The Impact of US Inflation Data on Crypto has become a pivotal concern for investors and market strategists in 2024. Recent inflation data releases have notably affected cryptocurrency prices and market sentiment, especially with Bitcoin’s fluctuations in response to the latest Consumer Price Index (CPI) reports. These data releases have shown immediate effects on crypto markets, such as significant shifts in trading volumes and market cap. With a close correlation between economic indicators and crypto performance, this topic has captured the attention of economic analysts, crypto investors, and market strategists. In the wake of inflation-driven volatility, understanding the crypto market’s reaction to these economic indicators has become vital. Keywords like crypto market response to US inflation and real-time crypto price changes after inflation data are central to this ongoing narrative.

Immediate Crypto Market Response to US Inflation Data

The cryptocurrency market tends to react swiftly to U.S. inflation data releases, with significant changes observed in prices and trading volumes of major cryptocurrencies like Bitcoin and Ethereum. In September 2024, the latest Consumer Price Index (CPI) report prompted immediate market responses, reflecting the heightened sensitivity of the crypto market to economic indicators. The release of this inflation data caused a ripple effect, leading to notable price fluctuations and shifts in trading volumes across the market.

Real-Time Price Changes in Major Cryptocurrencies

Immediately following the release of the September 2024 CPI report, the cryptocurrency market experienced considerable price movements. Bitcoin (BTC) witnessed a 3% surge, pushing its price over the $58,000 mark. This reaction was driven by the market’s anticipation of the U.S. Federal Reserve’s monetary policy adjustments in response to inflation data. Ethereum (ETH) also exhibited modest gains, aligning with the broader market sentiment. Such immediate responses underscore how closely the prices of these major cryptocurrencies are tied to U.S. economic data.

These price shifts were not isolated incidents. Previous inflation reports have similarly induced volatility in the crypto market, with traders and investors adjusting their positions in response to the evolving economic landscape. The correlation between U.S. inflation data and the performance of digital assets like Bitcoin and Ethereum has become a crucial factor in market analysis, often serving as an indicator of investor sentiment and future price trends.

Trading Volume Shifts Post-Inflation Report

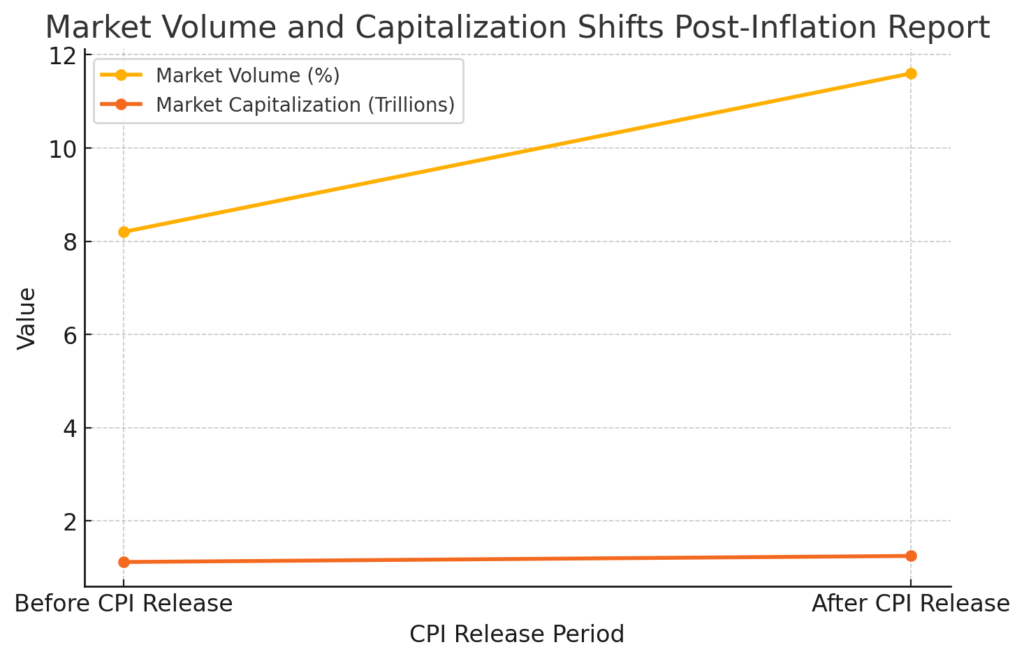

Beyond price changes, the release of the latest inflation data led to a significant impact on trading volumes within the crypto market. Following the September 2024 CPI announcement, there was an observed 11.6% rise in overall market volume, indicating heightened trading activity. This uptick in volume was accompanied by notable changes in the global crypto market capitalization, as investors quickly responded to the new economic information.

| Metric | Before CPI Release | After CPI Release |

|---|---|---|

| Market Volume | +8.2% | +11.6% |

| Market Capitalization | $1.12 Trillion | $1.25 Trillion |

The increased trading volumes suggest that market participants actively adjust their portfolios based on inflation data. A higher trading volume often reflects a dynamic market environment where investors are reassessing their strategies, buying or selling assets in response to perceived risks or opportunities. This behavior underscores the critical role that U.S. inflation data plays in shaping the short-term dynamics of the cryptocurrency market.

Altcoin Market Reactions

While Bitcoin and Ethereum often dominate market headlines, altcoins also exhibit significant reactions to U.S. inflation data. In the wake of the September 2024 CPI report, several altcoins experienced sharp movements. For example, Sui (SUI) surged by over 15%, indicating a strong positive reaction to the economic news. On the other hand, certain meme coins and smaller altcoins struggled to maintain their value, reflecting a more volatile and speculative market segment.

The varying responses among altcoins highlight the diverse nature of the crypto market, where different assets can react uniquely to the same economic indicators. Factors such as market sentiment, liquidity, and investor expectations play crucial roles in determining how individual altcoins respond to inflation data. This divergence also underscores the importance of understanding each asset’s characteristics and market dynamics when assessing the impact of economic events like inflation reports.

US Inflation Data and Crypto Market Sentiment Shifts

The latest US inflation data has had a significant impact on the sentiment within the crypto market, influencing investor behavior and driving price trends. Market optimism has been notably affected, with particular focus on expectations for a Federal Reserve rate cut. This development has contributed to shifts in how digital assets are perceived, leading to changes in market dynamics and investment strategies.

Investor Sentiment and Market Optimism

Recent US inflation data has shifted investor sentiment towards a more optimistic outlook. The data indicated a slowing inflation rate, which has raised hopes for a Federal Reserve rate cut in the near future. Investors view the potential rate reduction as a catalyst that could lower borrowing costs, thereby increasing liquidity in the markets. This optimism has positively influenced the crypto market, with digital assets experiencing upward price momentum in response to these inflation reports.

Checklist:

- Market’s Reaction to Inflation Data: Following the release of the inflation data, the crypto market displayed a strong response, with Bitcoin and other digital assets registering gains.

- Expectations for Federal Reserve Actions: Investors anticipate that the Federal Reserve may pivot towards a more dovish stance, potentially leading to a rate cut in the upcoming meetings.

- Influence on Crypto Market Cap: The optimism surrounding a possible rate cut has contributed to an increase in the overall crypto market capitalization, driven by heightened investor interest and trading volumes.

The anticipation of the Federal Reserve’s actions has created a bullish sentiment in the crypto space. The perceived correlation between interest rate policy and crypto prices has become a key consideration for market participants, influencing both short-term and long-term investment strategies. The market’s response to inflation data underscores the evolving narrative around digital assets as they increasingly intersect with macroeconomic indicators.

Correlation Between Inflation Expectations and Crypto Prices

The correlation between anticipated inflation figures and cryptocurrency prices has become increasingly evident in recent market behavior. Typically, lower-than-expected inflation figures tend to boost investor confidence, leading to positive price movements in cryptocurrencies like Bitcoin and Ethereum. For instance, after the latest inflation report showed a decrease in the annual inflation rate, Bitcoin experienced a surge in price, reflecting the market’s optimistic outlook.

However, there have been instances where the expected outcomes did not align with market reactions. For example, even when inflation data suggested a more favorable economic environment, market participants have sometimes responded cautiously, leading to subdued price movements or even declines. This discrepancy can be attributed to a range of factors, including concerns over regulatory actions, geopolitical events, and market liquidity conditions.

Understanding the correlation between inflation expectations and crypto prices is crucial for investors and market analysts. While positive inflation data can drive market optimism and lead to price increases, unexpected market dynamics can create volatility, making it essential to consider a broader set of factors when evaluating the crypto market’s response to economic indicators.

US Inflation Data and Crypto Market Sentiment Shifts

The latest US inflation data has played a crucial role in shaping crypto market sentiment. Recent CPI reports, such as the one released in September 2024, have directly influenced investor optimism, primarily due to their impact on expectations for a Federal Reserve rate cut. If inflation data points to a decrease, market participants anticipate a more favorable environment for digital assets, leading to a shift in sentiment and price trends across the crypto space.

Investor Sentiment and Market Optimism

Recent US inflation data has fueled investor optimism, with many expecting a reduction in interest rates by the Federal Reserve. Analysts suggest that if inflation figures align with expectations, it could trigger a short squeeze, driving Bitcoin prices higher. Conversely, higher-than-expected inflation could result in a sell-off of risk assets like Bitcoin. Investors are particularly focused on the CPI figures, as they indicate whether the Federal Reserve will maintain its hawkish stance or pivot toward rate cuts. This sentiment has contributed to fluctuations in crypto market capitalization, with traders adjusting their strategies based on the evolving macroeconomic landscape.

Checklist:

- Market’s Reaction to Inflation Data: The latest CPI reports showed Bitcoin climbing to $64,000 before retracing slightly, highlighting market sensitivity to inflation data.

- Expectations for Federal Reserve Actions: Lower inflation figures have led to speculation about a potential rate cut, impacting market sentiment.

- Influence on Crypto Market Cap: Optimism around a rate cut has resulted in fluctuations in the market cap, reflecting shifts in investor confidence.

Correlation Between Inflation Expectations and Crypto Prices

There is a clear correlation between inflation expectations and crypto prices. When inflation data aligns with or is lower than market expectations, it generally leads to an increase in cryptocurrency prices. For example, the recent CPI report met expectations, causing Bitcoin to surge past $64,000. However, when inflation data deviates from expectations, it can lead to market volatility. Higher-than-expected inflation figures often result in a sell-off as investors anticipate a more aggressive monetary policy from the Federal Reserve, impacting Bitcoin and other digital assets.

Note

This correlation indicates that while positive inflation data can trigger bullish trends, the market can also exhibit sudden shifts in response to unexpected data. Therefore, understanding these dynamics is essential for investors and market analysts when navigating the crypto market’s reaction to US inflation data.

Short-Term Volatility in Crypto Markets Post-Inflation Release

The crypto market often experiences significant short-term volatility immediately following US inflation data releases. These events typically result in swift and notable price swings for major cryptocurrencies such as Bitcoin and Ethereum, often triggered by changes in market sentiment and investor behavior.

Volatility Patterns in Major Cryptos

In the wake of recent inflation reports, major cryptocurrencies like Bitcoin and Ethereum have shown heightened volatility. For instance, Bitcoin’s price surged following the September inflation report, but the market remains unpredictable. Analysts suggest that if the Consumer Price Index (CPI) meets expectations, Bitcoin short sellers could face a squeeze, driving prices upward. Conversely, a higher-than-expected CPI could lead to a sharp sell-off. This dynamic creates an environment where rapid, short-term price movements are common, driven by speculation around inflation data and Federal Reserve actions.

Impact on Altcoin Volatility

Altcoins are particularly sensitive to inflation data, often exhibiting even more dramatic price movements compared to major cryptocurrencies. For example, higher-than-expected inflation data can trigger a broader sell-off in riskier altcoins, while a positive inflation report can result in a surge. These fluctuations highlight the speculative nature of the altcoin market, where investor sentiment can shift rapidly in response to macroeconomic indicators. As a result, altcoins frequently experience sharp gains or losses immediately following the release of US inflation data.

Influence of Inflation Data on Crypto Trading Strategies

US inflation data significantly influences crypto trading strategies, prompting traders to adjust their market positions and asset allocations in response to changes in economic conditions. The latest inflation reports have caused shifts in rate cut expectations, leading to noticeable changes in trading behaviors and portfolio structures.

Rate Cut Expectations and Crypto Trading

Following recent inflation data, traders have been closely monitoring Federal Reserve policy decisions. The anticipation of a rate cut, particularly in light of inflation figures aligning with market expectations, has led to increased trading volumes. For instance, after the May 2024 inflation report showed a 3.4% year-over-year increase, Bitcoin surged to $64,000. This positive response was partly driven by expectations that a steady economic environment might deter the Federal Reserve from implementing immediate rate hikes.

| Metric | Before Inflation Data | After Inflation Data |

|---|---|---|

| Bitcoin Trading Volume | $50 billion | $60 billion |

| Market Capitalization | $1.2 trillion | $1.35 trillion |

Traders adjust their strategies, often increasing their exposure to high-volatility assets like Bitcoin and Ethereum in anticipation of favorable Federal Reserve actions. In contrast, if inflation data deviates from expectations, it can lead to market sell-offs as traders move to mitigate potential risks.

Adjustments in Portfolio Allocation

In response to recent inflation data, traders have also been reallocating their portfolios, often shifting towards major cryptocurrencies and stablecoins. Bitcoin’s limited supply and its perceived role as a hedge against inflation have made it a preferred asset in times of economic uncertainty. Meanwhile, stablecoins provide a less volatile alternative, serving as a safe haven when market conditions are unpredictable.

Such portfolio adjustments reflect traders’ efforts to balance risk and preserve capital. For instance, with the rise in inflation figures, there has been an observable increase in the allocation of portfolios towards stablecoins like USDT and USDC, which maintain a stable value pegged to fiat currencies. This strategy allows traders to navigate market volatility while keeping a portion of their assets in less risky instruments.

Key Drivers of Crypto Market Movements After Inflation Reports

US inflation data plays a significant role in shaping the cryptocurrency market’s movements. Key drivers influencing these movements include investor sentiment, interest rate expectations, and changes in trading volumes. Inflation reports impact how investors perceive risk and determine their trading strategies, resulting in fluctuations in cryptocurrency prices.

Interest Rate Expectations and Market Reaction

Interest rate expectations following inflation data are crucial in influencing the crypto market. When the Federal Reserve hints at raising interest rates in response to rising inflation, it typically leads to a downturn in crypto prices. This reaction occurs because higher interest rates make traditional assets like savings accounts and bonds more attractive compared to riskier assets like cryptocurrencies. For example, during periods of rising interest rates, Bitcoin and other major cryptocurrencies have often experienced price declines as investors shift their capital toward safer assets. Conversely, when interest rates remain low or are expected to decrease, cryptocurrencies like Bitcoin tend to see a surge in demand as investors seek higher returns in riskier assets. This dynamic has been evident in recent years, where Bitcoin’s price has responded to both the Federal Reserve’s policy changes and the evolving interest rate environment.

Stablecoins’ Role in Market Stability

Stablecoins have become an essential component of the crypto market, providing stability amid inflation-driven volatility. These assets are typically pegged to fiat currencies like the US dollar, maintaining a stable value regardless of market fluctuations. In times of inflation or economic uncertainty, traders and investors often flock to stablecoins to mitigate risk and preserve capital. For instance, when inflation data indicates a potential increase in market volatility, there is usually a surge in stablecoin trading volumes as investors seek a safe haven. This flight to stability can help dampen the overall volatility in the crypto market, offering a buffer against rapid price swings in major cryptocurrencies and altcoins. However, while stablecoins provide short-term stability, they are not immune to the effects of inflation, particularly when the value of their underlying fiat reserves decreases over time.

Cheack the below Links for Further Reading

- Current Bitcoin Price Trends

- Ethereum Market Performance

- Crypto Market Reactions to Interest Rate Changes

- Market Effects of DeFi TVL Decline

- Analysis of Market Trends Post-Fed Meetings

The impact of US inflation data on the crypto market in 2024 has been multifaceted, driving volatility, influencing trading strategies, and affecting market sentiment. Inflation reports have become key events that traders and investors closely watch, as they often lead to rapid market adjustments. This year, we have seen how expectations around interest rate changes, guided by inflation data, have swayed investor sentiment, resulting in short-term price surges or sell-offs across major cryptocurrencies like Bitcoin and Ethereum.

Stablecoins have proven to be crucial during periods of heightened volatility triggered by inflation data releases. As more traders turn to these assets to mitigate risk, stablecoins provide a stabilizing force in the market, despite their limitations in fully countering the effects of inflation over the long term. Overall, the crypto market’s response to US inflation data in 2024 underscores the importance of macroeconomic indicators in shaping the landscape of digital assets.

For economic analysts, crypto investors, and market strategists, understanding the intricate relationship between inflation data and crypto market movements is essential. Staying informed and adapting to these developments is key to navigating the evolving crypto space effectively.