Cryptocurrency reporting has been a challenge for both traders and tax professionals. In 2024, the US IRS introduced new, simplified tax reporting guidelines. They aim to ease compliance for crypto holders and businesses. The biggest change is the new Form 1099-DA. Brokers will use it to report digital asset transactions, including sales and exchanges, starting in 2026. This shift is part of a broader IRS effort. It aims to simplify tax reporting for cryptocurrency. The previous complexities had deterred compliance.

Overview of IRS Crypto Tax Simplifications for 2024

In 2024, the IRS will simplify crypto tax reporting with new updates. These changes aim to ease tax compliance for those with digital assets. The main goal of these updates is to simplify the rules. They want to clarify tax obligations for digital asset transactions. The IRS aims to boost compliance rates. It will do this by giving clearer guidelines and tools. They will help taxpayers report their crypto gains and losses.

Introduction of Form 1099-DA

One of the most significant updates is the introduction of Form 1099-DA. In 2026, brokers will use this form to report digital asset sales and exchanges from transactions after January 2025. Brokers must submit this form to the IRS and taxpayers. It must detail digital asset transactions, including the date, type, and amount of the sale. The goal is to centralize the info. This will help investors and tax authorities track digital asset transactions. It will also help them report these transactions accurately.

Changes to Reporting for Crypto Brokers

The new rules require custodial brokers to report digital asset sales on Form 1099-DA. Custodial brokers hold and manage digital assets for clients. Non-custodial brokers, like decentralized exchanges, may be exempt from this reporting requirement. Final regulations are still being developed. A key aim of these updates is to ensure brokers report, accurately, the proceeds from digital asset sales. This will help the IRS monitor crypto market activity better. Below is a summary of the obligations for custodial and non-custodial brokers:

| Broker Type | Reporting Obligation |

|---|---|

| Custodial Brokers | Must report all digital asset sales |

| Non-Custodial Brokers | Currently exempt but under review |

This distinction is vital for brokers to ensure compliance and avoid potential penalties.

bar chart representing the reporting obligations for custodial vs. non-custodial brokers. In this chart:

- Custodial brokers must fully report (100%) all digital asset sales.

- Non-custodial brokers currently have no reporting obligation (0%) but are under review.

Simplified Reporting for Taxpayers

For taxpayers, these changes aim to make the reporting process easier. Form 1099-DA lets individuals receive pre-filled forms from brokers. This reduces filing errors. The IRS hopes that a single form will reduce reporting errors. These errors arose from taxpayers needing to calculate gains or losses themselves. This simplified process not only reduces stress for taxpayers but also boosts overall compliance.

Key Benefits of the IRS’s Simplified Reporting

The IRS’s new crypto tax guidelines aim to simplify tax reporting for taxpayers and crypto firms. The goal is to cut complexity that often causes mistakes. This will make compliance easier. These changes should improve tax filing accuracy. They will reduce the burden of calculating gains or losses. They will also encourage more consistent reporting across the industry.

Increased Accuracy in Tax Filing

Form 1099-DA’s introduction is a big step. It will improve tax filing accuracy. Starting in 2026, brokers must report detailed data on digital asset transactions. This includes the sale dates, proceeds, and cost basis. The form reduces errors in taxpayers’ capital gains calculations. It does this by providing this information automatically. This process aims to prevent errors and ensure taxpayers have the info needed for accurate filings. Auto-including transaction data helps crypto firms avoid penalties for inaccurate filings. It thus improves compliance.

Transitional Relief for Brokers

The IRS is offering brokers some relief during the early years of this new reporting requirement. For the 2024 and 2025 tax years, brokers will avoid penalties if they try to comply with the new rules, despite some errors. This time lets brokers adjust to the new systems. It avoids severe penalties. Also, brokers may be exempt from backup withholding rules during this time if they meet certain conditions.

A line graph shows the relief for brokers under the new IRS crypto reporting rules.

- For 2024 and 2025, brokers have a 0% penalty obligation. They are exempt from penalties if they make a good faith effort to comply.

- By 2026, brokers must fully comply with reporting rules or face penalties. Full penalties (100%) will be enforced.

Impact on Crypto Businesses and Exchanges

The new IRS rules for crypto transactions affect U.S. crypto exchanges and businesses. They aim to improve transparency and compliance. This will help ensure that taxable digital asset transactions are reported. Crypto exchanges and custodial brokers must prepare for new burdens. They are due to the expanded reporting requirements.

Reporting Requirements for Crypto Exchanges

Crypto exchanges, especially custodial ones, must now report all transactions over $10,000. This includes details such as the names, addresses, and social security numbers of individuals involved. The goal is to boost tax compliance. Custodial exchanges must disclose transaction details. Also, custodial exchanges must report gross proceeds and adjusted cost basis for all sales or exchanges. These reporting obligations will start in 2026, meaning exchanges need to ensure they have systems in place to comply with these rules.

A bar chart of the new IRS rules on reporting for custodial exchanges, non-custodial brokers, and stablecoin transactions.

- Custodial exchanges and stablecoin transactions over $10,000 have full reporting obligations (100%).

- Non-custodial brokers and stablecoin transactions under $10,000 are exempt from these reporting requirements (0%).

Exemptions for Non-Custodial Brokers

The IRS’s new reporting rules mostly exempt non-custodial brokers, like DeFi platforms. The IRS continues to evaluate whether non-custodial platforms should eventually have reporting responsibilities. However, for now, these decentralized exchanges and unhosted wallet providers must not report transactions. They do not control the customer’s identity or transaction details. This exemption allows decentralized platforms to operate without the burdens of custodial exchanges.

Impact on Stablecoins and Tokenized Assets

Stablecoins and tokenized assets also fall under the new IRS reporting requirements. Stablecoins track the value of fiat currencies. They are digital assets. Transactions over $10,000 are subject to reporting. The IRS has set a de minimis threshold for small stablecoin transactions. Transactions under $10,000 are exempt from reporting. This approach reduces the reporting burden for small transactions. It ensures that larger, significant exchanges are disclosed.

Preparing for IRS Crypto Tax Compliance in 2026

The upcoming IRS regulations set for full enforcement in 2026 mark a significant shift in how crypto businesses and traders will handle tax compliance. Businesses must create systems to streamline reporting and meet new standards.

Key Deadlines for Crypto Businesses

Starting in 2025, brokers must begin tracking gross proceeds from digital asset transactions. However, by 2026, the Form 1099-DA will be fully enforced. It will require brokers to report, not just the gross proceeds, but also cost basis, gains, and losses for all digital asset sales. This timeline lets businesses and brokers ensure their systems can report these transactions accurately. Businesses must track all necessary data, like customer info and transaction details, by 2026 to avoid penalties.

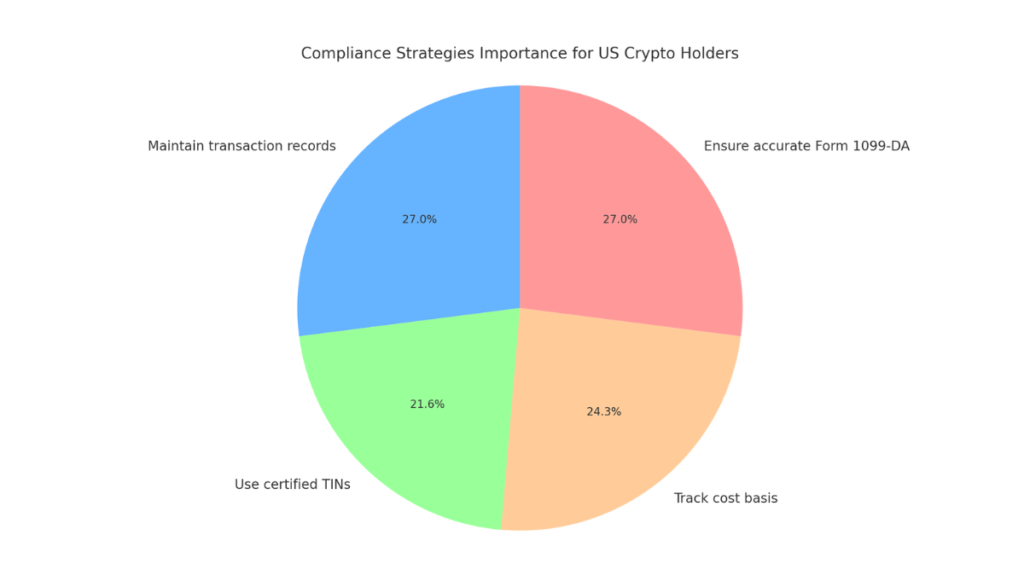

Compliance Strategies for US Crypto Holders

- The most critical tasks are to:

- Maintain transaction records.

- Ensure accurate Form 1099-DA details. Both are 100% important.

- Tracking cost basis across platforms is also crucial (90%).

- Using certified TINs holds significant importance (80%) but is slightly less emphasized.

For US crypto traders and businesses, it’s vital to prepare early to ensure compliance. A few strategies include:

- Track every buy, sell, and transfer of digital assets. Include the cost basis.

- Use certified TINs. Ensure all taxpayer identification numbers (TINs) are certified, especially for large transactions.

- Track cost basis across platforms. If assets are moved, use a tool like CoinTracker to reconcile gains and losses.

For Crypto Compliance:

- Record all crypto transactions and maintain copies of Form 1099-DA.

- Use tax software to calculate gains/losses from asset sales.

- Track transfers across wallets to avoid inflated capital gains.

- Ensure brokers provide accurate Form 1099-DA details by 2026.

Suggested Articles

- Mexico’s Crypto Assets Tax Laws

- Germany’s Crypto Tax Reporting Rules

- Russian Crypto Taxation Reforms

- US SEC’s Enforcement Actions Against Crypto

- Political Impact of US Presidential Candidates on Crypto

The IRS’s new reporting rules for crypto in 2026 will bring much-needed clarity and structure to the industry. Crypto traders and businesses must adapt early by tracking transactions, maintaining cost basis records, and preparing for Form 1099-DA reporting. Meeting these requirements ensures compliance and avoids penalties. As the crypto market evolves, staying informed about tax obligations is essential for long-term success.