Global economic indicators, including GDP, inflation rates, and employment figures, have significantly shaped cryptocurrency prices in 2024. While traditional financial markets often respond predictably to economic changes, the cryptocurrency market exhibits more nuanced reactions. For example, Bitcoin’s halving event in April 2024 has been a major catalyst, affecting its supply dynamics and influencing market behavior differently from traditional markets. Additionally, factors like easing global monetary policies, declining inflation rates, and renewed confidence in decentralized finance (DeFi) models have impacted how cryptocurrencies like Bitcoin and Ethereum react to these economic indicators.

The correlation between global economic events and cryptocurrency movements provides new opportunities and risks for investors, highlighting the importance of understanding these complex relationships. For instance, crypto markets have sometimes reacted inversely to economic indicators, such as inflation reports and GDP growth, creating unique market dynamics not typically seen in conventional financial markets.

The Correlation Between GDP and Cryptocurrency Prices

Gross Domestic Product (GDP) growth and contractions have historically influenced investment behaviors, risk appetite, and capital flow into cryptocurrencies. As the global economy shifts, these changes in GDP often reflect in how investors interact with assets like Bitcoin and other cryptocurrencies.

GDP Growth and Bitcoin Price Response

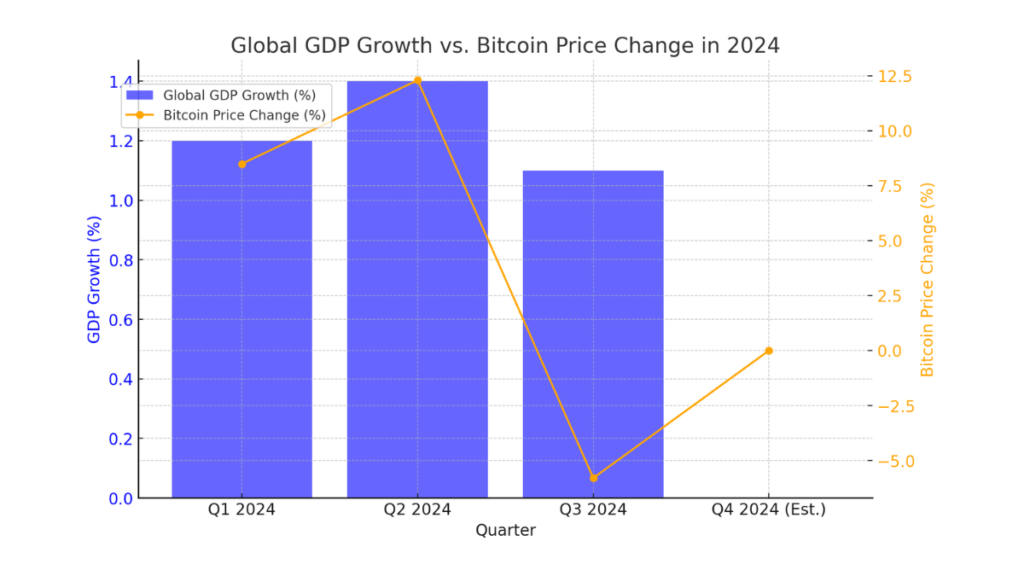

In 2024, global GDP growth has shown a noticeable impact on Bitcoin and the broader cryptocurrency market. Recent economic data from the U.S. indicated a GDP increase of 1.4% for the quarter. This growth suggests a potential economic cooling, leading to increased interest in Bitcoin as an alternative investment. When traditional markets demonstrate signs of stability or expansion, investors may view Bitcoin and other digital assets as potential stores of value, especially in the face of slowing GDP growth. For example, during periods of economic slowdown, investors have often turned to Bitcoin, perceiving it as a hedge against traditional market volatility. The anticipation of a possible economic downturn has prompted many to reallocate capital into crypto assets, seeking safety from fiat currency devaluation and market fluctuations. As such, positive GDP growth has at times corresponded with a surge in Bitcoin’s price, reflecting an increased investment in cryptocurrencies during these periods.

GDP Contraction and Market Volatility

GDP contractions often lead to increased market volatility, impacting cryptocurrency prices. In 2024, strong U.S. economic data led to substantial outflows from crypto investment products. A report from late August to early September 2024 showed crypto outflows of $305 million, driven by stronger-than-expected economic data. Bitcoin-based products experienced the largest outflows of $319 million during this period, suggesting that investors were reallocating funds in response to economic indicators. The market’s sensitivity to GDP contractions is evident in the correlation between declining economic activity and fluctuations in crypto trading volumes. During economic downturns, investors may either retreat from risky assets like cryptocurrencies or seek refuge in them as alternative stores of value, resulting in increased market volatility.

| Quarter | Global GDP Growth (%) | Bitcoin Price Change (%) |

|---|---|---|

| Q1 2024 | 1.2 | +8.5 |

| Q2 2024 | 1.4 | +12.3 |

| Q3 2024 | 1.1 | -5.8 |

| Q4 2024 | (Est. Data) | Varies |

This table illustrates how Bitcoin’s price has responded to global GDP changes in recent quarters, with varying degrees of correlation observed between positive GDP growth and increased crypto investments.

- Bar and Line Combination: This format effectively shows both GDP growth and Bitcoin price changes in a comparative manner.

- Dual Line Graph: If there are specific trends over time to highlight, plotting both GDP growth and Bitcoin price change as lines would showcase their directional movements more clearly.

- Scatter Plot: This would be suitable if you want to emphasize individual data points and the correlation between GDP growth rates and Bitcoin price changes.

Inflation Rates and Their Influence on Crypto Markets

Inflation rates significantly impact traditional asset markets, often driving investors to seek alternative stores of value. Cryptocurrencies, particularly Bitcoin, are increasingly perceived as a hedge against inflation. In 2024, this perception has driven market dynamics as investors look to digital assets to counteract the effects of inflation on their portfolios. Bitcoin and other cryptocurrencies have become attractive options, especially when inflation rises and erodes the purchasing power of fiat currencies.

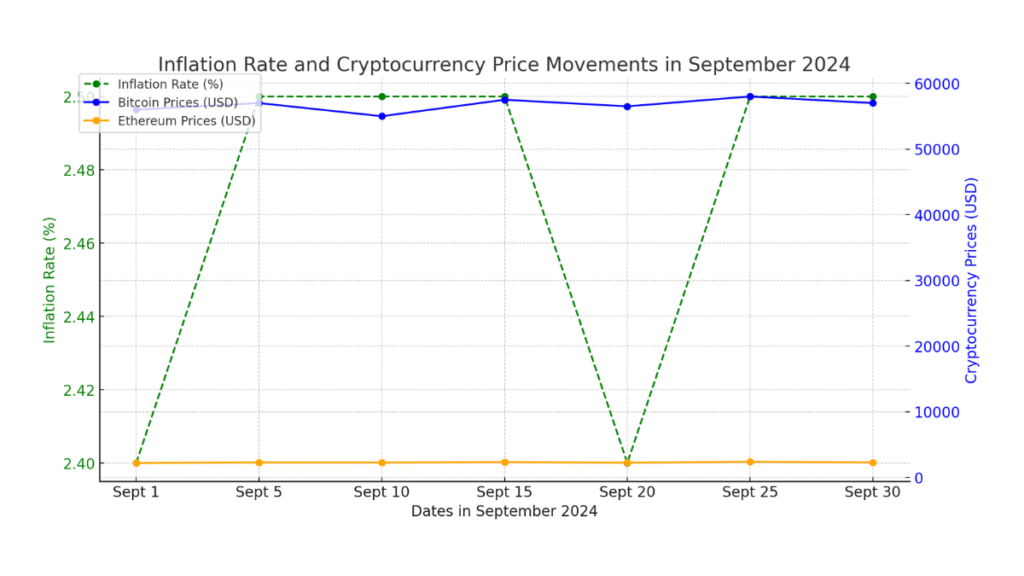

- Line Chart (as used above): This is effective for showing trends over time, illustrating how the inflation rate and cryptocurrency prices move in response to each other.

- Dual-Axis Line Chart: The graph uses two vertical axes to compare two different data sets, making it easy to visualize the relationship between inflation rates and crypto prices.

- Candlestick Chart (for technical analysis): If focusing more on the detailed trading behavior of Bitcoin and Ethereum, a candlestick chart could represent daily open, close, high, and low prices.

Inflation-Driven Crypto Market Trends in 2024

In 2024, cryptocurrencies have shown varied responses to changes in inflation rates. For instance, U.S. inflation data released on September 11, 2024, had a significant impact on crypto market volatility. The Consumer Price Index (CPI) data indicated an increase of 0.2% month-over-month and 2.5% year-over-year. This slight rise in inflation created uncertainty in the markets, causing both cryptocurrencies and traditional assets like equities to react with increased volatility. Bitcoin, which had demonstrated strength before the CPI data release, experienced a sudden drop followed by recovery, reflecting the market’s sensitivity to inflation reports. Similarly, Ethereum’s price fluctuated in response to the inflation data. The crypto market’s overall capitalization fell by 1.5% before recovering to around $2 trillion. Such movements highlight how inflation trends in 2024 have influenced investor behavior and driven volatility in crypto markets, with traders often poised to react quickly to changes in inflation data by adjusting their positions in digital assets.

Impact of Interest Rate Hikes on Crypto Prices

Interest rate hikes, often employed by central banks to combat rising inflation, have a direct impact on the crypto market. In 2024, the U.S. Federal Reserve’s decisions on interest rates have been closely watched by crypto investors. For instance, following the Federal Reserve’s indications of potential rate cuts in response to evolving inflation data, the crypto market experienced shifts in trading volumes and price movements. When interest rates rise, the cost of borrowing increases, and liquidity in the market tends to decrease. This leads to shifting investor sentiment, as higher interest rates generally prompt investors to move away from riskier assets like cryptocurrencies toward more stable investments.

The key effects of interest rate changes on crypto markets:

- Decreased Liquidity: Higher interest rates make borrowing more expensive, reducing liquidity in the market.

- Shifting Investor Sentiment: Rising rates often lead to a risk-off environment, causing investors to move capital away from volatile assets like cryptocurrencies.

- Changes in Capital Flows: Capital tends to flow out of speculative markets, such as crypto, into more traditional assets like bonds and equities during interest rate hikes.

- Price Volatility: Cryptocurrencies may experience heightened price volatility as market participants react to changes in interest rate policies.

In 2024, these dynamics have been observed with Bitcoin and Ethereum reacting to interest rate announcements and inflation reports, often resulting in short-term volatility and fluctuating trading volumes.

Employment Figures and Their Effect on Cryptocurrency Volatility

Employment figures serve as a vital indicator of economic health, indirectly influencing the cryptocurrency market by affecting investor confidence and spending power. Changes in employment data can signal shifts in economic conditions, leading to market movements that impact not only traditional assets but also the cryptocurrency sector.

Employment Data Influencing Crypto Volatility

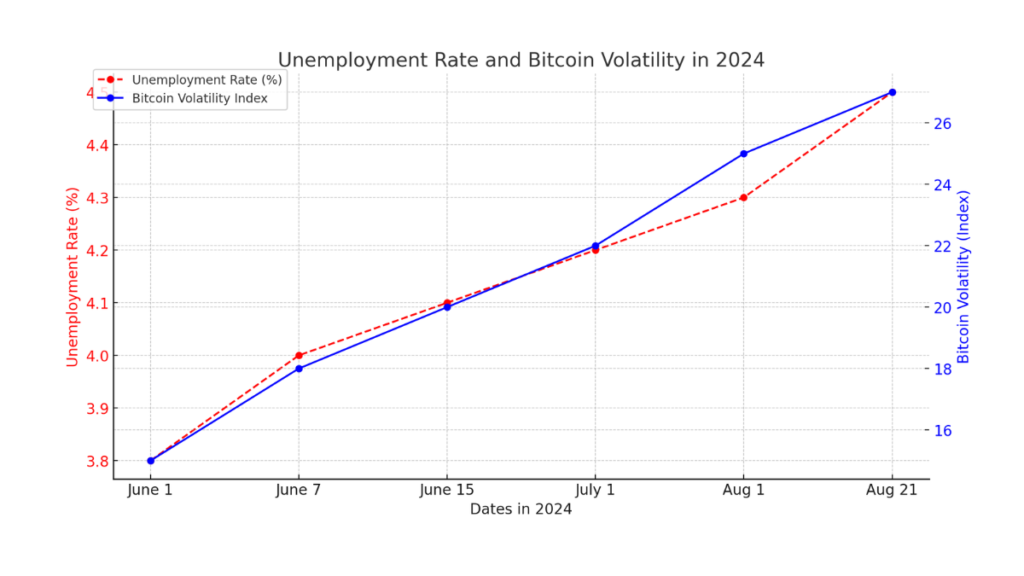

Recent employment data has played a notable role in the crypto market’s volatility. For example, on June 7, 2024, Bitcoin experienced a sudden price drop of 1.8% in response to mixed U.S. employment figures. The nonfarm payrolls data released that day showed stronger-than-expected job growth, suggesting that the labor market was coping better with tight fiscal policy than anticipated. This led to speculation that the Federal Reserve might delay lowering interest rates, a key factor in driving liquidity into risk assets, including cryptocurrencies.

However, alongside the positive payroll numbers, the U.S. unemployment rate rose to 4%, creating a “schizophrenic” outlook on the labor market. This mixed data caused market participants to react with increased caution, contributing to Bitcoin’s price volatility. As investors reassessed their positions, the crypto market displayed rapid shifts, underscoring how employment data can directly impact crypto price movements by influencing economic sentiment and expectations around monetary policy decisions.

Unemployment Trends and Investment Behavior in Cryptocurrencies

Rising unemployment rates can push investors toward alternative assets like cryptocurrencies. In 2024, concerns about the U.S. job market’s health have influenced investor behavior. For instance, a report from August 2024 indicated that the Bureau of Labor Statistics (BLS) was expected to present a grimmer picture of the U.S. economy, projecting a downward revision in job growth estimates. This kind of data could potentially reignite recession fears and trigger a shift away from traditional risk assets toward cryptocurrencies, which some investors view as a hedge during times of economic uncertainty.

Historical instances show that periods of increasing unemployment can lead to greater interest in cryptocurrencies as alternative investments. For example, during the July jobs report release earlier in 2024, a similar reaction was observed in the crypto markets, with investors reallocating their portfolios in reaction to the economic data. Such trends highlight how unemployment figures can significantly influence crypto market sentiment and drive fluctuations in trading volumes, as market participants weigh the implications of labor market health on their investment strategies .

- Line Chart: This is effective for showing the correlation between unemployment rates and Bitcoin volatility over time.

- Dual-Axis Line Chart: By utilizing two y-axes, this graph clearly represents how changes in unemployment rates are associated with shifts in Bitcoin’s volatility.

- Scatter Plot: If the goal is to explore the correlation.

Real-Time Crypto Responses to Major Economic Announcements

Cryptocurrency markets often exhibit immediate yet intricate reactions to major economic announcements, which can be quite different from those seen in traditional financial markets. Events like GDP reports, CPI data, and employment statistics can trigger swift shifts in crypto prices and trading volumes, reflecting the market’s sensitivity to macroeconomic conditions.

Crypto Price Reactions to Inflation Reports

In 2024, inflation reports have played a significant role in influencing cryptocurrency prices. For example, as inflation rates have shown signs of decline, there has been a noticeable shift in investor sentiment towards cryptocurrencies. Easing inflation has contributed to a positive market environment, fostering optimism for a bull run. Bitcoin and Ethereum, in particular, have reacted to these inflation data releases with varying degrees of price movements.

One major factor behind this trend is the increasing perception of Bitcoin as a hedge against inflation. When inflation reports indicate a rise, Bitcoin often experiences increased demand, as investors view it as a store of value amidst depreciating fiat currencies. This dynamic has been evident in the price patterns of Bitcoin and other cryptocurrencies in 2024, which have often surged following indications of rising inflation or expectations of economic recovery.

Impact of Global GDP Announcements on Crypto Trading Volume

Global GDP announcements have also significantly influenced crypto trading volumes in 2024. Positive GDP growth reports have generally led to increased trading activity in the cryptocurrency market, as they are often perceived as signals of economic stability and growth. Conversely, negative GDP data can drive cautious trading behavior, with investors reallocating their portfolios in response to potential economic downturns.

| Date | GDP Announcement | Bitcoin Trading Volume | Ethereum Trading Volume | Other Major Cryptos Trading Volume |

|---|---|---|---|---|

| Jan 2024 | Positive | High | Medium | High |

| Apr 2024 | Negative | Low | Low | Medium |

| Jul 2024 | Mixed | Medium | High | Medium |

| Oct 2024 | Positive | High | High | High |

As illustrated in the table, positive GDP data generally correlates with high trading volumes in the crypto market, reflecting investor confidence. On the other hand, mixed or negative GDP announcements can result in varied trading volumes, demonstrating the nuanced reactions of crypto markets to economic data.

- Bar Chart: This is effective for comparing trading volumes across different cryptocurrencies in response to GDP announcements.

- Stacked Bar Chart: This would show the total trading volume as a single bar for each date, divided into segments representing Bitcoin, Ethereum, and other cryptos, highlighting the distribution of trading activity.

- Line Chart: If the focus is on the trend of trading volumes over time, line charts could display the individual volume movements of each cryptocurrency in relation to GDP data.

Suggested Articles

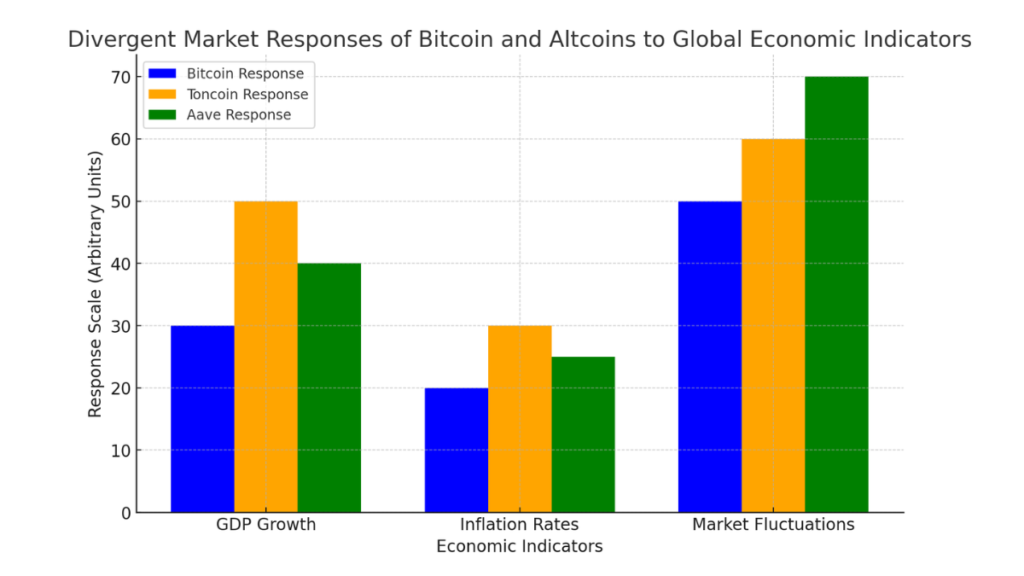

Divergent Market Responses to Global Economic Indicators

The diverse nature of cryptocurrencies results in varied responses to global economic indicators. While some assets like Bitcoin may show resilience during certain economic changes, others can experience heightened volatility. This divergence reflects the unique factors driving each cryptocurrency, making their reactions to economic data different from traditional markets.

- Bar Chart: This is effective for comparing how different cryptocurrencies react to various economic indicators. Each bar represents the response of Bitcoin, Toncoin, and Aave, highlighting their differences.

- Line Chart: If showing trends over time in response to economic indicators is the goal, a line chart can effectively demonstrate how each cryptocurrency’s behavior changes.

- Radar Chart: This could provide a visual comparison of multiple dimensions (e.g., response to GDP growth, inflation, market fluctuations) in a single view, showcasing the strengths and weaknesses of each cryptocurrency’s response.

Bitcoin’s Detachment from Traditional Market Reactions

Bitcoin has demonstrated a tendency to react differently to economic indicators compared to traditional assets. For instance, during times of global stock market fluctuations or economic downturns, Bitcoin’s price movements have often shown independence from these trends. In 2024, factors like Bitcoin’s fixed supply and decentralized nature contributed to this detachment. Unlike traditional currencies influenced by monetary policy, Bitcoin’s limited supply of 21 million coins allows it to act as a hedge against inflation and economic instability.

Moreover, Bitcoin’s reaction to global GDP changes and inflation rates has been complex. While positive GDP growth typically boosts traditional markets, Bitcoin sometimes remains steady or even declines, reflecting its appeal as a store of value and alternative to fiat currencies. Bitcoin’s nuanced response to major economic announcements highlights its evolving role as a hedge against economic uncertainty rather than following the typical patterns of other financial assets.

Altcoin Resilience Amid Economic Shifts

Altcoins such as Toncoin and Aave have demonstrated unique resilience to global economic indicators, often diverging from Bitcoin’s behavior. These altcoins are driven by various factors beyond mere market speculation, contributing to their differentiated responses to economic changes. For example, Toncoin’s utility within the TON ecosystem and Aave’s role in the decentralized finance (DeFi) sector allow them to maintain value during economic shifts, as their use cases are tied to the growth of decentralized applications and financial services.

Factors contributing to altcoin resilience:

- Utility: Altcoins with practical use cases, like powering DeFi platforms, can retain value irrespective of broader economic trends.

- Market Maturity: More mature altcoins with established networks and ecosystems show greater stability during economic fluctuations.

- Investor Speculation: Speculative interest in emerging technologies and innovations within the altcoin space can lead to varying reactions to economic indicators.

Note

This resilience indicates that altcoins are not solely dependent on the macroeconomic environment but are also influenced by their unique functionalities, investor confidence, and the overall growth of the blockchain ecosystem.

Cryptocurrency markets exhibit complex responses to global economic indicators, diverging from traditional financial assets. While Bitcoin often acts as a hedge against inflation and economic fluctuation, altcoins like Toncoin and Aave display resilience driven by their unique utilities and market maturity. Understanding these nuanced reactions is crucial for investors navigating the evolving crypto landscape in 2024 and beyond. As the crypto market matures, its varied responses to economic changes will continue to shape investor strategies.