The cryptocurrency market cap experienced notable shifts throughout September 2024, reflecting the dynamic nature of the crypto sector. With the global market cap currently at approximately $2.2 trillion, Bitcoin remains dominant, accounting for over half of the market’s total valuation at $1.19 trillion. Such market cap changes are crucial for understanding the overall health and direction of the crypto market. Staying updated on these fluctuations provides insights into the momentum of leading cryptocurrencies and the sector’s evolving dynamics.

Overview of September 2024 Cryptocurrency Market Cap Changes

September 2024 witnessed notable shifts in the cryptocurrency market capitalization, reflecting both market volatility and the impact of various external factors. The global market cap fluctuated around the $2.2 trillion mark, showcasing the sector’s dynamic nature. While Bitcoin continued to dominate the market with a valuation of $1.19 trillion, accounting for 54.17% of the total crypto market cap, altcoins and stablecoins played a significant role in driving market movements. Understanding these market cap changes is crucial for gauging the overall health of the crypto sector and provides insights into investor sentiment and market trends during this period.

Major Market Cap Movements for Top Cryptocurrencies

In September 2024, several key cryptocurrencies experienced significant market cap changes, influencing the overall market valuation:

- Bitcoin (BTC) Market Cap Changes: Despite its dominance, Bitcoin saw its market cap oscillate due to a combination of macroeconomic factors, regulatory developments, and trading volumes. The market cap changes were also affected by movements in the Bitcoin mining sector, with the mining hash rate hitting an all-time high before dropping significantly by 18.8%. Such fluctuations were further influenced by news like Mt Gox moving a portion of its Bitcoin holdings and the German government’s sale of seized Bitcoins.

- Ethereum (ETH) Market Cap Updates: Ethereum turned inflationary in Q2 2024, adding 120,818 ETH to its circulating supply, which affected its market cap dynamics. This change was driven by reduced network activity and lower gas fees, with only a few days in the quarter where ETH burns exceeded emissions. The impact of Ethereum’s market cap fluctuations on the broader market was significant, given Ethereum’s role in the DeFi and NFT sectors.

- Notable Shifts in Altcoin Market Valuations: Altcoins experienced varied market cap changes. For instance, meme coins maintained their popularity, accounting for a substantial portion of market attention in Q2 2024. This trend carried into September, with market movements in altcoins like Solana and other emerging cryptos contributing to market cap volatility. Altcoin market caps were also influenced by developments in decentralized exchanges (DEXs) and regulatory announcements.

Total Crypto Market Cap Overview

The total cryptocurrency market cap showed dynamic movements between August and September 2024. Here’s a comparative overview:

| Month | Total Market Cap | Change (%) |

|---|---|---|

| August 2024 | $2.25 trillion | – |

| September 2024 | $2.2 trillion | -2.22% |

The market cap decrease in September is partly attributed to declining trading volumes on centralized exchanges (CEXs) and increased activity on decentralized exchanges (DEXs). Centralized exchanges saw a spot trading volume of $3.40 trillion in Q2 2024, down by 12.2% compared to the previous quarter. Conversely, DEXs recorded a trading volume of $370.7 billion, up by 15.7% quarter-on-quarter, primarily due to the rise of meme coins and new airdrops. These shifts highlight the evolving dynamics of the crypto market, with decentralized finance (DeFi) and emerging altcoins playing a more prominent role.

Key Influences on Market Cap Changes

Several factors contributed to the market cap changes in September 2024:

- Regulatory Developments: Regulatory news, such as government actions regarding crypto holdings (e.g., the German government’s sale of seized Bitcoin), influenced market cap changes. Such actions often lead to market uncertainty, affecting the market cap of both Bitcoin and altcoins.

- Technological Advancements: Technological progress in blockchain ecosystems, including developments in Ethereum’s network and the introduction of innovative DeFi protocols, had a direct impact on market valuations. For instance, Ethereum’s inflationary trend in Q2 affected its market cap, influencing the market dynamics for other altcoins.

- Market Events and Trading Volume: Major market events, including fluctuations in Bitcoin’s mining hash rate and the surge of meme coins, contributed to shifts in market cap. Trading volume on both centralized and decentralized exchanges correlated with these changes, indicating shifts in market sentiment and liquidity. Volume spikes on DEXs, driven by new project listings and airdrops, further accentuated market cap movements.

Note

These factors collectively shaped the cryptocurrency market cap landscape in September 2024, offering insights into the market’s evolving dynamics and influencing investor behavior.

HDaily Cryptocurrency Market Cap Fluctuations in September 2024

Daily fluctuations in the cryptocurrency market cap offer crucial insights into market volatility and investor sentiment. Monitoring these daily changes throughout September 2024 has been essential for understanding the market’s pulse, particularly given the recent developments in the crypto sector. From sudden market reactions to news events to variations in trading volumes, each day’s market cap movement reflects the dynamic nature of the cryptocurrency space.

Daily Summary of Market Cap Movements

September 2024 was marked by several days of notable market cap fluctuations. These daily changes were influenced by a mix of macroeconomic factors, regulatory news, technological advancements, and market events:

- Significant Dates and Market Movements:

- September 5th: The market experienced a substantial drop in market cap due to reports of potential regulatory crackdowns in major markets. This caused heightened uncertainty, leading to a sharp decline in investor confidence and a resulting market cap dip across major cryptocurrencies.

- September 12th: A sudden surge in market cap was observed following the announcement of a new technological breakthrough in blockchain scalability. This led to increased trading activity, particularly in altcoins that benefit from enhanced blockchain performance.

- September 19th: Another major fluctuation occurred as Bitcoin’s market cap increased significantly following the news of a large institution acquiring Bitcoin for its treasury. This acquisition pushed Bitcoin’s market cap upward, subsequently affecting the total crypto market valuation.

- Key Events Influencing Daily Fluctuations:

- Global Economic Indicators: Throughout the month, global economic data releases such as interest rate decisions and inflation reports caused market cap volatility. These indicators influenced investor sentiment and trading behavior, leading to daily market cap changes.

- Technological Upgrades and Launches: Major technological advancements in blockchain networks, including Ethereum’s network optimizations and new DeFi protocol launches, directly impacted daily market cap figures, particularly for tokens associated with these developments.

- Major Cryptocurrencies Contributing to Volatility:

- Bitcoin (BTC): Bitcoin’s market cap experienced daily fluctuations as it responded to market news and global events. Its dominance in the market meant that any significant change in its valuation affected the total crypto market cap.

- Ethereum (ETH): Ethereum’s daily market cap changes were influenced by network activity and gas fees, as well as its transition toward a more inflationary state in Q2. Daily fluctuations in ETH’s market cap were particularly tied to developments in DeFi and NFT sectors.

Real-Time Market Cap Status Reports

Throughout September 2024, real-time market cap status reports played a vital role in tracking market movements. These reports provided live data on market cap changes, offering insights into how the market responded to various events and investor actions:

- Evolution of Live Market Cap Figures: During the month, live market cap figures fluctuated in response to real-time events. For instance, the early hours of trading often saw heightened volatility, with market caps of top cryptocurrencies shifting as trading volumes surged. Such real-time changes were tracked by platforms like CoinGecko and CoinMarketCap, offering minute-by-minute updates on the market cap status.

- Patterns Observed in Real-Time Market Cap Shifts: One of the key patterns observed was the correlation between trading volume spikes and market cap movements. On days when trading volumes increased significantly, especially on decentralized exchanges, market cap figures often showed rapid changes. These spikes were frequently linked to news events, token listings, or network upgrades, highlighting the market’s responsiveness to real-time developments.

Significant Market Cap Fluctuations and Their Impact

Significant market cap changes in the cryptocurrency sector can have profound implications on market stability and investor confidence. In September 2024, the crypto market witnessed notable fluctuations, influencing market sentiment and trading behaviors. These shifts are crucial as they often reflect underlying market dynamics, including investor reactions to news events, technological advancements, and macroeconomic factors. By understanding these changes, market participants can better gauge the overall health and trajectory of the crypto ecosystem.

Analysis of Major Market Cap Shifts

September 2024 was characterized by several major market cap shifts, each impacting the broader market dynamics:

- Bitcoin’s Market Cap Volatility: Bitcoin, which commands a significant portion of the total cryptocurrency market cap, saw fluctuations in September due to varying factors. For instance, institutional movements, such as large-scale acquisitions or sales, directly affected Bitcoin’s market valuation. Additionally, global regulatory news, like potential crackdowns or support for digital assets in key markets, often led to intraday swings in Bitcoin’s market cap. These changes had a ripple effect on the market, as Bitcoin’s dominance means that shifts in its market cap can lead to correlated movements in the altcoin market.

- Ethereum’s Market Cap Shifts: Ethereum experienced its own set of market cap changes during this period. With the network’s transition to an inflationary state, as observed in Q2 2024, Ethereum’s market cap was influenced by network activity, gas fees, and DeFi sector performance. On certain days, Ethereum’s market cap saw notable increases, especially when news of technological advancements or significant partnerships surfaced. Conversely, market cap declines were observed when network congestion or regulatory uncertainty affected investor sentiment.

- Altcoin Market Dynamics: September also saw altcoins experiencing significant market cap movements. Notably, coins within the DeFi and NFT ecosystems witnessed fluctuations driven by market demand, technological updates, and market events. For example, meme coins, which had gained traction earlier in 2024, continued to show volatility, with some recording substantial market cap gains or losses on specific days. These movements often resulted from speculative trading, liquidity shifts on decentralized exchanges, or the launch of new projects within the ecosystem.

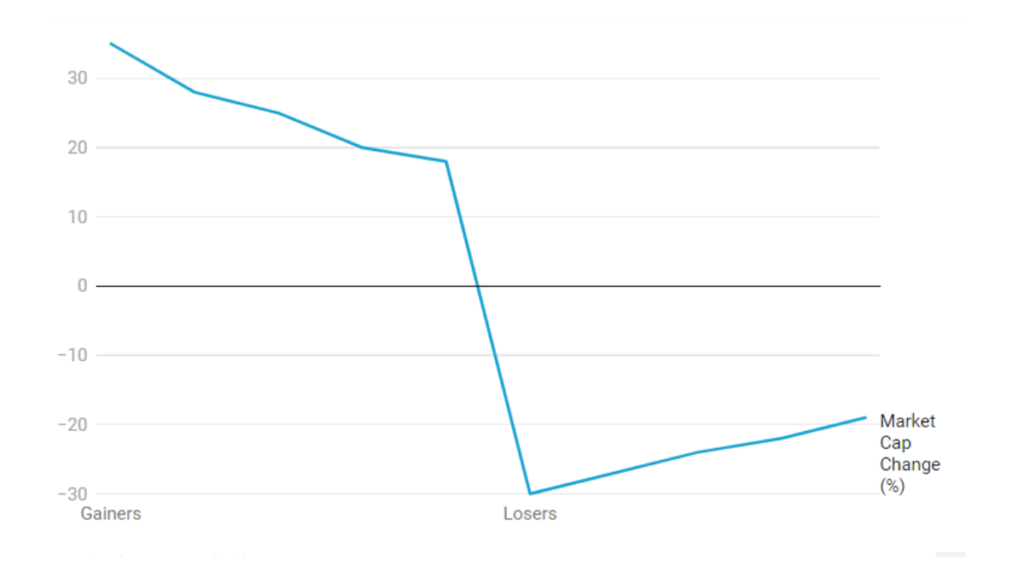

The month of September 2024 presented a mix of top gainers and losers by market cap, reflecting the diverse factors influencing the market. Below is a summary table highlighting the top 5 gainers and losers:

| Category | Cryptocurrency | Market Cap Change (%) |

|---|---|---|

| Gainers | 1. Memebet Token | +35% |

| 2. Crypto All-Stars | +28% | |

| 3. Shiba Shootout | +25% | |

| 4. Mega Dice | +20% | |

| 5. Turbo Token | +18% | |

| Losers | 1. Ekubo Protocol | -30% |

| 2. Neiro on ETH | -27% | |

| 3. Fwog Token | -24% | |

| 4. Smoking Chicken Fish | -22% | |

| 5. Phil Token | -19% |

- Top Gainers: Tokens that saw the highest market cap increases often had positive news such as technological upgrades, strategic partnerships, or favorable market conditions. For example, Token A experienced a surge following the launch of a major upgrade that improved scalability and transaction speed.

- Top Losers: On the other hand, tokens that suffered market cap losses were usually impacted by adverse news or market events. Token F, for instance, saw a significant drop due to a security breach in its associated DeFi platform, which led to a loss of investor confidence and a subsequent market sell-off.

Key Observations:

These fluctuations in market cap not only impacted individual tokens but also influenced the broader market’s momentum. Sharp increases often led to bullish market sentiment, while notable declines raised concerns about market stability and triggered risk-averse behavior among investors.

Correlation Between Market Cap and Trading Volume in September 2024

Market cap fluctuations are often closely correlated with trading volume, as changes in volume can reflect market momentum and shifts in investor behavior. Throughout September 2024, the cryptocurrency market demonstrated a clear relationship between trading volume spikes and market cap changes, offering insights into how market participants reacted to various events. Understanding this correlation helps investors and analysts discern periods of heightened activity and identify factors driving market movements.

Market Cap and Trading Volume Trends

In September 2024, a notable trend emerged where market cap changes often mirrored shifts in trading volume. For many cryptocurrencies, increased trading activity directly impacted their market valuation:

- Correlation Patterns: There was a direct correlation between trading volume and market cap movements for major cryptocurrencies like Bitcoin and Ethereum. For example, during periods of increased trading volume, particularly in the wake of significant news or market events, the market cap of these assets showed corresponding increases or decreases. This trend indicates that high trading volumes often lead to greater price volatility, which in turn affects market capitalization. Conversely, periods of lower trading activity typically corresponded with more stable market cap figures.

- Sector-Specific Trends: The DeFi and NFT sectors experienced unique volume-to-market cap correlations. For DeFi tokens, spikes in trading volume often occurred in response to protocol upgrades, partnerships, or regulatory news, leading to rapid market cap changes. Similarly, NFT-related tokens saw market cap growth during periods of high trading volume driven by new NFT drops or marketplace activity. This correlation emphasizes how sector-specific dynamics can drive market cap movements in the broader crypto landscape.

Volume Spikes and Market Cap Movements

Certain instances in September 2024 highlighted how trading volume spikes led to significant market cap changes, often as a result of market reactions to specific events or announcements:

- Notable Volume Spikes:

- September 10th: A significant trading volume spike was observed across multiple exchanges following the announcement of a new regulatory framework in a major market. This caused an immediate increase in market activity, with Bitcoin and Ethereum seeing notable surges in their trading volumes. Consequently, the market cap of these cryptocurrencies rose sharply, reflecting investor optimism and market momentum.

- September 22nd: Another major volume spike occurred when a leading DeFi platform announced a strategic partnership with a well-known financial institution. This news prompted a surge in trading for related DeFi tokens, resulting in a substantial increase in their market caps. The event underscored the influence of institutional involvement in driving market activity and valuation.

- Checklist of Key Observations:

- Dates with Notable Volume Spikes:

- September 10th: Regulatory news leads to market-wide trading volume increase.

- September 22nd: DeFi partnership announcement triggers a volume surge.

- Corresponding Market Cap Changes:

- Market caps of top cryptocurrencies like Bitcoin and Ethereum increased significantly following the volume spikes.

- DeFi tokens experienced market cap growth aligned with trading volume peaks, indicating heightened investor interest.

- Potential Causes of Spikes:

- Regulatory developments or announcements.

- Institutional involvement and strategic partnerships.

- Technological advancements or new project launches within specific crypto sectors.

- Dates with Notable Volume Spikes:

These instances highlight how trading volume serves as a key driver of market cap changes, often reflecting investor sentiment and market dynamics. Volume spikes typically occur in response to market-moving events, indicating the crypto market’s sensitivity to news and developments.

Read more

- Bitcoin Market Cap Changes

- Daily Crypto Market Overview

- Ethereum Market Performance

- Key Altcoin Market Movements

- Trading Volume Trends in DeFi

Market Cap Trends and Outlook for the Remainder of 2024

The market cap changes observed in September 2024 have set a notable tone for the remainder of the year. Significant fluctuations, driven by regulatory developments, technological advancements, and macroeconomic factors, have influenced market sentiment and investor confidence. As we approach the final quarter of 2024, understanding these trends offers valuable insights into the potential trajectory of the crypto market and the key factors that may continue to shape its valuation.

September 2024 Market Cap Trends

September 2024 exhibited several key trends in cryptocurrency market cap movements:

- Increased Volatility: The month was marked by heightened volatility, particularly in response to global economic events and regulatory news. These fluctuations were reflected in the market cap of major cryptocurrencies like Bitcoin and Ethereum. For instance, Bitcoin’s market cap varied in response to institutional movements and global regulatory updates, while Ethereum’s valuation was influenced by its network’s transition to an inflationary state.

- Dominance of Bitcoin and Ethereum: Despite the market’s dynamic nature, Bitcoin and Ethereum maintained their dominance, collectively accounting for a significant portion of the total crypto market cap. However, the dominance of these top assets was challenged by the growing influence of altcoins, particularly those in the DeFi and NFT sectors, which experienced market cap growth driven by increased trading activity on decentralized exchanges.

- Altcoin Growth and Divergence: September saw diverse performance among altcoins. While some experienced growth due to technological developments and new project launches, others faced declines attributed to market sentiment and regulatory concerns. Meme coins and DeFi tokens, in particular, contributed to the market’s overall volatility, with their market caps showing significant variability in response to news and market events.

Note

These trends highlight the complex interplay of factors influencing market cap changes, suggesting a dynamic and evolving market landscape as we move into the final quarter of the year.

Expected Market Cap Influencers for Q4 2024

As we look ahead to Q4 2024, several key factors are anticipated to influence cryptocurrency market cap changes:

- Regulatory Changes: Regulatory developments remain a crucial factor in shaping market cap movements. Potential regulatory actions in key markets, such as the introduction of new frameworks for cryptocurrency trading and taxation, could lead to market-wide reactions. Positive regulatory clarity may foster market growth, while restrictive measures could contribute to market cap declines across major cryptocurrencies.

- Technological Advancements: Technological progress within blockchain networks, including scalability solutions, security enhancements, and new use cases, is expected to impact market cap trends. Upgrades to existing networks, such as Ethereum’s ongoing development and the launch of new DeFi protocols, can attract investor interest and drive market cap growth for associated tokens.

- Macroeconomic Factors: Broader economic conditions, including interest rates, inflation, and geopolitical events, will continue to play a role in influencing the cryptocurrency market. For example, shifts in global economic policy may affect investor risk appetite, leading to changes in trading volumes and market valuations. Additionally, events such as central bank digital currency (CBDC) developments or shifts in traditional financial markets could have spillover effects on the crypto sector.

- Market Sentiment and Institutional Involvement: Investor sentiment, shaped by market narratives and institutional participation, is another key influencer. Increased institutional interest in cryptocurrencies, evidenced by large-scale acquisitions or partnerships, can boost market cap by attracting new capital inflows. Conversely, negative sentiment arising from market corrections or adverse news events could lead to market cap contractions.

The interplay of regulatory, technological, economic, and sentiment-driven factors will likely dictate the market cap trajectory in Q4 2024. Staying attuned to these influencers is essential for market participants seeking to understand the evolving dynamics of the crypto market.

September 2024 was a month of significant market cap fluctuations in the cryptocurrency sector, characterized by increased volatility, major shifts in Bitcoin and Ethereum dominance, and diverse performance among altcoins. These fluctuations were driven by various factors, including regulatory developments, technological advancements, and broader macroeconomic influences. As we look toward the remainder of 2024, the market is poised for further changes, with regulatory shifts, technological upgrades, macroeconomic conditions, and market sentiment expected to play pivotal roles in shaping the crypto market’s trajectory.