Taiwan’s digital asset regulation is set to undergo significant changes in 2024. The Financial Supervisory Commission (FSC) has announced new measures aimed at enhancing investor protection and ensuring that the country’s financial system is shielded from the risks posed by digital assets. These updates come as Taiwan strengthens its regulatory framework, making it a critical region for cryptocurrency stakeholders. With new penalties and stricter oversight, these regulations emphasize compliance and investor safety, highlighting Taiwan’s proactive role in the global regulatory landscape.

Taiwan’s Financial Supervisory Commission (FSC) Regulatory Focus

Taiwan’s Financial Supervisory Commission (FSC) plays a key role in shaping the regulatory landscape for the cryptocurrency industry. In 2024, the FSC has reinforced its commitment to overseeing digital assets by introducing new measures designed to enhance the safety of digital markets and protect investors. These updates not only strengthen market oversight but also ensure Taiwan’s position as a forward-thinking player in the global cryptocurrency ecosystem.

Key Objectives of the FSC’s 2024 Regulatory Framework

The FSC’s 2024 regulatory framework focuses on three main objectives: investor protection, fraud prevention, and ensuring the stability of the financial system. To safeguard investors, the framework emphasizes the creation of stringent measures that limit the risks of fraud within the crypto market. It aligns Taiwan’s approach with global trends, ensuring its policies support the security and growth of blockchain industries. Additionally, this framework provides Taiwan with a stable legal foundation to balance innovation in digital assets while protecting the broader financial ecosystem.

Penalties for Non-compliant Virtual Asset Service Providers (VASPs)

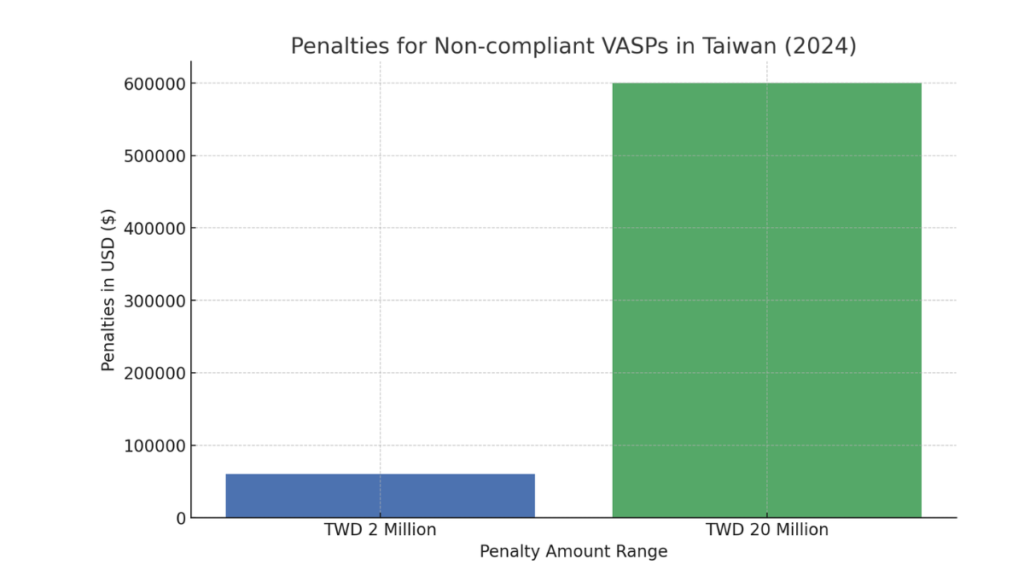

The updated regulations impose penalties on VASPs operating without proper licensing, with fines ranging from TWD 2 million to 20 million ($60,000 to $600,000). These penalties are designed to enforce compliance and reduce the risks posed by unregulated platforms. The FSC aims to establish a robust legal environment that ensures crypto compliance updates are closely monitored, reducing the chances of unregulated practices.

This is a bar chart illustrating the penalties for non-compliant VASPs in Taiwan under 2024 regulations, which range from TWD 2 million to TWD 20 million.

Safeguarding Traditional Financial Systems

One of the FSC’s main concerns is the destabilizing potential that digital assets could have on traditional financial systems. As digital currencies become increasingly intertwined with traditional financial institutions, the FSC’s framework seeks to shield the conventional financial system from these risks. This is achieved by implementing safeguards that aim to balance innovation in the digital sector with the financial stability required to maintain market confidence.

The Virtual Asset Management Bill and Its Implications

The Virtual Asset Management Bill introduced to Taiwan’s parliament in October 2023 marks a critical step toward a regulated and secure cryptocurrency industry. This bill lays the foundation for protecting customer assets while promoting industry transparency and compliance. As Taiwan seeks to create a more structured legal environment for digital assets, the bill focuses on ensuring that both domestic and foreign service providers meet clear standards.

Key Provisions of the Virtual Asset Management Bill

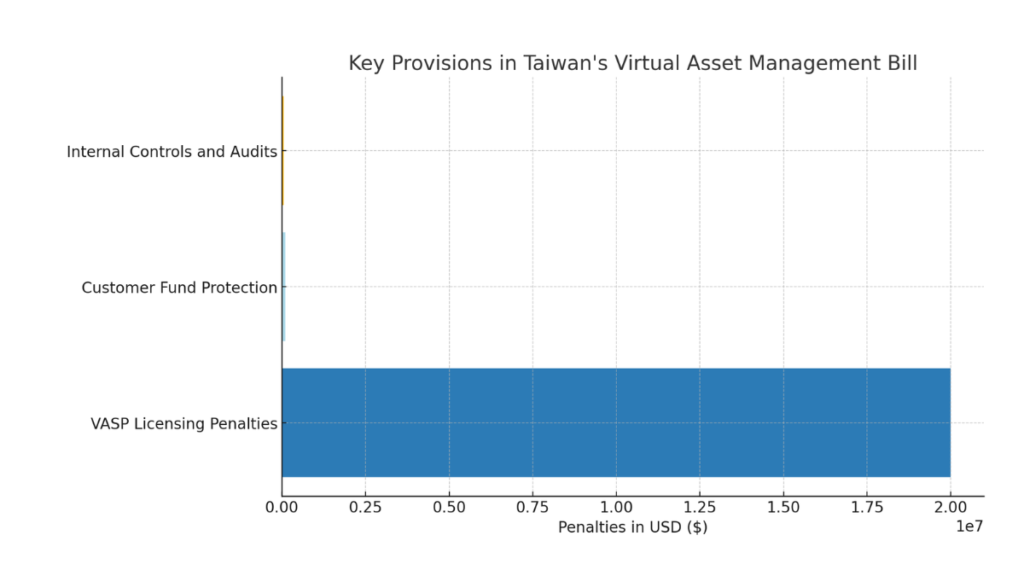

The bill includes several core provisions aimed at creating a secure and compliant digital asset market:

- Licensing Requirements for Virtual Asset Service Providers (VASPs): Service providers must obtain a proper license to operate legally in Taiwan. VASPs that fail to comply face penalties ranging from TWD 2 million ($60,000) to TWD 20 million ($600,000), with a six-month window for existing companies to apply for licensing.

- Customer Fund Protection: The bill mandates that VASPs segregate customer funds from company reserves to ensure customer assets are protected and accessible.

- Internal Controls and Compliance: VASPs must implement internal audit systems to ensure ongoing compliance with Taiwan’s regulatory standards. Additionally, participation in local trade associations is encouraged to foster industry self-regulation.

| Provision | Details | Compliance Timeline |

|---|---|---|

| VASP Licensing | Required for legal operations | 6-month grace period |

| Customer Fund Protection | Separation of customer and company funds | Immediate upon licensing |

| Penalties for Non-compliance | TWD 2M to TWD 20M fines | After licensing deadline |

| Internal Audit and Control Systems | Required for all VASPs | Ongoing |

- A pie chart to show the proportional emphasis on each requirement (e.g., licensing vs. internal controls).

- A line graph for tracking changes in penalties or compliance over time if historical data is available.

Impact on Crypto Exchanges and Service Providers

The bill places substantial restrictions on foreign crypto exchanges and service providers, requiring them to seek approval from Taiwan’s Financial Supervisory Commission (FSC) before operating in the country. This move ensures that foreign platforms adhere to the same standards of customer protection and market transparency as local exchanges. These restrictions also aim to mitigate risks posed by offshore platforms that may operate without the necessary oversight.

Enhancing Consumer Protection and Market Integrity

Customer protection is a key priority under this bill. By mandating clear guidelines for fund management, the bill significantly reduces the risks associated with fraud or mishandling of customer assets. Additionally, penalties for non-compliance are structured to deter unethical behavior among virtual asset service providers. This emphasis on consumer protection rules aligns with Taiwan’s broader goal of fostering a secure and trustworthy crypto market.

The Role of Self-Regulation in Taiwan’s Crypto Industry

In a significant move to foster transparency and compliance within the digital asset industry, Taiwan’s major cryptocurrency exchanges formed a self-regulatory association in September 2023. This effort reflects the growing collaboration between industry leaders and regulators to strengthen market oversight and promote best practices in the evolving crypto sector.

The Establishment of the Self-Regulatory Association

Several of Taiwan’s leading cryptocurrency exchanges, including BitstreetX, Hoya Bit, and MaiCoin, joined forces to establish the Taiwan Virtual Asset Platform and Transaction Business Association. The goal of this association is to create a unified front for enforcing compliance, promoting industry standards, and advocating for the interests of the crypto community. By coordinating closely with Taiwan’s Financial Supervisory Commission (FSC), the association aims to ensure that exchanges and other service providers operate within a transparent and accountable framework.

Benefits of Self-Regulation for the Crypto Market

- A bar chart to compare these benefits across other regions or sectors.

- A stacked bar chart for showing cumulative effects over time or how these priorities evolve.

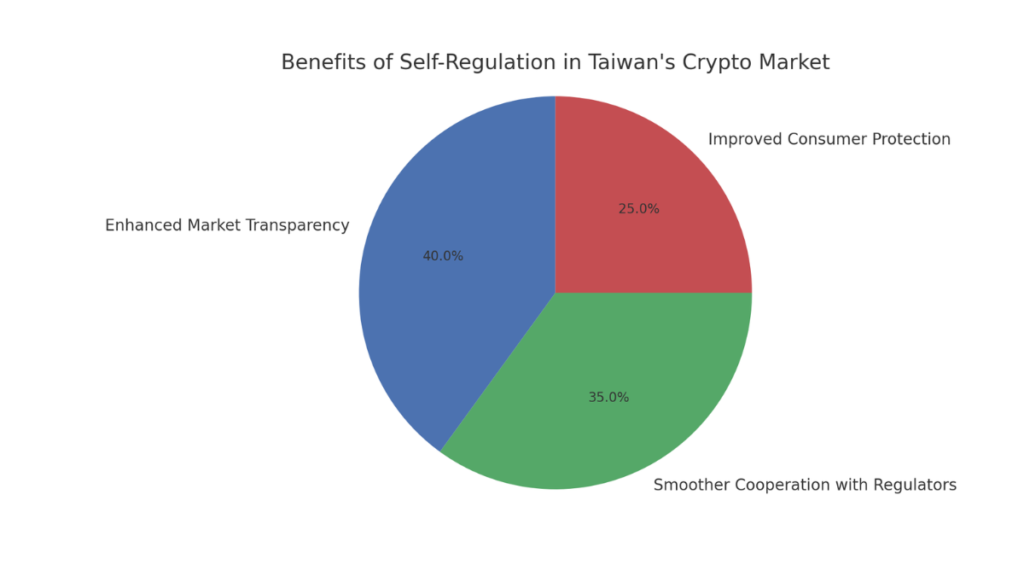

The formation of a self-regulatory body offers several key advantages for Taiwan’s crypto market:

- Enhanced Market Transparency: The association helps build trust by ensuring that service providers adhere to consistent standards, thus fostering confidence among investors and consumers.

- Smoother Cooperation with Regulators: By working alongside the FSC, the association facilitates easier compliance with regulatory guidelines, reducing friction between regulators and crypto businesses.

- Improved Consumer Protection: Self-regulation allows exchanges to implement better consumer safeguards, helping to prevent fraud and secure user assets.

Future of Digital Asset Markets Under Taiwan’s Regulations

As Taiwan rolls out its comprehensive digital asset regulations, the country’s crypto market is expected to become more secure and well-regulated. Taiwan’s focus is on fostering innovation while protecting the traditional financial system from the volatility of digital assets. This section explores how these changes will shape the market for both local and international participants.

- A stacked bar chart if more categories or comparisons (e.g., local vs. international) are added.

- A line graph if tracking changes in regulatory focus over time or across different regions.

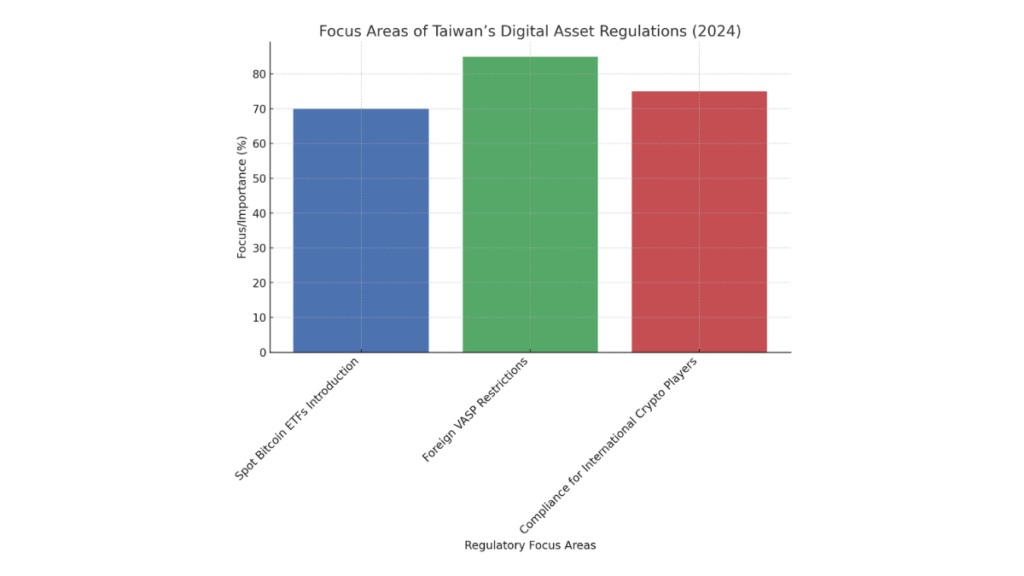

Taiwan’s Stance on Bitcoin ETFs and International Products

Taiwan is exploring the introduction of spot Bitcoin ETFs under its regulatory framework. The Financial Supervisory Commission (FSC) has expressed interest in integrating these products into the local market, aligning with international trends. A study conducted by the Taiwan Chamber of Commerce, due in April 2024, will assess the risks and benefits of spot Bitcoin ETFs. While Taiwan is open to introducing domestic Bitcoin ETFs, it remains cautious about foreign crypto-based ETFs due to concerns about regulatory uncertainties and fraud risks.

Long-term Impact on International Crypto Players

Taiwan’s new regulations impose stringent requirements on foreign Virtual Asset Service Providers (VASPs). These providers must obtain approval from the FSC before offering services in Taiwan. The FSC aims to safeguard the local market from unregulated foreign platforms, which are viewed as higher risk. This move will likely impact international crypto companies looking to enter the Taiwanese market, forcing them to comply with Taiwan’s licensing and compliance requirements. In the long term, the regulations may deter some foreign players but provide a more secure environment for compliant international firms and investors.

Read More:

- US SEC’s Enforcement Actions Against Crypto

- FATF Guidelines on Crypto Transactions

- Brazil’s Cryptocurrency Regulation Initiatives

- China’s Crypto Anti-Money Laundering Laws

- Germany’s Crypto Tax Reporting Rules

Taiwan’s evolving digital asset regulations mark a significant step toward creating a more secure and structured crypto market. Taiwan is positioning itself as a leader in crypto regulation by implementing stricter rules for Virtual Asset Service Providers (VASPs) and exploring innovative products like spot Bitcoin ETFs. These changes are designed to protect both local and international investors while ensuring compliance within the growing digital asset space.

The introduction of penalties for non-compliant VASPs, along with the development of consumer protection measures, reflects Taiwan’s commitment to fostering a trustworthy environment. Additionally, the cautious approach towards foreign products, including crypto-based ETFs, underscores the country’s dedication to maintaining financial stability.

As the regulatory landscape continues to evolve, both domestic and international stakeholders will need to adapt to these new requirements. Taiwan’s proactive stance offers a model for balancing innovation and security in the global digital asset market.