Nigeria introduced a law to regulate cryptocurrencies. In 2024, Nigeria’s Federal Inland Revenue Service (FIRS) proposed a framework. It aims to address the digital economy and ensure crypto trading helps the economy. The new rules aim to fix issues with crypto exchanges. They include taxation, market integrity, and compliance standards. With clear guidelines, this framework should boost Nigeria’s role in Africa’s digital economy.

An Analysis of Nigeria’s Proposed Crypto Regulation

Nigeria’s new crypto rules aim to connect the digital asset market to its economy. The Federal Inland Revenue Service (FIRS) leads this effort. It aims to create a law to regulate cryptocurrency operations. The bill will focus on tax compliance and market integrity. It seeks to protect investors and the economy.

This effort aims to reduce risks. It will help Nigeria use the potential of digital assets. Nigeria hopes to modernize its financial system with these regulations. They aim to align it with global standards and boost economic growth.

Goals of the New Framework

The primary objectives of Nigeria’s proposed crypto legal framework include:

- Enhancing market integrity: The rules will set clear guidelines. They will ensure fair practices in the crypto market. This will reduce fraud and manipulation risks.

- The government wants to reduce tax evasion. It aims to curb tax avoidance by formalizing tax rules for digital assets. It wants crypto transactions to contribute to the country’s revenue.

- Promoting transparency: We will improve compliance. This includes Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. These protocols will make crypto transactions transparent. They will protect the financial system from illegal activities.

FIRS and SEC’s Roles in Regulation

The FIRS and SEC will regulate Nigeria’s cryptocurrency space. They will play pivotal roles in this.

- FIRS: It focuses on tax collection and compliance with digital asset tax laws. It aims to tax crypto transactions. It will collect revenue from individuals and businesses in the crypto market.

- SEC: It oversees crypto exchanges and ensures market compliance. The SEC will regulate crypto offerings and exchanges. It will ensure investor protections are in place.

| Regulatory Body | Duties |

|---|---|

| FIRS | Tax collection, ensuring compliance |

| SEC | Exchange regulation, investor protection |

Crypto Taxation and Compliance Measures

Nigeria’s new rules stress the need for clear tax guidelines for crypto transactions. The FIRS, a government agency, aims to modernize its tax system. This is to reflect the rise of digital assets in Nigeria’s economy. This framework will ensure that crypto investors comply with Nigerian tax laws.

Tax Laws for Cryptocurrency Transactions

The plan will tax all cryptocurrency transactions. This includes buying, selling, or trading digital assets. A 10% capital gains tax will apply to profits from selling digital assets, like crypto. This tax applies to both individuals and businesses operating within Nigeria. Also, this move aims to increase transparency in the digital economy. It will ensure that crypto activities contribute to the country’s revenue.

Note

The FIRS said the new tax laws aim to simplify crypto tax reporting and payments. They will have clearer guidelines for reporting crypto gains. Penalties for non-compliance are expected to be enforced.

Business and Investor Compliance Requirements

The proposed rules say businesses and investors must follow KYC and AML rules for crypto. Both local and international exchanges in Nigeria must verify their users’ identities. This is to ensure that transactions are lawful and traceable. The regulations will require businesses to collect customer data. They must report any suspicious activities to Nigerian authorities. This will strengthen the financial system’s integrity.

Here is a compliance requirement for businesses and investors:

- KYC Implementation: All exchanges must verify the identities of users.

- AML Adherence: Firms must detect and report suspicious transactions.

- Reporting Crypto Income: Investors and businesses must report crypto income for taxes.

- Capital Gains Tax Filing: Ensure compliance with the 10% tax on gains from the sale of digital assets.

Impact on Crypto Exchanges and Market Integrity

Nigeria’s crypto exchange rules aim to build trust in the digital asset market. The SEC has introduced new rules for exchanges. They must meet strict licensing criteria. These measures aim to protect investors and the market. They also encourage long-term growth.

Licensing Requirements for Crypto Exchanges

The SEC’s licensing requirements for crypto exchanges in Nigeria set a high bar for market entry. Exchanges must meet capital requirements. They need a least paid-up capital of 500 million naira. They also need a Fidelity Insurance Bond covering at least 25% of the capital. This threshold ensures exchanges can protect investors’ funds and run their operations. Exchanges must show operational transparency. They must have audits. They must comply with anti-money laundering (AML) and counter-terrorism financing (CTF) standards.

Note

Exchanges like Quidax and Busha have received provisional licenses. This marks a big step in Nigeria’s changing crypto regulations. These licensed exchanges must work closely with banks and financial institutions. They should further integrate crypto into Nigeria’s economic system.

Market Integrity Measures

SEC requires exchanges to implement several key measures to safeguard market integrity. They include audits, strict reporting, and better cybersecurity to prevent hacking and fraud. Exchanges must report suspicious activities and financial discrepancies to regulators. Also, the SEC enforces market transparency. It requires exchanges to communicate clearly and consistently with investors and regulators.

The goal is to stop market manipulation. We want a safe, smooth crypto ecosystem in Nigeria. By adopting these standards, Nigeria aims to lead Africa’s crypto market. It seeks to balance innovation with investor protection.

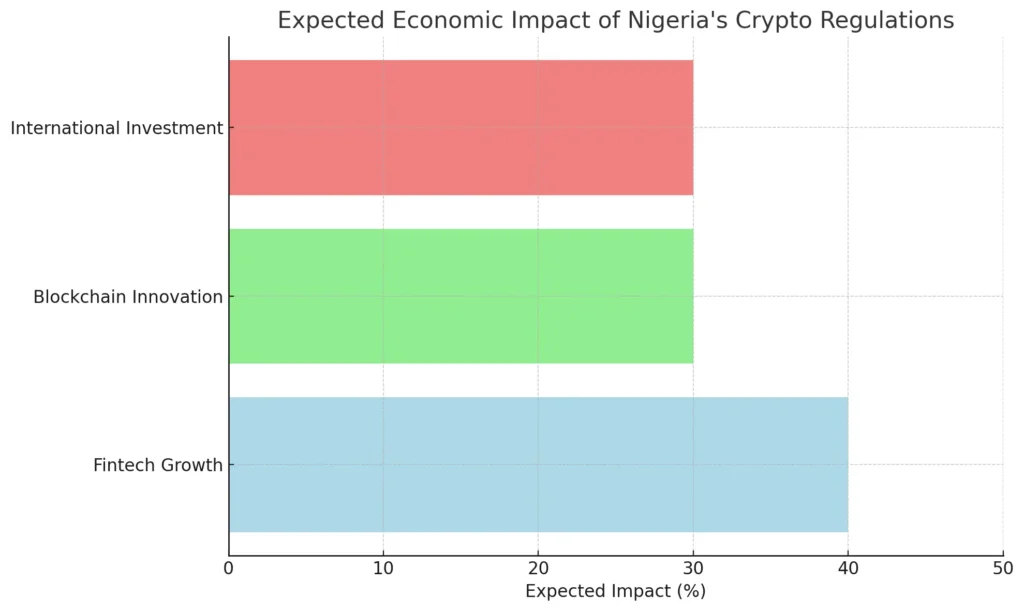

Economic Impact of Nigeria’s Crypto Regulations

Nigeria’s crypto regulations will significantly affect fintech, foreign investment, and economic growth. The government wants to unlock the crypto market’s potential. It aims to do this by setting clear rules for crypto operations. These rules will ensure a stable environment for local and international investors. The rules seek to balance innovation and security. They could make Nigeria a key player in the global crypto economy.

Growth Opportunities for Fintech and Blockchain Startups

New rules can provide significant advantages to fintech startups and blockchain projects. Nigeria’s fintech sector has drawn considerable investment. With new crypto rules, startups can expand their services. More precise regulations will boost fintech by encouraging innovation. They will help blockchain solutions for identity, financial inclusion, and secure finance.

Also, Nigeria’s Startup Act promotes digital innovation. Combined with crypto regulations, it could help fintech thrive. Startups could gain early-stage funding and tax breaks. This would boost funding access and digital economy participation.

Encouraging International Investment

A precise crypto regulation will boost foreign investment by ensuring certainty. Investors prefer markets with clear rules, especially in new fields like crypto. Nigeria wants to attract global investors by enforcing AML and CTF regulations. It aims to create a safe investment environment.

The IMF has noted that Nigeria can attract global investors. It can stabilize its financial market by licensing and regulating crypto exchanges. It could improve remittance systems for the Nigerian diaspora. It would make transfers more efficient and boost economic stability.

Challenges and Future Prospects of Crypto Regulation in Nigeria

Nigeria’s move to regulate cryptocurrency is a positive step. But, enforcing compliance and public awareness is still a challenge. Nigeria’s regulations aim to protect the economy and investors. But, enforcing these laws is complex. This is especially true for decentralized platforms and P2P exchanges.

Enforcing Compliance Across the Sector

Enforcing Nigeria’s new crypto tax and regulatory laws is challenging. This is especially true in the decentralized and P2P trading space. P2P platforms dominate Nigeria’s crypto market. Users have limited access to centralized exchanges. Many users prefer P2P services to bypass naira restrictions. This complicates enforcing tax and anti-money laundering (AML) rules. P2P trades lack central control. This makes it hard for authorities to track and tax crypto transactions. Also, businesses and individuals may exploit these platforms to avoid detection. This will lower compliance with the new laws.

Future Developments in Nigeria’s Crypto Regulation

In the future, Nigeria will likely align its rules with global standards as crypto evolves. The government may introduce stricter rules to regulate digital assets. It might work with groups like the FATF to ensure consistent enforcement. New tax laws in late 2024 show Nigeria’s commitment to new tech and market protection.

Check the below Links for Further Reading

- Regulatory Announcements Affecting Crypto

- Crypto’s Role in High-Inflation Economies

- Impact of US Inflation Data on Crypto

- Growth in Crypto Derivatives Trading

- Analysis of Market Trends Post-Fed Meetings

Nigeria’s quest for a crypto regulatory framework is both promising and complex. The rules aim to boost growth and ensure market integrity. They also seek to create a safe environment for local and international investors. But, challenges remain in enforcing these laws, particularly for decentralized platforms. Nigeria must improve its methods to meet global standards and adopt new tech.