The EU’s Markets in Crypto-Assets (MiCA) regulation changes self-hosted crypto wallets. It takes effect in 2024. This legislation targets privacy and security concerns while enforcing anti-money laundering (AML) measures.

Rules exist for transactions over €1,000 between self-hosted wallets and regulated entities. They aim to balance user rights with regulatory compliance. We will explore how MiCA affects self-hosted wallets. What do these changes mean for users and crypto service providers?

Understanding MiCA’s Impact on Self-Hosted Wallets

MiCA is a new crypto law. It targets self-hosted wallets, especially their use with crypto-asset service providers (CASPs). A key focus is to address privacy and security concerns.

We must also follow anti-money laundering (AML) regulations. CASPs must verify and report any transactions over €1,000 involving self-hosted wallets. This is a key rule. This creates stricter controls on wallet use and user privacy.

Key MiCA Provisions Affecting Self-Hosted Wallets

MiCA requires CASPs to follow strict reporting rules for self-hosted wallets. They must verify the ownership of the self-hosted wallet for any transaction over €1,000. CASPs must collect specific info about the sender and receiver, including names, wallet addresses, and ID numbers. This is especially true for high-value or cross-border transactions. This is part of the broader Travel Rule. It aims to prevent money laundering and terrorist financing by making crypto transactions more transparent and traceable.

Mica provides needed oversight, but it impacts wallet holders’ privacy. CASPs must report sensitive information. P2P transfers between two self-hosted wallets are not subject to these rules, so private transactions are still possible in the decentralized space.

Privacy Concerns Under MiCA for Self-Hosted Wallet Users

MiCA’s impact on privacy worries users who value crypto’s anonymity and decentralization. The regulation requires CASPs to detail any transaction over €1,000. This means users will have less anonymity when using self-hosted wallets. This contradicts the core ethos of blockchain: privacy and decentralization.

The trade-off between security and privacy is a major aspect of MiCA. These measures boost transparency and security in the fight against financial crimes. But they limit the anonymity that many users enjoy. MiCA introduces a balanced, but controversial framework. It boosts security but reduces privacy.

This could show the overlap and tension between security and privacy. A large part of the intersection could be labeled “MiCA.” It shows where the regulation tries to balance both sides. The non-overlapping sections would show pure security and privacy. MiCA does not address these aspects.

Compliance Requirements for Crypto Asset Service Providers (CASPs)

MiCA introduces new rules. They will greatly affect how CASPs handle transactions with self-hosted wallets. These rules aim to boost transparency and ensure compliance with AML measures. Under MiCA, CASPs must collect and report data when transacting with self-hosted wallets. This applies to transactions over €1,000.

Transaction Thresholds and Reporting Obligations

Under MiCA, a self-hosted wallet must report any transaction over €1,000 to a CASP. CASPs must gather detailed information about the sender and recipient, including their names, wallet addresses, and, in some cases, IDs. This rule is part of the broader Travel Rule. It aims to combat money laundering and terrorist financing and make transaction details traceable across borders. A self-hosted wallet must meet these requirements for the transaction, even if a CASP does not manage it.

Small transactions under €1,000 may require some due diligence. This is true, especially if there are signs of suspicious activity. CASPs must check if many smaller transfers exceed the threshold. If so, it would trigger more reporting requirements.

Verification Procedures for Self-Hosted Wallets

MiCA requires CASPs to verify self-hosted wallets. This is key for compliance. For transactions over €1,000, CASPs must confirm that the user owns the self-hosted wallet involved. This is usually done with cryptographic signatures. The wallet holder proves they control the wallet’s private keys. This process ensures seamless compliance while minimizing interruptions to the user experience.

Also, CASPs must do enhanced due diligence for high-risk transactions with poor info. This may include gathering more data or pausing the deal until complete verification.

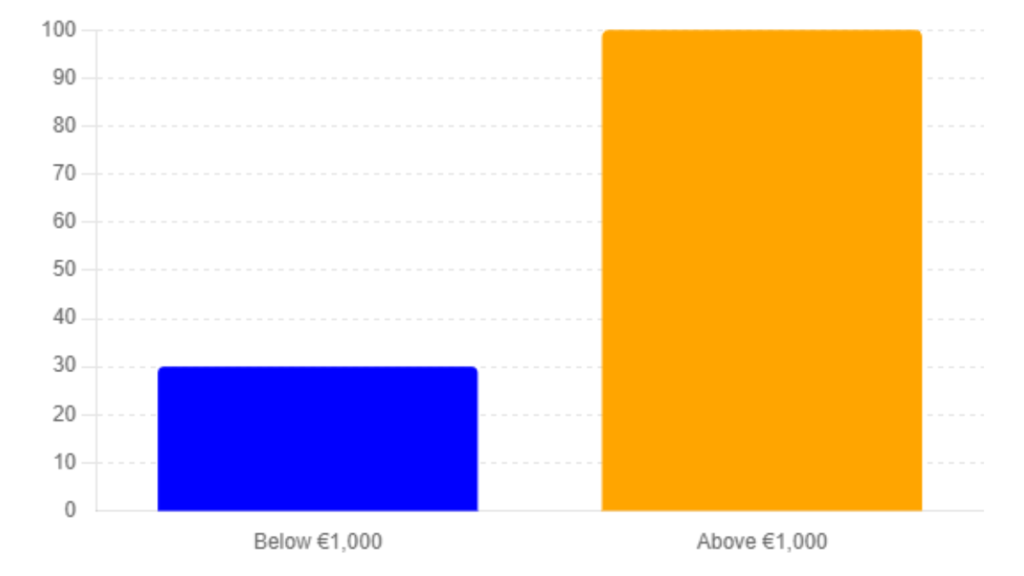

Here is a bar chart comparing the compliance requirements for self-hosted wallets under MiCA.

- Below €1,000: Lower reporting requirements.

- Above €1,000: Full reporting and verification required.

Privacy vs. Security in MiCA Regulations

As the EU implements the MiCA crypto regulation, it must balance privacy with the need for security and transparency to prevent crime. MiCA introduces strict rules for Crypto Asset Service Providers (CASPs). They must comply with anti-money laundering (AML) measures and data-sharing obligations. This often conflicts with MiCA’s security rules. They affect users of self-hosted wallets.

Security Obligations Under MiCA

MiCA enforces key security measures. They protect transaction integrity and reduce financial crime risks. These include:

- Data Encryption: CASPs must use strong encryption for stored and transmitted data. This ensures that sensitive information related to wallet transactions is securely handled.

- Identity Verification: A strong identity verification process is needed. It is vital for transactions over €1,000. This is critical for verifying that self-hosted wallets are owned by the users engaging in transactions.

- Compliance with AML Regulations: CASPs must follow strict AML rules and report details of transactions when users send crypto-assets to or from self-hosted wallets.

Security Best Practices:

- Use encrypted storage to protect customer data.

- Implement identity verification for transactions over €1,000.

- Ensure full compliance with AML and data reporting regulations.

Balancing User Privacy with Regulatory Compliance

While MiCA aims to safeguard financial systems, it also introduces challenges for user privacy. A contentious issue is the need for CASPs to report user data for transactions over €1,000 with self-hosted wallets. It includes personal ID and wallet details. This erodes the privacy of decentralized finance and crypto transactions.

MiCA aims to balance by excluding P2P transactions between self-hosted wallets from these strict rules. However, when interacting with CASPs, users must accept some loss of anonymity. The rules aim to stop the use of crypto for money laundering and terrorism. But privacy advocates are worried about them.

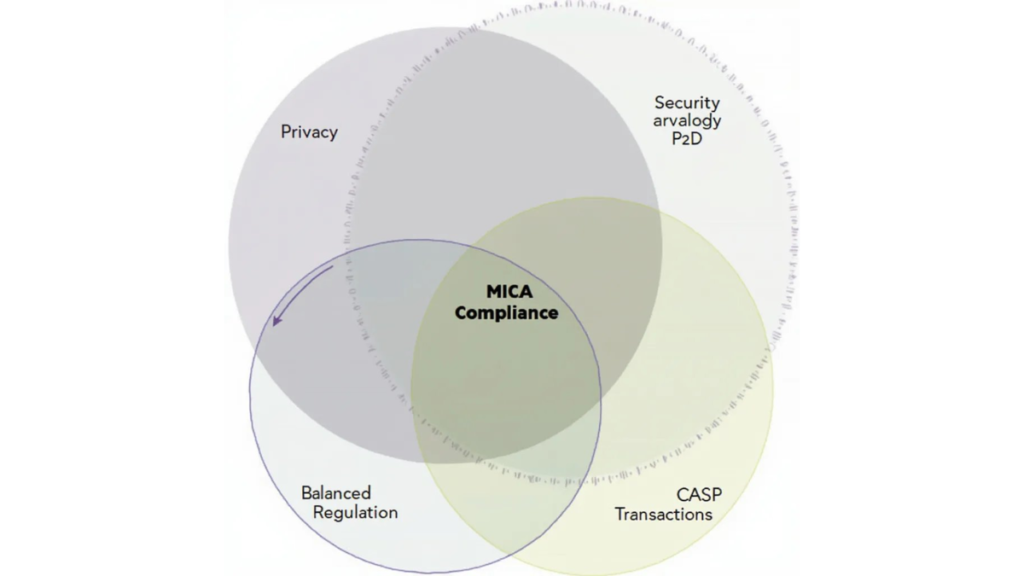

A Venn diagram could show the overlaps and differences among privacy, security, and MiCA compliance.

Implications for Peer-to-Peer (P2P) Transactions and DeFi Wallets

MiCA’s rules impose stricter controls on transactions with crypto-asset service providers (CASPs). However, P2P transactions between self-hosted wallets are mostly unregulated, which provides a level of freedom for users in the decentralized finance (DeFi) space. These exemptions ensure privacy and freedom for users of self-hosted wallets. They can transact directly without a third-party CASP, unlike transactions involving centralized intermediaries.

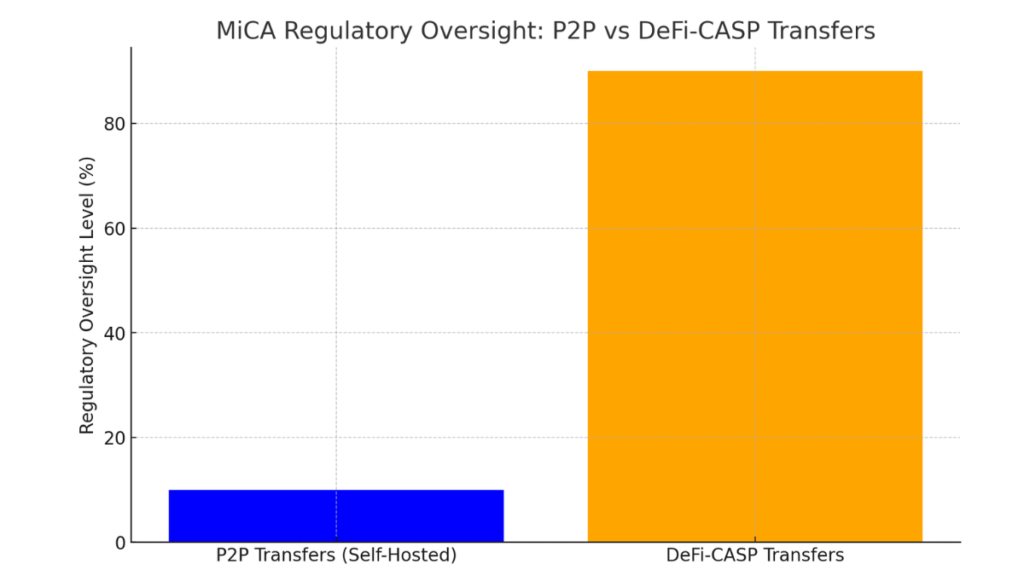

Here is a bar chart. It compares the regulation of P2P transfers (self-hosted wallets) and DeFi-CASP transfers under MiCA.

- P2P Transfers: Minimal regulatory oversight (low reporting and privacy concerns).

- DeFi-CASP Transfers: High regulatory oversight (subject to AML compliance and reporting).

P2P Transfers Exempt from MiCA Reporting

Under MiCA, P2P transactions using self-hosted wallets are exempt from its strict reporting rules. The exclusion means such transfers don’t require personal data. This preserves user anonymity. However, if a transaction involves a CASP, the standard reporting rules apply. This includes transfers between a self-hosted wallet and an exchange. This balance allows privacy in decentralized transactions. It also enforces compliance in a centralized environment.

DeFi Wallet Operations Under MiCA

Mica does not cover decentralized finance (DeFi) operations, but it could indirectly affect DeFi transactions when funds interact with CASPs. Transfers from DeFi wallets to centralized entities, like exchanges, must comply with MiCA’s AML and reporting rules. Also, DeFi wallets often use self-hosted solutions, so users must comply with AML checks when using regulated platforms.

Read More:

- EU’s MiCA Regulation Overview

- Bulgaria’s MiCA Implementation Draft Law

- FATF Guidelines on Crypto Transactions

- Regulatory Developments from the G20 Summit

MiCA’s rules will significantly alter Europe’s crypto landscape. This is especially true for self-hosted wallets, P2P transactions, and DeFi operations. MiCA tightens rules for interactions with centralized crypto-asset service providers (CASPs), but it allows privacy and freedom within completely decentralized systems.