Argentina’s crypto regulatory framework underwent significant changes in 2024. These changes reshape how cryptocurrencies operate in the country. The new laws, like Law N°27,739, align Argentina’s rules with global standards. They also put the sector under the CNV’s oversight. These changes, including mandatory VASP registration, aim to improve AML and financial transparency. As Argentina’s crypto market grows, businesses are grappling with new rules. They must balance innovation with compliance.

Key Legislative Updates in Argentina’s Crypto Regulation

In 2024, Argentina updated its crypto rules in 2024. It aimed to improve AML compliance and better oversee crypto firms. The passage of Law N°27,739 and subsequent decrees drove the reforms. They required VASPs to register with the country’s securities commission (CNV). These measures show Argentina’s efforts to meet global standards, including the FATF’s. They ensure crypto firms operate under stricter rules.

Law N°27,739 and its Implications for Crypto Firms

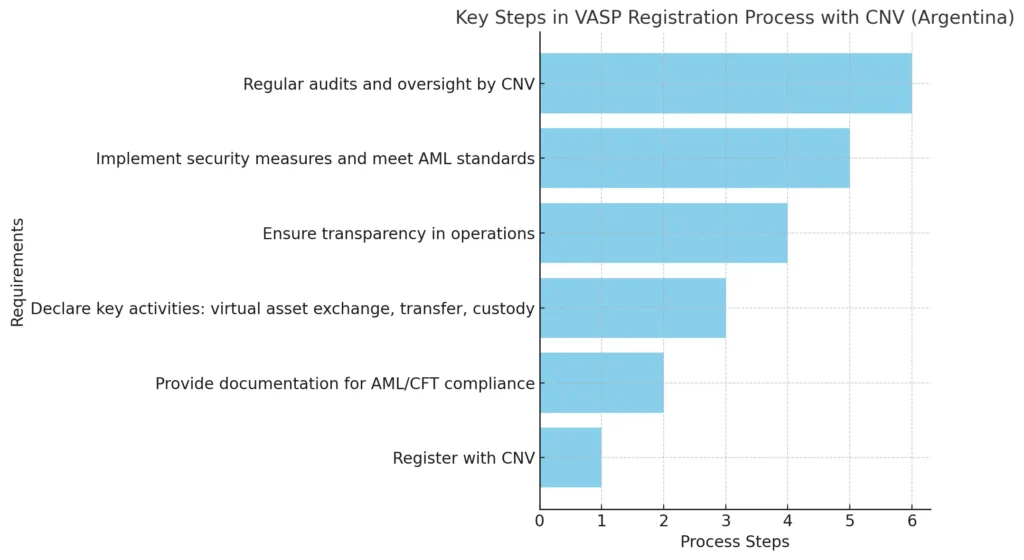

Law N°27,739, enacted in March 2024, made significant changes. All crypto asset service providers (VASPs) in Argentina must register with the CNV to operate legally. This law aims to combat money laundering and terrorism financing using virtual currencies. It lists key activities that must registration. VASPs exchange and transfer virtual assets. They also provide custody and financial services for virtual asset sales. The legislation stresses the need for oversight. It requires VASPs to be transparent and meet security and AML standards.

VASP Registry and Compliance Requirements

The VASP registry plays a crucial role in regulating the Argentine crypto market. Resolution N°994 requires all VASPs to register if they handle virtual assets. This applies to both local and foreign VASPs. This includes targeting Argentine residents via ads, domains, or partnerships. Foreign firms face strict requirements. They must comply with national regulations to operate in Argentina.

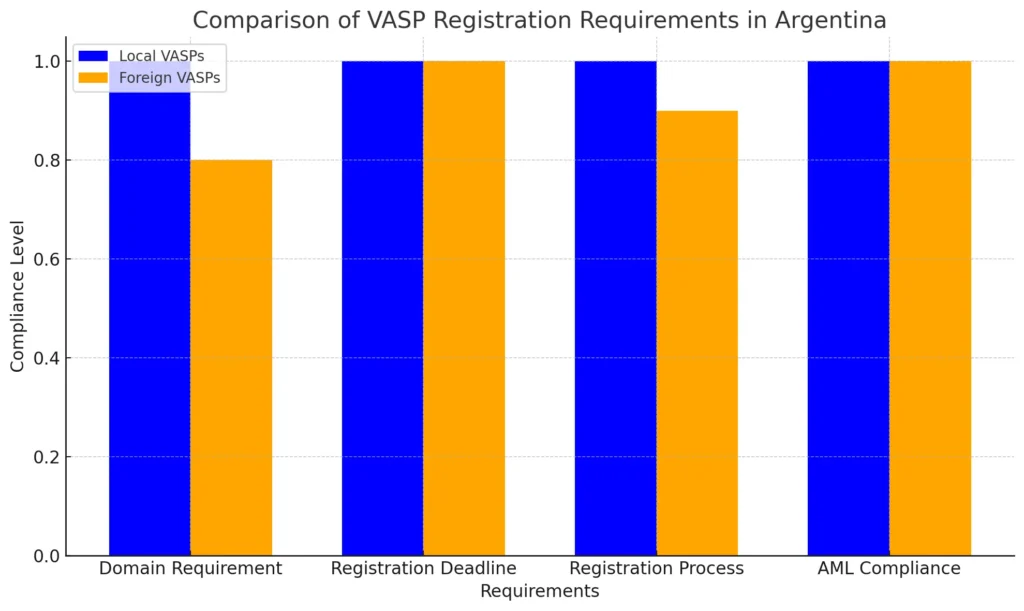

To clarify, here’s a table comparing the conditions for local and foreign VASPs:

| Requirement | Local VASPs | Foreign VASPs |

|---|---|---|

| Domain Requirement | Must use a “.ar” domain if operating online | Must use “.ar” or show commercial activity in Argentina |

| Registration Deadline | Within 45 days of law enactment | Same as local |

| Registration Process | Standard CNV registration | Must meet FATF guidelines |

| AML Compliance | Mandatory | Mandatory, with international transparency conditions |

FATF Guidelines and AML Requirements

Argentina’s 2024 crypto rules follow FATF guidelines. They aim to prevent financial crimes. Law N°27,739 requires crypto firms to report suspicious activities and comply with the UIF. The rules require the crypto industry to meet strict AML standards. This alignment aims to secure the local crypto market. It also seeks to meet the FATF’s global standards.

Impact of Argentina’s Crypto Regulations on Businesses

Argentina’s new crypto rules have changed things for local and global crypto businesses. The mandatory registration and stricter rules for VASPs have changed their operations. These rules aim to align Argentina with global standards, focusing on those of the Financial Action Task Force (FATF). The goal is to make the crypto ecosystem more transparent and secure.

Regulatory Challenges for International Crypto Firms

Foreign crypto firms face several challenges when entering or operating in Argentina. A key one is registering with Argentina’s National Securities Commission (CNV).

Note

This applies to any business targeting Argentine residents, using a “.ar” domain, or generating more than 20% of its turnover from Argentina. Non-compliance can lead to significant legal and operational risks, including fines and the prohibition of conducting business.

Here’s a compliance checklist for foreign VASPs:

- Register with CNV: Ensure your business meets the mandatory registration requirements.

- Local Partnerships: Partner with locals to ease compliance and improve market entry.

- Advertising Compliance: Ads for Argentine residents must follow local laws.

- Reporting Obligations: Report financial activities as required under AML laws.

Local Crypto Market Adjustments to New Regulations

Local crypto exchanges and businesses are quickly adjusting to Argentina’s new crypto rules. Lemon Cash, a top crypto exchange in Argentina, is one such company. It has updated its systems to register assets with the government voluntarily. This shows a proactive approach to compliance. Many local firms are adapting to new AML standards and reporting rules.

Note

Regulatory changes have shifted how businesses operate. They now focus on transparency, legal compliance, and improving user security. This shift is vital to build market trust and protect investors from fraud.

Taxation and Crypto Reporting Framework

Argentina added cryptocurrencies to its tax laws in 2024 as part of broader economic reforms. These measures introduced reporting requirements and compliance obligations for all crypto asset holders. The new tax laws aim to ensure transparency and curb tax evasion. They also seek to align with international standards, like the FATF’s. As crypto gains popularity in Argentina, the government wants to tax it.

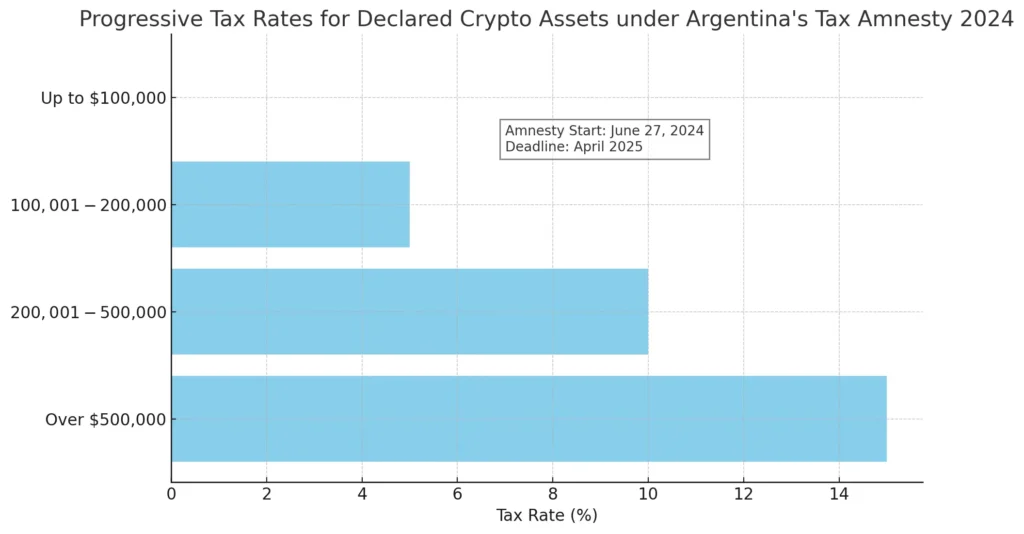

Argentina’s Crypto Asset Tax Amnesty 2024

The 2024 tax amnesty law lets Argentine residents declare undeclared crypto assets. They won’t face severe penalties. Approved on June 27, 2024, Law N°27,743 allows taxpayers to declare crypto holdings. They can declare assets up to $100,000 with no initial tax. Assets over this threshold will incur a 5% to 15% tax, depending on when the owner declares them. The tax will be progressive. Many view the FATF pressures as prompting this move. Argentina wants to avoid the “grey list.” Until April 2025, the tax amnesty requires only regularizing local crypto assets. The custodian must register with Argentina’s CNV (Comisión Nacional de Valores).

Valuation Methods and Tax Implications for Crypto

Under the new rules, crypto asset tax valuations use the higher of the acquisition or regularization date. Some taxpayers criticize this approach, as it could raise their taxes. However, it ensures that assets are assessed fairly at their most recent market value. The law also requires crypto holders to report their holdings in detail. Argentina’s tax authority can audit these reports. Compliance with these regulations is essential for avoiding penalties.

Future Directions for Argentina’s Crypto Regulation

Argentina’s push for crypto rules has opened the door for new developments. With rising crypto adoption, regulations will likely evolve. They must balance innovation and compliance. Argentina’s push to improve its legal system has drawn global attention. It meets international AML and FATF standards.

Predictions for Regulatory Enhancements in 2025

Argentina will likely introduce better crypto regulations in 2025. This could include more oversight of Virtual Asset Service Providers (VASPs). It could also mean stricter rules for exchanges and wallet providers. One option for future laws is to create licenses for crypto firms. These would ensure service providers meet high standards for security and transparency. These measures will likely add to the CNV registry. So, compliance will be a key focus for local and foreign entities. More oversight could mean stricter reporting rules. This might affect crypto taxes and how we check suspicious activities.

Global Impact of Argentina’s Crypto Regulations

Argentina’s crypto regulations could ripple through South America. Argentina has one of the region’s largest economies. Its tighter crypto laws may encourage other countries to adopt similar rules. Argentina’s balanced crypto rules may prompt Brazil and Chile to rethink their policies. President Javier Milei supports cryptocurrencies like Bitcoin. Argentina’s rules may inspire countries that want to adopt digital assets and meet global standards.

Check the below Links for Further Reading

- Taiwan’s Digital Asset Regulations Update

- US IRS Simplifies Crypto Tax Reporting Guidelines

- FATF Guidelines on Crypto Transactions

- Brazil’s Cryptocurrency Regulation Initiatives

- Impact of SEC Rulings on Crypto

Argentina’s new crypto rules are critical to a safe, transparent market. New laws, like N°27,739, require VASP registration and a crypto tax amnesty. They set the stage for more crypto rules in 2025. Argentina’s rise in crypto makes it a leader in South American crypto governance. It is also committed to AML compliance. As the rules unfold, businesses must adapt, stay compliant, and seize new opportunities.