The blockchain hard forks in 2024 have significantly impacted the cryptocurrency market. Key events such as Cardano’s Chang hard fork and Ethereum’s Dencun upgrade have reshaped network governance, token distribution, and overall market dynamics. These developments are crucial for crypto investors, blockchain enthusiasts, and technology professionals to understand, given their profound effects on token redistribution, network upgrades, and the post-fork performance of major cryptocurrencies.

Major Blockchain Hard Fork Events in 2024

The major blockchain hard fork events in 2024, including Cardano’s Chang hard fork and Ethereum’s Dencun upgrade, have played a pivotal role in shaping market trends and network dynamics. These events have introduced significant changes, from governance structures to network scalability and transaction costs, impacting both the token redistribution and the broader cryptocurrency market.

Cardano’s Chang Hard Fork

Cardano’s Chang hard fork marks a transformative step toward decentralized governance within the Cardano ecosystem. Named after mathematician Tsutomu Chang, this hard fork introduces on-chain participatory governance, allowing ADA holders to have a direct influence on the network’s future. The hard fork also establishes the constitutional committee (CC) and delegated representatives (DReps), creating new roles for stakeholders in the decision-making process.

The Chang upgrade enhances Cardano’s decentralization by implementing on-chain voting mechanisms. This means that ADA holders can now propose and vote on protocol changes directly on the blockchain, ensuring transparency and community-driven network governance. Additionally, PlutusV3 enhancements have been introduced to improve smart contract functionality and network security, further solidifying Cardano’s position in the crypto space.

| Feature | Description |

|---|---|

| On-Chain Voting | Direct voting on protocol changes |

| Decentralized Governance | Introduction of the CC and DReps |

| ADA Holder Empowerment | ADA holders participate in network decisions |

| Smart Contract Enhancements | PlutusV3 improvements for better security |

| Network Governance Changes | Shift towards a community-driven approach |

Ethereum’s Dencun Upgrade

The Ethereum Dencun upgrade in March 2024 is one of the most significant Ethereum hard forks since the Merge. A key aspect of this upgrade is EIP-4844, which introduces “proto-danksharding.” This enhancement reduces costs for layer-2 rollups, thereby increasing the network’s scalability and efficiency. As a result, Ethereum’s network can now handle a higher volume of transactions at a lower cost, aligning with its goal to support a rollup-centric future.

The Dencun upgrade also addresses other network improvements, such as enhancing transaction throughput and decreasing storage costs. These changes are crucial in reducing the burden on the main Ethereum chain, facilitating a more robust and scalable ecosystem for decentralized applications (DApps).

Key Improvements Checklist:

- Enhanced scalability through layer-2 rollups

- Reduced transaction costs

- Improved support for layer-2 solutions

- Increased network throughput and efficiency

Bitcoin Halving and Its Effects

The 2024 Bitcoin halving is a notable event that differs from typical hard forks. Scheduled for block height 840,000, this event reduces the block reward from 6.25 BTC to 3.125 BTC. This halving cycle is expected to significantly impact miner profits by decreasing the incentive for mining, potentially leading to increased network security through technological advancements in mining hardware. Historically, Bitcoin halvings have led to scarcity and upward pressure on prices, often triggering bull market phases.

The reduced block reward necessitates more efficient mining operations, pushing miners to adopt advanced hardware and energy-efficient solutions. This halving event also has broader implications for market dynamics, potentially increasing Bitcoin’s value due to its deflationary nature. The halving acts as a counterbalance to inflation, attracting investors who view Bitcoin as a hedge against traditional fiat devaluation.

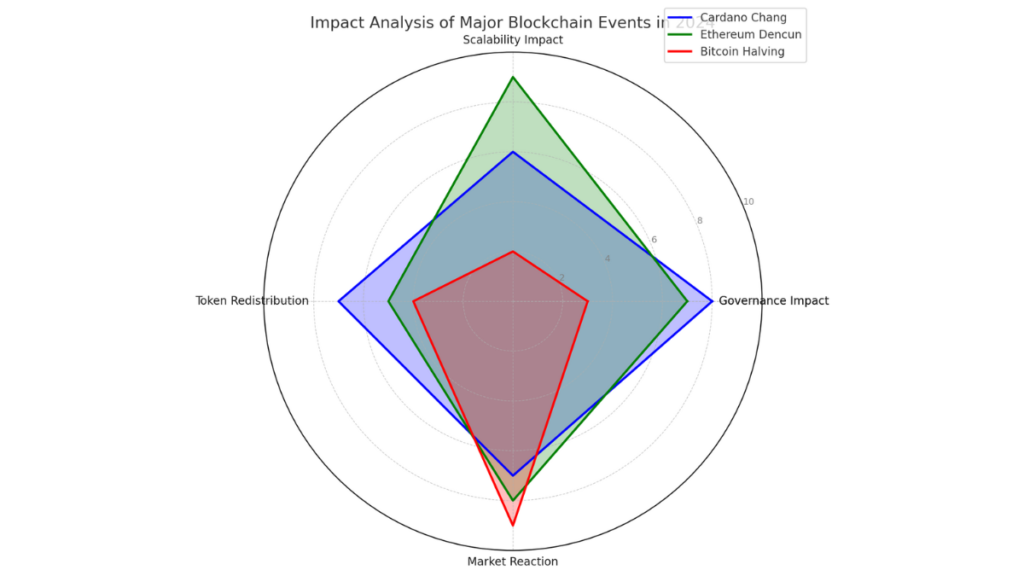

The radar chart visualizes the impact of the three major blockchain events in 2024—Cardano’s Chang hard fork, Ethereum’s Dencun upgrade, and Bitcoin Halving—across four key areas: governance impact, scalability impact, token redistribution, and market reaction.

- Cardano Chang: Shows a high impact on governance and token redistribution, with moderate influence on scalability and market reaction.

- Ethereum Dencun: Strongly impacts scalability and market reaction, while also contributing to governance and token redistribution.

- Bitcoin Halving: Mainly affects market reaction, with lesser influence on governance, scalability, and token redistribution.

Impact of Hard Forks on Token Redistribution and Supply

Hard forks can significantly influence the distribution and supply of tokens within a blockchain network. By modifying the blockchain’s protocol, these events often result in changes to tokenomics, affecting both the circulation of tokens and their market value. In 2024, key hard forks such as Cardano’s Chang and Ethereum’s Dencun have played pivotal roles in reshaping token redistribution and supply dynamics, leading to various market reactions and shifts in liquidity.

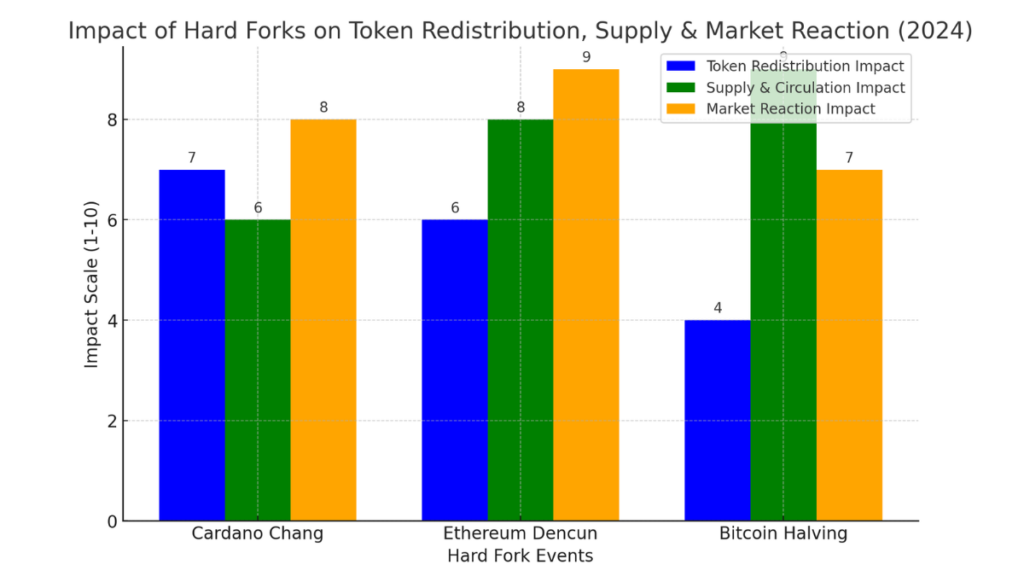

The bar chart illustrates the impact of the three major blockchain events in 2024—Cardano’s Chang hard fork, Ethereum’s Dencun upgrade, and Bitcoin Halving—across three key areas:

- Token Redistribution Impact: Cardano Chang has the highest impact, followed closely by Ethereum Dencun, with Bitcoin Halving having a moderate impact on token redistribution.

- Supply & Circulation Impact: Bitcoin Halving shows the most significant impact on supply and circulation, reflecting its effect on Bitcoin’s scarcity. Ethereum Dencun also demonstrates a strong influence in this area, while Cardano Chang has a moderate impact.

- Market Reaction Impact: Ethereum’s Dencun upgrade has the most pronounced effect on market reactions, with Cardano Chang and Bitcoin Halving following.

Token Redistribution Post-Hard Fork

Token redistribution is one of the most immediate outcomes of a hard fork. When a hard fork occurs, the blockchain network can split into two separate chains, resulting in the creation of new tokens or the redistribution of existing ones. In the case of Cardano’s Chang hard fork, the introduction of on-chain governance allowed ADA holders to directly participate in decision-making processes. This shift towards decentralized governance brought new voting mechanisms and roles, redistributing power among ADA holders and influencing the distribution of ADA tokens.

Similarly, Ethereum’s Dencun upgrade led to significant changes in token dynamics. Although it was not a chain-splitting fork, its introduction of features like EIP-4844 and improved support for layer-2 solutions indirectly affected token distribution by reducing transaction costs. By enhancing scalability and lowering the cost of using Ethereum-based decentralized applications (DApps), the upgrade has led to an increased utility and redistribution of ETH within the network.

Impact on Token Supply and Circulation

Hard forks can also alter the token supply and circulation within a network. For example, the Bitcoin Halving event in 2024 did not create new tokens or split the blockchain but reduced the block reward from 6.25 BTC to 3.125 BTC, effectively decreasing the rate at which new Bitcoins are introduced into the market. This reduction in supply leads to increased scarcity, potentially driving up demand and influencing Bitcoin’s market value.

In contrast, hard forks like Cardano’s Chang and Ethereum’s Dencun enhance the network’s functionality and efficiency, thereby increasing token circulation. By introducing new governance models and improving scalability, these upgrades encourage more active use of the network, which can result in higher transaction volumes and greater token movement. This increased circulation can, in turn, influence market dynamics, as the availability and liquidity of the tokens are directly impacted by how frequently they are exchanged and utilized within the network.

Market Reaction to Token Redistribution

The market’s response to token redistribution caused by hard forks can vary. In many cases, significant changes in tokenomics lead to price fluctuations and shifts in liquidity. For instance, after a hard fork event, if the new or redistributed tokens are perceived to add value or utility, investors may react positively, leading to an increase in demand and upward price movements. However, uncertainty or disagreement over the hard fork’s impact can result in market volatility and liquidity shifts.

In 2024, both Cardano’s Chang and Ethereum’s Dencun upgrades demonstrated how the market reacts to changes in token distribution. Cardano’s shift to decentralized governance and Ethereum’s enhanced scalability led to increased trading volumes and price movements. The reduced transaction costs in the Ethereum network, in particular, improved liquidity by making it more cost-effective for users to participate in the network’s activities. As a result, both ADA and ETH saw periods of increased market activity post-fork, with price movements reflecting the market’s assessment of the network upgrades and their implications for the cryptocurrency ecosystem.

Network Upgrades and Enhancements Following Hard Forks

Hard forks in 2024, such as Ethereum’s Dencun and Cardano’s Chang, have significantly contributed to the advancement of network upgrades and efficiency improvements within their respective ecosystems. These upgrades have not only enhanced the scalability and performance of their networks but also introduced enhanced governance structures and security measures that aim to provide a more robust and secure blockchain infrastructure.

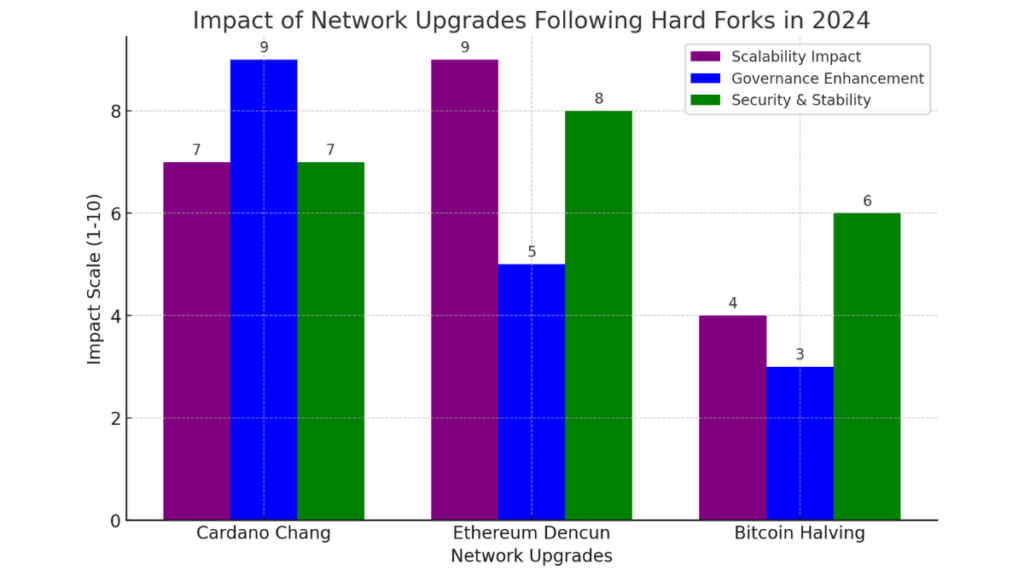

The bar chart visualizes the impact of network upgrades following the major hard forks in 2024—Cardano’s Chang, Ethereum’s Dencun, and Bitcoin Halving—across three key aspects:

- Scalability Impact: Ethereum’s Dencun upgrade shows the highest impact on scalability, reflecting the introduction of features like EIP-4844 and reduced layer-2 rollup costs. Cardano Chang also has a significant impact, while Bitcoin Halving’s effect on scalability is moderate.

- Governance Enhancement: Cardano Chang leads in governance enhancement, owing to its shift towards decentralized governance with the introduction of on-chain voting mechanisms. Ethereum Dencun has a moderate impact, while Bitcoin Halving’s influence in this area is minimal.

- Security & Stability: Ethereum’s Dencun upgrade and Cardano Chang both show notable improvements in network security and stability. Bitcoin Halving also contributes to enhanced network security, mainly by incentivizing the use of more efficient mining hardware.

Scalability and Performance Improvements

One of the primary goals of hard forks is to improve network scalability and performance. Ethereum’s Dencun upgrade in March 2024 is a prime example of this objective. By introducing EIP-4844, known as “proto-danksharding,” this hard fork has significantly reduced costs associated with layer-2 rollups, thus enhancing Ethereum’s scalability. By lowering transaction costs and improving network throughput, the Dencun upgrade has made it more feasible for users and developers to interact with decentralized applications (DApps) on the Ethereum network.

Scalability improvements from this upgrade include more efficient use of blockchain resources, allowing Ethereum to handle a higher volume of transactions without compromising speed or increasing costs. The enhancement of layer-2 solutions through Dencun not only optimizes the network’s performance but also encourages the development of more complex and scalable DApps, fostering a more vibrant decentralized ecosystem.

Cardano’s Chang hard fork also brought significant performance enhancements. Although the primary focus was on governance, it indirectly impacted scalability by streamlining on-chain processes. The PlutusV3 ledger language enhancements introduced more advanced cryptographic capabilities, allowing for more efficient smart contract execution, which in turn improves the network’s overall performance.

Enhanced Governance and Decentralization

Cardano’s Chang hard fork represents a landmark shift toward decentralized governance within the Cardano network. By implementing on-chain governance mechanisms, the hard fork empowered ADA holders to actively participate in the decision-making process, marking a transition from a more centralized governance structure to a community-driven model. Through the introduction of the Constitutional Committee (CC) and Delegated Representatives (DReps), Cardano established a governance framework that allows for on-chain voting, where stakeholders can directly propose and vote on protocol changes.

This move toward decentralized governance not only enhances the network’s transparency but also increases the accountability of network changes. The ability for ADA holders to have a say in protocol adjustments means that the network evolves based on the community’s collective input, making it more resilient to central points of failure. This enhancement has positioned Cardano as a frontrunner in blockchain governance, emphasizing the importance of a community-centric approach in the evolution of blockchain networks.

Improved Security and Stability

Hard forks often contribute to improved network security and stability, ensuring the blockchain remains robust against various threats. Ethereum’s Dencun upgrade plays a crucial role in enhancing the network’s security posture. By improving the layer-2 infrastructure and introducing advanced cryptographic capabilities, the network has become more resistant to attacks, particularly those targeting transaction verification and data integrity. The reduced transaction costs on layer-2 rollups have also helped mitigate network congestion, reducing the likelihood of denial-of-service (DoS) attacks that could exploit high transaction fees during periods of high network activity.

Bitcoin’s post-halving period also showcases how network stability can be improved following a significant protocol change. The 2024 Bitcoin halving reduced the block reward, making it less profitable for miners using outdated hardware. This reduction has indirectly increased the network’s security by incentivizing miners to upgrade to more efficient, high-performance mining rigs, thereby increasing the overall hash rate and making the network more secure against 51% attacks.

Key Observations:

In the case of Cardano, the Chang hard fork introduced on-chain governance as a mechanism to enhance the network’s stability. By allowing for direct stakeholder participation in network decisions, Cardano can adapt more dynamically to emerging security threats and network challenges. The hard fork’s focus on decentralized governance ensures that security upgrades are aligned with the community’s consensus, fostering a more stable and secure blockchain environment.

Market Trends and Price Movements Post-Hard Fork

In 2024, major hard fork events like Ethereum’s Dencun upgrade and the Bitcoin Halving have significantly influenced cryptocurrency market trends and price movements. These events led to fluctuations in prices and shifts in investor sentiment, contributing to periods of increased market volatility and changing liquidity dynamics.

Price Movements of Forked Cryptocurrencies

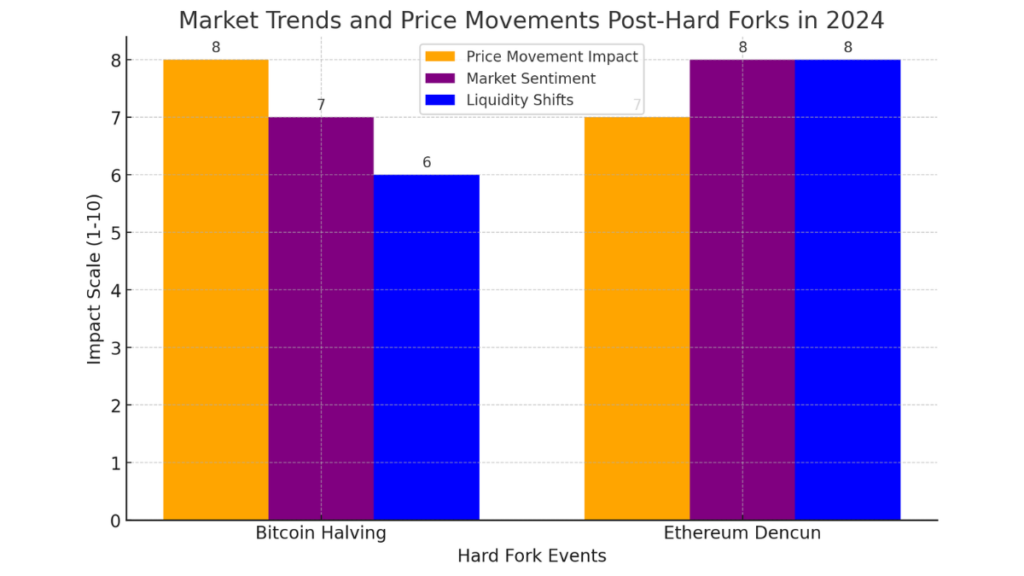

The bar chart illustrates the market impact of the major hard fork events in 2024—Bitcoin Halving and Ethereum’s Dencun upgrade—across three key aspects:

- Price Movement Impact: Bitcoin Halving had a slightly higher impact on price movements compared to Ethereum’s Dencun upgrade. The halving led to significant fluctuations due to reduced supply and increased scarcity, with potential for long-term price increases.

- Market Sentiment: Ethereum’s Dencun upgrade generated more positive market sentiment, given its focus on enhancing scalability and reducing transaction costs. Bitcoin Halving initially created uncertainty, but sentiment improved over time.

- Liquidity Shifts: Both events caused shifts in liquidity, but Ethereum’s Dencun had a more pronounced impact. Reduced transaction costs and enhanced network throughput encouraged more trading activity and improved liquidity within the Ethereum network.

Following the Bitcoin Halving on April 20, 2024, Bitcoin experienced a wave of price fluctuations. Initially, this event brought about volatility, with Bitcoin’s price dropping briefly before rebounding to $66,000, marking a significant recovery. This was followed by a surge in prices as the market absorbed the reduced supply and increased scarcity, with some analysts predicting new all-time highs. Several forecasts suggest Bitcoin’s price could rise to levels between $130,000 and $280,000 in the next year, with some speculating on even higher values, thanks to the halving’s long-term effects on supply and demand dynamics.

Ethereum also experienced notable price movements following its Dencun upgrade in March 2024. The upgrade, which included EIP-4844, reduced costs for layer-2 rollups and contributed to Ethereum’s price appreciation. Ethereum outperformed Bitcoin by around 20% during this period, driven by increased on-chain activity and anticipation of the network upgrade. However, like Bitcoin, Ethereum faced volatility, with price corrections in response to market conditions.

Market Sentiment and Investor Reactions

The market sentiment surrounding these hard fork events was mixed. Bitcoin’s halving initially led to a sense of uncertainty and fear, resulting in outflows from digital asset investment products in the weeks leading up to the event. However, as the market stabilized post-halving, investor sentiment improved, with many viewing the halving as a catalyst for a potential bull run. Analysts noted that Bitcoin’s deflationary feature attracted investors looking to hedge against inflation, further driving positive sentiment.

For Ethereum, the Dencun upgrade fostered optimism among investors due to its focus on enhancing scalability and reducing transaction costs. This upgrade was seen as a pivotal step toward a rollup-centric future, encouraging a more active participation in the network. While Ethereum experienced periods of increased volatility, the long-term outlook remained positive, with many investors anticipating further growth in the network’s ecosystem.

Liquidity Shifts and Trading Volume Changes

The liquidity shifts and trading volumes following these hard fork events were significant. Post-halving, Bitcoin experienced an increase in trading volume as investors sought to capitalize on potential price movements. However, the reduced block rewards pressured miners, leading to a decrease in mining profitability and a subsequent impact on network liquidity. Bitcoin miners’ daily revenue reached its lowest point in 2024, necessitating strategic overhauls to maintain profitability.

Ethereum’s Dencun upgrade also impacted liquidity by reducing transaction costs and improving network throughput. The upgrade’s enhancements encouraged greater on-chain activity, leading to increased liquidity and higher trading volumes. As layer-2 rollups became more cost-effective, Ethereum witnessed a more active market, with increased trading activity and engagement within the network.

Note

Linking Suggestions

- Market Effects of DeFi TVL Decline

- Impact of Network Congestion on Crypto Prices

- Bitcoin Dominance in Crypto Markets

- Impact of Upcoming Token Unlocks on Crypto Markets

Real-Time Updates and Future Outlook on Hard Forks

Staying informed about upcoming and ongoing hard fork events is crucial for understanding their potential impact on the blockchain technology and the cryptocurrency market. As these events can significantly affect network functionality, governance, and market dynamics, they offer insights into the evolving landscape of decentralized technologies.

Upcoming Hard Fork Events

Cardano’s Chang Hard Fork has successfully taken place, marking the beginning of Cardano’s transition to the Voltaire era. This upgrade has introduced decentralized governance mechanisms, allowing ADA holders to participate directly in the voting process for governance actions. It implements on-chain participatory governance via Cardano Improvement Proposal-1694, introducing roles for stake pool operators and a constitutional committee. The first stage of this upgrade aims to ensure security and continuity, with a second phase in 2025 expected to facilitate self-governance initiatives within the ecosystem.

Ethereum’s Dencun Hard Fork, scheduled for March 13, 2024, is another significant event. This upgrade introduces EIP-4844, which is aimed at reducing the costs of layer-2 rollups and enhancing scalability. By incorporating a new method for rollups to add cheaper data to blocks through “blob space,” the Dencun hard fork focuses on making Ethereum more efficient. The full impact of these changes, however, will become evident only after the upgrade is completed and rollups implement the necessary updates to take advantage of the new functionalities.

Monitoring Real-Time Market Effects

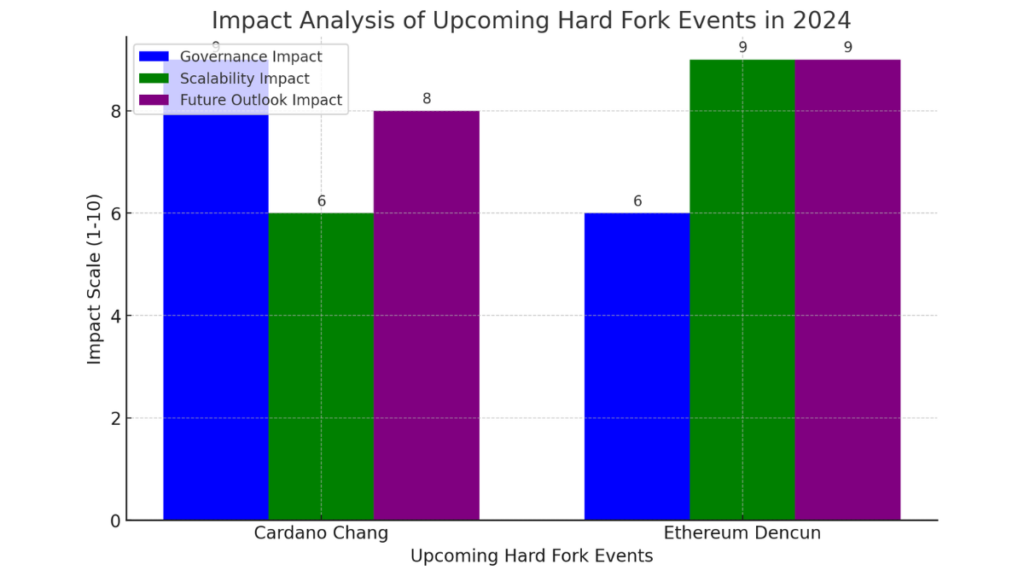

The bar chart illustrates the impact of the upcoming hard fork events in 2024—Cardano’s Chang and Ethereum’s Dencun—across three key aspects:

- Governance Impact: Cardano’s Chang hard fork has a significant governance impact due to its focus on decentralized governance mechanisms, giving ADA holders more influence over network decisions. Ethereum’s Dencun upgrade has a moderate impact on governance as its primary focus is on scalability and efficiency.

- Scalability Impact: Ethereum’s Dencun upgrade leads in this area, introducing features like EIP-4844 to reduce costs for layer-2 rollups and enhance network scalability. Cardano’s impact on scalability is less pronounced, given its emphasis on governance.

- Future Outlook Impact: Both hard forks have a strong influence on the future outlook of their respective networks. Ethereum’s rollup-centric future and Cardano’s community-driven governance model are expected to drive long-term development and adoption in the blockchain ecosystem.

Investors and enthusiasts can monitor the real-time effects of hard fork events using various tools. Blockchain explorers like Etherscan for Ethereum and Cardanoscan for Cardano provide up-to-date information on network activity, including block production, transaction volumes, and network upgrades. Market analysis platforms such as CoinMarketCap, CoinGecko, and TradingView offer live updates on price movements, trading volumes, and market trends, which can help investors gauge the market’s response to hard forks.

Staying informed through crypto news outlets like Cointelegraph and Decrypt is also vital. These platforms regularly publish analyses and expert opinions on ongoing and upcoming hard forks, offering insights into the market sentiment and potential long-term impacts of these events. Participating in social media discussions, including those on Twitter and Reddit, can provide additional perspectives on how the crypto community is reacting to these changes.

Long-Term Implications of Hard Forks

The long-term implications of major hard forks can significantly influence the cryptocurrency ecosystem. Cardano’s shift toward decentralized governance through the Chang hard fork is expected to lead to a more community-driven network, fostering innovation and adaptability. By empowering ADA holders in the decision-making process, Cardano aims to enhance the network’s resilience and align its evolution with the community’s interests.

Ethereum’s Dencun upgrade represents a crucial step toward a rollup-centric future, signaling a move to enhanced scalability and efficiency. By introducing features like EIP-4844, Ethereum is positioning itself as a more attractive platform for decentralized applications (DApps) and layer-2 solutions. This shift is expected to lead to a more scalable and cost-effective network, promoting broader adoption and development within the Ethereum ecosystem.

Note

Overall, The hard forks demonstrate the evolutionary nature of blockchain networks, emphasizing the importance of adaptability, community involvement, and technological advancement in shaping the future of decentralized technologies.

The key hard fork events in 2024, including Cardano’s Chang and Ethereum’s Dencun upgrades, have had far-reaching impacts on the cryptocurrency landscape. These events have influenced various aspects of blockchain networks, from governance and scalability to market trends and liquidity shifts. Cardano’s focus on decentralized governance and Ethereum’s emphasis on scalability represent significant steps toward a more adaptable and efficient blockchain future. Monitoring these developments and understanding their implications is crucial for investors and blockchain enthusiasts, as they signal the direction of the crypto market and the evolution of decentralized technologies.