Bitcoin’s price was affected by political events. These included a plot to assassinate Trump and concerns about the U.S. elections. These disruptions caused big price swings. They showed Bitcoin’s sensitivity to political risks. Traders and analysts watched these events closely. They wanted to see their impact on Bitcoin’s market stability and trading volumes. We will explore Bitcoin’s behavior during these turbulent times.

Political Uncertainty and Its Immediate Impact on Bitcoin Prices

Bitcoin faced notable price fluctuations due to rising political tensions. The attempt to assassinate Donald Trump on September 15th hurt market sentiment. It showed that political instability can have this effect. This section explores how such events immediately impacted Bitcoin’s price and investor confidence.

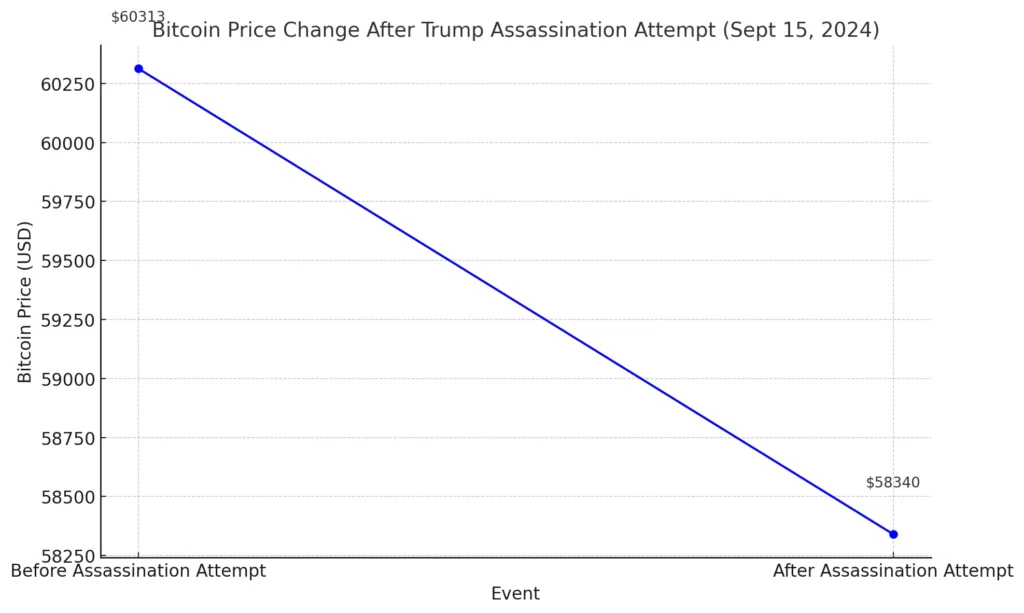

Bitcoin Price Drop Following Trump Assassination Attempt

After a failed assassination of Trump at his West Palm Beach golf course, Bitcoin’s price fell by about 3%. It fell from $60,313 to about $58,340. Investors reacted swiftly to the chaos. They likely feared for the U.S. election and regulatory outlook. This price dip caused big liquidations in the market. Over $116 million in long trades were wiped out.

| Event | Bitcoin Price Before | Bitcoin Price After | Price Change |

|---|---|---|---|

| Trump assassination attempt (Sept 15) | $60,313 | $58,340 | -3% |

| Total liquidations | – | – | $116.52 million |

Bitcoin Market Volatility During Election Periods

Leading up to the 2024 U.S. elections, Bitcoin exhibited increased volatility. Political events, like debates and policy announcements, have moved markets. Changes in candidate standings have also impacted them. Traders reacted cautiously to these developments, seeking to hedge against political uncertainty. As a result, Bitcoin’s price fluctuated often. Market participants were unsure of the long-term rules depending on the election’s outcome.

Trading Volume Spikes During Political Uncertainty

Political uncertainty often triggers sharp movements in Bitcoin’s trading activity. In September 2024, Bitcoin trading volumes surged. This was due to high-profile events, including an assassination attempt on Donald Trump. Traders sought to manage risk and profit from volatility. This surge in activity showed Bitcoin’s sensitivity to political instability.

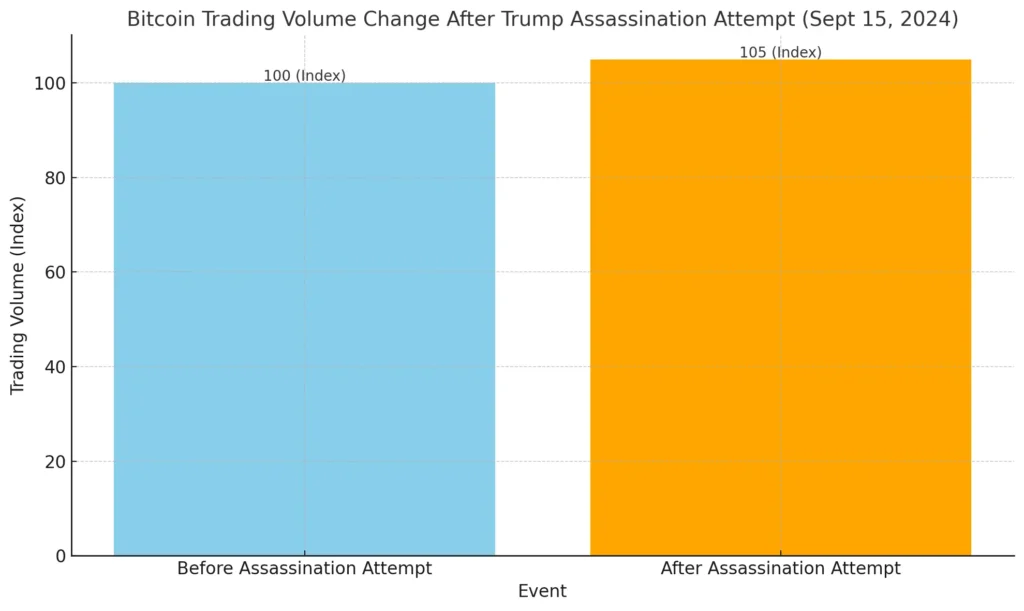

Impact of Trump-Related Political Events on Bitcoin Trading Volumes

After a second attempt to assassinate Trump on September 15, 2024, Bitcoin’s trading volume surged. The market fell on fears of political instability and Trump’s impact on U.S. crypto regulation. Reports showed that Bitcoin trading volumes surged over 5% after the assassination attempt. Many traders rushed to adjust their positions in response.

Note

The volume rose. It caused higher market volatility and large liquidations. Bitcoin dropped about 3%. This caused liquidations of about $116 million. These spikes often occur during major political events. Traders seek to hedge risks or profit from the price swings.

Election Debates and Their Influence on Bitcoin Trading Activity

Also, the Trump assassination attempt and election debates have affected Bitcoin trading volumes. Political announcements and debates have historically led to a surge in trading activity. Traders try to predict policy changes that could affect cryptocurrencies. Ahead of the 2024 U.S. elections, debates caused trading surges. Many traders wanted to align their portfolios with expected outcomes.

Political Events Driving Trading Volume Spikes:

- Trump assassination attempt (September 15, 2024).

- U.S. election debates (Ongoing, September 2024).

- Federal Reserve meetings impacting broader market sentiment.

Long-Term Impacts of Political Risks on Bitcoin Stability

Political uncertainty has both immediate and long-term impacts on Bitcoin’s market stability. In 2024, U.S. elections and regulatory changes may affect Bitcoin’s liquidity and price. This section looks at how political risks affect Bitcoin’s long-term stability and liquidity.

Political Risks and Bitcoin Liquidity in 2024

Political uncertainty, especially about regulations, harms Bitcoin’s liquidity. In 2024, fears of crackdowns under a possible Harris administration have made the market wary. Traders are cautious. Unclear policies could restrict or boost Bitcoin, depending on regulations. Large institutions entering the market have significantly affected Bitcoin’s liquidity. As more investors buy Bitcoin ETFs, liquidity improves. But, political risks, like sudden policies or geopolitical events, pose challenges.

Note

Despite these risks, Bitcoin’s liquidity is strong. In 2024, its 24-hour trading volume often topped $100 billion. But, liquidity can change sharply due to regulations and political decisions. This adds volatility to the market.

Bitcoin’s Long-Term Price Outlook Amid Political Events

The long-term price outlook for Bitcoin amid political uncertainty remains mixed. Analysts predict Bitcoin may be volatile short-term due to politics. But, its long-term outlook is promising. If Trump wins the election, the market expects a friendlier crypto-regulatory environment. This could boost Bitcoin prices. A Harris win may bring stricter rules. This could hurt Bitcoin due to more volatility.

After the elections, global economic tensions and conflicts may affect Bitcoin’s long-term price. Yet, many experts remain bullish about Bitcoin’s long-term prospects. By 2026, Bitcoin could hit $750,000 to $1 million. This is due to more institutions using it and people wanting a hedge against risks.

Geopolitical Risks and Bitcoin’s Global Market Performance

In September 2024, global geopolitical tensions significantly influenced Bitcoin’s market performance. U.S. politics often grab attention. So do global conflicts and economic instability. They also drove Bitcoin’s price fluctuations. This section shows how global events have affected Bitcoin. It also covers its role as a safe-haven asset.

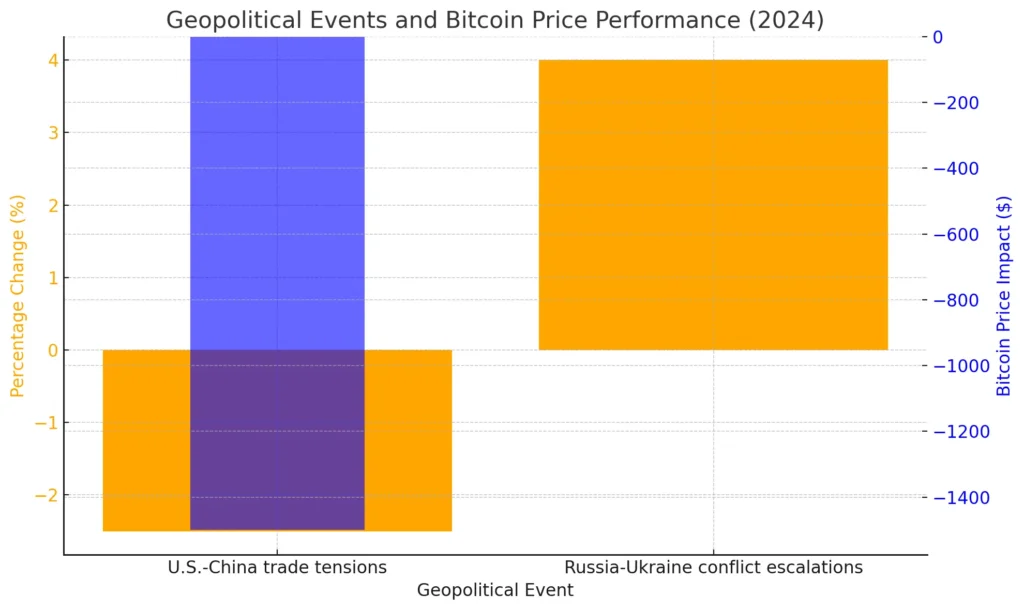

Global Geopolitical Events Driving Bitcoin Price Volatility

In 2024, the Russia-Ukraine war and U.S.-China trade tensions made Bitcoin more volatile. Unrest in the Middle East added to this. These events have raised uncertainty in global markets. Many investors are now shifting to assets like Bitcoin. It is seen as a hedge against traditional market risks.

For example, a 2.5% drop in Bitcoin’s price followed September’s rise in U.S.-China tensions. Global markets reacted negatively. Ongoing instability in Ukraine affected investor sentiment. Bitcoin was volatile, moving between $60,000 and $58,500 during key political events.

| Event | Bitcoin Price Impact | Percentage Change |

|---|---|---|

| U.S.-China trade tensions | Drop from $60,000 to $58,500 | -2.5% |

| Russia-Ukraine conflict escalations | Volatility increased by 4% | N/A |

Bitcoin’s Safe-Haven Appeal During Political Crises

Bitcoin is seen as a safe-haven asset, especially during geopolitical unrest. Its lack of ties to any nation’s financial system makes it a popular store of value in crisis-hit, inflationary countries. In Venezuela, people use Bitcoin to protect their wealth. It’s to escape hyperinflation and strict capital controls.

Note

Additionally, Bitcoin’s appeal as a hedge against sanctions and economic instability has grown. In sanctioned regions like Iran and Russia, Bitcoin has bypassed traditional finance. This has made it a valuable asset during political crises.

Regulatory Uncertainty’s Role in Bitcoin Price Movements

With the 2024 U.S. presidential election near, uncertainty is affecting Bitcoin’s price. The election’s outcome could affect crypto regulations. It may impact Bitcoin’s stability and investor sentiment. In September 2024, the market watched Kamala Harris and Donald Trump on crypto. The election could shift crypto regulation, depending on who wins.

Regulatory Fears Under a Harris Administration

If Kamala Harris wins the 2024 election, the crypto community fears stricter regulations. Harris has been in the Biden administration, which is strict on cryptocurrencies. Under Biden, the SEC has aggressively pursued major crypto firms, like Coinbase and Binance. Harris has not released a clear policy on digital assets. Her links to these efforts raise fears of strict measures from her administration. This uncertainty has made some hesitant in the market. Bitcoin saw short-term dips as investors speculated about future policies.

Harris has yet to release a clear policy on digital assets, but her association with these regulatory efforts raises fears that her administration might continue with similarly stringent measures. This regulatory uncertainty has caused some hesitancy in the market, with Bitcoin seeing short-term price dips as investors speculate about future policies.

How Trump’s Potential Policies Could Shape Bitcoin’s Future

Trump victory could bring a more bullish outlook for Bitcoin. Trump, once critical of cryptocurrencies, now supports them in the 2024 election. He supports making the U.S. a “crypto capital.” He has launched pro-Bitcoin initiatives. If re-elected, Trump will favor deregulation. This could boost institutional investment and raise Bitcoin’s price. Analysts predict that, under Trump, Bitcoin could rise to $125,000 by 2024. They expect deregulation and a better economy to boost it.

Check the below Links for Further Reading

- Bitcoin Dominance in Crypto Markets

- Impact of US Inflation Data on Crypto Markets

- Crypto Market Response to U.S. Election

- Institutional Investment in Bitcoin

- Future of Bitcoin ETFs

The 2024 U.S. election brings considerable uncertainty to Bitcoin’s market outlook, with regulatory shifts under Kamala Harris or Donald Trump likely influencing Bitcoin’s future price and market behavior. A Harris administration could see increased scrutiny, while Trump’s pro-crypto stance may boost Bitcoin’s prospects. As investors brace for these potential changes, the crypto market remains sensitive to political outcomes, underscoring the importance of closely monitoring regulatory developments.