It’s crucial for beginners to pick a secure crypto exchange before starting with cryptocurrency. Strong security measures are vital to guard against hacks and fraud. These include two-factor authentication (2FA), cold storage, and multi-signature wallets. This guide will help new traders choose a reliable platform. It will focus on key factors: security, fees, and the range of cryptocurrencies.

Understanding the Importance of Security in Crypto Exchanges

In the fast-evolving crypto world, security is the key factor in choosing an exchange. With billions of dollars stored in digital currencies, hackers continuously target exchanges. The most secure platforms now use strong security. They use cold storage and multi-signature wallets. They protect users from cyberattacks and unauthorized transactions.

Cold Storage and Multi-Signature Wallets

Cold storage solutions are a secure, offline way to store cryptocurrency private keys. These wallets keep keys offline, reducing exposure to online threats. Cold storage is great for long-term asset holding. Exchanges, like Gemini and Kraken, use it to protect user funds.

Multi-signature wallets, on the other hand, offer an added layer of protection by requiring multiple private keys to authorize a transaction. This prevents a single point of failure, as no single key holder can move funds without the agreement of others. This feature is especially useful for businesses and group ownership, as it promotes shared control and accountability.

Two-Factor authentication (2FA)

Two-factor authentication (2FA) is a common security measure. It is used by top exchanges like Binance and Crypto.com. This system requires users to verify their identity using two different authentication methods, such as a password and a one-time code sent to a mobile device, making unauthorized access significantly harder. Besides 2FA, encryption keeps all sensitive data safe from hackers. This includes login credentials and personal information.

Regulatory Compliance and Insurance

Choosing a regulated exchange provides an extra layer of security. Platforms that meet strict regulations, like the FCA in the UK or the SEC in the US, must be very secure and transparent. Also, exchanges like Gemini insure digital assets. This protects users if there is a security breach.

Secure Exchange:

- Ensure the exchange is regulated by a recognized financial authority.

- Verify if the exchange offers insurance coverage for user funds.

- Confirm that the platform adheres to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Comparing Exchange Fee Structures

Traders must know the fee structures of crypto exchanges. They can greatly affect trading costs. Each exchange has its own fee model. It includes maker and taker fees, deposit and withdrawal costs, and various discounts or promotions based on trading volume and account status.

Maker and Taker Fees Explained

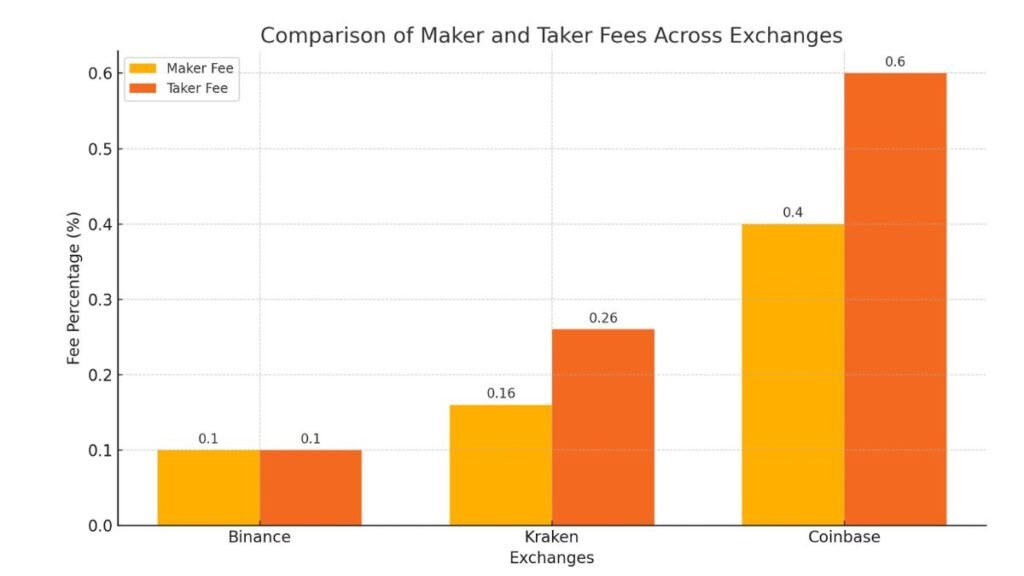

Maker and taker fees are the backbone of crypto exchange fee structures. Makers provide liquidity by placing limit orders. Takers remove it by executing trades at the market price. Binance has the most competitive fees. Maker fees start at 0.10%. They drop to 0.075% if users pay with Binance’s token (BNB). In comparison, Kraken starts at 0.16% for makers and 0.26% for takers for trading volumes under $50,000 over a 30-day period.

Coinbase, on the other hand, charges significantly higher fees, with maker fees ranging from 0.00% to 0.40% and taker fees ranging from 0.05% to 0.60%. This makes it a more expensive option, particularly for frequent traders.

| Exchange | Maker Fee | Taker Fee | Notes |

|---|---|---|---|

| Binance | 0.10% (0.075% w/BNB) | 0.10% (0.075% w/BNB) | Low fees, BNB discounts |

| Kraken | 0.16% – 0.00% | 0.26% – 0.10% | Volume-based discounts |

| Coinbase | 0.00% – 0.40% | 0.05% – 0.60% | Higher fees, fee-free with Coinbase One for small traders |

Withdrawal and Deposit Fees

Deposit and withdrawal fees vary widely across exchanges. They are important to consider, especially for frequent transactions. Kraken generally charges a flat fee for crypto withdrawals (e.g., 0.0005 BTC for Bitcoin). Binance tends to have lower fees for both deposits and withdrawals. In addition, Binance offers fee-free crypto deposits.

Coinbase charges variable withdrawal fees, depending on the method. For example, ACH withdrawals are free, but wire transfers may cost $25 per transaction. When using credit or debit cards, fees can reach as high as 3.99% for instant purchases.

the bar chart comparing maker and taker fees across Binance, Kraken, and Coinbase. The chart compares, side by side, the maximum fees of each exchange for maker and taker transactions. It can help assess the costs of trading on each platform.

Assessing Cryptocurrency Variety

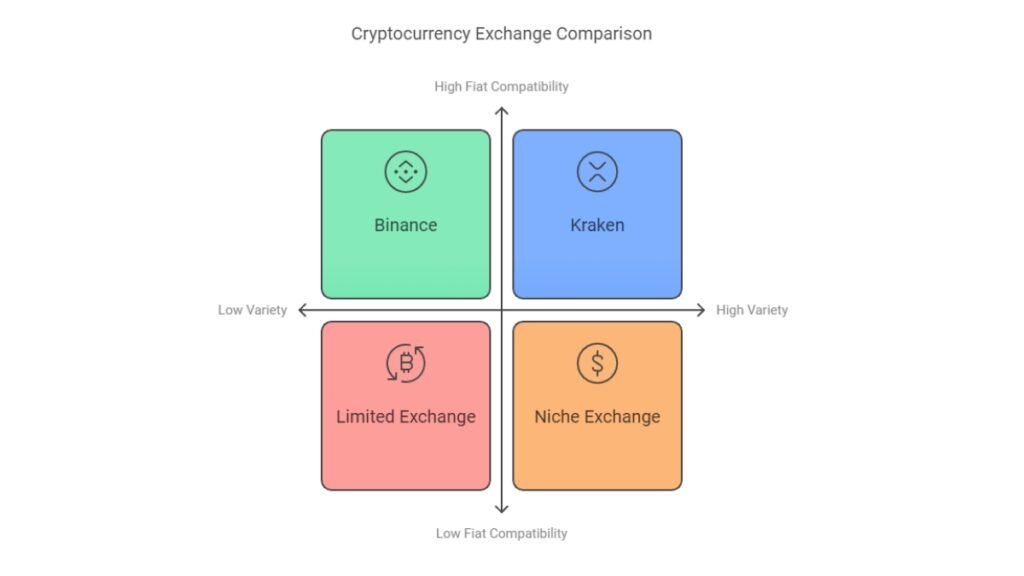

Users seeking to diversify their portfolios must choose an exchange with a wide variety of cryptocurrencies. Many exchanges offer many altcoins beyond Bitcoin and Ethereum. They can greatly boost a trader’s options and strategies. Top platforms like Binance and Kraken offer hundreds of digital assets. They are great for users seeking diverse investments.

Availability of Altcoins

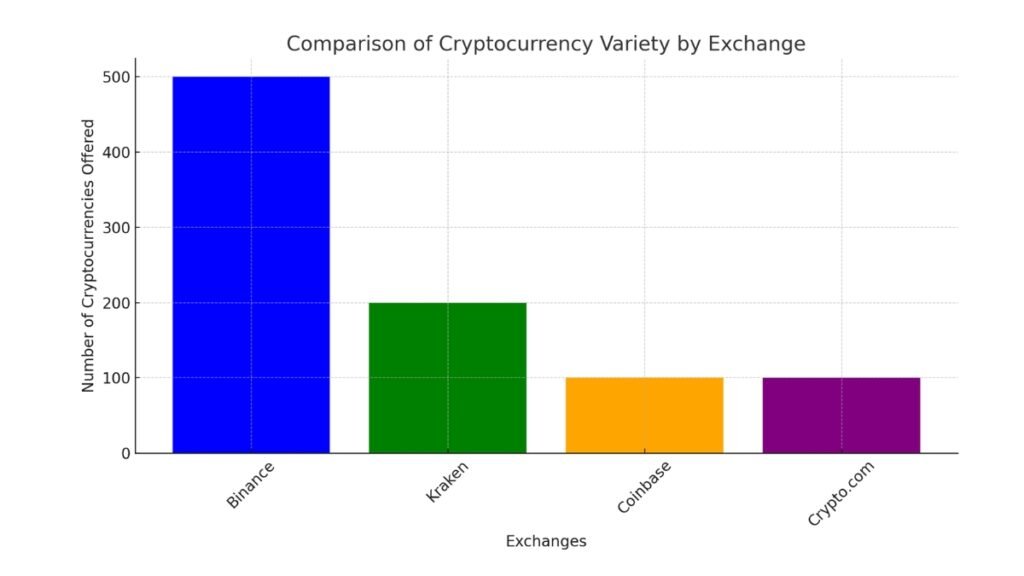

Exchanges like Binance boast the largest selection of cryptocurrencies, with over 500 assets available for trading. This includes a mix of popular altcoins such as Solana (SOL), Cardano (ADA), and Polkadot (DOT), alongside many lesser-known coins. Binance’s extensive offerings allow users to explore niche assets and build more complex trading strategies.

Kraken has fewer assets than Binance. But, it supports over 200 cryptocurrencies, including many altcoins. It’s especially favored by traders who seek long-term security and regulatory compliance. Both exchanges offer a good mix of altcoins that can cater to traders of all experience levels.

Fiat Compatibility

For beginners entering the crypto space, fiat compatibility is a critical factor. It allows users to purchase cryptocurrencies directly using traditional currencies like USD, EUR, or GBP. Coinbase stands out as one of the best exchanges for this, offering fiat-to-crypto transactions with easy deposit options through bank transfers, credit cards, and even PayPal.

Similarly, Crypto.com provides robust fiat support, offering multiple fiat pairs and simple purchasing methods for users in over 100 countries. This feature makes these platforms more accessible for users who are just starting with crypto.

A bar chart compares the number of cryptocurrencies offered by four exchanges: Binance, Kraken, Coinbase, and Crypto.com. The chart shows that Binance has the most cryptocurrencies. Kraken is next. Coinbase and Crypto.com have fewer, but they are great for beginners due to their strong fiat support.

Evaluating User-Friendly Interfaces and Customer Support

A user-friendly interface and great support are key for smooth trading, especially for beginners. Exchanges like Coinbase and Crypto.com have intuitive platforms. In contrast, Kraken offers advanced tools and strong security. Each exchange offers different advantages that cater to both new and experienced users.

Platform Usability for Beginners

Coinbase gets praise for its clean, simple design. It’s one of the best platforms for beginners. The layout is easy to navigate. It has simple options for buying, selling, and storing cryptocurrencies. Also, Coinbase has a “Learn to Earn” program. It teaches users about crypto. It rewards them with small amounts of it for completing tutorials. For beginners, this user-friendly interface builds confidence and reduces the learning curve.

Note

On the other hand, Kraken targets advanced traders. But, it has improved its interface to be more beginner-friendly. Kraken’s intuitive design includes basic buy/sell options. Its advanced features, like margin and futures trading, are more prominent.

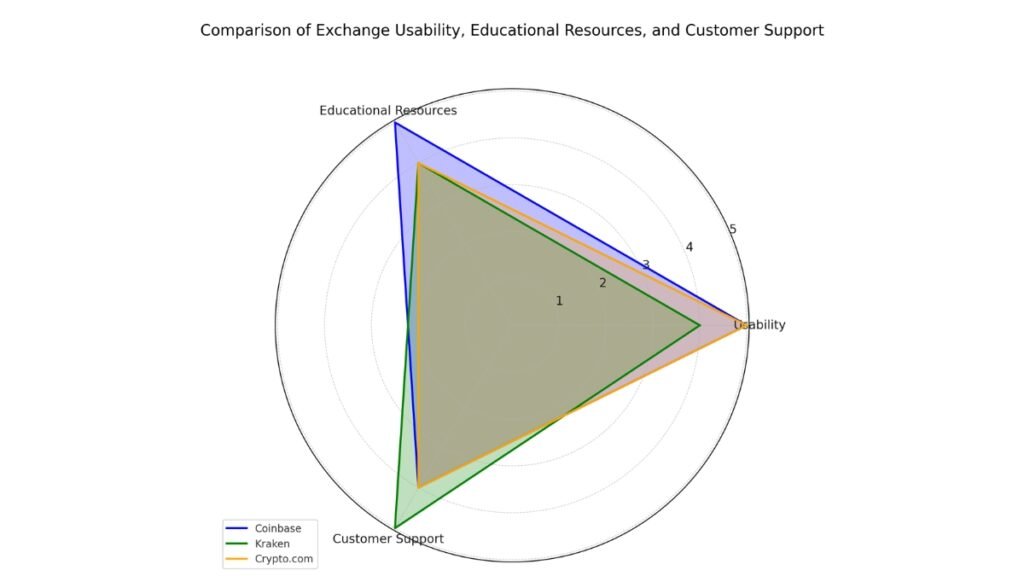

A radar chart that compares Coinbase, Kraken, and Crypto.com. It uses three key categories: usability, educational resources, and customer support. The chart shows that Coinbase excels in usability and education. Kraken, but, has better customer support. It offers a balanced experience for advanced users. Crypto.com has strong usability. It’s a bit less focused on education than Coinbase.

Customer Support and Educational Resources

Customer support is another critical factor, especially when dealing with financial transactions. Coinbase offers 24/7 support via email and phone. Users report delays in response times. The platform offers many educational resources. They help beginners learn crypto trading through tutorials and guides.

Kraken has strong security. It also offers 24/7 customer support, including live chat. It is one of the few exchanges to provide phone support, making it more accessible in times of urgent need. Also, Kraken’s educational resources help users with crypto trading. So, it is a good choice for traders who want strong support.

You Might Also Like:

- Cryptocurrency security for beginners

- Storing cryptocurrencies securely

- Introduction to cryptocurrency regulations

- Wallets with multi-signature support

- Bitcoin vs altcoins explained

Choosing the right cryptocurrency exchange is critical for beginners and experienced traders. To trade without risk, consider these factors: security, fees, crypto variety, and user experience. Exchanges like Binance, Kraken, and Coinbase have unique perks. Binance has low fees. Kraken has top security. Coinbase is easy to use. By evaluating these factors, users can find the best trading platform. This will maximize opportunities and cut risks.