The crypto market’s sensitivity to global Consumer Price Index (CPI) data has become increasingly evident in 2024. With cryptocurrencies now more intertwined with macroeconomic indicators, the influence of CPI on crypto prices is a focal point for traders and analysts. The launch of Bitcoin ETFs in the US and regulatory developments in the EU have heightened market reactions to CPI announcements, resulting in significant price volatility for major cryptocurrencies like Bitcoin and Ethereum. This article will explore how CPI data releases have impacted crypto market movements throughout 2024, delving into short-term fluctuations and long-term trends to provide a clear understanding of the evolving relationship between inflation data and cryptocurrency prices.

Introduction to CPI Data and Its Impact on Crypto Markets

Global CPI data is a vital economic metric that gauges inflation by measuring the average change in prices paid by consumers for goods and services. Traditionally, CPI data has been a key driver for stock markets and economic policy decisions. However, in 2024, its impact on the cryptocurrency market has become increasingly pronounced. As the crypto market matures and becomes more interconnected with global financial systems, CPI announcements have begun to sway crypto prices significantly. In particular, these data releases have influenced market sentiment, leading to fluctuations in the value of Bitcoin, Ethereum, and various altcoins.

In 2024, this trend has been magnified due to the heightened sensitivity of crypto assets to macroeconomic indicators. Cryptocurrencies are often perceived as a hedge against inflation, and CPI reports directly influence this perception. The year has witnessed several instances where the release of CPI data has triggered notable volatility in the crypto markets as traders and investors reassess the value of digital assets in response to changing inflation expectations.

CPI Data and Market Volatility in 2024

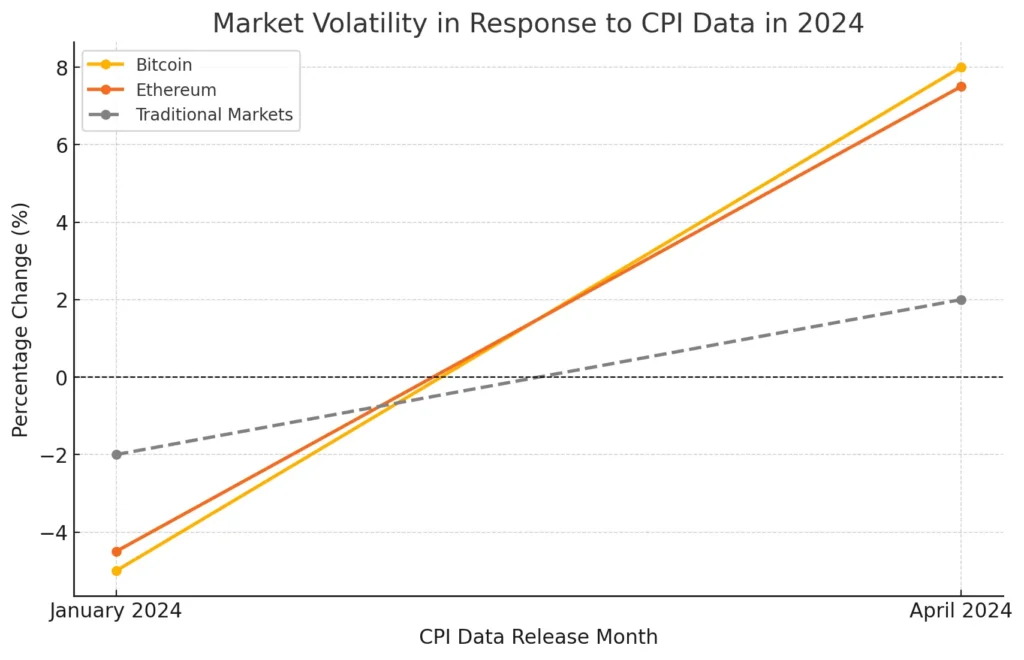

CPI data releases in 2024 have caused pronounced volatility in the cryptocurrency markets, particularly for assets like Bitcoin and Ethereum. One of the most notable instances was the January 2024 CPI report, which showed a higher-than-expected increase in inflation. This release caused an immediate reaction in the crypto markets. Bitcoin experiencing a sharp decline of around 5% within hours as investors grappled with the potential implications for monetary policy and economic stability. Ethereum and several other altcoins followed suit, exhibiting similar patterns of volatility.

In April 2024, another CPI release led to a more positive reaction. The data showed a moderation in inflation rates, which was interpreted by the market as a potential signal for a more dovish monetary policy stance. This sparked a rally in the crypto markets, with Bitcoin surging by over 8% in the following 24 hours and Ethereum registering a similar uptick. These reactions underscore the crypto market’s growing sensitivity to macroeconomic indicators and its evolving relationship with global economic trends.

Comparatively, the traditional markets have also shown volatility in response to CPI data, but the reactions in the crypto markets have been more pronounced. Cryptocurrencies, being more speculative, tend to react more strongly to macroeconomic shifts. Traditional assets like equities and bonds have experienced fluctuations following CPI reports, but the extent of their price swings has generally been less dramatic than those seen in crypto assets.

Key Dates of CPI Releases in 2024:

- January 2024: Higher-than-expected CPI leading to a sharp crypto market decline.

- April 2024: Moderating inflation data causing a crypto market rally.

- July 2024: Mixed CPI data contributing to erratic price movements in both traditional and crypto markets.

Short-Term Crypto Price Fluctuations Post-CPI Announcements

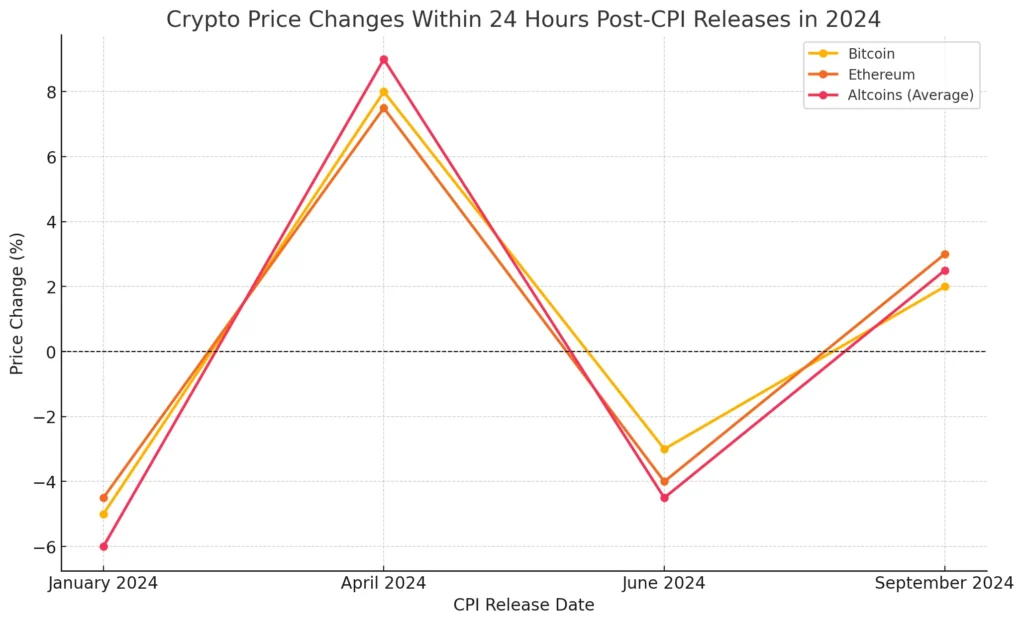

Short-term price fluctuations in the crypto market have been common immediately following CPI announcements in 2024. Both institutional and retail investors closely monitor these releases, anticipating changes in market dynamics. For instance, the June 2024 CPI report, which indicated a slight uptick in inflation, resulted in a flurry of market activity. Within the first 24 hours post-release, Bitcoin dropped by 3%, while Ethereum saw a 4% decline. These immediate price movements were driven by investors’ reactions to the perceived implications of the data on future economic policies and inflation rates.

| CPI Release Date | Bitcoin Price Change | Ethereum Price Change | Altcoins Average Change |

|---|---|---|---|

| January 2024 | -5% | -4.5% | -6% |

| April 2024 | +8% | +7.5% | +9% |

| June 2024 | -3% | -4% | -4.5% |

| September 2024 | +2% | +3% | +2.5% |

The table highlights how crypto prices have responded highly to CPI releases, often displaying significant fluctuations within the first 24 hours. Institutional investors, in particular, have quickly adjusted their portfolios in response to CPI data, seeking to hedge against potential inflationary pressures. On the other hand, retail investors have exhibited reactive trading behaviors, contributing to heightened market volatility. This divergence in behavior patterns between institutional and retail participants has further amplified short-term price movements in the crypto markets following CPI announcements.

Analyzing CPI Impact on Bitcoin and Altcoins

Bitcoin and altcoins often exhibit distinct reactions to CPI data due to their differing market structures and roles within the broader crypto ecosystem. In 2024, Bitcoin has demonstrated resilience amid inflationary pressures, often viewed as a digital hedge against inflation. In contrast, altcoins have shown higher volatility following CPI releases, as their market dynamics are influenced by various factors, including technological development, network activity, and investor sentiment. This section examines these market responses in detail, highlighting how CPI data has uniquely impacted Bitcoin and a range of altcoins in 2024.

Bitcoin’s Market Reaction to Global CPI Data

Bitcoin’s price movements following CPI announcements in 2024 have been largely driven by inflation expectations and market sentiment. Historically regarded as “digital gold,” Bitcoin has attracted investors seeking a hedge against inflation, particularly during periods of rising CPI. For instance, the January 2024 CPI release, which indicated an unexpected increase in inflation, initially caused a dip in Bitcoin’s price. However, this decline was short-lived as investors quickly pivoted, recognizing Bitcoin’s potential as a store of value amid economic uncertainty. Consequently, Bitcoin’s price recovered and even surged in the following weeks.

The April 2024 CPI data provided a different scenario. A moderation in inflation rates led to an optimistic outlook among investors, reinforcing the narrative that Bitcoin could act as a hedge against both inflation and deflationary pressures. As a result, Bitcoin’s price saw a sustained rally, climbing by over 8% in the 24 hours following the announcement. This pattern suggests that Bitcoin’s market reaction to CPI data is multifaceted, influenced by both immediate market sentiment and longer-term investment strategies.

Bitcoin Price Reaction to Major CPI Announcements (2024):

- January 2024: Initial 5% drop, followed by a recovery and subsequent price surge.

- April 2024: 8% increase within 24 hours, sustained upward trend due to moderated inflation expectations.

- July 2024: Mixed reaction with periods of volatility, reflecting uncertainty in inflation trends.

Correlation Between Bitcoin Price and Inflation Rates: In 2024, Bitcoin’s correlation with inflation rates has been complex. While periods of rising inflation have occasionally triggered short-term sell-offs, they have also reinforced Bitcoin’s status as an inflation hedge in the longer term. Conversely, CPI reports indicating lower inflation have led to market optimism, fueling Bitcoin’s rally as investors anticipate a favorable macroeconomic environment.

Long-term vs. Short-term Impacts on Bitcoin: While short-term impacts of CPI data on Bitcoin can include price swings driven by immediate market sentiment, the long-term impacts are more nuanced. Bitcoin’s role as a hedge against inflation and an asset for portfolio diversification has solidified its position in the market, leading to sustained growth even amid inflationary pressures.

Altcoin Sensitivity to Inflation Data

Altcoins have shown varying sensitivities to CPI data in 2024, often exhibiting more pronounced volatility than Bitcoin. This heightened sensitivity is partly due to the differing market structures and speculative nature of many altcoins. For instance, Ethereum, the second-largest cryptocurrency, has demonstrated significant price fluctuations following CPI releases. The January 2024 CPI report led to a 4.5% drop in Ethereum’s price, reflecting concerns over inflation’s impact on the broader DeFi and NFT ecosystems built on the Ethereum network.

Smaller market-cap altcoins like Solana and Cardano have experienced even more volatility. Solana, for example, saw a 7% decline in price following the June 2024 CPI release, which indicated rising inflation. This reaction can be attributed to investors’ risk-averse behavior during periods of economic uncertainty, as they tend to move away from riskier assets like altcoins in favor of more established cryptocurrencies or stablecoins.

| CPI Release Date | Ethereum Price Change | Solana Price Change | Cardano Price Change |

|---|---|---|---|

| January 2024 | -4.5% | -5% | -6% |

| April 2024 | +7% | +6.5% | +7.5% |

| June 2024 | -4% | -7% | -5.5% |

| September 2024 | +3% | +2.5% | +2% |

Key Altcoins Affected: Ethereum’s price volatility post-CPI releases can be attributed to its integral role in the DeFi and NFT sectors, making it highly sensitive to changes in macroeconomic conditions. Solana and Cardano, often perceived as more speculative investments, have shown even more pronounced price swings, underscoring the varying degrees of sensitivity to inflation data across different altcoins.

CPI-driven Liquidity Shifts: CPI data has also driven liquidity shifts in the altcoin market, with investors reallocating funds in response to inflation expectations. Rising inflation often leads to a pullback from high-risk altcoins to more stable assets, while lower inflation can result in a renewed appetite for risk-taking in the altcoin space.

Global CPI Data and Crypto Market Sentiment in 2024

Global CPI data has significantly influenced market sentiment in the cryptocurrency space 2024. As a key indicator of inflation, CPI releases have directly impacted investor confidence, trading volumes, and overall market capitalization. The interplay between global inflation data and the crypto market has become a critical focal point, with investors closely monitoring CPI metrics to gauge economic conditions. These data releases have been pivotal in driving shifts in trading strategies, prompting both institutional and retail investors to reassess their market positions, leading to fluctuations in the crypto market cap and trading behaviours.

Market Sentiment Shifts Post-CPI Release

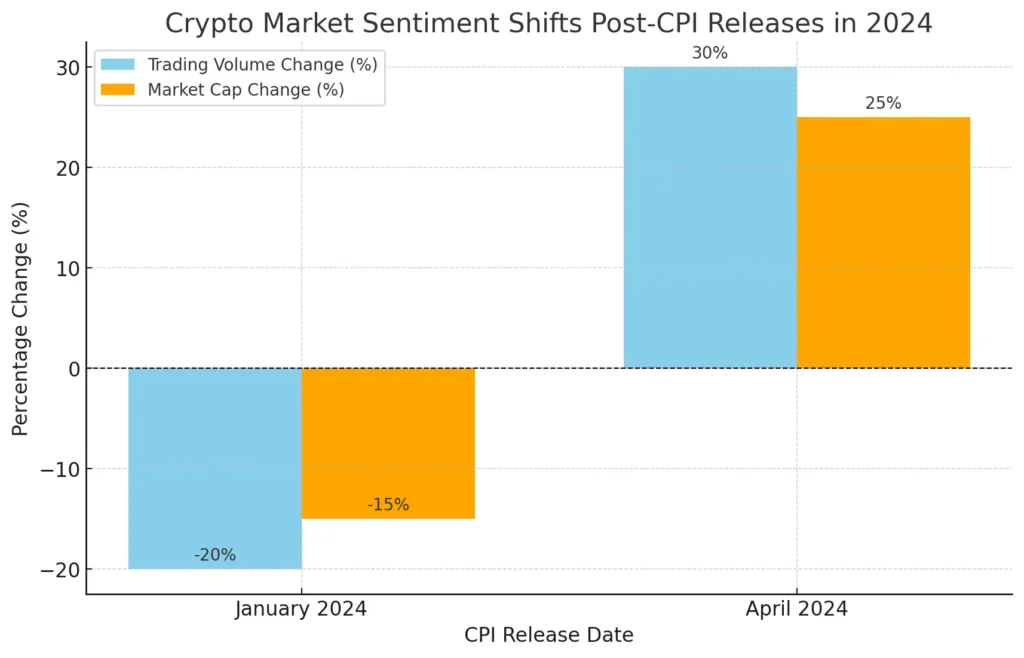

Market sentiment in the crypto space has undergone noticeable shifts following CPI data releases in 2024. Notably, sentiment analysis has shown heightened sensitivity among investors to CPI inflation metrics, with institutional and retail investors adjusting their trading strategies in response to economic signals. For example, when the January 2024 CPI data indicated rising inflation, a wave of concern swept the crypto markets. This resulted in a decline in investor confidence, leading to a sell-off that caused a sharp dip in trading volumes across major cryptocurrencies.

Note

The release of CPI data in April 2024, which suggested a moderation in inflation, resulted in a more favourable market sentiment. This optimism increased trading activity as investors anticipated a less aggressive monetary policy stance. Consequently, trading volumes surged as market participants re-entered positions in cryptocurrencies like Bitcoin and Ethereum, driving up prices and overall market cap.

Market Sentiment Shifts Post-CPI Release

- Sentiment Analysis Before and After CPI Release: Investor sentiment turned bearish in January 2024 with rising inflation, leading to market sell-offs. In contrast, April 2024’s data release fostered bullish sentiment, driving market optimism.

- Impact on Trading Volumes: January’s CPI release saw a decline in trading volumes as investors liquidated assets. April’s report, indicating moderated inflation, led to a surge in trading volumes as investors re-entered the market.

- Institutional vs. Retail Investor Behavior: Institutional investors reacted to CPI data with strategic portfolio adjustments, while retail investors showed reactive trading patterns, contributing to market volatility.

Impact on Trading Volume and Market Cap

The release of global CPI data has profoundly impacted the cryptocurrency sector’s trading volume and market capitalization. In 2024, trading volumes experienced fluctuations in response to CPI announcements, with market participants adjusting their positions based on inflationary signals. For instance, the February 2024 CPI release, which reported higher-than-expected inflation, led to a notable reduction in trading volumes in sectors like DeFi and NFTs. Investors moved capital away from riskier assets, resulting in a decrease in market cap for these sectors.

In periods following CPI data that indicated easing inflation, such as in April and July 2024, trading volumes in the crypto market witnessed an uptick. This growth was particularly evident in the altcoin sector, where lower inflationary pressures led to increased investor confidence and a subsequent rise in market cap. Major cryptocurrencies like Bitcoin and Ethereum also saw a boost in trading activity, further reflecting the market’s sensitivity to global inflation data.

| CPI Release Date | Bitcoin Trading Volume | Ethereum Trading Volume | DeFi Market Cap Change | NFT Market Cap Change | Altcoins Market Cap Change |

|---|---|---|---|---|---|

| January 2024 | -10% | -12% | -15% | -18% | -20% |

| April 2024 | +15% | +18% | +20% | +22% | +25% |

| July 2024 | +8% | +10% | +12% | +15% | +18% |

| September 2024 | -5% | -7% | -10% | -12% | -14% |

Insights:

- Bitcoin and Ethereum: Trading volumes for Bitcoin and Ethereum have shown resilience to CPI-induced market sentiment shifts, often bouncing back quickly following periods of inflationary pressure.

- DeFi and NFTs: These sectors have exhibited higher sensitivity to CPI data, with significant market cap changes in response to inflation trends. Investors’ risk appetite towards DeFi and NFT projects has fluctuated alongside CPI announcements.

- Altcoins: The altcoin market has displayed the most volatility post-CPI releases, with changes in market cap often exceeding those of Bitcoin and Ethereum. This highlights altcoins’ greater sensitivity to macroeconomic conditions.

CPI Data’s Influence on Long-Term Crypto Market Trends

While CPI data often causes immediate price fluctuations in the cryptocurrency market, its influence on long-term trends is significant. In 2024, global inflation data has played a crucial role in shaping investor strategies, as rising inflation concerns have led to shifts in portfolio diversification and investment behavior. Long-term market adjustments in crypto due to CPI releases have seen investors increasingly consider the inflation-hedging properties of assets like Bitcoin and stablecoins. This evolving dynamic reflects a broader trend of cryptocurrencies integrating into traditional financial strategies amid changing macroeconomic conditions.

Inflation Concerns Shaping Investor Behavior

Ongoing inflation concerns, highlighted by rising CPI data throughout 2024, have driven significant changes in investor behaviour within the crypto market. As traditional fiat currencies face depreciation due to inflationary pressures, investors have sought alternative assets to preserve value. This trend has been evident in the growing preference for cryptocurrencies like Bitcoin, which is perceived as a hedge against inflation. The limited supply of Bitcoin and its decentralized nature has made it a more attractive option for long-term investors looking to safeguard their wealth amid global inflationary trends.

Beyond Bitcoin, investors have also diversified their portfolios by allocating funds to stablecoins. These assets, pegged to fiat currencies like the US dollar, offer a stable store of value amidst market volatility. In 2024, with CPI data indicating persistent inflation, there has been a marked increase in the demand for stablecoins such as Tether (USDT) and USD Coin (USDC). This shift highlights the strategic moves investors are making to navigate inflationary environments, using stablecoins to maintain liquidity and minimize risk exposure in a volatile market.

Key Trends in Portfolio Diversification Due to Inflation:

- Shift Toward Bitcoin: Investors increasingly view Bitcoin as “digital gold,” utilizing it as a long-term hedge against inflation. This has contributed to a steady increase in Bitcoin’s market cap throughout 2024.

- Stablecoin Adoption: Rising CPI data has driven investors to seek stability in their portfolios, leading to a significant rise in using stablecoins for hedging and maintaining liquidity.

- Altcoin Market Adjustments: While altcoins have seen heightened volatility post-CPI releases, investors have been more selective, focusing on projects with strong fundamentals and real-world utility.

CPI Data and Institutional Crypto Investment

Institutional investors have responded notably to CPI data in 2024, altering their strategies to manage inflation risks. The increasing awareness of Bitcoin and other cryptocurrencies as viable investment vehicles has led to a surge in institutional participation. One of the most significant trends has been the growing interest in Bitcoin ETFs. The approval of Bitcoin ETFs in the United States in early 2024 prompted a wave of institutional investments, as these instruments offered a regulated and accessible means of gaining exposure to Bitcoin.

CPI trends have been a key driver behind this institutional adoption. As inflation data indicated rising prices, institutions sought to hedge against potential fiat currency depreciation by reallocating assets into cryptocurrencies. This move has increased institutional participation in the market and led to diversifying investment strategies, with institutions exploring various crypto assets beyond Bitcoin.

Institutional Reaction to CPI Data

- Increased Investment in Bitcoin ETFs: Rising CPI data has led to increased institutional interest in Bitcoin ETFs, seen as a more accessible and regulated entry point into the crypto market.

- Shift Toward Crypto as an Inflation Hedge: Institutions are diversifying portfolios to include cryptocurrencies as part of their strategy to hedge against long-term inflation.

- Exploration of Altcoins: Some institutions have ventured into altcoins with solid utility and growth potential, albeit with caution, to balance risk and returns amid inflationary concerns.

Note

The long-term impact of CPI data on institutional crypto investment has been profound. As these investors increasingly incorporate cryptocurrencies into their portfolios, the market has experienced enhanced liquidity and maturity. This trend has solidified Bitcoin’s role as a macroeconomic asset, sensitive to technological advancements within the crypto space and broader economic indicators like inflation.

Future Outlook: Anticipating Market Reactions to Upcoming CPI Data

As 2024 progresses, upcoming CPI data releases are expected to play a pivotal role in influencing the dynamics of the cryptocurrency market. With the growing correlation between inflation indicators and crypto prices, investors and market participants are keenly watching each CPI release to gauge potential impacts on market sentiment and price movements. Given the trends observed, the future holds various scenarios that could affect the trajectory of Bitcoin, Ethereum, and other altcoins.

Preparing for Market Volatility

The crypto market’s sensitivity to CPI data has made it crucial for investors to prepare for periods of heightened volatility surrounding these economic releases. As seen in 2024, CPI reports often trigger swift market reactions, with prices responding to inflationary trends. Investors can take several steps to manage their exposure to risk during these times.

Checklist: Preparing for Market Volatility:

- Monitoring Key CPI Release Dates: Investors should keep track of the scheduled release dates for CPI data. These dates are crucial for anticipating market movements, allowing investors to make informed decisions regarding entry and exit points. Market calendars and economic news websites can provide timely updates on upcoming CPI releases.

- Implementing Risk Management Strategies: To mitigate potential losses, investors can employ risk management tools such as stop-loss orders and hedging strategies. Stop-loss orders can help limit downside risk by automatically selling assets if their price falls below a certain threshold. Additionally, diversifying across different asset classes, including stablecoins and traditional assets, can help cushion the impact of market volatility.

- Diversifying Crypto Portfolios: Diversification is key to managing the risk associated with CPI-driven volatility. Investors may consider holding a mix of assets, including Bitcoin, Ethereum, stablecoins, and select altcoins with strong fundamentals. This approach can help balance the portfolio, reducing exposure to any single asset’s price fluctuations.

Expected Trends Post-CPI Announcements

Given the patterns observed in 2024, future CPI announcements are likely to continue exerting a significant influence on the cryptocurrency market. If inflation continues to rise, as indicated by CPI data, we can expect an increase in market volatility. Bitcoin may experience upward pressure as investors seek to hedge against inflation, while altcoins may exhibit more erratic behavior depending on their use cases and market speculation.

Conversely, if upcoming CPI releases indicate a moderation in inflation, the crypto market could respond with a rally, driven by renewed investor confidence. In such scenarios, we may see a broader market recovery, with altcoins experiencing significant gains alongside major cryptocurrencies like Bitcoin and Ethereum.

| CPI Scenario | Bitcoin Expected Movement | Ethereum Expected Movement | Altcoins Expected Movement |

|---|---|---|---|

| Rising Inflation | Moderate upward trend | Mild upward movement | Increased volatility, mixed trends |

| Moderating Inflation | Significant upward trend | Strong upward movement | Broad market rally, high growth |

| Stable Inflation | Gradual growth | Steady growth | Selective altcoin gains, reduced volatility |

| Falling Inflation | Short-term volatility | Mild corrections | Altcoin correction, stabilization |

Insights:

- Rising Inflation: If CPI data points to rising inflation, Bitcoin is expected to experience a moderate upward trend as it continues to attract investors as a store of value. Ethereum may follow suit with mild upward movement, while altcoins could see increased volatility.

- Moderating Inflation: In the event of moderating inflation, a stronger market rally is anticipated. Bitcoin and Ethereum could see significant upward trends, while altcoins may experience broad-based growth, capitalizing on renewed investor confidence.

- Stable Inflation: A scenario of stable inflation may lead to gradual growth in Bitcoin and Ethereum prices. Altcoins with solid fundamentals may see selective gains, with reduced overall market volatility.

- Falling Inflation: Should CPI data indicate falling inflation, the market may initially react with short-term volatility, potentially leading to mild corrections. However, this could stabilize the market in the long term, particularly for altcoins.

Related Topics for Further Reading

- Latest Current Bitcoin Price Trend Analysis

- Impact of US Inflation Data on Crypto Markets in 2024

- Crypto Investment Strategies in Inflationary Periods

- The Role of Stablecoins in Volatile Markets

- Bitcoin ETFs and Institutional Investment Trends

In 2024, global CPI data has become a pivotal factor in shaping the cryptocurrency market’s short-term fluctuations and long-term trends. Inflation concerns have driven strategic shifts among both retail and institutional investors, influencing market sentiment, trading volumes, and investment strategies. As CPI data continues to impact the crypto landscape, understanding its influence on market dynamics is essential for navigating this evolving space.