, influenced by regulatory approvals, technological advancements, and market dynamics. These shifts have impacted how assets like Bitcoin, Ethereum, and others are traded, affecting overall market behavior and sentiment. Increased adoption and the introduction of Bitcoin exchange-traded funds (ETFs) have been particularly influential, driving global cryptocurrency activity to new heights. This section explores these key liquidity trends, highlighting their effects on market stability and trading dynamics.

Key Liquidity Trends in 2024

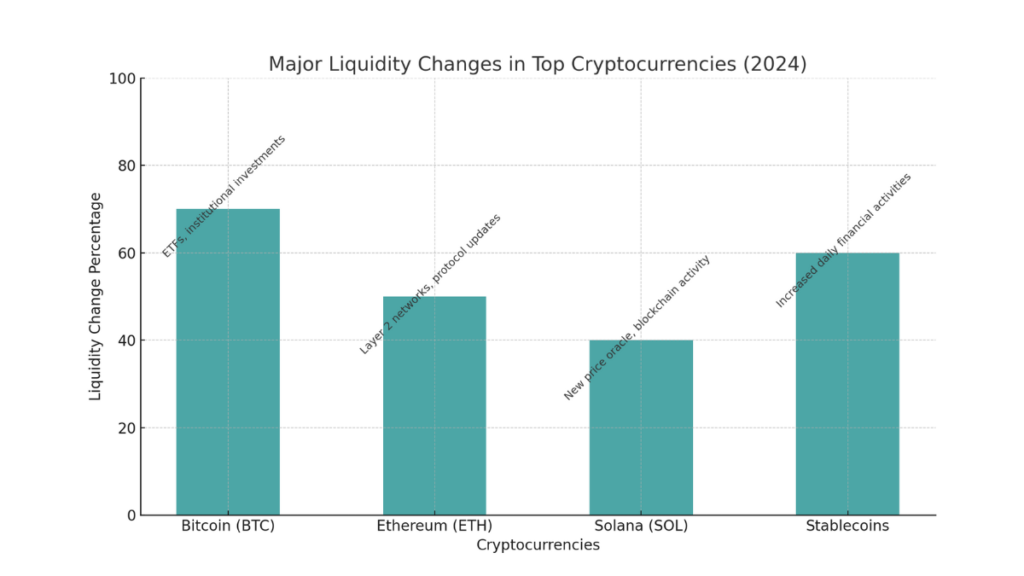

The bar chart illustrating the major liquidity changes in top cryptocurrencies for 2024. The chart shows the liquidity change percentages for Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Stablecoins, along with the contributing factors for each asset.

In 2024, a few key liquidity trends have shaped the cryptocurrency markets:

- Bitcoin ETFs and Market Activity: The approval of Bitcoin ETFs in the United States has been a game-changer, driving a surge in global crypto activity. The launch of these ETFs in January 2024 triggered a massive increase in the value of Bitcoin transactions across all regions. This development led to heightened market activity, surpassing even the peak levels observed during the 2021 bull market. Institutional investors have played a significant role in this trend, especially in high-income regions like North America and Western Europe, contributing to market liquidity and overall trading volume.

- Stablecoin Transactions: Stablecoins have seen a marked increase in usage, especially among retail and professional investors. In 2024, the volume of transactions via stablecoins has begun to surpass those of traditional financial networks like Visa, highlighting stablecoins as a critical component of daily financial activities and market liquidity.

- Trading Volume and Exchange Liquidity: Liquidity on cryptocurrency exchanges has been bolstered by factors such as increased trading volumes, deeper markets, and a wider range of trading pairs. High liquidity indicates a healthy market, enabling smooth transactions and stable prices. This has allowed investors to enter and exit positions more efficiently, reducing transaction costs and the risk of abrupt price swings.

| Cryptocurrency | Major Liquidity Change (2024) | Contributing Factors |

|---|---|---|

| Bitcoin (BTC) | Significant increase | Bitcoin ETFs, institutional investments |

| Ethereum (ETH) | Doubling of revenue | Layer 2 networks, protocol updates |

| Solana (SOL) | High growth in market cap | New price oracle, blockchain activity |

| Stablecoins | Surpassing Visa transactions | Increased daily financial activities |

Major Crypto Assets Experiencing Liquidity Changes

- Bitcoin (BTC): Bitcoin has been at the forefront of liquidity shifts in 2024, primarily due to the launch of Bitcoin ETFs. This has made Bitcoin more accessible to a broader investor base, leading to an influx of capital and increased liquidity. The upcoming Bitcoin Halving event also contributes to market dynamics, influencing supply and demand.

- Ethereum (ETH): Ethereum has experienced a doubling in revenue, driven by its Layer 2 networks like Polygon and Arbitrum. Protocol updates and a focus on reducing transaction fees have attracted more users and traders, enhancing Ethereum’s liquidity.

- Solana (SOL): Solana has emerged as a significant player, with substantial growth in market capitalization and Total Value Locked (TVL). Innovations such as the new price oracle, Pyth, have contributed to its rising liquidity, making it one of the top blockchains by market cap.

Market Reactions to Liquidity Shifts

Market reactions to these liquidity shifts have been multifaceted:

- Price Fluctuations: The introduction of Bitcoin ETFs has led to increased market activity, resulting in price fluctuations across major cryptocurrencies. Increased liquidity has contributed to more stable price movements, although instances of high volatility still occur, especially during major market events like ETF launches or protocol updates.

- Trading Volume: Higher liquidity has encouraged more trading activity, as investors can now execute trades more efficiently without significant price impact. This has led to a surge in trading volumes, particularly for Bitcoin and Ethereum.

- Investor Sentiment: Positive market sentiment has been buoyed by these liquidity shifts. Institutional investors’ growing involvement has added credibility to the market, attracting more participants and fostering an environment of confidence and growth.

Impact of Liquidity Shifts on Cryptocurrency Prices and Volatility

Liquidity shifts play a crucial role in shaping cryptocurrency prices and market volatility. In 2024, these shifts have influenced the crypto markets in various ways, both directly and indirectly. For investors and traders, understanding the relationship between liquidity and market dynamics is key to navigating the often unpredictable crypto landscape.

Effects on Price Fluctuations

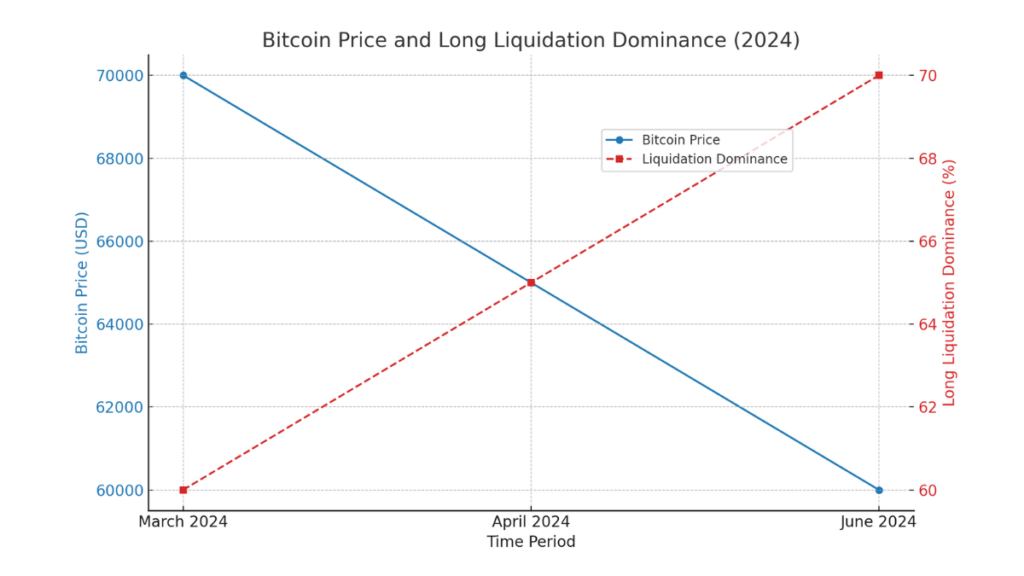

Changes in liquidity have a direct impact on cryptocurrency price movements. In 2024, fluctuations in Bitcoin’s liquidity, especially in futures markets, have led to significant price changes. For instance, Bitcoin’s long liquidation dominance fluctuated notably throughout the year, especially in April and June. During these periods, spikes in long liquidations correlated with Bitcoin’s price declines, demonstrating how market corrections can trigger rapid shifts in leveraged positions. In March, long liquidation dominance surged over 60%, coinciding with a price drop from around $70,000 to $60,000. This pattern indicates that when liquidity is constrained, especially during periods of market correction, it can lead to sharper price movements and increased volatility.

Moreover, Bitcoin’s upcoming halving event is expected to further impact altcoin ecosystems, with altcoins reacting differently based on factors like tokenomics and market sentiment. Historically, altcoins have mirrored Bitcoin’s price dynamics around such events, with changes in Bitcoin’s liquidity causing ripple effects across the broader crypto market. For example, the anticipation of the 2024 halving has already influenced investor behavior, with many turning towards altcoins with solid fundamentals in search of better returns, adding to liquidity-driven price changes across multiple assets.

Influence on Market Volatility

Liquidity shifts are also a key driver of market volatility. In 2024, Bitcoin’s market volatility has been partly driven by changes in liquidity, particularly in futures trading. As liquidity decreases, the market becomes more sensitive to large orders, leading to abrupt price swings. The dominance of long liquidations in the Bitcoin futures market, which hit 70% in June, underscores this point. When liquidity is low, large sell-offs or buy-ins can have an outsized effect on prices, leading to turbulent market conditions. Conversely, increased liquidity can stabilize markets by absorbing large trades without causing significant price disruptions.

The Bitcoin halving event expected in 2024 further contributes to this volatility. By reducing the issuance rate of new bitcoins, the halving creates a supply shock that can exacerbate market fluctuations. Market participants are closely watching these dynamics, as changes in liquidity around the halving may lead to a period of heightened volatility, affecting not only Bitcoin but also the broader altcoin market.

Short-Term vs. Long-Term Liquidity Shifts

The effects of short-term liquidity shifts differ significantly from long-term trends. Short-term liquidity shifts, such as those caused by sudden market corrections or news events, can lead to rapid price changes and increased volatility. For example, spikes in long liquidations can cause swift price declines, as seen in Bitcoin’s price drop from $70,000 to $60,000 in March 2024. These short-term shifts can result in volatile trading environments, with sharp swings in prices as traders react to the changing market landscape.

In contrast, long-term liquidity trends are influenced by broader factors such as market maturation, regulatory changes, and technological advancements. Over the long term, the approval of Bitcoin ETFs and the growing adoption of decentralized finance (DeFi) are expected to improve overall market liquidity, reducing volatility and fostering a more stable trading environment. However, long-term shifts like Bitcoin halving can also introduce periods of increased volatility as markets adjust to new supply and demand dynamics. Thus, understanding the interplay between short-term liquidity shifts and long-term trends is essential for investors and traders aiming to navigate the crypto market effectively.

The line graph showing Bitcoin’s price and long liquidation dominance in 2024. The chart displays how Bitcoin’s price declined over key months while the liquidation dominance increased, indicating the impact of liquidity shifts on market volatility.

Liquidity Shifts and Market Sentiment in 2024

In 2024, liquidity shifts have significantly influenced market sentiment within the cryptocurrency landscape. The relationship between liquidity levels and investor sentiment is intricate, with shifts in liquidity often driving periods of both optimism and caution in the crypto market.

Liquidity-Driven Market Sentiment Shifts

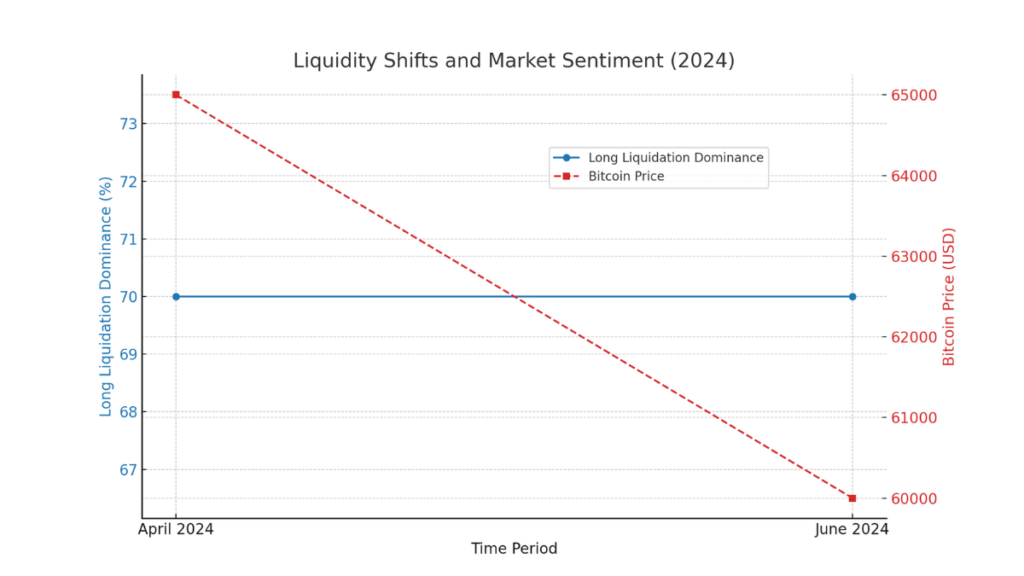

Liquidity changes have been a key driver of market sentiment in 2024. For instance, Bitcoin’s long liquidation dominance spiked in April and June, reaching as high as 70%, which coincided with a decline in Bitcoin’s price. This surge in liquidation dominance indicates heightened market instability and risk aversion among traders, leading to a more bearish sentiment during those periods. Conversely, when liquidity is more abundant, markets generally experience periods of bullish sentiment, as investors feel more confident entering and exiting positions without significantly impacting prices. This trend underscores how liquidity-driven changes can influence the overall mood of the market, triggering cycles of bullishness and bearishness based on the prevailing liquidity conditions.

This line graph illustrates the relationship between long liquidation dominance and Bitcoin’s price in 2024. It shows how spikes in long liquidation dominance coincide with declines in Bitcoin’s price, highlighting the impact of liquidity shifts on market sentiment.

Investor Reactions to Liquidity Changes

Investor behavior has been notably reactive to recent liquidity shifts. As liquidity fluctuates, it directly affects trading behaviors and market strategies. For example, increased long liquidation dominance in 2024 led to more cautious trading, with investors adjusting their strategies to mitigate risks associated with leveraged positions. Additionally, as Bitcoin’s realized cap approached $600 billion, reflecting increased confidence among long-term holders, short-term holder activity also spiked. This rejuvenation of market forces suggests that investors are becoming more willing to engage in speculative activities during periods of improved liquidity, leading to new investment cycles and shifts in market dynamics. This real-time analysis of liquidity changes indicates that investor sentiment is closely tied to liquidity conditions, often dictating market moves and strategic decisions.

Correlation Between Liquidity and Market Stability

Liquidity levels play a crucial role in determining market stability. In periods of high liquidity, markets tend to be more stable, as they can absorb large buy and sell orders without causing significant price disruptions. However, when liquidity is low, the market becomes more volatile and susceptible to abrupt price swings. In 2024, the fluctuating liquidity levels have been associated with market instability, particularly during instances of high long liquidation dominance. These fluctuations can either bolster or undermine market confidence, depending on how they affect traders’ ability to execute large transactions efficiently. The interplay between liquidity and stability is thus a key factor that market participants must consider, as it can dictate the extent of price movements and the overall market environment.

Global Factors Influencing Liquidity Shifts in Cryptocurrencies

In 2024, several global economic and regulatory factors have significantly influenced liquidity in the cryptocurrency market. These factors range from central bank policies to changing regulatory landscapes and broader macroeconomic events, all contributing to shifts in liquidity levels for major cryptocurrencies like Bitcoin and Ethereum.

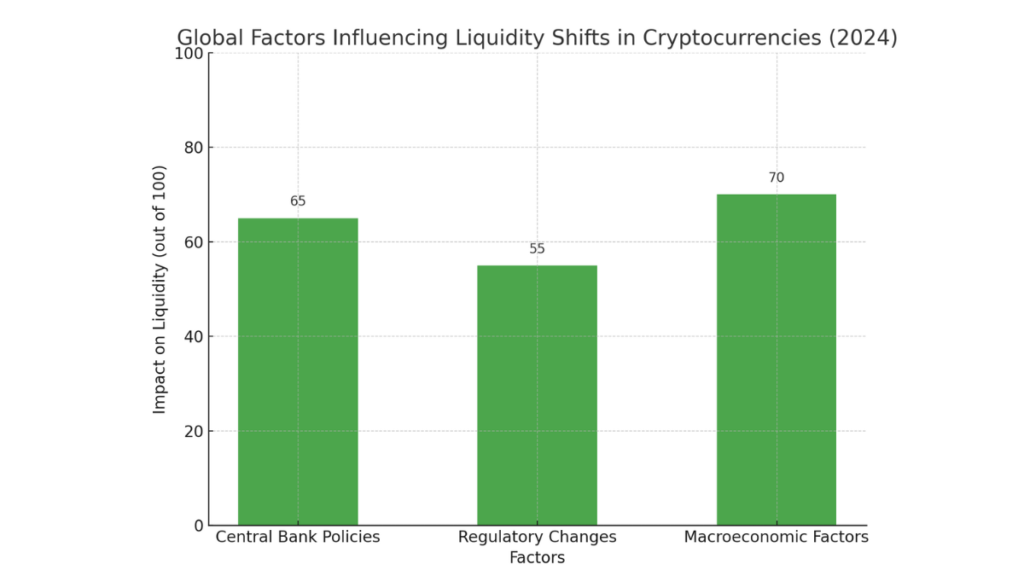

A bar chart illustrating the impact of different global factors on cryptocurrency liquidity shifts in 2024. The chart shows the hypothetical impact scores of central bank policies, regulatory changes, and macroeconomic factors on market liquidity.

Central Bank Policies and Liquidity

Central bank policies, particularly those of the U.S. Federal Reserve, have had a profound impact on global liquidity and, by extension, on the cryptocurrency market. In 2024, actions such as interest rate changes and monetary policy adjustments have created ripple effects across the crypto landscape. For instance, the U.S. was expected to enter a recession in the first half of 2024, marked by the longest bond market inversion in history. Although the recession has not fully materialized, this inversion served as a strong signal of looming economic uncertainty, influencing investor sentiment and crypto market liquidity. The introduction of Bitcoin ETFs with significant inflows ($14.5 billion) has helped maintain Bitcoin’s price above $30,000, demonstrating how central bank policies indirectly impact the liquidity of major crypto tokens by affecting the broader economic environment.

Regulatory Developments and Market Liquidity

Regulatory changes have been pivotal in shaping market liquidity in 2024. Various jurisdictions have been moving towards stricter oversight of the crypto market, aiming to enhance stability and investor protection. Notably, the introduction of Bitcoin and Ethereum ETFs has played a key role in increasing market liquidity. These financial products have attracted substantial inflows, despite experiencing some net outflows recently, as observed with a $54 million outflow in Ark’s ETFs. This regulatory push has encouraged the creation of crypto-focused financial products, which have, in turn, drawn more institutional investors into the market. However, the tightening regulatory environment also presents compliance challenges for crypto entities, creating a complex dynamic where regulations both support and restrict liquidity in different ways.

Macroeconomic Factors Influencing Liquidity

Global economic factors, such as inflation rates and geopolitical events, have significantly influenced liquidity in the crypto markets in 2024. For example, Bitcoin has been seen as a hedge against inflation, particularly in countries like Brazil, where annual inflation rates have reached 13%. This situation has prompted more investors to turn to cryptocurrencies, thereby influencing liquidity. Additionally, political changes and economic uncertainty have driven Bitcoin’s price to an all-time high in Q4 2024. Despite initial recession predictions, Bitcoin has largely traded above $60,000 since March, indicating how macroeconomic factors can drive liquidity shifts in crypto markets by altering investor behavior and risk perceptions.

Read More

- Key Altcoin Market Movements

- Impact of Network Congestion on Crypto Prices

- Market Reactions to Interest Rate Changes

- Market Dynamics Influenced by Liquidity in Crypto Assets

Liquidity Trends: Forecasts and Expectations for the Remainder of 2024

The cryptocurrency market in 2024 is marked by several key factors that are expected to influence liquidity trends in the coming months. The launch of Bitcoin exchange-traded funds (ETFs), monetary policy shifts, and the global economic climate are some of the primary drivers shaping the landscape. The continued growth in crypto activity surpassing the peaks of 2021 sets the stage for a dynamic market environment where liquidity plays a central role in investor strategies.

Anticipated Liquidity Drivers

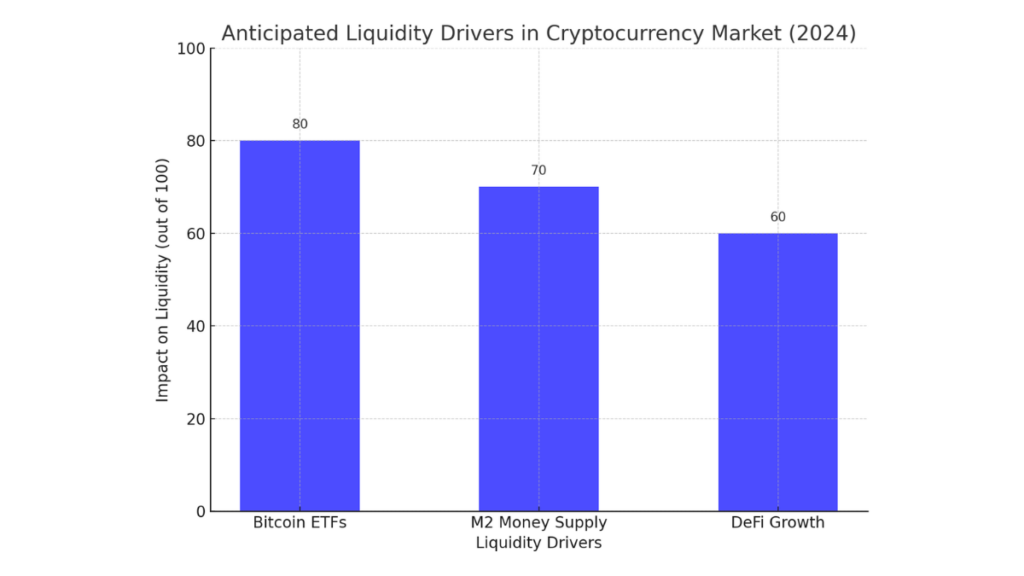

Key drivers expected to influence liquidity trends in the near future include:

- Bitcoin ETFs: The introduction of Bitcoin ETFs in the U.S. has sparked a surge in crypto activity globally. Since their launch, these ETFs have attracted considerable inflows, driving liquidity in the market. According to reports, the total value of global crypto transactions increased significantly between Q4 2023 and Q1 2024, largely due to the influx from Bitcoin ETFs. This trend is expected to continue, with institutional investors fueling the liquidity by using ETFs as a vehicle for market entry.

- Monetary Policies and M2 Money Supply: Changes in the money supply, particularly the M2 money supply, play a crucial role in shaping Bitcoin’s price cycles. The rate of change in the money supply has historically correlated with Bitcoin bull runs. In 2024, as the M2 supply growth turned positive, it signaled potential upward momentum for Bitcoin, which can impact market liquidity. Analysts predict that if the U.S. dollar weakens, it could act as “rocket fuel” for Bitcoin, driving further liquidity into the crypto market.

- DeFi Growth and Market Evolution: Decentralized finance (DeFi) is another key area that could drive liquidity. As DeFi protocols evolve to become more capital-efficient, they are likely to attract more users and liquidity providers. The focus on sustainable business models within DeFi, such as reducing reliance on protocol-generated token inflation, is expected to lead to a more robust market structure, enhancing liquidity flows.

A bar chart illustrating the impact of key liquidity drivers in the cryptocurrency market for the remainder of 2024. It highlights how Bitcoin ETFs, M2 money supply growth, and DeFi market evolution are expected to influence liquidity levels.

Potential Risks and Opportunities

While opportunities for increased liquidity are present, there are also notable risks:

Potential Opportunities:

- ETF Adoption: The rapid adoption of Bitcoin ETFs, which has been faster than any previous ETF, presents an opportunity for increased market liquidity. This could provide more entry points for institutional investors and stabilize trading activity.

- DeFi Maturation: As DeFi projects mature, they will offer new ways for investors to earn yields, creating more avenues for liquidity growth. Innovative DeFi models that focus on capital efficiency could result in a more liquid market.

Potential Risks:

- Regulatory Changes: Regulatory scrutiny remains a significant risk to liquidity. Policies enacted by governments worldwide could either facilitate or restrict liquidity flows, depending on the nature of the regulations.

- Market Volatility: The market is prone to volatility due to macroeconomic events. For example, if the dollar strengthens or interest rates rise, it could lead to reduced liquidity as investors seek safer assets.

Risk Assessment Checklist:

- Changes in global regulatory policies

- Fluctuations in the U.S. dollar index

- Shifts in central bank monetary policies

- DeFi project security risks

Strategies for Navigating Liquidity Changes

Investors and analysts can adopt several strategies to navigate these changing liquidity conditions:

- Diversification: Spreading investments across various crypto assets and DeFi platforms can help mitigate the risks associated with liquidity shifts.

- Monitoring Macro Indicators: Keeping a close watch on macroeconomic indicators like the M2 money supply and central bank policies can provide insights into potential liquidity movements.

- Utilizing ETFs: Bitcoin ETFs offer a regulated avenue for institutional investors to participate in the market, potentially providing a buffer against extreme liquidity fluctuations.

Note

By staying informed about these drivers and strategically managing exposure, investors can better position themselves to capitalize on emerging trends while mitigating potential risks.

In 2024, liquidity shifts in the cryptocurrency market have become a key factor influencing price dynamics, market sentiment, and investor behavior. As the market evolves, factors like Bitcoin ETFs, central bank policies, and DeFi innovations are driving new liquidity trends. Looking ahead, managing these shifts will be crucial for both short-term trading strategies and long-term market stability.