Stablecoin price volatility has been a key concern in the crypto market during September 2024, with fluctuations driven by various market events. Understanding these shifts is essential as stablecoin market capitalization continues to grow, reaching a record high of $168 billion. Tether (USDT) has maintained a market cap nearing $120 billion, with low volatility, while USDC’s increasing dominance, influenced by regulatory compliance, has contributed to notable price movements. These changes underscore the importance of monitoring factors affecting stablecoin stability and their broader impact on the cryptocurrency ecosystem.

Daily Stablecoin Price Changes and Significant Events

Throughout September 2024, stablecoin price movements have been shaped by various market events and trends, reflecting the crypto market’s dynamic nature. Major stablecoins like USDT, USDC, and DAI experienced fluctuations due to changing market conditions, regulatory developments, and macroeconomic factors. This section delves into daily price fluctuations and examines the key events influencing stablecoin prices during the month.

Major Price Fluctuations on Key Dates

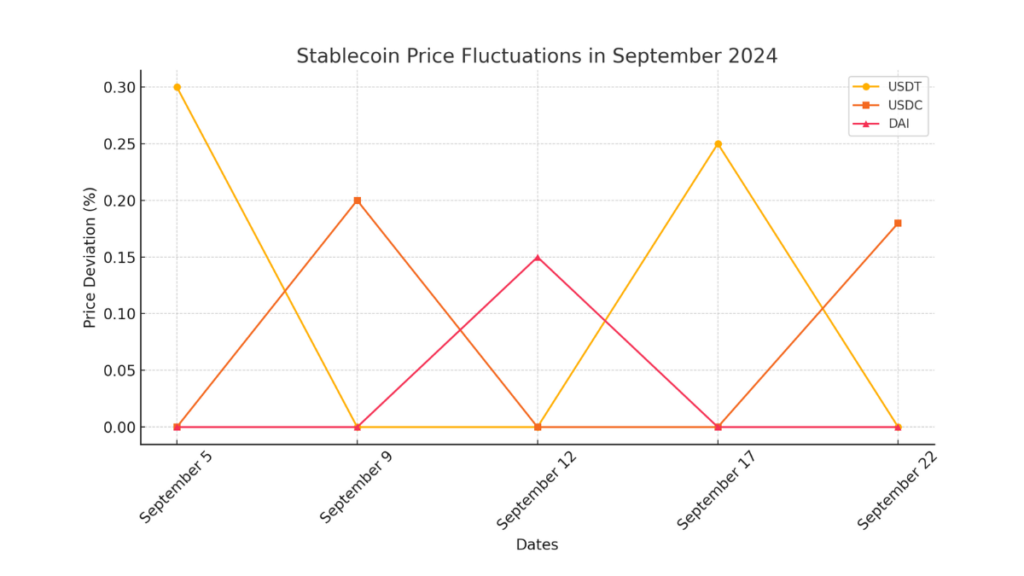

Stablecoins such as Tether (USDT), USD Coin (USDC), and DAI have shown varying degrees of price stability in September 2024. While these assets are designed to maintain a peg to a specific value, like the US dollar, they still experience minor deviations driven by market dynamics and demand-supply fluctuations.

- USDT: Tether (USDT) has maintained its dominant position in the stablecoin market with a market cap nearing $120 billion. Despite this stability, USDT has seen minor daily price fluctuations, typically staying within a 0.1-0.3% range around its $1 peg. Key dates of note include:

- September 5: USDT experienced a brief deviation of 0.3%, attributed to a spike in trading volume on centralized exchanges, likely influenced by market participants reacting to an unexpected regulatory announcement in Europe.

- September 17: Another fluctuation of 0.25% occurred, correlating with a market-wide reaction to economic data releases, including US inflation reports.

- USDC: USD Coin (USDC) has remained relatively stable, bolstered by its compliance with European regulations. Its trading activity increased significantly, especially in regions where Tether’s regulatory challenges were more pronounced. Key fluctuations include:

- September 9: USDC deviated slightly by 0.2% following a surge in trading activity on decentralized exchanges. This increase was primarily driven by speculation around potential changes in interest rates in the United States.

- September 22: USDC experienced a brief fluctuation of 0.18%, coinciding with the release of new regulatory guidelines affecting stablecoin issuance in certain Asian markets.

- DAI: DAI, a decentralized stablecoin, saw minor price movements influenced by changes in DeFi protocols and liquidity pools.

- September 12: DAI’s price shifted by 0.15% as a result of liquidity shifts within major DeFi platforms. The announcement of new yield farming incentives on platforms like Aave and Compound led to changes in DAI’s market demand.

| Date | Stablecoin | Price Deviation (%) | Notable Event |

|---|---|---|---|

| September 5 | USDT | 0.3% | Regulatory announcement in Europe |

| September 9 | USDC | 0.2% | Speculation around US interest rates |

| September 12 | DAI | 0.15% | Changes in DeFi liquidity pools |

| September 17 | USDT | 0.25% | Reaction to US inflation data |

| September 22 | USDC | 0.18% | New regulatory guidelines in Asia |

Impact of Market Events on Stablecoin Prices

Several market events in September 2024 played pivotal roles in influencing stablecoin prices:

- Regulatory Developments: European regulations have placed additional scrutiny on stablecoin issuers, notably affecting USDT’s trading volumes. The Markets in Crypto-Assets (MiCA) Regulation raised concerns about USDT’s future in Europe, causing brief market instability and influencing traders to pivot towards USDC, which has complied with new regulations. As a result, USDT experienced brief price deviations due to shifts in trading volumes on both centralized and decentralized exchanges.

- Economic Data Releases: US inflation data released in mid-September led to market-wide fluctuations. Inflation rates directly impact interest rates, which in turn affect crypto market sentiment. On September 17, stablecoins like USDT and USDC saw slight deviations from their $1 peg as traders adjusted their positions in response to the data, leading to increased trading activity and brief periods of instability.

- Market Shocks: Throughout September, isolated market shocks, such as sudden changes in liquidity on DeFi platforms, caused noticeable price deviations in stablecoins. For instance, on September 12, a surge in DeFi activity caused DAI’s price to shift, reflecting changes in demand within the ecosystem.

Note

By monitoring these daily changes and understanding the events behind them, traders and analysts can better gauge the stability of stablecoins and their response to broader market conditions.

Key Factors Influencing Stablecoin Price Stability

Stablecoin price stability in September 2024 has been influenced by a myriad of factors ranging from market liquidity to broader economic conditions and regulatory changes. Understanding these factors is essential for comprehending why stablecoins like USDT, USDC, and DAI deviate from their pegged value. This section explores the role of liquidity and market demand alongside external economic and regulatory influences.

Liquidity and Market Demand

Liquidity and market demand are central to stablecoin price stability. In September 2024, the liquidity landscape for stablecoins has experienced fluctuations that directly impacted their stability.

- Liquidity Conditions: The liquidity of stablecoins like USDT and USDC is often tied to the availability of these assets on both centralized and decentralized exchanges. High liquidity typically correlates with tighter price stability as there are enough buyers and sellers to keep the price around its peg. During periods of low liquidity, such as market downturns or when exchanges face regulatory pressures, stablecoins can experience slippage. In September, Tether (USDT) maintained its dominance due to its deep liquidity pools, which helped keep its price deviations minimal, even during periods of heightened market stress.

- Market Demand: Market demand for stablecoins can shift due to several factors, including investor sentiment, market volatility, and shifts in trading strategies. For instance, during market volatility or uncertainty, investors often flock to stablecoins as a safe haven, driving up demand. This increased demand can sometimes push the stablecoin’s price slightly above its peg. In September, we observed an increase in USDC demand as traders sought more regulatory-compliant stablecoins, particularly in regions where USDT faced regulatory scrutiny. Conversely, when market sentiment is bullish, the demand for stablecoins may decline as investors move into more volatile assets, potentially affecting the stablecoin’s liquidity and price.

- Trading Volume: Trading volume is a crucial indicator of market demand and liquidity. High trading volumes typically lead to more stable prices due to the constant flow of trades that keep the price anchored around its peg. In September 2024, trading volumes for stablecoins like USDT and USDC varied, with USDC seeing an uptick in trading activity due to its increased regulatory compliance. However, periods of low trading volume, often during market consolidation phases, can lead to minor price fluctuations as the lack of trades makes it easier for larger transactions to influence the price.

External Economic and Regulatory Factors

External economic and regulatory factors have a significant impact on the stability of stablecoin prices. In September 2024, these factors played a crucial role in shaping market dynamics for stablecoins.

- Macroeconomic Data: Macroeconomic indicators such as inflation rates, interest rates, and economic growth data can indirectly influence stablecoin prices. For example, in September 2024, the release of US inflation data led to shifts in market sentiment. Higher-than-expected inflation often triggers concerns about fiat currency devaluation, prompting investors to seek refuge in stablecoins. Conversely, lower-than-expected inflation can lead to reduced demand for stablecoins, causing slight price deviations.

- Regulatory Developments: Regulatory announcements have been a driving force behind stablecoin price volatility. In September, the implementation of the Markets in Crypto-Assets (MiCA) Regulation in Europe introduced new requirements for stablecoin issuers, particularly impacting USDT. The need for e-money licenses and substantial reserves created uncertainty around USDT’s future in European markets. This led to a temporary shift in market sentiment, as traders pivoted towards USDC, which had already complied with these regulations. Regulatory news from other regions, including Asia, also contributed to fluctuating stablecoin prices, as market participants adjusted their positions in response to new policy guidelines.

- Geopolitical Events: Geopolitical developments, such as trade tensions, international sanctions, or political instability, can affect global markets and indirectly impact stablecoin prices. In September, the global market observed several geopolitical events, including economic policy shifts in key markets. Such events can cause investors to seek stablecoins as a hedge against uncertainty, leading to increased demand and potential price deviations.

Key External Factors Checklist

- Interest Rate Changes: Shifts in central bank interest rates influence market sentiment and the attractiveness of holding stablecoins.

- Regulatory Announcements: New policies or guidelines affecting stablecoin issuance, trading, or reserve requirements can impact market dynamics.

- Geopolitical Events: Political or economic instability in major markets can drive demand for stablecoins.

- Economic Data Releases: Inflation rates, GDP growth, and employment figures influence macroeconomic conditions that affect stablecoin demand.

Key Observations:

By examining these factors, we gain a comprehensive understanding of the elements that contribute to stablecoin price stability, enabling market participants to better navigate the complexities of the crypto market.

Stablecoin Market Impact and Dominance Shifts

In September 2024, stablecoin market dynamics have been marked by notable price volatility and shifts in dominance among key players like USDT, USDC, and DAI. The impact of this volatility has been felt across the broader crypto market, influencing trading volumes, market capitalization, and investor sentiment. Understanding how these shifts occurred provides insight into the evolving role of stablecoins in the crypto ecosystem.

USDT, USDC, and DAI Dominance in September 2024

In terms of market cap and dominance, the stablecoin landscape in September 2024 has seen significant developments:

- Tether (USDT): USDT continues to hold its position as the dominant stablecoin in the market. Its market capitalization has climbed to nearly $120 billion, representing over 70% of the stablecoin market. Despite regulatory scrutiny in some regions, USDT’s vast liquidity and adoption across various exchanges and platforms have contributed to its dominance. This month, USDT maintained a stable peg, with minimal volatility in its price, affirming its role as the go-to stablecoin for traders seeking liquidity and stability. However, its dominance has slightly dipped in regions where regulatory compliance has become a more significant concern, leading some users to diversify into other stablecoins like USDC.

- USD Coin (USDC): USDC has seen a surge in market dominance, particularly in markets that prioritize regulatory compliance. With a market cap exceeding $34 billion, USDC has solidified its position as the second-largest stablecoin. Its growing dominance is attributed to its compliance with regulatory standards such as the Markets in Crypto-Assets (MiCA) Regulation in Europe. USDC’s compliance efforts have attracted institutional investors and traders seeking a stablecoin with clear regulatory backing. In September 2024, USDC’s trading volumes rose, especially in regions where regulatory pressures on USDT were most intense. The shift towards USDC also reflects market participants’ preference for transparent and fully-backed stablecoins amidst increasing regulatory scrutiny.

- DAI: DAI, the decentralized stablecoin, has maintained its role within the DeFi ecosystem, albeit with a smaller market cap compared to USDT and USDC. DAI’s performance in September 2024 was influenced by shifts in the DeFi landscape, including changes in liquidity pools and yield farming incentives. As a decentralized stablecoin, DAI’s dominance is closely tied to the health and activity of the DeFi sector. During the month, DAI saw increased usage on decentralized exchanges (DEXs) and lending platforms, contributing to its resilience amidst market volatility. Its market cap, while lower than USDT and USDC, reflects the growing interest in decentralized finance and the desire for stablecoins that operate outside centralized frameworks.

Price Volatility and Market Sentiment

Stablecoin price volatility has had a notable impact on overall market sentiment throughout September 2024. The movements in stablecoin prices often serve as a barometer for broader market trends, reflecting investor reactions to various economic and regulatory events.

- Influence on Market Sentiment: Stablecoins are typically viewed as safe havens during periods of market turbulence. As such, their price stability or volatility can significantly influence market sentiment. In September, instances of brief price deviations in USDT and USDC sparked concerns over regulatory uncertainty and market liquidity. For example, following regulatory developments in Europe, traders exhibited cautious behavior, with some moving their assets into more stable, regulatory-compliant stablecoins like USDC. This shift highlighted the market’s sensitivity to regulatory actions and their potential impact on the perceived stability of major stablecoins.

- Correlation with Broader Market Trends: Stablecoin price movements have also been correlated with trends in the broader crypto market. During periods of heightened market volatility, the demand for stablecoins typically rises as traders seek to mitigate risk. In September, as the crypto market faced several shocks—including unexpected regulatory announcements and macroeconomic data releases—the increased demand for stablecoins was evident in their trading volumes. USDC’s compliance-driven demand surge, alongside USDT’s continued dominance, underscored the market’s dual focus on stability and regulatory adherence.

- Investor Behavior: The volatility and dominance shifts in stablecoins have influenced investor behavior, particularly in terms of risk management and portfolio diversification. As stablecoins serve as on-ramps and off-ramps for crypto trading, changes in their stability can prompt traders to adjust their positions. September 2024 saw an uptick in the use of stablecoins not just as a means of preserving value during market downturns but also as tools for quick entry and exit in volatile markets. This behavior highlights the growing role of stablecoins as essential instruments in trading strategies, reflecting their impact on market sentiment.

the volatility and dominance shifts of stablecoins like USDT, USDC, and DAI in September 2024 have had a multifaceted impact on the crypto market. By serving as indicators of market sentiment and instruments for risk management, these stablecoins continue to shape the dynamics of the broader crypto ecosystem.

Note

Real-Time Stablecoin Price Movements and Market Analysis

As we delve into September 2024, real-time stablecoin price movements reveal a dynamic and fluctuating market landscape. The following analysis provides insights into the current trends, identifying notable price shifts and market reactions. By examining real-time data, traders and analysts can gain a deeper understanding of ongoing market behavior and anticipate future movements.

Real-Time Price Fluctuations Analysis

Recent data shows that the stablecoin market continues to experience minor yet noticeable fluctuations in response to ongoing market events. For instance, Tether (USDT), which maintains a market cap of nearly $120 billion, has shown resilience, with its price consistently oscillating around the $1 peg. However, even slight deviations, such as a drop to $0.998 or a rise to $1.002, have occurred intermittently throughout the month. These fluctuations often coincide with broader market movements, such as changes in Bitcoin’s price, significant trades on centralized exchanges, or regulatory announcements.

USD Coin (USDC) has also shown relatively stable real-time price movements, generally staying within a narrow band around its peg. Nevertheless, brief deviations have been observed, particularly during periods of increased trading volume on decentralized exchanges. For example, recent shifts in liquidity pools on Uniswap and other DEXs have occasionally caused minor price deviations, pushing USDC momentarily above or below the $1 mark.

DAI, the decentralized stablecoin, has exhibited similar real-time price fluctuations, primarily influenced by changes in the DeFi ecosystem. The continuous adjustment of collateralization ratios and borrowing rates on platforms like MakerDAO impacts DAI’s supply and demand dynamics. As a result, DAI’s price has fluctuated within a tight range, reflecting the balance between market forces and automated stabilization mechanisms inherent in its protocol.

These real-time fluctuations highlight the nuanced interplay between stablecoins and the broader crypto market. Events such as sudden market sell-offs, spikes in demand for stablecoins as safe havens, or adjustments in liquidity pools can all contribute to short-term price shifts. Despite these fluctuations, the overall price stability of major stablecoins remains relatively intact, underscoring their role as key instruments in the digital asset space.

Market Reactions to Stablecoin Price Shifts

Market participants, including traders, institutional investors, and DeFi users, have reacted to recent stablecoin price shifts with varying strategies. The slight deviations in stablecoin prices have led to several market responses:

- Traders: Active traders on both centralized and decentralized exchanges are leveraging these minor fluctuations for arbitrage opportunities. For example, when USDT dips slightly below $1 on one exchange and remains at or above $1 on another, traders quickly execute arbitrage trades to capitalize on the price difference. This activity not only provides profit opportunities but also contributes to restoring the stablecoin’s peg across different trading platforms.

- Institutional Investors: Institutions are closely monitoring stablecoin price stability, especially given their growing role in the cryptocurrency market. Recently, the preference for regulatory-compliant stablecoins like USDC has increased among institutional players, particularly after the regulatory scrutiny faced by USDT in certain jurisdictions. Institutions are deploying these stablecoins as part of their risk management strategies, using them for hedging purposes or as a means of quickly entering and exiting market positions without directly impacting the volatility of more traditional cryptocurrencies.

- DeFi Users: Within the decentralized finance (DeFi) ecosystem, users are responding to stablecoin price shifts by adjusting their strategies in lending, borrowing, and liquidity provision. For example, fluctuations in DAI’s price directly affect the collateralization requirements on MakerDAO and other DeFi platforms. Users are dynamically adjusting their collateral to avoid liquidation during periods of heightened volatility. Additionally, liquidity providers on DEXs like Uniswap and Curve are adjusting their positions to optimize returns in response to changes in stablecoin prices and trading volumes.

Overall, market sentiment toward stablecoins remains cautiously optimistic. While minor price shifts prompt immediate market reactions, the prevailing perception of stablecoins as relatively stable assets has not been fundamentally altered. Traders and investors continue to use stablecoins as essential tools for managing market volatility and facilitating seamless transactions in the crypto ecosystem.

Overview of Stablecoin Price Fluctuations for Analysts

September 2024 has been a notable month for stablecoin price fluctuations, marked by a series of market events that have influenced the stability and performance of key stablecoins like USDT, USDC, and DAI. This section provides a comprehensive overview of the major price movements and their impact on the stablecoin market, offering valuable insights for analysts and traders.

Monthly Recap of Significant Price Events

Throughout September, the stablecoin market experienced several periods of heightened volatility, each influenced by distinct market events:

- Regulatory Announcements and Compliance Shifts: The month began with regulatory developments in Europe that impacted USDT’s market performance. The implementation of the Markets in Crypto-Assets (MiCA) Regulation prompted concerns over USDT’s future in European markets. In response, traders shifted toward USDC, which had already complied with the new regulations. This regulatory pressure led to minor deviations in USDT’s peg and a slight increase in USDC’s market share. Analysts observed that these regulatory-induced fluctuations highlighted the market’s growing sensitivity to compliance and legal frameworks, particularly in regions with stringent regulatory environments.

- Market Volatility and Safe Haven Demand: During periods of broader market turbulence, stablecoins typically serve as safe havens. In September, fluctuations in the cryptocurrency market led to increased demand for stablecoins like USDT and USDC, causing momentary deviations from their $1 pegs. For example, mid-month economic data releases in the United States, particularly concerning inflation rates, prompted a rush into stablecoins as traders sought to hedge against potential volatility. This influx of demand resulted in brief price spikes for USDC, particularly on decentralized exchanges where liquidity was momentarily constrained.

- DeFi Ecosystem Shifts: The decentralized finance (DeFi) landscape also played a role in stablecoin price movements this month. DAI, the decentralized stablecoin, experienced fluctuations tied to changes in DeFi protocols, including adjustments in collateralization ratios on MakerDAO and shifts in liquidity pools on platforms like Uniswap. These ecosystem changes contributed to minor price deviations, emphasizing the interconnected nature of stablecoin stability and DeFi market dynamics. Analysts noted that these events underscored the importance of monitoring DeFi activity to understand stablecoin price behavior.

- Market Reactions to External Economic Factors: External economic factors, such as geopolitical developments and macroeconomic data, also influenced stablecoin prices in September. Notably, geopolitical tensions and international trade discussions caused short-term market uncertainty, leading to an increased preference for stablecoins as a safe store of value. As a result, the stablecoin market saw periods of high trading volumes and minor price fluctuations, particularly for USDT and USDC, reflecting the market’s response to external economic conditions.

These significant events collectively shaped the stablecoin market landscape in September 2024, providing analysts with key insights into the factors driving price stability and volatility.

Key Takeaways and Market Outlook

- Stablecoin Resilience Amid Volatility: Despite experiencing minor fluctuations, the primary takeaway from September is the overall resilience of stablecoins like USDT, USDC, and DAI. Their ability to maintain relative price stability amidst regulatory challenges, market turbulence, and DeFi shifts reaffirms their role as vital instruments in the cryptocurrency market. These assets continue to serve as a cornerstone for traders, providing liquidity and stability even during periods of market stress.

- Regulatory Compliance as a Key Driver: The market’s reaction to regulatory developments, particularly in Europe, highlights the growing importance of compliance for stablecoin issuers. USDC’s increasing dominance in regions with strict regulatory frameworks indicates a market preference for transparent and fully-backed stablecoins. Analysts anticipate that future regulatory actions will continue to influence stablecoin market dynamics, potentially driving further shifts in market share.

- Interplay with Broader Market Trends: The correlation between stablecoin price movements and broader market events, such as economic data releases and geopolitical developments, emphasizes the role of stablecoins as both a reflection and a stabilizing force within the crypto ecosystem. Traders and institutional investors have leveraged stablecoins to navigate market volatility, suggesting that these assets will remain integral to market strategies.

- Outlook for Stablecoin Market: Looking forward, analysts expect the stablecoin market to evolve in response to ongoing regulatory developments, technological advancements in DeFi, and shifts in global economic conditions. While the precise nature of future fluctuations remains uncertain, the current trends suggest a market increasingly focused on stability, compliance, and the seamless integration of stablecoins into various financial systems.

In September 2024, stablecoin price volatility reflected a complex interplay of market forces, regulatory shifts, and evolving market dynamics. Despite minor fluctuations, stablecoins like USDT, USDC, and DAI showcased resilience, affirming their role as critical instruments in the crypto market. As the market continues to adapt to regulatory landscapes and economic conditions, stablecoins remain a focal point for traders and analysts navigating this evolving ecosystem.